Token Chronicle - Week 2 July 2025

Top cryptos

Extract from CoinMarketCap.com on July 15th 2025

Meme of the week

Market Sentiment:

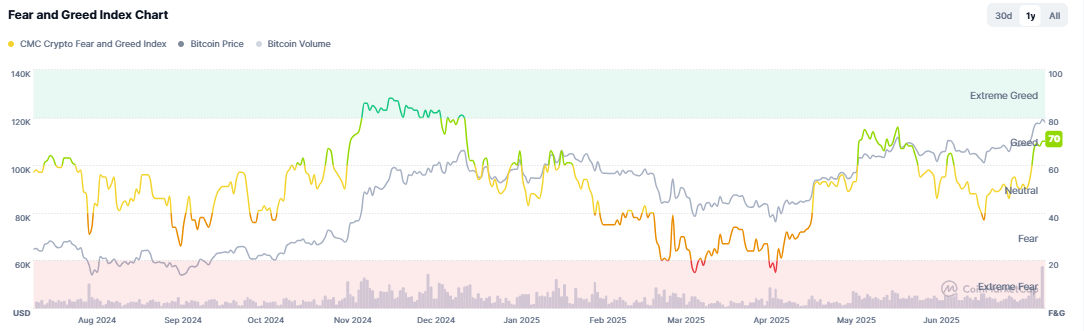

Market update: Big surge for BTC and the overall market this week, with Bitcoin hitting a new all-time high at $123K (vs $109K last week). We saw a small correction today with BTC at $116-117K, which is perfectly normal after such a run-up. We'll see how it develops over the week with the US “Crypto Week” and upcoming announcements on inflation, etc. Also in play are the USA/EU tariff tensions, now pushed back to August but still without an agreement. ETH is also performing well, breaking above $3K. Overall, the rally is being driven by banks through ETFs and by companies (strategic reserves), while retail investors (individuals) are still largely absent — many are not even aware of these market developments, as it’s getting little coverage in mainstream media.

Main points this week:

International Point:

New threats, new delay: Trump’s tariff war bogs down – While the U.S. tariffs were supposed to take effect on July 9, the President has granted Europe and the rest of the world a new deadline until August 1 to negotiate. Between repeated threats and ever longer delays, Donald Trump’s tariff war is stalling.

$8 billion: Tether holds 80 tons of gold in a secret Swiss vault – According to CEO Paolo Ardoino, Tether holds nearly 80 tons of gold, worth about $8 billion. The precious metal is stored in a secret vault in Switzerland owned by the company. Outside of states and central banks, this makes Tether one of the largest gold holders in the world, on par with Australia. For comparison, it’s roughly equivalent to all the precious metals held by UBS, which reported $7.62 billion at the end of Q1 this year.

USDC lands in China thanks to Ant Group – Goodbye digital yuan? – The stablecoin sector is booming following major regulatory advances in the U.S., greatly benefiting Circle’s USDC, now favored by Chinese giant Ant Group. Reports suggest this move is backed by businessman Jack Ma, founder and former chairman of Alibaba Group. Ant Group is apparently about to integrate USDC into its AntChain blockchain — an unprecedented opening for Circle, given Ant’s transaction potential estimated at over $1 trillion last year, a third tied to this blockchain. This initiative is likely linked to the ambitions of Ant International in stablecoins, following recent applications in June (with tech giant JD.com) to authorities in Singapore and Hong Kong to create a native version.

“Crypto Week” in Washington – 3 major crypto bills under review this week – This week, the U.S. is set to vote on three major crypto bills. First, the House will decide on the “GENIUS Act,” a law regulating private stablecoins, formally authorizing private companies to issue them. The other two bills focus more on U.S. institutions: the “Digital Asset Market Clarity Act,” which clarifies SEC vs. CFTC jurisdictions — mature cryptocurrencies will no longer be subject to the Howey Test and will instead be overseen by the CFTC, while the SEC continues to handle initial investment offerings. The third bill, the “Anti-CBDC Surveillance Act,” strongly backed by Republicans, aims to prevent the Federal Reserve from issuing a central bank digital currency (CBDC).

Trump tariffs: Europe tries to salvage the situation, prepares countermeasures – Unless a deal is struck before August 1, Donald Trump will impose 30% tariffs on European imports. Brussels is attempting a last round of negotiations in a delicate balancing act.

