Token Chronicle - Week 3 July 2025

Top cryptos

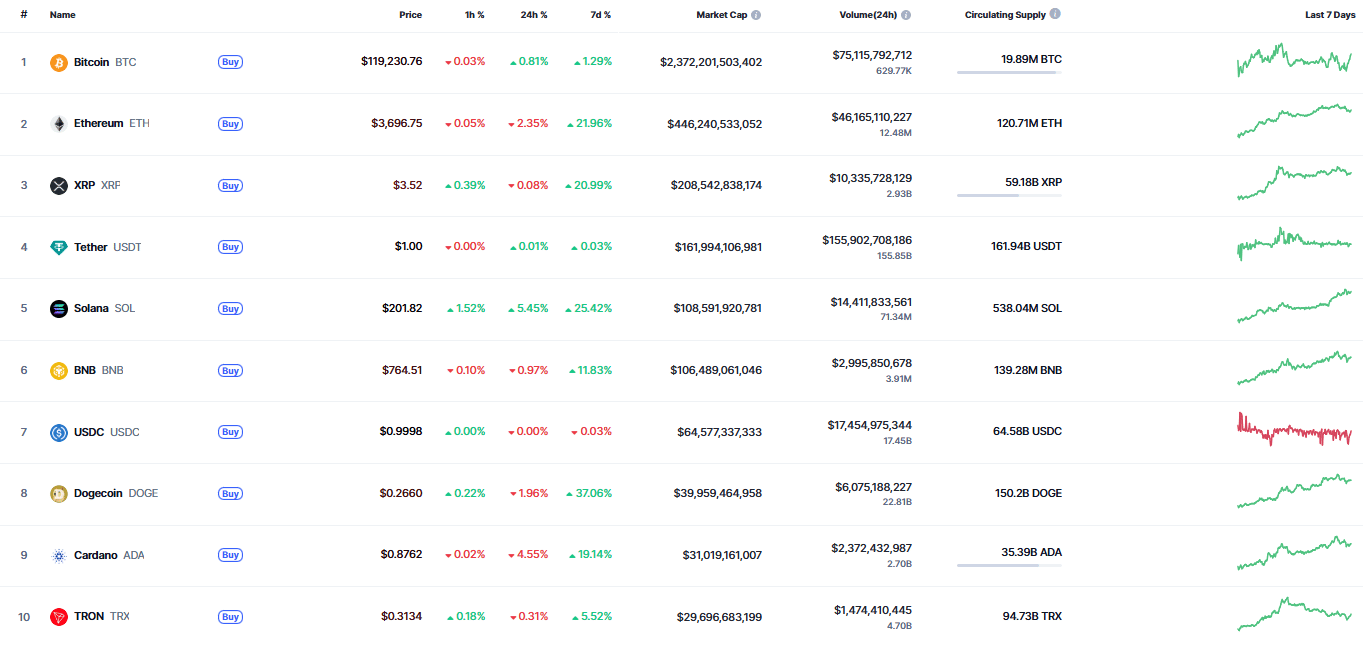

Extract from CoinMarketCap.com on July 22nd 2025

Meme of the week

Market Sentiment:

F&GI from CoinMarketCap.com on July 22nd 2025

Market update: BTC is pausing around $119K, allowing altcoins to take the lead. Indeed, we are seeing strong performances from ETH at $3,700 and SOL at $200, along with the broader altcoin market. The market is overwhelmingly bullish, driven by the adoption of the Genius Act (stablecoin legislation) in the U.S. and massive investments in BTC and ETH by banks and various corporations. The possibility of Jerome Powell resigning or upcoming rate cuts is also being positively priced in by the market. The remaining uncertainty lies in trade tariffs with the EU and others, as deadlines for pauses approach. However, while this aspect does affect EU and Asian equity markets, it has little impact on the crypto market (or merely slightly offsets the massive investments). Even one of the most crypto-skeptical banks, JP Morgan, is diving in headfirst with a stablecoin project and BTC/ETH-backed products.

