Token Chronicle - Week 3 April 2025

Top cryptos

Extract from CoinMarketCap.com on April 23rd 2025

Meme of the week

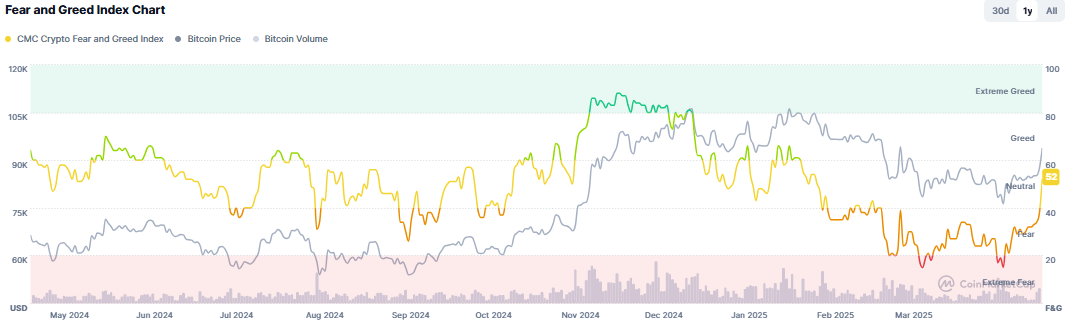

Market Sentiment:

F&G from CoinMarketCap.com on April 23rd 2025

Market update: We are witnessing what was mentioned two weeks ago — a decoupling between the crypto market and traditional markets (especially tech stocks). While the Nasdaq had another rough week, Bitcoin rebounded to touch $94K this week (notably today), recovering 50% of its losses from its all-time high (ATH). Its behavior this week is drawing closer to that of gold.

The overall crypto market is following the same trend, despite mounting tensions over U.S.-China tariffs and Donald Trump's stance toward the Fed/Chairman Powell (even though he toned things down yesterday).

The appointment of Paul Atkins to the SEC earlier this week was positively received by the market.

Let’s see how it goes in the following days !

Main points this week:

International:

1) Trump’s Bitcoin reserve could be funded by… tariff revenues: In an interview on Monday, April 14, 2025, Bo Hines, Donald Trump’s executive director for digital assets, unveiled new strategies to build a strategic Bitcoin reserve. The Trump administration is exploring the idea of using revenue from customs tariffs to avoid increasing the tax burden on citizens. Another topic: What if Bitcoin-backed Treasury bonds could help fund the U.S. debt? Faced with a wall of debt to refinance and interest rates strangling public finances, VanEck is proposing a bold idea: backing part of the U.S. debt with Bitcoin. This hybrid financial product would be composed of 90% traditional U.S. debt and a partial 10% exposure to BTC. With this strategy, the U.S. government could reduce the cost of refinancing its $14 trillion debt maturing over the next 3 years.

2) Is China discreetly selling seized Bitcoins? What does China do with Bitcoins seized in criminal investigations? According to Reuters, Chinese provinces may be quietly selling their BTC on the private market. These practices exist in a legal grey area that Beijing may address in the coming months. Officially, Bitcoin trading is banned in China. But some provinces seem to be finding ways to bypass central control and sell crypto. According to a Reuters report, local governments are exploiting a legal vacuum.

3) Russia officially wants to launch its own stablecoin: Under pressure after wallets linked to Tether’s USDT were frozen, Moscow is considering launching its own stablecoins pegged to other currencies like the ruble. This is a strategic move in the ongoing global race toward crypto dominance, signaling the Kremlin’s ambition to become a key player in the emerging digital monetary order.

4) Is Sweden about to adopt Bitcoin as a reserve asset? As geopolitical and economic uncertainty pushes more states to reassess their reserves, Sweden might take the plunge and adopt BTC as a strategic reserve asset. A Swedish MP recently proposed the creation of a Bitcoin reserve alongside Sweden’s gold and currency holdings. MP Rickard Nordin sent an open letter to Finance Minister Elisabeth Svantesson, urging her to consider adopting Bitcoin as a national reserve asset. A few days later, his colleague Dennis Dioukarev echoed the request with a formal inquiry.