Czech National Bank invests in Coinbase: $18 million worth of shares – In its latest investment disclosure, the Czech National Bank revealed it bought nearly 52,000 shares of Coinbase. This comes as the crypto platform performs very well on the stock market, now valued at over $100 billion.

Japan’s Financial Services Agency (JFSA) and Deloitte Tohmatsu released a joint study on stablecoins, emphasizing their benefits—such as low-cost, fast transactions without crypto volatility—while addressing risks like illicit use. The report recommends measures like address blocklisting, asset freezing, and public-private partnerships (e.g., the T3 Financial Crime Unit) to combat crime. A separate FSA report flagged crypto exchanges as high-risk for money laundering, citing mixers, no-KYC platforms, and P2P transfers as key challenges. However, it also highlighted compliant exchanges' role in detecting suspicious activity (via blockchain analytics) and blocking high-risk transactions.

Malaysia’s Securities Commission (SC) has proposed major updates to its digital asset exchange (DAX) rules, aiming to strengthen market growth while improving investor safeguards. Key changes include scrapping pre-approval requirements for token listings—letting exchanges decide, provided tokens meet strict criteria like FATF compliance, 1+ year trading history, and annual security audits. The reforms also mandate 90% cold wallet storage for customer assets and higher capital/resilience standards for DAXs. The move comes as Malaysia’s 2024 crypto trading volume hit a record RM 13.9 billion (USD 3.27 billion), though the SC notes local activity still lags global markets. The proposal builds on Malaysia’s recent sandbox launch and tokenized securities framework, signaling a push to balance innovation with risk controls.

Compliance / Regulation / Justice:

Two OmegaPro executives indicted for stealing $650 million from investors – New developments in the OmegaPro case, which left many victims worldwide. Two leaders of this fraudulent exchange platform have been indicted in New York. They targeted vulnerable people in the U.S. and abroad, extracting over $650 million with false promises of high returns and safety. They face up to 20 years in prison per count.

Hack on GMX: this Hyperliquid competitor loses $42 million – On Wednesday afternoon, decentralized perpetuals exchange GMX suffered a $42 million hack. According to DefiLlama, GMX now holds $405 million in TVL, down from $506 million pre-hack. The GMX token also fell 19.5% over 24 hours to $11.50, with a market cap of $117.3 million.

Victory for DeFi: U.S. drops controversial tax rule – The scrapped rule (26 CFR Part 1 under Section 6045 of the IRC) would have required certain DeFi protocols to file and transmit tax reports as brokers. Set to take effect February 28, 2025, this regulation was removed, marking a win for DeFi players.

Mysterious 2011 address moves billions in Bitcoin (BTC) – Bitcoin’s price records continue to awaken whales. An anonymous address moved over $2 billion in BTC last night — 18,643 BTC were transferred to a Galaxy Digital exchange address. Analyst Conor Grogan suggests these coins belonged to a miner active in 2011.

U.S.: Banks can now custody crypto for their clients – Yesterday, the Fed, FDIC, and OCC published guidance clarifying that banks may offer crypto custody services, provided they meet strict security and compliance standards. This confirmation does not create new rules but lays out expectations on risk management and legal compliance (AML/BSA/OFAC). It marks an important milestone, confirming banks can directly hold private keys under robust frameworks.

A Manhattan federal judge barred mention of OFAC’s sanctions against Tornado Cash in developer Roman Storm’s upcoming trial, ruling the backstory—including their 2022 imposition, 2024 reversal, and a Texas court’s illegality finding—would confuse jurors with unnecessary "mental gymnastics." The decision sidelines a key defense argument about regulatory ambiguity, narrowing the case to Storm’s alleged role in the privacy tool’s operations. The ruling underscores the legal complexities of prosecuting crypto developers for neutral infrastructure amid shifting enforcement landscapes.

Traditional Finance:

Robinhood’s tokenized stocks: many private firms want in – A week after launching in Europe a platform for buying tokenized stocks, Robinhood’s CEO says many private companies have expressed interest, seeing it as a way to open their capital to the public.

Major UK bank finally offers Bitcoin & Ether trading – On Tuesday, July 15, in London, Standard Chartered became the first G-SIB bank to launch spot Bitcoin and Ether trading for institutional clients. This comes as Bitcoin hits new highs.

