Token Chronicle - Week 1 September 2024

Top cryptos

Extract from CoinMarketCap.com on September 8th 2024

Meme of the week

Quick bites:

Qatar establishes a new framework to regulate digital assets. This initiative aligns with Qatar's digital transformation goals and supports the Third National Development Strategy, the final phase of Qatar's National Vision 2030.

The SEC has charged the cryptocurrency advisory firm Galois Capital for failures in managing and protecting client assets.

According to CoinGecko, $62 million in Bitcoin has been transferred from a wallet apparently linked to Terraform Labs and Do Kwon.

The Penpie protocol appears to have been hacked, with over $25 million stolen. The protocol has announced it has frozen deposits and withdrawals.

The FBI has warned that North Korea is attempting to hack and steal cryptocurrency and Bitcoin funds from U.S. ETFs.

The DeFi project supported by Trump, World Liberty Financial, will be developed on Ethereum and Aave. A non-transferable governance token is also planned.

The Bank of Canada has once again reduced its key interest rates by 25 basis points.

Three major Japanese banks (Mizuho, MUFG, and SMBC) are working on an instant international payment system using blockchain technology.

Coinbase's CFO announced that Kamala Harris uses their platform to accept cryptocurrency donations.

Russian Bitcoin miners successfully mined 54,000 BTC, worth $3 billion 💰 in 2023, according to local media reports.

Mastercard launches a euro debit card allowing users to spend their cryptocurrencies directly from a non-custodial wallet at over 100 million merchants.

Core Blockchain introduces $LstBTC, a liquid staking token indexed to Bitcoin. It allows users to earn rewards while maintaining Bitcoin liquidity for DeFi use.

Market update: A rather volatile week again, with BTC dropping from $59K to $53K before returning to around $55K. Arthur Hayes believes the bottom will be reached during September, followed by a strong rebound in the fall. It's worth noting that the crypto market's decline is not due to internal or structural crypto factors but to uncertainties and concerns surrounding the US economy. We'll see the impact of the next FED pivot on September 18, which could lead to a drop in US interest rates. Will it be beneficial? Too soon? For the right reasons? US employment results were disappointing, and US tech stocks, particularly Nvidia, saw a significant decline.

Main points this week:

Project Updates:

Potential issues with the launch of SAGA2, the second phone with integrated blockchain from Solana, due to the financial difficulties of its partner, OSOM.

Cardano update: The blockchain officially deploys its Chang hard fork, moving towards decentralized governance similar to Polkadot or Cosmos. In the coming weeks, ADA holders, the native cryptocurrency of the blockchain, will be able to decide the future of Cardano.

Announced over a year ago, the migration of MATIC from Polygon to the POL token takes place today. For many users, no action is required as the migration is automatic, particularly for MATIC on the Polygon PoS network. However, some actions may be needed for those holding MATIC on Ethereum (ETH).

To ensure better rewards for restakers and maintain a competitive edge, EigenLayer’s restaking protocol has been updated. It will now allow restaking of any ERC-20 standard token from EigenLayer. This update is primarily designed to improve the performance of EigenPods, EigenLayer’s restaking smart contracts for ETH deposited on the Beacon Chain, Ethereum's proof-of-stake (PoS) layer.

Regulation Point:

FTX case remains unresolved, and customers have still not been reimbursed. The U.S. Securities and Exchange Commission (SEC) has issued a statement: it does not plan to authorize reimbursements in cryptocurrencies, even in stablecoins. "[The SEC] reserves the right to oppose transactions involving crypto assets."

Binance: The trial of one of the exchange’s officials in Nigeria has begun. Arrested last February by Nigerian authorities and placed in custody, Tigran Gambaryan, Binance's head of compliance for financial crime, faces accusations. Binance is held responsible for worsening the country's monetary failure (the fall of the Naira) and for not properly registering. Gambaryan was reportedly mistreated during his detention and has mobility issues.

On Wednesday, the CFTC announced a settlement with Uniswap Labs, imposing a civil fine of $175,000. From at least March 2021 to September 2023, the decentralized exchange (DEX) is accused of enabling leveraged trading in the U.S. for "a limited number of tokens," including BTC and ETH, which the CFTC considers commodities.

According to the U.S. Federal Reserve, the United Texas Bank, a crypto-friendly banking institution, failed to meet several of its risk management obligations in its dealings with clients. The Fed has issued a cease-and-desist order against United Texas Bank.

Robinhood pays a $3.9 million fine for not allowing cryptocurrency withdrawals: As crypto withdrawals were not available on Robinhood when it first entered the ecosystem, the platform faced legal action, resulting in a $3.9 million penalty.

Telegram CEO arrested: Following the arrest of Pavel Durov, CEO and co-founder of Telegram, the messaging service has reassessed its moderation policy. The company behind the platform has decided to review its rules to offer better moderation of private conversations and discussion groups.

Institutions:

In 2024, central banks set records for gold purchases, reflecting an intensification of de-dollarization. By diversifying their reserves, they protect themselves against economic risks, also paving the way for Bitcoin, which could become a new safe-haven asset amid uncertainties about the dollar's future.

