Token Chronicle - Week 2 April 2025

Top cryptos

Extract from CoinMarketCap.com on April 15th 2025

Meme of the week

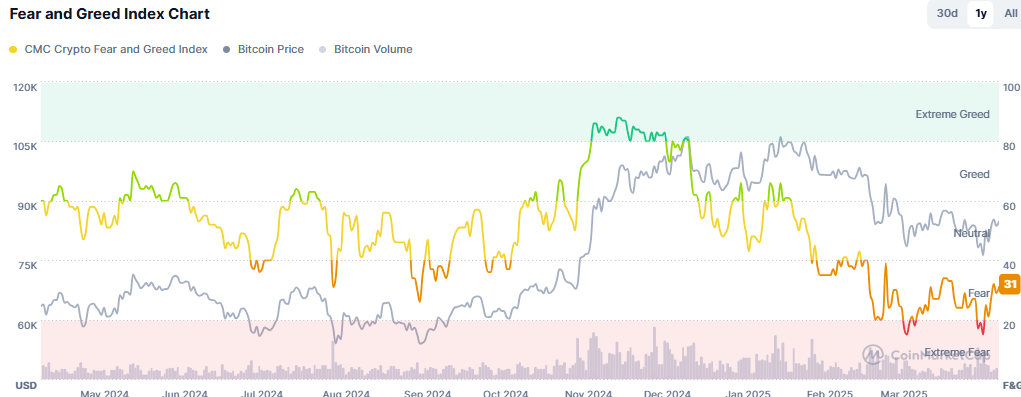

Market Sentiment:

F&G from CoinMarketCap.com on April 15th 2025

Market update: Big rebound in the market following Donald Trump's decision last Wednesday to pause tariffs (except with China, which faces a 124% rate — excluding tech products like components, smartphones, etc). As a result, BTC is back around $85K, while ETH is still lagging at $1.6K. The rest of the market has rebounded, but BTC remains dominant for now. The overall stock markets have also caught their breath and are now waiting for further decisions in three months.

Main points this week:

International Update:

China and Russia Now Use Bitcoin for Energy Trade:

China and Russia are increasingly turning to Bitcoin. According to certain sources, both countries have started using BTC in strategic trade exchanges. It's a quiet but significant signal of Bitcoin's growing role in international economic relations.New York State Could Soon Accept Crypto for Payments:

New York is reviewing a bill that would allow the use of cryptocurrencies for public payments. The goal is to enable citizens to pay various fees to government administrations — including fines, administrative charges, taxes, and other financial obligations — using crypto. This proposal marks a major step toward integrating cryptocurrencies into public infrastructure, while also planning strict oversight of their use.Cryptos May “Create Stability Issues,” Warns European Authority:

Last week, a director at the European Securities and Markets Authority (ESMA) warned about the potential dangers of crypto-assets. “EU financial markets are currently under intense stress due to wider political and geopolitical developments. The crypto-asset markets remain relatively small. However, in the current market environment, volatility even in smaller markets can create or amplify wider stability risks within our financial system. Rigorous risk monitoring and strong crisis preparedness are high on the agenda.” Natasha Cazenave, the director in question, also stated that 95% of the EU’s major banks are not involved in crypto-related activities — a surprising figure, given that financial giants like Société Générale, BBVA, BNP Paribas, and Commerzbank are all working on crypto-related initiatives, albeit discreetly.

Trump Family Invests in Sei Network with Crypto Project:

Over the weekend, the crypto project World Liberty Financial (WLFI), backed by the Trump family, invested in the Sei Network token.BRICS Global Payment System to Rival SWIFT:

A real challenger to SWIFT? The BRICS nations are scaling up their payment system ambitions — now aiming to roll it out globally, even to non-member countries. Initially positioned as an internal system for BRICS nations only, "BRICS Pay" now aims to become a true alternative to SWIFT. According to Russian Foreign Minister Sergey Lavrov, the group will propose a full-scale international equivalent.Binance co-founder Changpeng "CZ" Zhao is stepping back into the crypto spotlight with a surprising new role - advisor to Pakistan's freshly formed Crypto Council. Pakistan is making an aggressive play to become the crypto capital of South Asia, and they've tapped one of the industry's most recognizable faces to help make it happen. CZ will be guiding Pakistan on regulations, infrastructure, education, and adoption strategies - essentially architecting their entire crypto ecosystem from the ground up.