BTC's dominance has declined slightly to make room for altcoins but remains around 60%, while the Fear and Greed Index stands at 67 (out of 100). With BTC at $119K, this suggests there is still significant room for potential upside.

Main points this week:

International Highlights:

$72 Billion: Europe’s Potential Response to U.S. Tariffs Could Be Costly – Faced with Donald Trump’s hesitations and reversals, Europe may toughen its stance. Targeted by a significant tariff increase in two weeks, it could retaliate just as harshly.

Kazakhstan Wants to Invest "Aggressively" in Cryptocurrencies – As cryptocurrencies evolve, they continue to gain new, sometimes unexpected, statuses. One example is their inclusion in government strategic reserves, now open to options like Bitcoin. According to Timur Suleimenov, Governor of Kazakhstan’s National Bank, during a recent press conference, the choice of cryptocurrencies follows positive experiences in Finland, the U.S., and the Middle East.

El Salvador and Pakistan Establish Bilateral Collaboration on Cryptocurrencies – In the race for Bitcoin adoption, El Salvador is undoubtedly a pioneer. Now, Pakistan is joining this position through a bilateral relationship centered on cryptocurrencies. The partnership will involve sharing knowledge and experience in crypto. Unofficially, it may also include discussions about their complicated dealings with the IMF.

UK Prepares to Sell $7.2 Billion in Bitcoin (BTC) – Facing a glaring budget deficit, the UK is considering liquidating a $7.22 billion digital treasure in Bitcoin, seized in a 2018 fraud case. Meanwhile, Reform UK, Nigel Farage’s party, is pushing for a strategic Bitcoin reserve instead. Chancellor Rachel Reeves is under pressure to find £20 billion (about $26.7 billion) by fall to balance the country’s finances. The digital goldmine she sits on could provide part of that sum.

Ripple has expanded its institutional custody services into the Middle East, partnering with UAE-based tokenization platform Ctrl Alt to support Dubai’s government-led real estate digitization initiative. The deal will see Ctrl Alt use Ripple’s custody infrastructure to store tokenized property title deeds issued by the Dubai Land Department (DLD) on the XRP Ledger (XRPL).

UK Chancellor Rachel Reeves unveiled sweeping fintech and digital asset reforms in her Mansion House speech, targeting blockchain leadership through tokenized securities, stablecoins, and a digital gilt (DIGIT) initiative. The new Growth and Competitiveness Strategy balances innovation with "robust crypto rules" to curb fraud while modernizing finance—including plans to digitize securities and advance the Digital Gilt project. The moves aim to position the UK as a global crypto hub, countering US dominance, with industry applauding the regulatory clarity.

Compliance/Regulation/Legal:

Ripple (XRP) Confirms Plans to Obtain MiCA License – This week, Ripple (XRP) reaffirmed its ambition to secure a MiCA license to expand its presence in the European market. To do so, Ripple may choose Luxembourg as its base, according to Ledger Insights, though the company has not yet commented on this speculation. On April 21, Ripple established a Luxembourg entity as its European hub.

"No Legitimate Use for Crypto": Democrat Stephen Lynch Calls for a Central Bank Digital Currency – In Washington, several Democratic figures, including Stephen Lynch and Maxine Waters, have criticized cryptocurrencies, calling them a "scam." They are demanding the rapid creation of a central bank digital currency (CBDC). This is a new offensive following Donald Trump’s January executive order banning any experimentation with a digital dollar.

House of Representatives Passes Donald Trump’s Crypto Bills – The U.S. regulatory framework for crypto, now nearing completion, consists of three distinct parts, including the (non-)development of a CBDC. These long-awaited bills were officially passed by the House of Representatives. After heated debates on Wednesday, the regulatory frameworks were approved on Thursday with the following results:

Digital Asset Market Clarity (CLARITY) Act: 294 votes for, 134 against

GENIUS Act: 308 votes for, 122 against

Anti-CBDC Surveillance State Act: 219 votes for, 210 against

Democrats were largely supportive, with over 80 votes in favor of CLARITY and more than 100 for the GENIUS Act. However, the Anti-CBDC bill passed with a slim 9-vote majority. Maxine Waters warned of "gaping holes in federal financial laws" that could enable insider trading. If no amendments derail Trump’s plans, the GENIUS Act could be signed by the end of the week. The other bills must still pass the Senate before final approval.