5) In Panama City, citizens can now pay taxes in BTC and ETH: Panama City has become the first public institution in the country to accept cryptocurrency payments for municipal fees. Thanks to an instant dollar conversion system, the capital elegantly circumvents legal restrictions without changing the law.

6) France invests in Ethereum-based tokenization via Bpifrance: On Thursday, Bpifrance revealed an investment in Spiko’s tokenized euro money market fund. Through this move, the public bank is fulfilling its promise to support the French blockchain industry. Less than a month ago, Bpifrance announced plans to invest up to €25 million in local crypto projects. This week, they acted on that promise with their first equity investment in Spiko’s tokenized fund.

7) Following in Trump’s footsteps? South Korea might elect its first pro-crypto president: With a snap presidential election approaching, one South Korean candidate is drawing attention by making crypto deregulation and breakthrough technologies the core of his platform. During a speech in Seoul on April 16, he unveiled 27 economic proposals, with the main goal of turning blockchain and crypto into national growth engines. He wants to dismantle current regulations, much like Trump’s policies in the U.S. Beyond crypto, Hong Joon-pyo’s program includes broader modernization plans, with a massive investment of 50 trillion won (about $35 billion) over five years to boost R&D in key tech sectors.

8) A Scottish school now teaches Bitcoin: Could the future of education revolve around Bitcoin? In the U.K., Lomond School has become the first to accept tuition in Bitcoin and integrate it into its curriculum alongside economist Saifedean Ammous. Starting in Fall 2025, Lomond aims to introduce "sound money" principles to prepare students for an uncertain future. Offering BTC tuition payments is, according to the school, “a modern, secure, and borderless payment option that aligns with [their] philosophy of independent thinking and innovation.” Following this announcement, Palestinian-Jordanian economist Saifedean Ammous revealed he will develop an educational program at the school combining Bitcoin and Austrian economics.

9) Canada is set to launch the world’s first spot Solana ETFs this week, with offerings from Purpose, Evolve, CI, and 3iQ, reportedly approved by the Ontario Securities Commission. The ETFs will include staking features, potentially yielding higher returns than ETH staking while reducing holding costs. This development positions Canada at the forefront of Solana-based investment products. In the U.S., asset managers are quickly filing for spot Solana ETFs following the March debut of Solana futures ETFs by Volatility Shares. Meanwhile, Kaiko analysts suggest XRP may be next for a U.S. spot ETF due to its strong liquidity and Teucrium’s new 2x leveraged product.

10) Seychelles-based cryptocurrency exchange OKX is expanding to the U.S. and establishing a new regional headquarters in San Jose, California. The exchange will rolling out access to its platform and its native OKX Wallet to U.S.-based crypto traders.

11) The European Central Bank warned that President Trump's crypto push could trigger financial "contagion" in Europe, according to a policy paper seen and reported on by Politico. The ECB apparently fears EU MiCA rules may be too weak to counter U.S. efforts to globalize dollar-backed stablecoins through new legislation. However, the European Commission reportedly pushed back on the central bank's analysis, with one official claiming the ECB has been overplaying the threat of stablecoins to garner political support for its controversial digital euro project.

Compliance / Regulation / Justice

1) British minister’s X account hacked to promote a fake crypto: The verified X account of Lucy Powell, U.K. Minister for Parliamentary Relations, was hijacked to promote a fictional cryptocurrency called “$HCC.” This is yet another identity-theft-based crypto scam. Minimal gains for scammers, but an increasingly common method.

