Token Chronicle - Week 3 October 2024

Top cryptos

Extract from CoinMarketCap.com on October 22nd 2024

Meme of the week

Market update: Bitcoin rose above $69,000 yesterday at the start of the Asian morning before retreating slightly to trade around $68,350. BTC's jump led to higher prices throughout the rest of the crypto market, with SOL rising nearly 5% to $166.50. The broader digital asset market, as measured by the CoinDesk 20, is 1.9% higher in the last 24 hours. Traders' attention is increasingly turning to the U.S. election, now barely two weeks away, with the pro-crypto candidate Donald Trump heavily favored on predictions site Polymarket. Bitcoin is also expected to be aided by macroeconomic factors in Japan and China, according to Singapore-based QCP Capital.

Main points this week:

International:

The first Ethereum (ETH) spot ETF arrives in Australia with Monochrome: After Hong Kong and the United States, Australia now welcomes its first Ethereum spot ETF. Asset manager Monochrome launched the IETH overnight. According to the technical documentation provided on the issuer's website, the custody of the ETH held in this ETF has been entrusted simultaneously to BitGo and Gemini. Regarding management fees, they amount to 0.5% per year. In Australia, this launch of Ethereum spot ETFs comes just months after the arrival of the first Bitcoin spot ETFs in June.

Three months after the MiCA rules on stablecoins took effect, 67% of euro-backed stablecoins are compliant with the new regulations: Among these euro stablecoins are, of course, Circle's EURC and Société Générale — Forge's EURCV.

Heavily indebted, the Italian government seeks solutions to reduce its debt and cover annual expenses. One of these includes increasing the tax burden on crypto investors profiting from Bitcoin (BTC) and other cryptocurrencies. Maurizio Leo, Italy's deputy minister of economy and finance, announced an upcoming increase in capital gains tax on cryptocurrencies. Instead of a current 26% rate, it will rise to 42%.

Terra case: Despite being imprisoned in Montenegro, Do Kwon may have managed to make crypto transactions. Arrested in Montenegro in March 2023, Do Kwon, founder and former CEO of Terraform Labs, has been imprisoned for over a year in one of the country’s harshest prisons. Despite this, he may have found a way to carry out crypto transactions while detained.

Siam Commercial Bank, Thailand's oldest bank, announces the launch of an international transfer service using stablecoins. This partnership with Asian fintech Lightnet aims to offer faster, 24/7, and lower-cost cross-border payments, responding to growing demand for more modern and efficient financial solutions. Lightnet specializes in cross-border payments, using blockchain to offer fast, affordable, and accessible transfers, with a strong focus on financial inclusion in Southeast Asia. It remains to be seen whether a baht-backed stablecoin will be introduced, or if the bank will simply offer access to existing stablecoins, such as USDT.

In an effort to reduce their reliance on the US dollar, the nine BRICS+ countries have decided to create their own payment system for trade exchanges, BRICS Pay. This unprecedented initiative shows BRICS+'s desire to rely on a more resilient and autonomous financial infrastructure. For Chinese leaders of the project, this payment system should give countries more means to settle their trade in goods and services while strengthening economic ties without involving third-party actors.

Hong Kong police just dismantled a crypto scam ring that used AI and deepfake tech to pull off a $46M romance fraud. In a 4,000-sq-ft fraud factory, 27 suspects in their 20s-30s crafted fake personas, tricking victims via video chats with deepfakes.

South Korea’s crypto scene is facing turbulence as loan defaults among young investors skyrocket. Defaults for borrowers under 30 have surged 484% since last December, with $288M in outstanding debt. K Bank, tied to Upbit, leads with a 4.05% default rate.

Yuichiro Tamaki, leader of Japan’s Democratic Party for the People, wants to shake up Japan’s crypto tax system. He’s pushing for a flat 20% tax on crypto gains, instead of the current high rates, and aiming to turn Japan into a crypto hub with NFT governance and crypto ETFs.

Mt. Gox has extended the bitcoin repayment deadline for creditors to October 2025, easing immediate sell pressure in the market. This has boosted optimism, with Bitcoin now trading around $67,000—up nearly 6% in October and 10.6% over the past 30 days.

The crypto heart is beating strongest in Asia and Oceania, with $750B in inflows this year! Surprisingly, India leads grassroots adoption despite a tough government stance, while Indonesia surges ahead with 200% market growth, outpacing India in value received.

Taiwan's FSC is set to launch a pilot program for local banks to offer crypto custody services in Q1 2025, boosting institutional crypto adoption . Meanwhile, unlicensed crypto activity faces stricter enforcement starting January 1, 2025.