$9 Trillion: Donald Trump Bets on Crypto to Transform Retirement Plans – The U.S. crypto market is accelerating with the House’s passage of the GENIUS Act. Trump now aims to introduce crypto-based retirement plans, urging regulators to investigate hurdles for including alternative investments in 401(k) funds. According to the Financial Times, Trump may sign an executive order soon to initiate this process.

Donald Trump Signs the GENIUS Act on Stablecoins – The First U.S. Crypto Law Is Passed – Stablecoins have gone from marginal crypto products to strategic tools in U.S. finance. With the GENIUS Act, Trump legalizes and legitimizes dollar-backed stablecoins.

Ethereum: SEC Chair Paul Atkins Says ETH Is Not a Security – "Like Bitcoin, the SEC has stated, more informally than formally, that Ether is not a security. It’s clear that the Ethereum blockchain is a key component of many other digital currencies. It’s up to companies to decide where they want to invest and what strategy they adopt. That’s obviously not for me to say, but I find it encouraging that these digital assets are being adopted by the market. And I believe this opens up great development opportunities."

Pakistan has approved a new crypto regulator, the Pakistan Virtual Assets Regulatory Authority (PVARA), to oversee licensing, AML compliance, and investor protection for VASPs. The State Bank of Pakistan is also preparing a CBDC pilot and finalizing crypto regulations. Despite crypto's legal gray area, Pakistan ranks 7th globally in crypto adoption (TRM Labs 2024). Recent initiatives include a Crypto Council, a partnership with World Liberty Financial to boost blockchain adoption, and plans for a national Bitcoin reserve. The moves aim to balance innovation with risk control as Pakistan positions itself as a crypto-friendly market.

Australia's Project Acacia advances with 24 selected use cases exploring tokenized assets, including 19 live pilots and 5 simulated tests. Teh initiative, led by the RBA, ASIC, and Treasury, covers assets like fixed income, carbon credits, and stablecoins, using both private and public blockchains. ASIC granted regulatory relief to facilitate testing, aiming to balance innovation with risk management. Major banks and fintechs are participating, signaling growing institutional adoption of wholesale CBDCs and tokenization in Australia's financial markets.

The EU is ramping up its crypto oversight with four key actions this week: ESMA issued guidance for unregulated crypto services and reviewed Malta's MiCA compliance, highlighting licensing best practices like strict supervision and governance. AMLA labeled crypto a high-risk sector, pledging direct oversight of 40 firms by 2028 and warning against uneven AML enforcement. Meanwhile, the EU sanctioned Russia-linked stablecoin platform A7, mirroring earlier UK action—signaling tighter crypto sanctions coordination. Together, these steps show the bloc’s push for harmonized regulation, tougher AML enforcement, and strategic use of crypto sanctions.

Traditional Finance:

Coca-Cola, McDonald’s… Gemini Adds 5 New Tokenized Stocks to Its Platform – As new assets are added weekly, five more stocks are now available: Nike (NKR), Coca-Cola (KO), McDonald’s (MCD), Starbucks (SBUX), and Yum! (YUM). Over 30 stocks are already listed on Gemini’s new product, including Adobe, Uber, and Delta Airlines.

Even JPMorgan’s CEO Feels Compelled to Embrace Stablecoins – A tsunami for the financial world? Jamie Dimon, one of crypto’s loudest critics, announced JPMorgan will explore stablecoins. The bank seems to have adopted the motto, "Keep your friends close and your enemies closer." It’s not alone—many banks are studying the field, especially as the possibility of a U.S. CBDC fades due to Republican opposition.