2) Crypto exchange OKX pays $500 million to settle charges and expand into the U.S.: Accused of transmitting money without the proper license, OKX has agreed to pay a record $500 million to the U.S. Department of Justice. This settlement coincides with the company’s announcement of a strategic U.S. expansion.

3) “A rational, consistent, and principle-based approach” – The new SEC Chair is sworn in: Paul Atkins, the new chair of the Securities and Exchange Commission (SEC), officially took office Monday. According to official disclosures, Atkins holds up to $5 million in crypto. A former Patomak Global Partners exec, he has helped develop the digital asset industry. In stark contrast to Gary Gensler, Atkins joins the SEC under a very crypto-friendly Trump administration, likely to favor the sector in the U.S.

4) Ethereum Layer 2 project ZKsync reported a $5 million theft after an admin account tied to its airdrop contract was compromised. The attacker seized remaining unclaimed ZK tokens, prompting a swift 20% drop in the token's price as the stolen assets were sold off. ZKsync assured users that the core protocol and ZK token contract remain secure, and no user funds were ever at risk. The team is conducting an investigation and plans to release a full report. The incident comes amid prior community criticism over the fairness and execution of ZKsync’s 2024 airdrop.

5) Last Friday, the Securities and Exchange Commission Philippines released a revised draft of its rules for crypto asset service providers (CASPs), keeping its core regulatory approach while refining definitions and shifting certain requirements—such as cybersecurity and market abuse—into a separate draft of operational guidelines. CASPs, including exchanges, custodians, and token offerers, will still need to obtain SEC licenses to operate locally, and both the updated rules and guidelines are open for public comment until April 26, 2025. The SEC also introduced a strategic sandbox (StratBox) tailored for CASPs, offering a controlled environment to test innovative services under relaxed regulatory conditions, aimed at fostering responsible innovation and investor protection.

6) Oregon Attorney General Dan Rayfield filed a securities lawsuit against Coinbase, mirroring previously dropped federal charges related to unregistered crypto activity and consumer protection concerns. The lawsuit alleges Coinbase enabled the sale of risky, unregistered crypto assets to Oregonians and exposed them to potential financial loss. Coinbase criticized the move as politically motivated and counterproductive, arguing it undermines bipartisan efforts in Congress to establish clear national crypto regulations. With the SEC pulling back from several crypto investigations, Rayfield says states must now step up to enforce protections as federal regulators shift focus under new leadership.

7) Arizona's Senate Bill (SB) 1373, which proposes a state-run digital assets reserve fund, passed a House committee and awaits a full floor vote before potentially reaching the governor. The bill would allow the state treasurer to manage seized crypto and legislative funds using approved custody solutions, with the option to loan assets for additional income. SB 1373 broadly defines digital assets to include cryptocurrencies, stablecoins, NFTs and other blockchain-based tokens with economic value. Despite progress, Arizona’s crypto bills could be stalled as Governor Katie Hobbs has pledged to veto all legislation until a disability funding measure is approved.

8) The Bank of Korea announced its active involvement in shaping stablecoin regulations to manage potential threats to monetary policy and financial stability. It warned that stablecoins, unlike other virtual assets, function as payment tools and could disrupt traditional financial systems if widely adopted. South Korea is working on a second crypto bill to regulate stablecoins, improve transparency in token listings and define crypto service providers more clearly. With over 18 million crypto investors, the country is also advancing central bank digital currency trials, including P2P transfers in an upcoming phase.

Traditional Finance

1) Larry Fink says Bitcoin could dethrone the dollar if U.S. debt keeps rising: In his annual letter to shareholders, BlackRock CEO Larry Fink issued a warning: America’s growing debt threatens the dollar’s dominance as a global reserve currency. According to Fink, this instability could benefit Bitcoin, as investors might turn to crypto alternatives. His concern echoes growing distrust in the dollar, already weakened by U.S. credit downgrades and political uncertainty with Trump’s return. In November, Moody’s downgraded the U.S. debt outlook to “negative.”