Bitcoin surged past $118,000 as traders rushed to capitalize ahead of a pivotal "Crypto Week" in the US, where lawmakers are expected to advance tax and regulatory measures to legitimize digital assets. Spot Bitcoin ETFs saw massive inflows of $1.2 billion in a single day—their sixth straight gain—fueling FOMO-driven momentum. Crypto-linked stocks like Coinbase (+55% YTD) and Robinhood (+155%) also soared, reflecting broad market enthusiasm. However, while Bitcoin is often touted as "digital gold," its price moves more like a risky asset, closely tracking stock market trends rather than serving as a reliable hedge in downturns. Investors should remain cautious, as the current rally hinges on speculative bets rather than fundamental stability.

Bernstein expects bitcoin to hit $200,000 by early 2026 as institutional adoption, rather than retail speculation, drives a "long and exhausting" crypto bull market. Analysts at the research and brokerage firm see regulatory clarity in the U.S. through the GENIUS and Clarity Acts boosting adoption too, reshoring trading, and legitimizing firms like Circle, Coinbase, and Robinhood. Tokenization, stablecoins, and blockchain integration into traditional finance will also help fuel growth in networks like Ethereum and Solana, reinforcing their investment case as the cycle broadens beyond Bitcoin, in Bernstein's view. "It is easy to dismiss the current cycle as yet another crypto bull market," the analysts said. "We are seeing on-ground adoption and widespread integration with the traditional financial system. You may want to err on the side of our belief this time."

Grayscale has confidentially filed draft IPO paperwork with the SEC, signaling another potential U.S. crypto listing after Circle's NYSE debut. Wall Street's crypto IPO pipeline is heating up under President Trump's pro-crypto stance, with Gemini, Kraken, Bullish, and others also lining up to follow Circle and Coinbase. The IPO would cap a busy 18 months for Grayscale following the conversion of its landmark Bitcoin and Ethereum trusts into ETFs. The confidential filing keeps Grayscale's share offering, valuation target, and timing under wraps until it's ready to gauge investor appetite, with firms typically unveiling a prospectus 15 days before a roadshow begins.

Tech News:

After Twitter and BlueSky, Jack Dorsey unveils Bitchat, a Bluetooth messenger without Internet – Jack Dorsey, co-founder of Twitter and initiator of Bluesky, is back with Bitchat, a peer-to-peer Bluetooth messaging app that works without the Internet. Designed to be resilient, encrypted, and decentralized, it continues his push for tech independent from major platforms, connecting users over short distances without any online connection.

Ethereum co-founder Vitalik Buterin and developer Toni Wahrstaetter have introduced EIP-7983, a proposal to enforce a 16.8M gas limit per transaction (2²⁴)—a dramatic reduction from Ethereum’s current design, which permits single transactions to consume nearly an entire block’s gas allocation. The cap aims to improve network efficiency by preventing oversized transactions from disrupting block execution, while aligning with Ethereum’s modular scaling roadmap. Though large transactions may need to be split, the change could strengthen stability for high-throughput applications. The proposal reflects ongoing efforts to optimize Ethereum’s performance ahead of future upgrades.

Eigen Labs, the team behind EigenLayer, has laid off 29 employees (25% of staff) as CEO Sreeram Kannan restructures to prioritize EigenCloud—a "verifiable" cloud-computing alternative. The firm denies financial strain, despite EigenLayer’s TVL plunging from $20B to $12B since June amid criticism over missing protocol safeguards and controversy around Ethereum Foundation advisors’ payouts. The cuts signal a strategic shift toward decentralized infrastructure, even as the once-hot restaking protocol faces growing pains.

Adoption:

Dubai airport will soon allow crypto payments – A further step toward crypto adoption: the UAE signed a declaration so visitors at Dubai airport flying with Emirates will be able to pay in crypto, leveraging Crypto.com’s services.

$2 trillion market cap for stablecoins? Ripple’s CEO believes so – The rush toward stablecoins isn’t over, says Ripple (XRP) CEO Brad Garlinghouse. He predicts stablecoins could reach a $2 trillion market cap in coming years, up from today’s $261 billion. For perspective, Tether’s USDT was only at $11.8 billion in July 2020 and has exploded to $158 billion by July 2025.

Bitcoin stronger than Amazon: BTC becomes the world’s 5th largest financial asset – Thanks to stellar performance, Bitcoin has overtaken Amazon to rank as the 5th largest financial asset globally.