Vanguard Heavily Invested in Crypto? The World’s 2nd-Largest Asset Manager Holds Bitcoin Unintentionally – Despite its anti-crypto stance, Vanguard holds significant crypto exposure. Historically skeptical of Bitcoin, the firm does not offer a Bitcoin ETF. Former CEO Tim Buckley called BTC "speculative" and unfit for long-term portfolios. Yet, Vanguard indirectly holds at least 47,400 BTC through investments in firms like Strategy (7.88% stake), Coinbase (9.14%), and MARA (15.32%).

Two Major Banks Seriously Studying Stablecoins – Like many traditional finance players, Morgan Stanley and Bank of America are exploring stablecoins. BoA is gauging client demand, which remains low for now, and may launch a stablecoin "when the time is right," likely via a partnership. Morgan Stanley CFO Sharon Yeshaya said they are "actively discussing" stablecoins but it’s "too early to determine their role."

30,000 Bitcoins and a $4.5 Billion Deal? A New Market Giant Emerges – A potential partnership between Cantor Fitzgerald and Bitcoiner Adam Back could create a Bitcoin Treasury Company holding 30,000 BTC. Back’s Blockstream would contribute the BTC, while Cantor’s investors have already raised $200M, with another $800M possible—totaling $4.5B.

Staking on Ethereum ETFs Soon? Nasdaq Files for BlackRock’s ETHA – No U.S. ETF currently offers ETH staking rewards, but that may change. Nasdaq has applied for BlackRock’s ETHA, though the iShares Ethereum Trust hasn’t yet amended its S-1 filing. Staking was discussed in a May SEC meeting, suggesting approval may come.

Inspired by Crypto? London Stock Exchange Considers 24/7 Trading – Has fintech and crypto influenced traditional markets? The LSE is exploring extended or even round-the-clock trading, following U.S. exchanges like NYSE and Nasdaq, which are in talks with the SEC. Tokenized stocks, tradable anytime, could drive this shift.

JPMorgan: The Largest U.S. Bank Plans Crypto-Backed Loans – Jamie Dimon once called Bitcoin a "fraud" for criminals. Now, JPMorgan is preparing to lend against crypto—specifically BTC and ETH—putting them on par with fiat. Launch could come as early as next year.

Cathie Wood's Ark Invest sold $13.3 million worth of Coinbase shares and $8.7 million of its own spot bitcoin ETF on Tuesday after both assets hit record highs. The firm rebalanced its Next Generation Internet fund to keep individual holdings within its 10% cap, with Coinbase and ARKB still among the fund's top four positions. Coinbase closed Monday at a record $394.01 and crossed a $100 billion market cap before slipping slightly on Tuesday. Bitcoin also saw an all-time high above $123,000 on Monday. Ark Invest's spot bitcoin ETF has generated $2.9 billion in cumulative net inflows since launch, with $5 billion in assets now under management amid the concurrent price rise.

Canary Capital just filed for a staked Injective ETF with the SEC. This could open the door for other layer-1 tokens to get similar products. Injective has been building momentum as a layer-1 blockchain. The token trades around $13.84, and institutional investors might soon get a regulated way to earn staking rewards on it.

Tech News:

Eclipse, the layer-2 that combines technology from the Ethereum and Solana blockchains, shared that it has gone live with an airdrop of its $ES token. The team behind the network shared that the initial distribution will occur over the next 30 days, and a total of 1 billion $ES tokens have been minted, with distribution structured to go to community incentives and long-term protocol sustainability. Of the supply, 15% is allocated to an airdrop and liquidity provisions for core community members and developers who have supported the network from the start. 35% will support ecosystem growth and research and development, aimed to help scale the network. Contributors will receive 19% of the supply, including team members, with a four year vesting period and three year lockup schedule. The remaining 31% is for early supporters and investors, who are subject to a three year lockup schedule to commit to Eclipse’s roadmap long-term.