2) Trump Media enters crypto ETFs with Crypto.com and Yorkville: Founded by Donald Trump, Trump Media & Technology Group is expanding into finance, launching crypto ETFs in partnership with Crypto.com and Yorkville America Digital—a strategic and politically charged move into digital assets.

3) U.S. Federal Reserve Chair Jerome Powell signaled a potential easing of crypto-related restrictions for banks during remarks at The Economic Club of Chicago, acknowledging the industry's growing mainstream presence despite past "failures and fraud." Powell said regulators had taken a conservative approach but indicated that "some loosening" could occur, provided it supports innovation while maintaining consumer protections and banking system stability. He also backed congressional efforts to regulate stablecoins, emphasizing the need for transparency and safeguards as the digital asset class gains broader appeal.

4) According to BitMEX co-founder Arthur Hayes, we might be looking at the "last chance" to buy Bitcoin below $100,000. Hayes points to incoming US Treasury buybacks as the potential catalyst that could propel Bitcoin to six figures. These Treasury operations inject liquidity into the financial system and typically benefit risk assets. Meanwhile, other analysts predict Bitcoin could surge above $132,000 before year's end, driven by growth in the fiat money supply.

5) Bitcoin could continue its upward trajectory as threats to the U.S. Federal Reserve’s independence increase government-sector risk, a key driver of bitcoin outperformance, according to Standard Chartered’s Global Head of Digital Assets Research Geoffrey Kendrick. He cited President Trump’s recent calls to replace Fed Chair Jerome Powell as a signal of rising political pressure on monetary policy, arguing that bitcoin serves as a hedge against both private-sector failures and government instability. Although bitcoin has recently lagged the sharp rise in U.S. Treasury term premiums, Kendrick believes it has room to catch up if macro uncertainty persists. He reaffirmed his bullish price targets of $200,000 by 2025 and $500,000 by 2028, calling ongoing pressure on the Fed a potential catalyst for new all-time highs.

Tech News

1) Crypto ads: Google updates rules for Europe – What’s changing? Google has clarified its rules for crypto advertising in Europe. Companies must now obtain a Crypto Asset Service Provider (CASP) license under MiCA regulations from a national authority. They must also comply with any additional local rules and be certified by Google.

2) Kraken may soon become a fintech? The crypto exchange expands into stocks and ETFs: Kraken is broadening its scope, announcing the launch of U.S.-listed stocks and ETFs trading. American users in select states (like New Jersey, Connecticut, Wyoming) will gain access to over 11,000 stocks and ETFs, commission-free. National rollout is planned. Co-CEO Arjun Sethi says the future of trading is “borderless, 24/7, and built on crypto rails.” Kraken’s move into traditional markets is likely just the first step toward a world of tokenized equities.

3) Anti-inflation stablecoin: USDi aims to protect savers from rising prices: To combat inflation while avoiding market volatility, a team of entrepreneurs is developing the USDi stablecoin. Co-founded by Michael Ashton, André Fately, and Roger Ramia, USDi is inspired by inflation-protected securities (TIPS), with some differences: “Inflation data is published monthly. USDi converts this into daily inflation adjustments by interpolating the last three and two months of non-seasonally adjusted CPI to get a reference CPI.”

4) OpenAI is reportedly working on a social media rival to X: Another Elon Musk vs. Sam Altman rivalry? According to The Verge, OpenAI is quietly developing an AI-based microblogging platform to compete with X. Early development is underway inside OpenAI, with the new platform currently focused on ChatGPT’s image generation capabilities. It’s unclear whether it will be a standalone app or integrated into ChatGPT.