Nvidia has experienced the largest market capitalization drop in history, losing $278 billion in a single day. This 9.5% decline is the largest ever seen in U.S. stock market history. The cause stems from a Bloomberg report published yesterday, which revealed that Nvidia had received a subpoena from the U.S. Department of Justice (DOJ), suggesting that authorities are seeking evidence that the tech giant violated antitrust laws.

Bloomberg terminals now integrate Polymarket data: Bloomberg, the renowned provider of financial news and data worldwide, has integrated data from the Polymarket prediction platform.

International:

President Nicolas Maduro, recently re-elected, wants to refocus his country on "the crypto path" after the PDVSA scandal and the failure of the Petro (PTR).

Telegram: South Korea has launched an investigation into pornographic deepfakes on the platform, which involve illegal content created with artificial intelligence (AI) to produce realistic but fake images.

The FBI reports an increase in attacks targeting Bitcoin (BTC) and Ethereum (ETH) ETF-related businesses. The aim is to deploy malware on these companies' networks to steal their cryptocurrencies.

Switzerland: One of the country's largest banks now allows its clients to invest in Bitcoin (BTC) and Ethereum (ETH). Zürcher Kantonalbank (ZKB), the 4th largest Swiss bank, has long been interested in blockchain technology. It now enables its clients to acquire Bitcoin (BTC) and Ether (ETH) through the bank.

Introduction to Key KPIs and Tools for Analyzing BTC and ETH:

When analyzing the performance and trends of major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), key performance indicators (KPIs) and data-driven insights are crucial. One of the leading sources for these metrics is 21.co, the parent company of 21Shares, which manages one of the largest ranges of crypto ETFs and ETPs worldwide. Through its open-source dashboards on Dune, 21.co provides valuable, free access to important metrics for both BTC and ETH.

Key BTC Metrics:

The BTC dashboard offers a wide array of indicators, including:

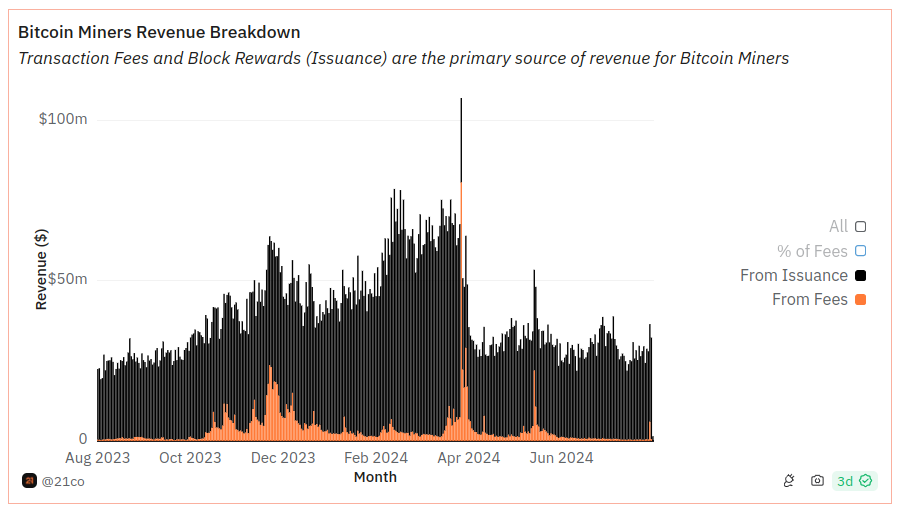

Miner Revenue Tracking: This metric compares the revenue miners earn from block rewards versus transaction fees, providing insights into the profitability of BTC mining.

On-Chain Activity: A look at the number of active Bitcoin addresses and the settled on-chain volume, revealing the overall network activity and user engagement.

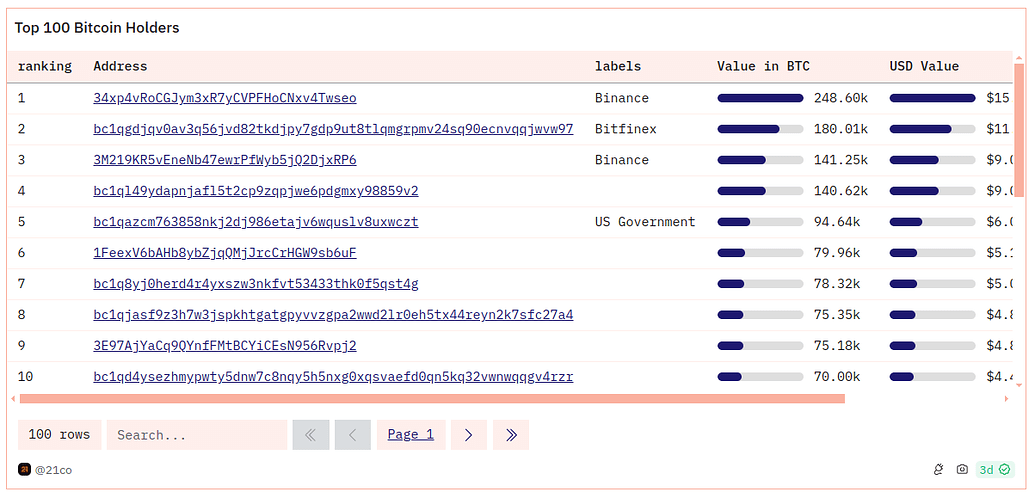

Top BTC Holders: A detailed table of the largest BTC holders, offering a glimpse into the distribution of Bitcoin among major players.