Global crypto funds saw $240 million in net outflows last week as tariff fears rippled through financial markets, but look beneath the surface and a fascinating story emerges. While the U.S. and Germany led outflows, Canada and Brazil took a "buy the dip" approach with modest inflows of $4.8 million and $1.4 million. Perhaps the most revealing signal comes from blockchain-related stocks, which notched their second consecutive week of inflows despite the market turmoil. This suggests experienced investors are using the dip to quietly accumulate positions.

MANTRA’s OM token plunged over 90% on Sunday, crashing from around $6 to $0.45 and triggering over $70 million in liquidations. The team blamed the drop on a large investor’s forced liquidation, not a hack or rug pull. Community lead Dustin McDaniel denied any team involvement in selling, despite past accusations that MANTRA controlled a significant share of OM’s supply. Nomura’s Laser Digital, a major investor, also denied any role, responding to claims that wallets tied to it had moved $227M in OM to exchanges. Laser attributed the activity to a third-party financing trade and stressed its investment remains locked. OKX has since updated its risk settings and is investigating suspected coordinated activity.

Compliance / Regulation / Justice:

The U.S. Declares Peace with Self-Custody – A Signal Bitcoin Was Waiting For?

Self-custody is no longer in the crosshairs of U.S. authorities. The Department of Justice is now focusing its efforts on serious crypto-related crimes. This strategic shift opens the door to a more favorable regulatory climate for Bitcoin and its users. This week, the DOJ announced the dissolution of its National Cryptocurrency Enforcement Team (NCET), originally created in 2022 to fight crypto crime.Ethereum Developer Freed After North Korea Presentation:

Virgil Griffith, former Ethereum Foundation developer, has been released after serving time in a high-profile case that intersected blockchain and international diplomacy. The case began in 2019 when Griffith traveled to Pyongyang to present at a conference titled “Blockchains for Peace.” U.S. authorities accused him of providing technical advice that could help North Korea evade international sanctions using crypto.In 2021, facing a harsh sentence, he pleaded guilty to violating the International Emergency Economic Powers Act (IEEPA) to avoid trial. Sentenced to 63 months in 2022, his sentence was reduced to 56 months by Judge Kevin Castel in July 2024.The Biggest Market Manipulation Ever? Suspicion Hangs Over Donald Trump:

A recent financial market surge, triggered by a Donald Trump announcement, has sparked major suspicions of insider trading or manipulation.

On April 9, after a steep market drop, Trump posted “It’s a good time to buy!!! DJT” on Truth Social. Just four hours later, he announced a 90-day pause on nearly all tariffs — a decision that sent stock indices soaring.

The S&P 500 jumped 9.5%, recovering nearly $4 trillion in market cap in one day, while the Nasdaq 100 saw its biggest one-day gain since 2008.

Richard Painter, former White House ethics lawyer, raised alarm: “He loves to control markets, but he should be careful.” The key question: Had Trump already decided to pause tariffs when he made his post?The U.S. Department of Justice has disbanded its National Cryptocurrency Enforcement Team (NCET), effective immediately, narrowing its focus on crypto enforcement. The DOJ will stop prosecuting crypto exchanges and services for regulatory violations, focusing instead on criminal activities involving digital assets. This move follows President Trump's executive order aiming to provide regulatory clarity for the crypto industry.

U.S. lawmakers are pushing for comprehensive crypto regulations following the DOJ’s decision to shut down its crypto enforcement unit. At a House Financial Services Committee hearing, legislators stressed the need for clear digital asset rules, with growing support for bills like FIT 21. While stablecoin legislation appears more feasible, broader market structure reforms face greater challenges due to their complexity. Some Democrats criticized the DOJ’s move, raising concerns about regulatory oversight and the adequacy of existing legal frameworks.