Traditional finance:

MicroStrategy continues to grow as part of its strategy to accumulate as many Bitcoins (BTC) as possible. The company has set a long-term ambitious goal: to become a Bitcoin bank with a valuation exceeding $1 trillion. If the company reaches this goal, its primary activity "will consist of creating Bitcoin capital market instruments in the fields of stocks, convertible bonds, fixed-income securities, and preferred shares," explains Michael Saylor. According to MicroStrategy's co-founder, the company has already taken the time to analyze the project's feasibility and establish much of its roadmap.

Litecoin: After XRP, Canary Capital aims to launch an ETF on LTC. On Tuesday, the crypto asset manager filed an S-1 form with the Securities and Exchange Commission (SEC) to launch a spot ETF on Litecoin (LTC). This comes a week after its request for an XRP ETF.

In the face of escalating geopolitical tensions and economic uncertainty, investors seek solutions to protect themselves from inflation. In this context, Quantity Funds is launching an innovative new ETF combining 100% Bitcoin and 100% gold, two assets recognized for their anti-inflation properties. The BTGD combines Bitcoin futures and ETPs with gold futures and ETPs, offering full exposure to both assets. For every dollar invested, holders receive both $1 of exposure to Bitcoin and $1 to gold.

According to rumors reported by Bloomberg, BlackRock is negotiating with leading crypto platforms to deploy its BUILD token as collateral for derivative products. Last spring, BlackRock partnered with Securitize to launch its own tokenized investment fund called BUILD, all deployed on the Ethereum (ETH) blockchain. Since then, the asset has been gradually growing, and at the time of writing, it is capitalized at just over $550 million.

The SEC authorizes NYSE and CBOE to offer trading in options on Bitcoin (BTC) spot ETFs: Just one month after Nasdaq obtained authorization from the Securities and Exchange Commission (SEC) to offer options trading on a Bitcoin spot ETF, NYSE and CBOE have also gained approval from the US financial regulator. In finance, options are a tool for buying or selling an asset at a given price and date in advance. For several crypto ecosystem players, options trading on Bitcoin spot ETFs could increase interest in cryptocurrencies and make them more accessible to investors, while also attracting more capital.

In a recent document, the Federal Reserve Bank of Minneapolis suggests that taxing or banning Bitcoin is necessary to maintain its deficit. According to the authors, Bitcoin could prevent the government from effectively managing permanent budget deficits. Amol Amol, research analyst, and Erzo G.J. Luttmer, researcher, explain that the government can maintain a permanent budget deficit using "continuous Markov strategies." These strategies allow for ongoing adjustments to deficits and payments to creditors, avoiding the need for the government to balance its budget.

DBS, Singapore’s largest bank, has launched "DBS Token Services" to boost liquidity and streamline operations for institutional clients. Integrated with its permissioned blockchain, the service enables smart contracts for treasury tokens, programmable payments, and rewards.

Grayscale has filed to convert its Digital Large Cap Fund into an ETF, aiming to provide a balanced crypto index rather than the current 75% Bitcoin and 19% Ethereum focus. This ETF would simplify investment, offering broader market exposure in a single package.

Tech:

Vitalik Buterin proposes major changes for the Ethereum network, particularly regarding the staking mechanism and transaction validation. He suggests a switch to "single slot finality," which would reduce validation time to 12 seconds, or even 8 or 4 seconds, to improve speed on layers 1 and 2. Currently, it takes 32 slots of 12 seconds to validate a transaction. He also envisions lowering the staking participation threshold from 32 ETH to 1 ETH to attract more validators while improving security against DOS attacks by making validators more anonymous.

Kraken launches ETH restaking service with EigenLayer (EIGEN): Restaking is booming, and the Kraken exchange platform wants to position itself in this growing field. It has just confirmed the launch of restaking services based on the EigenLayer (EIGEN) protocol. Specifically, Kraken allocates users' ETH to restaking, following their request. The operation is carried out via the Staked validator, a Kraken subsidiary usually available only to institutional clients.

A few days ago, Vitalik Buterin, co-founder of Ethereum, expressed his desire to strike a balance between decentralization and cooperation within the decentralized finance (DeFi) ecosystem. The DeFi Collective, a non-profit association supporting resilient DeFi protocols, picked up on the topic. According to the Ethereum co-founder, it is necessary to ensure that all projects based on his blockchain "collectively build something resembling a single ecosystem, rather than 138 incompatible fiefdoms." To achieve this, Vitalik Buterin has mentioned the idea of one or more platforms dedicated to analyzing the decentralized finance world, similar to L2beat.

Following the launch of cbBTC by its competitor Coinbase, Kraken unveiled this week the kBTC, an ERC-20 version of Bitcoin (BTC). For this launch, Kraken partnered with several decentralized finance (DeFi) protocols to offer an initial offering. These include deBridge, Definitive, Gauntlet, ParaSwap, and Yearn.