Key ETH Metrics:

Similarly, for Ethereum, 21.co provides a comprehensive dashboard to monitor fundamental dynamics:

ETH/BTC Ratio: This ratio is a useful tool for identifying periods where ETH outperforms or underperforms relative to BTC.

Correlation with Major Altcoins: A monthly analysis of ETH's correlation with other major altcoins helps users decide whether to diversify their portfolios.

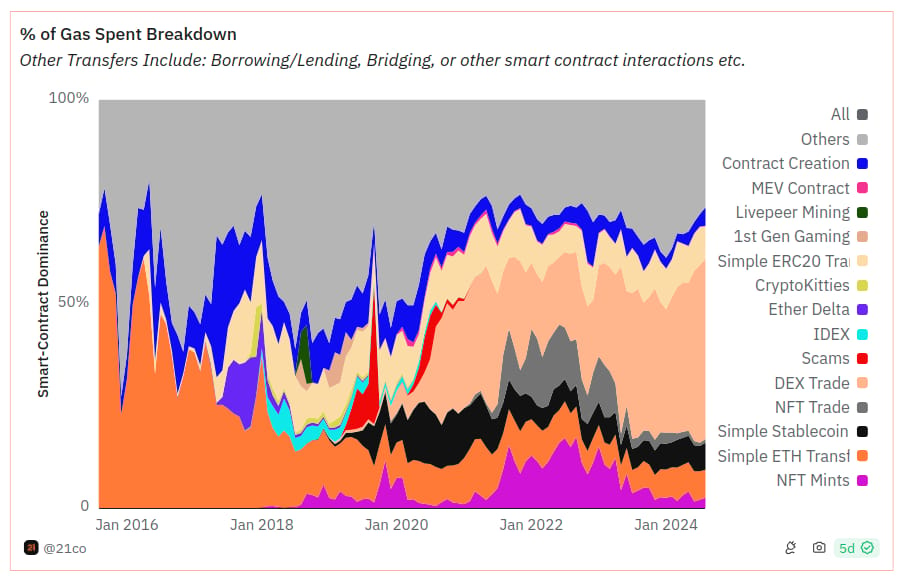

Gas Expenditure Analysis: An estimation of gas spending across Ethereum’s ecosystem, allowing users to track demand across various sectors.

Top ETH Holders: A table showcasing the largest holders of ETH, shedding light on the concentration of Ethereum among key stakeholders.

Let’s talk about: the decentralized lending platform Aave

Aave, a pioneer in decentralized finance (DeFi), initially launched as ETHLend in 2017 and rebranded to Aave in 2020. Since then, it has established itself as one of the leading platforms in the DeFi space. Aave operates as a decentralized lending platform, allowing users to both lend and borrow cryptocurrency assets in a system similar to traditional banking. Lenders deposit funds to earn yield, while borrowers provide collateral that exceeds the amount they wish to borrow, ensuring repayment. Unlike traditional banks, however, Aave uses smart contracts to facilitate all transactions, eliminating intermediaries and offering 24/7 access to global users. No KYC, approvals, or waiting periods are required, making it a user-friendly, permissionless alternative to conventional banking.

Aave’s Potential:

Over the years, Aave has attracted significant liquidity, solidifying its place in the DeFi ecosystem. It currently holds around $12 billion in Total Value Locked (TVL), which may seem small when compared to major financial institutions like JPMorgan ($2.1 trillion) or Goldman Sachs ($363 billion). However, this contrast underscores the potential market Aave could tap into. The platform’s strength lies in its efficiency—Aave operates with 30 times less TVL than Goldman Sachs but requires 750 times fewer employees. With just 5 employees managing $1 billion in TVL, compared to 114 at JPMorgan and 123 at Goldman Sachs, Aave’s streamlined operations position it as a disruptor to traditional finance.

Source: Dune Analytics

Aave's Business Model:

Aave’s business model is simple yet effective: it generates revenue by offering lower yields to lenders and charging higher interest rates to borrowers. The difference between these rates forms the protocol’s revenue. For example, lending $USDC on Aave may yield 5.8%, while borrowing the same asset costs 7.6%, with rates fluctuating based on market demand. When borrowing activity increases and reserves shrink, interest rates rise to attract more lenders and balance supply and demand. This dynamic system allows Aave to efficiently manage liquidity and encourage optimal use of its resources.

By combining scalability, efficiency, and accessibility, Aave is well-positioned to challenge traditional banking giants in the evolving financial landscape.

Join me on Twitter: @Token_Chronicle

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.