Boundless, the decentralized zero-knowledge (ZK) compute marketplace powered by RISC Zero, has launched its incentivized testnet (which it is calling “Mainnet Beta”) on Base, Coinbase’s Ethereum layer-2 network. With Boundless’ incentivized testnet, developers can build and test applications in an environment as if the protocol is in fully live format. The network has already landed early support from industry heavyweights like the Ethereum Foundation, Wormhole and EigenLayer. A decentralized marketplace for zero-knowledge compute connects those who need zero-knowledge proofs — such as developers building rollups, bridges, or privacy-preserving applications — with a distributed network of independent “ZK provers or miners” who generate and verify those proofs. Instead of relying on centralized parties, this model allows anyone with the right hardware to contribute computing power and be rewarded for doing that cryptographic work.

A new Bitcoin draft proposal wants to do what’s long been unthinkable: Freeze coins secured by legacy cryptography — including those in Satoshi Nakamoto’s wallets — before quantum computers can crack them. That’s according to a new draft proposal co-authored by Jameson Lopp and other crypto security researchers, which introduces a phased soft fork that turns quantum migration into a ticking clock. Fail to upgrade, and your coins become unspendable. That includes the roughly 1.1 million BTC tied to early pay-to-pubkey addresses, like those of Satoshi’s and other early miners. “This proposal is radically different from any in Bitcoin's history just as the threat posed by quantum computing is radically different from any other threat in Bitcoin's history,” the authors explained as a motivation for the proposal. “Never before has Bitcoin faced an existential threat to its cryptographic primitives.”

Avalon Labs became an executive member of the Bitcoin for Corporations alliance co-founded by MicroStrategy. The group has over twenty member companies focused on corporate Bitcoin adoption. They're building their entire business model around Bitcoin infrastructure.

Adoption (Retail & Corporate Reserves):

Ethereum: This Public Company Uses DeFi to Borrow and Buy More ETH – On July 14, 2025, BTCS Inc. borrowed $2.34M via Aave to buy 2,731 ETH, boosting its holdings to 31,855 ETH (~$96M). The board capped leverage at 40% to avoid liquidations. Total assets now exceed $100.6M.

SharpLink Gaming disclosed it bought 74,656 ETH for around $156 million last week, raising its total treasury to 280,706 ETH ($854 million) and surpassing the Ethereum Foundation's holdings. The company funded the spree with proceeds from a $413 million at-the-market offering, leaving $257 million for more ether purchases. Nasdaq-listed SharpLink has also staked nearly all its ETH holdings, earning rewards and introducing an "ETH concentration" metric for investors. Sharplink features on a growing list of firms like BitMine and Bit Digital using ATM offerings to compete as the largest publicly traded ether holders.

$4 Trillion: Crypto Market Hits New Record – The total crypto market cap reached a new all-time high amid recent rallies.

Mastercard Promises New Era of Regulatory Clarity and Trust with GENIUS Act – The GENIUS Act’s passage opens a new chapter for dollar-backed stablecoins, and Mastercard plans to play a key role.

SpaceX Moves $153M in Bitcoin (BTC) After 3 Years of Inactivity – Did the bull run wake SpaceX’s wallets? An address linked to Elon Musk’s company moved 1,308 BTC (~$153M) to another internal address, likely a cold wallet reorganization. Fees: just $29.

Bitwise CIO Matt Hougan said in a client memo that legislation advancing during "Crypto Week" could permanently change the crypto landscape. The House is moving on three key bills: the GENIUS Act to regulate stablecoins, the Clarity Act to define crypto asset market infrastructure rules, and the Anti-CBDC Act to ban a U.S. central bank digital currency, Hougan noted. Clear U.S. regulation would attract major Wall Street institutions, unlock billions in investment, move trillions of traditional assets onto blockchain rails, and reduce risks from unregulated markets, he said. "You can't put the genie back in the bottle. If these bills pass through Congress and eventually get signed into law, we've entered a new era," Hougan concluded. "Crypto is going mainstream, risk is being reduced, and Wall Street is moving into the space in a big way. No wonder we're at all-time highs."