Corporate Bitcoin treasuries hit record with 159,000 BTC accumulated in Q2 – The trend is accelerating so much that it’s now possible to speak of a true corporate Bitcoin treasury boom, setting a new record for BTC purchases in Q2 this year.

BIT Mining is pivoting to the Solana ecosystem with plans to raise between $200 million and $300 million to build a SOL treasury. To kick off the new strategy, the company will convert all its existing crypto holdings into SOL and adopt a "long-term holding strategy." BIT Mining also plans to expand its role in the Solana ecosystem by running validator nodes to help maintain network decentralization and security while earning staking rewards. BIT Mining currently operates self-mining, hosting, and hardware businesses for Bitcoin, Litecoin, Dogecoin, and Ethereum Classic, ranking as the 17th largest public miner by market cap. Confusingly, two other mining companies with names starting "Bit" — Bit Digital and BitMine — have also launched crypto treasury strategies in recent weeks, albeit for Ethereum rather than Solana.

Funding & Partnerships:

Volkswagen’s self-driving unit ADMT has partnered with Hivemapper—a Solana-based DePIN project—to leverage its crowdsourced real-time mapping data for refining autonomous ride-hailing precision. Using street imagery from Hivemapper’s contributor network, Volkswagen aims to enhance its Robotaxi fleet’s curbside accuracy ahead of a 2025 U.S. pilot with Uber, signaling growing auto-industry adoption of blockchain-enabled geospatial data. The collaboration underscores the rise of decentralized physical infrastructure (DePIN) as AV firms seek dynamic, high-resolution maps beyond traditional providers.

Nasdaq-listed SharpLink Gaming bought 10,000 ETH directly from the Ethereum Foundation for $25.7 million, boosting its treasury to 215,634 ETH ($558 million). The company, chaired by Ethereum co-founder Joseph Lubin, aims to become the largest publicly traded ETH holder, aggressively building its treasury since June. SharpLink said its buying, staking, and restaking strategy strengthens Ethereum's ecosystem by removing supply and supporting decentralization. SBET shares rose 10% pre-market as investors reacted to the rare direct sale from the foundation to a public company, and are currently trading up 16% on Friday. Meanwhile, BTC Digital established a $1 million ETH reserve with plans to scale further.

Coinbase has teamed up with Perplexity AI to launch a real-time crypto data service aimed at improving trader decision-making. The partnership starts by integrating Coinbase's market data and COIN50 index into Perplexity's platform for market analysis before rolling out a conversational interface. The move follows other high-profile blockchain–AI tie-ups, like Polymarket's deal with Elon Musk's xAI last month. "I expect enhanced crypto functionality will be a catalyst for AI to achieve another 10x unlock," Coinbase CEO Brian Armstrong wrote on X.

The top 3 recent fundraises: Pump.fun, a Solana-based memecoin launch platform, raised $600 million in a public token sale completed in just 12 minutes. It sold 150 billion PUMP tokens at $0.004 each, following an earlier private sale of 180 billion tokens at the same price, bringing the total to $1.32 billion. Agora, a stablecoin startup co-founded by Nick van Eck (son of VanEck CEO Jan van Eck) alongside crypto veterans Drake Evans and Joe McGrady, raised $50 million in a Series A led by Paradigm with participation from Dragonfly. Distinct Possibility Studios, a new blockchain game studio founded by EverQuest and H1Z1 creator John Smedley, raised $30.5 million in a round led by Bitkraft and Brevan Howard Digital. Other backers include Hashed, Delphi Ventures, Shima Capital, North Island Ventures and Decasonic.

Sonnet BioTherapeutics, Inc. has agreed to merge with Rorschach I LLC to form Hyperliquid Strategies, Inc. and launch a HYPE treasury initiative. At closing, the new Nasdaq-listed entity is expected to hold 12.6 million HYPE tokens and $305 million in cash, aiming to build one of the largest Hyperliquid strategic reserves. Investors including Paradigm, Galaxy, and Pantera are backing the $888 million-valued merger deal, designed to help provide U.S. investors access to the Hyperliquid ecosystem. Sonnet will keep its biotech business as a Hyperliquid Strategies subsidiary, with shareholders retaining rights to future payouts as the firm pivots to a crypto treasury strategy under new leadership.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.