Jack Dorsey’s Block, Inc. has agreed to a $40 million settlement with New York regulators over anti-money laundering (AML) failures tied to its Cash App platform. The New York Department of Financial Services found that Block lacked proper risk-based controls and permitted high-risk Bitcoin transactions without adequate oversight. As part of the settlement, Block must appoint an independent monitor and has already begun improving its compliance systems. This deal resolves all outstanding state regulatory issues for Block, following an earlier $80 million settlement with 48 other states.

The Hong Kong Securities and Futures Commission (SFC) has issued new guidance allowing licensed virtual asset trading platforms (VATPs) and authorized virtual asset funds (VA Funds) to offer staking services, pending prior approval. VATPs must implement strong safeguards, including fraud detection, operational risk controls, and restrictions on third-party custody. Staked crypto assets must be protected as securely as other client assets. VA Funds can stake through licensed platforms or authorized institutions, provided it aligns with their investment strategy and includes thorough oversight. This marks the first major step under the SFC’s ASPIRe roadmap to expand Hong Kong’s regulated crypto market.

South Korea’s Financial Services Commission (FSC) is considering allowing foreigners to trade on domestic crypto exchanges, provided those platforms have strong anti-money laundering (AML) systems in place. FSC official Kim Sung-jin voiced support for foreign investment during a National Assembly seminar, noting it could boost market competitiveness and reduce volatility. Currently, foreigners are barred from trading on local exchanges. The move reflects Korea’s evolving crypto policy, as it balances market growth with regulatory controls. This follows earlier FSC plans to allow institutional crypto trading in phases throughout 2025 and accelerate regulation of corporate crypto use and stablecoins.

Traditional Finance:

First-Ever XRP ETF Launches on NYSE Arca:

Against all odds, the first ETF based on Ripple’s XRP has launched on the NYSE Arca exchange. Issued by Teucrium, the “2x Long Daily XRP (XXRP)” is a leveraged product that tracks XRP at twice the daily rate. Note: this is not a spot ETF — spot ETF approvals are still pending.Options Now Approved on Ethereum Spot ETFs – What Will Change?

The U.S. Securities and Exchange Commission (SEC) has officially approved trading of options on multiple Ether-based ETFs. This long-awaited regulatory move brings crypto even deeper into traditional finance by allowing investors to apply speculative or hedging strategies through options contracts tied to Ether spot ETFs.Staking May Soon Be Available on Ethereum Spot ETFs:

Since launch, Ether spot ETFs haven’t drawn massive interest — partly due to the lack of passive income options like staking. That may soon change: according to Bloomberg’s James Seyffart, the SEC is considering allowing staking features in spot Ethereum ETFs starting as soon as May.BlackRock CEO: “Tokenization Is the Future of Financial Markets”:

In his annual letter to shareholders, BlackRock CEO Larry Fink described tokenization as a financial revolution. He envisions tokenized assets gradually replacing traditional financial infrastructure.

A major hurdle? Digital identity.

Fink also criticized the SWIFT system — describing it as slow, fragmented, and outdated — and said tokenization could do to finance what email did to physical mail.BlackRock picked Anchorage Digital to provide digital asset custody for its spot crypto ETFs. BlackRock cited rising demand for crypto investment products as the reason for partnering with an institutional service provider like Anchorage. With recent regulatory approvals and partnerships, Anchorage is expanding its role in institutional crypto custody by supporting BlackRock as well as the global financial services firm Cantor Fitzgerald. BlackRock manages IBIT, the world's largest spot bitcoin ETF with roughly $44 billion in assets under management.

Sui blockchain is knocking on Wall Street's door with a potential ETF. Cboe just filed key paperwork with the SEC to advance Canary Capital's plans for SUI ETF, pushing the former Facebook engineers' project closer to mainstream investment access. The Nashville-based asset manager isn't stopping with Sui - they've also filed for Pudgy Penguins, Solana, and XRP ETFs.

JPMorgan’s blockchain division, Kinexys (formerly Onyx), has launched GBP-denominated blockchain deposit accounts, expanding its real-time settlement services beyond euros and dollars. The new offering allows corporate clients to make 24/7 cross-border transactions and foreign exchange transfers between GBP, EUR, and USD. Early adopters include SwapAgent (part of the London Stock Exchange Group) and commodities giant Trafigura. This move builds on Kinexys’ rapid growth — the platform has processed over $1.5 trillion in transactions since 2019, with daily volumes now averaging $2 billion and annual payments volume up 10x, according to JPMorgan.