AdTech firm Thumzup Media, where Donald Trump Jr. is a shareholder, has received board approval to hold up to $250 million in crypto assets — including bitcoin, ether, Solana, XRP, Dogecoin, and USDC. The company cited favorable U.S. policy shifts as a key reason for the move. “As the federal government moves toward more crypto-friendly policies, Thumzup is committed to remaining at the forefront of this transformative technology,” CEO Robert Steele said. Thumzup reported a $2.2 million net loss in Q1 2025. Its stock closed down 2.9% on Thursday but remains up 17% over the past week and 267% year-to-date.

Strategy has bought another 6,220 BTC for $739.8 million, bringing its total holdings to 607,770 BTC — worth around $71.8 billion. The latest buy was funded via at-the-market sales of its Class A stock (MSTR) and preferred shares STRK, STRF, and STRD, leaving billions in remaining capacity across its equity programs. Strategy's BTC stack now places it among the top 10 corporate cash-equivalent holdings in the S&P 500, according to the company, ranking just behind General Motors and ahead of ExxonMobil. Its holdings account for nearly 3% of bitcoin’s total supply, far outpacing other corporate BTC treasuries like Marathon, Riot, and Metaplanet. TD Cowen has raised its price target for Strategy to $680, expecting BTC to hit $155,000 by December 2025.

The total NFT market cap has jumped past $6 billion, its highest since February. Daily NFT sales volume surged 154% to $41.4 million, according to CryptoSlam. A whale spent over 2,080 ETH ($7.8 million) on 45 CryptoPunks, driving the floor price up nearly 16% to 47.5 ETH. Analysts say rising altcoin prices and risk-on sentiment are reviving interest in legacy NFT collections — though activity remains concentrated in blue chips. Experts warn that sustained momentum will depend on deeper wallet engagement and a new narrative beyond established collections like CryptoPunks.

Funding & Partnerships:

Ether Machine: The Ethereum Treasury Project That Could Boost ETH’s Price – Nasdaq-listed Dynamix Corp. is merging with The Ether Reserve to form The Ether Machine, aiming to be the largest public ETH investment vehicle. Funding includes $800M in shares (at $10/share) from Kraken, Pantera Capital, and others, plus $645M (169,984 ETH) from co-founder Andrew Keys.

Ethena Raises $360M to Launch Its ENA Treasury – Post-GENIUS Act, Ethena launched a treasury to buy $360M in ENA tokens. Backers include Dragonfly, Pantera, and Polychain. The subsidiary will buy $5M daily in ENA for six weeks (~8% of circulating supply).

The Blockchain Group Rebrands as Capital B, Announces Abu Dhabi Subsidiary – The Bitcoin Treasury Company, now Capital B, is expanding to Abu Dhabi. It ranks as the 24th-largest public BTC holder.

Crypto Custodian BitGo Plans IPO – BitGo, securing $100B in assets and 9.3M wallets, filed for an IPO. Share count and pricing are undecided; timing depends on SEC review and market conditions.

Trump Media Buys $2B in Bitcoin – The company is now the 5th-largest public BTC holder. Its Truth Social platform also aims to launch crypto ETFs, pending SEC approval.

Aethir, a decentralized GPU cloud network, has teamed up with Credible Finance, a lending protocol, to introduce what they call the first credit card and loan product powered by a decentralized physical infrastructure network (DePIN). The move is designed to give Aethir’s native ATH token holders and node operators access to stablecoin credit without liquidating their tokens — a step toward blending on-chain infrastructure with real-world financial capital. The product, which debuted on Wednesday, lets eligible users collateralize their ATH tokens to access a revolving credit line or preload a no-fee card with ATH or stablecoins on Solana. Loan approvals and limits are determined by Credible’s AI-driven credit engine, which evaluates a user’s on-chain activity, asset holdings and transaction history.

Decentralized exchange dYdX has acquired Pocket Protector, a crypto social trading platform, marking its first external acquisition. The deal brings in most of Pocket Protector’s engineering team along with co-founders Eddie Zhang and Kaiser Kinbote, who join dYdX as president and head of growth, respectively. The acquisition — a mix of cash and dYdX tokens — was disclosed by founder and CEO Antonio Juliano. The company plans to expand into new forms of trading and integrate social features, though specific product plans weren’t shared.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.