5) Ethereum fees fall to their lowest level in 5 years: Transaction fees on the Ethereum network have dropped to their lowest level since 2020, due to a global economic slowdown. Could this lull be a prelude to a rebound? The upcoming May 7 “Pectra” upgrade may restart activity. Phase 1 includes key improvements: doubling blob capacity for layer-2s (from 3 to 6), lower fees, less congestion, and allowing stablecoin-based gas fees (like USDC or DAI). Another major change: the staking cap will rise from 32 ETH to 2,048 ETH—long awaited by validators. Phase 2 (late 2025 or early 2026) will introduce a new data structure and better validation technology. These updates could breathe new life into Ethereum. Brian Quinlivan believes: “The more retail interest fades while development remains active, the greater the odds of a sudden, sharp rebound.”

6) Circle unveils new payment and cross-border transfer network: Circle, the company behind USDC, makes a bold move from One World Trade Center. They’re returning to their roots—peer-to-peer payments—by launching a new solution poised to disrupt the space, potentially challenging giants like Visa and Mastercard. Managing over $60 billion via USDC, Circle aims to capitalize on new global stablecoin regulations that are opening up the market. Industry insiders see this as a logical step in Circle’s mission to facilitate global payments via blockchain.

7) Nvidia announced it will produce its next-generation AI chips and supercomputers entirely in the U.S. for the first time, aligning with a broader trend of localizing advanced tech manufacturing. The move comes amid soaring AI infrastructure demand and opens new opportunities for crypto miners, who are increasingly pivoting toward AI and high-performance computing (HPC). With access to power-dense infrastructure and industrial-scale operations expertise, miners are well-positioned to enter the AI supply chain. However, recent tariffs imposed by President Trump are creating uncertainty, as higher import costs on ASICs and data center hardware could impact operations.

8) Noble, a blockchain focused on issuing real-world assets (RWAs) and stablecoins, has announced the launch of AppLayer, an Ethereum-compatible rollup designed to let developers build custom RWA applications and infrastructure. AppLayer will integrate with Celestia, a modular data availability blockchain, to reduce storage costs and improve scalability for data-heavy use cases. By combining EVM compatibility with Cosmos ecosystem interoperability, Noble aims to create a developer-friendly platform optimized for building financial tools around tokenized real-world assets, including stablecoins pegged to fiat currencies.

9) Ethereum's co-founder gave a proposal that might completely transform the network. Vitalik Buterin wants to replace Ethereum's current virtual machine language with something called RISC-V architecture. This isn't a minor update - it's a fundamental redesign of how the world's original smart contract platform functions.

10) MANTRA founder and CEO John Patrick Mullin announced he will burn his entire allocation of 150 million OM tokens to help restore community trust following the token’s dramatic 90% crash on April 13, which erased $5 billion in market cap; discussions are underway with partners to potentially expand the burn to 300 million OM—16.5% of total supply—with the goal of lowering the bonded ratio and increasing staking APR, while Mullin reaffirmed that neither he nor the team sold during the collapse, pledged full transparency, and committed to completing the token burn by April 29.

Adoption

1) Stablecoins outperform Visa: $13.5 trillion in volume in 2024: Stablecoins reached roughly $13.5 trillion in transaction volume in 2024, outpacing Visa. With the U.S. stepping in, the upcoming STABLE Act could further boost this momentum. Next year’s data will be crucial to watch.

2) $19 billion in RWA: tokenized asset value doubles in under a year: As Real-World Asset (RWA) adoption accelerates, their market cap now exceeds $19 billion. With initiatives like Ondo Finance aiming to make financial markets 24/7 through tokenization, this is likely just the beginning. However, caution is needed, as shown by recent issues with Mantra (OM).

3) Binance is advising several governments on crypto regulation: Long criticized for compliance lapses, Binance’s CEO now says many governments are turning to the exchange for guidance on crypto regulation. While he didn’t name specific countries, Richard Teng said about 1,500 of Binance’s 6,000 employees work in compliance roles.