Tech News:

Vitalik Buterin Unveils New Ethereum Roadmap – Key Takeaways:

Ethereum founder Vitalik Buterin has shared an updated roadmap emphasizing privacy.

Key proposals: Wallets should include a protected balance. Sending funds should default to “Send from protected balance.” No need for a separate “privacy wallet.”

He also highlighted the need to improve privacy at the RPC (Remote Procedure Call) level — the protocols wallets use to interact with the blockchain. Servers currently may collect sensitive data, and Buterin advocates for wallets to connect to a different RPC for each app by default.Trump’s Tariffs: A Nightmare for U.S. Bitcoin Miners:

New tariffs announced by Trump are throwing the U.S. Bitcoin mining industry into turmoil. Plunging profitability ; Heavily taxed machines ; Threats to hashrate decentralization The situation is worse for miners who import Chinese machines. After the Wednesday announcement, tariffs on these imports now reach 131% of their original value, according to estimates by Nick Hansen.EigenLayer, the Ethereum restaking protocol, will launch its long-awaited slashing feature on April 17, making it "feature-complete" for the first time. Slashing allows Actively Validated Services (AVSs) to penalize underperforming operators while rewarding compliant ones. EigenLayer pioneered restaking, enabling users to secure multiple protocols with staked ETH, but its delayed slashing mechanism left room for rivals like Symbiotic to gain traction. Competitors have already attracted EigenLayer users, including Hyperlane and Ethena, by offering restaking for various assets.

Rootstock, one of Bitcoin's oldest ecosystem projects, is advancing layer-2 development with its new computational layer using "BitVMX," a modified version of the BitVM programming language. RootstockLabs is set to release software development kits (SDKs) in the coming weeks, enabling developers to build Bitcoin layer-2 solutions. Founder Sergio Lerner confirmed that the project is nearing completion, aiming to enhance Bitcoin's utility and interoperability. SDKs will provide essential tools for third-party developers to create applications on BitVMX.

Funding / Partnerships:

Ripple (XRP) Acquires Hidden Road for $1.25 Billion – A Historic Deal:

On April 8, 2025, Ripple acquired Hidden Road, a multi-asset prime broker, for $1.25 billion. This move marks Ripple as the first crypto company to own a global-scale prime broker — a massive step in its global expansion strategy and deeper push into DeFi. Hidden Road processes over $3 trillion in annual volume and works with 300+ financial institutions across FX, derivatives, fixed income, and digital assets.NFT marketplace Magic Eden has acquired Slingshot Finance, marking its first major purchase as it aims to compete with centralized exchanges. The deal grants Magic Eden access to Slingshot’s chain abstraction technology, enabling seamless token trading across multiple blockchains. Despite a downturn in NFT activity, Magic Eden remains confident in the sector’s long-term value, emphasizing utility and ease of use as adoption drivers. The acquisition, which includes a team of up to 50 and backing from major investors, signals Magic Eden’s shift toward broader crypto services.

Bitcoin-focused life insurance firm Meanwhile has raised $40 million in a Series A round, boosting its total funding to $60.75 million. The round was co-led by Framework Ventures and Fulgur Ventures, with support from high-profile investors like former Xapo Bank CEO Wences Casares. Meanwhile’s main product, BTC Whole Life, provides life insurance with tax-advantaged growth, using bitcoin for premiums, policy loans, and payouts — aiming to merge traditional financial planning with long-term BTC exposure.

Janover, a commercial real estate financing firm, has adopted a crypto-focused treasury strategy by purchasing over 83,000 SOL (worth ~$9.6M) within two days. Following the board’s approval on April 4, the firm’s stock soared more than 1,100%, pushing its market cap to around $73.5 million. CEO Joseph Onorati described Janover as a transparent, efficient vehicle for crypto accumulation, with Solana chosen for its dynamic potential and growth prospects. The firm plans to stake its SOL and run validators to earn rewards and compound returns. While currently focused on Solana, Janover is open to expanding into other digital assets in the future.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.