On Thursday, Worldcoin (WLD) announced a series of updates, including a name change and the launch of its mainnet. World ID 3.0 appeared on World App. Thus, NFC-compatible passports can be registered in the app, particularly to prove one's age or nationality, without the data being stored outside the device, ensuring that the World Foundation or its partners cannot access it. At the same time, a new, more efficient Orb for iris scans was launched. Similarly, the third version of World App was released, featuring a series of embedded mini-apps.

Funding & Partnerships:

Stripe, the leader in financial technology, has just made the largest crypto acquisition in history by purchasing Bridge for $1.1 billion. Founded in 2022, Bridge facilitates international stablecoin payments for companies like Coinbase and SpaceX. This acquisition is part of Stripe's strategy to become a key player in cryptocurrency payments. With the recent launch of its "Pay with crypto" service, Stripe aims to broaden access to stablecoin payments, particularly USDC, to accelerate global transactions and reduce costs associated with cross-border payments.

Blockstream raised $210M through a financing round led by Fulgur Ventures to boost Bitcoin Layer 2 tech, scale mining operations for the next Bitcoin market cycle, and strengthen its Bitcoin treasury.

Praxis, the self-proclaimed world's first "Network State," raised $525M to build a tech-focused city advancing crypto, AI, energy & biotech. 🚀 Investors include Arch Lending, GEM Digital, & Farcaster CEO Dan Romero. Previously backed by Paradigm & others.

Focus: Let’s talk about Scroll

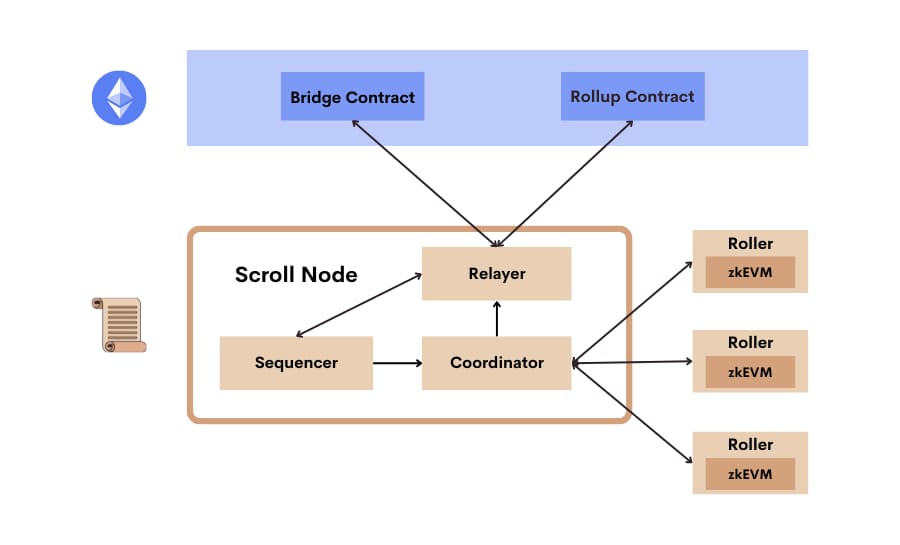

Scroll is a Layer 2 scaling solution for Ethereum that uses zero-knowledge (zk) proof technology to enhance scalability while maintaining security. It is an EVM-equivalent zk-Rollup, meaning that it is fully compatible with the Ethereum Virtual Machine at the bytecode level. This compatibility allows developers to migrate existing Ethereum dApps seamlessly to Scroll without needing to modify smart contracts.

Scroll's design follows the broader Ethereum community's adoption of rollups as a scaling solution. By mid-2020, rollups were recognized as a critical part of Ethereum's roadmap, abstracting transaction execution to Layer 2 (L2) while ensuring security by rolling up and posting transactions to Ethereum's Layer 1 (L1). Scroll implements this approach with three main components:

Scroll Nodes: These include the Sequencer, Coordinator, and Relayer, which handle transaction processing, block creation, and the commitment of blocks to Ethereum's L1.

Roller Network: Rollers generate zk-proofs for the blocks produced on Scroll, with the ability to generate multiple proofs in parallel to speed up the process.

Rollup and Bridge Contracts: These smart contracts link Scroll with Ethereum L1, ensuring the validity and availability of data for all transactions.

Scroll’s architecture has been developed in collaboration with the Ethereum Foundation’s Privacy and Scaling Explorations group, ensuring robust security and scalability while maintaining compatibility with Ethereum's L1.

Join me on Twitter: @Token_Chronicle

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.