4) 13,000 institutions now have Bitcoin exposure through Strategy: In 2025, over 13,000 institutions and 55 million people are exposed to Bitcoin via Strategy. Thanks to its inclusion in the Nasdaq 100, the company is attracting institutional investors, positioning $MSTR stock as a key vehicle for BTC exposure. Recent buyers include central banks of Norway and Switzerland. In December 2024, the firm joined the Nasdaq 100—home to the 100 largest non-financial companies on the Nasdaq. Saylor revealed that 13,000 institutions and 814,000 individuals hold MSTR shares, giving 55 million people indirect BTC exposure.

5) Michael Saylor’s company, Strategy, bought 6,556 more bitcoin for about $555 million at an average price of $84,785 each between April 14 and April 20. The purchase was funded by selling shares of its MSTR and STRK stock, raising $555 million through ongoing stock sale programs. Strategy now holds 538,200 bitcoin bought for $36.47 billion total, with a current market value near $46.8 billion. After reporting $5.91 billion in unrealized Q1 losses, bitcoin’s price recovery has flipped Strategy's holdings into gains.

Funding & Partnerships:

1) Treehouse Finance has secured new strategic funding at a $400 million fully diluted valuation to scale its DeFi fixed-income platform, ahead of a mainnet launch slated for June. While the amount raised remains undisclosed, the round was reportedly led by the venture arm of a major financial services firm managing over $500 billion in assets — widely believed to be MassMutual Ventures, a prior backer. CEO Brandon Goh says Treehouse aims to unlock a $600 trillion opportunity by bridging traditional finance with DeFi, and the firm plans to launch an "eight-figure" ecosystem fund to drive adoption across both institutional and decentralized sectors.

2) Optimum, a decentralized memory layer for blockchains, raised $11 million in a seed round led by 1kx, with participation from top crypto VCs including Spartan, Animoca, and CMS. Founded by researchers from Harvard and MIT, Optimum aims to solve inefficiencies in data storage and propagation across Web3 by introducing a performance-enhancing layer powered by Random Linear Network Coding (RLNC), a method pioneered by MIT professor Muriel Médard. The protocol addresses issues like bloated nodes, slow access, and outdated gossip networks by optimizing how blockchain data is shared and retrieved. Now live on a private testnet, Optimum is inviting L1s, L2s, and node operators to integrate and test its scalable memory infrastructure.

3) DWF Labs is investing $25 million in World Liberty Financial (WLFI), the decentralized finance protocol backed by U.S. President Donald Trump and his family. The crypto market maker is also entering the U.S. market with a new office in New York City as part of its broader expansion plans, according to a press release.

4) California-based bitcoin miner and AI infrastructure firm Auradine has raised $153 million in an oversubscribed Series C round to expand its U.S.-engineered Teraflux bitcoin miners and launch AuraLinks AI, a networking solution for AI data centers. The round, led by StepStone Group with support from Samsung Catalyst Fund, Qualcomm Ventures, MARA Holdings, and others, included $138 million in equity and $15 million in venture debt, bringing Auradine’s total funding to over $300 million. As Chinese competitors face mounting pressure from newly imposed U.S. tariffs, Auradine plans to grow its 100-person team and capitalize on domestic demand, with CEO Rajiv Khemani stating the company is on track to become EBITDA-positive within the next few quarters and currently holds an annualized revenue run rate exceeding $150 million.

5) Nasdaq-listed healthcare tech firm Semler Scientific has filed with the SEC to raise up to $500 million through one or more securities offerings, aiming to use part of the funds to purchase additional bitcoin alongside general corporate purposes. Since adopting its bitcoin strategy in May 2024, Semler has accumulated 3,192 BTC worth roughly $266 million. The company also reached a tentative $29.75 million settlement with the U.S. Department of Justice over alleged False Claims Act violations related to Medicare device marketing and secured a loan agreement with Coinbase to borrow against its bitcoin holdings to help fund the settlement.

6) a16z Crypto invested $55 million in LayerZero, a blockchain interoperability protocol, through the purchase of its ZRO token, which is locked for three years.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.