Token Chronicle - Week 1 November 2024

Top cryptos

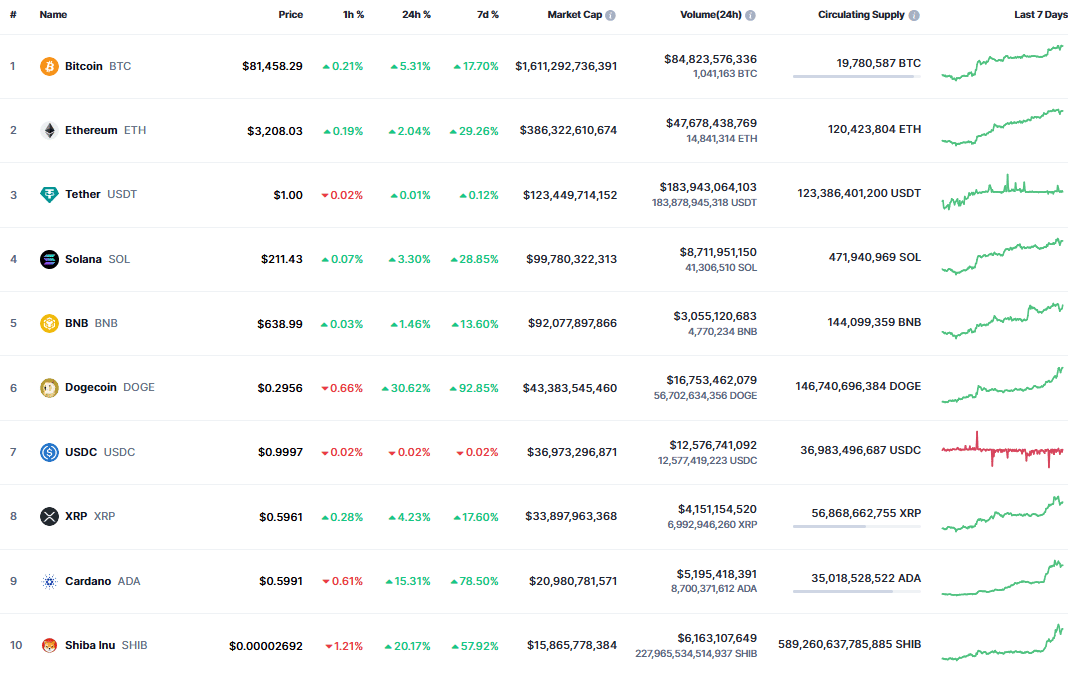

Extract from CoinMarketCap.com on November 11th 2024

Meme of the week

Market update: Major breakthrough this week in the crypto market following the results of the US elections and Trump’s victory. BTC rose from $69K on the eve of the election to $81K this Monday, November 11, with ETH back around $3K; the entire crypto market is also trending upward. The US stock market has reached new highs as well, somewhat reassured by Trump's win. Although he won’t take office until January 20, 2025, the crypto market is anticipating very bullish promises for the sector: the expected departure of Gary Gensler from the SEC, an "antagonist" to the ecosystem who maintained confusing, anti-crypto regulations; and, thus, the promise of clear regulations that could make the US a driving force in the market again. Also noteworthy is the country’s establishment of strategic BTC reserves amounting to nearly $80 billion—an initiative that could encourage other countries (and possibly companies, like Metaplanet or MicroStrategy) to follow suit. Finally, the new Senate and Congress are expected to be far more favorable to the sector, suggesting a potential breakthrough in US regulatory progress. Additionally, last Thursday, the Fed (and the Bank of England) lowered interest rates by another 25 basis points. While this move was somewhat overshadowed by the elections, it’s also quite bullish for assets like crypto. Coming up this week: new US inflation figures are due on Wednesday.

Main points this week:

US Elections:

Donald Trump is elected President of the United States: The cryptocurrency market surges upwards: With his victory over Kamala Harris, Donald Trump will become the 47th President of the United States on January 20th. Following this election, the cryptocurrency market has significantly appreciated. During his campaign, Trump notably promised to fire Gary Gensler, the current SEC Chair, as soon as he takes office. During an appearance at the Bitcoin 2024 conference in Nashville last July, Trump also pledged to free Ross Ulbricht, the creator of Silk Road, or to establish a national Bitcoin (BTC) reserve, while opposing the idea of a central bank digital currency (CBDC).

For Brian Armstrong, CEO of Coinbase: “This election was a huge win for crypto.” Following Trump’s election and the Democratic Party’s victory, Brian Armstrong, CEO of Coinbase, shared his thoughts on what this means for cryptocurrencies. Armstrong didn’t limit his comments to Trump’s election but also expressed his views on the Congressional renewal, which now sees a majority of seats represented by Republican red. Now, we wait until 2025 to assess the concrete actions that will be implemented, while the coming weeks will test the observed upward trend in prices.

In parallel with Trump’s victory, the S&P 500 recorded its biggest performance in history on a post-election day. Among the companies within the index, some performed better than others. This was especially true for Tesla, whose CEO, Elon Musk, strongly supported Trump throughout this election campaign. On Wednesday, the electric vehicle manufacturer’s stock price rose by 14.75%.

The U.S. Senate now has a Republican majority – Towards pro-crypto legislation in the U.S.? As the world celebrates Trump’s victory in the U.S. presidential election, the United States also voted to renew part of its Senate. The results place the Republican Party as the majority faction in the Senate, opening the door to pro-crypto regulation in the country. A majority in Congress would enable the U.S. to work freely on defining a clear regulatory framework, reducing the ambiguities that currently hinder innovation and broader investment opportunities. Among the submitted bills the new Senate could review is the Digital Commodities Consumer Protection Act. This legislative framework, favorable to companies, would allow the Commodity Futures Trading Commission (CFTC) to take control over digital asset trading regulation, without sharing this role with the Securities and Exchange Commission (SEC). Additionally, Senator Cynthia Lummis from Wyoming is advocating for the Bitcoin Act, a bill that proposes using cryptocurrency as a reserve unit. The U.S. Treasury Department would be asked to build a reserve of one million BTC, worth over $76 billion, intended solely for national debt reduction by leveraging its appreciating value.

As Donald Trump appoints a new SEC Chair, Robinhood’s Chief Compliance Officer and General Counsel, Dan Gallagher, appears to be the frontrunner. Other candidates for the SEC Chair position include Paul Atkins, who previously served as an SEC commissioner and was part of Trump’s transition team in 2016. Paul Atkins, CEO and founder of consulting firm Patomak Global Partners, is also being considered. Robert Stebbins, a lawyer from Willkie Farr & Gallagher, could also be in the running. During Trump’s first term, Stebbins served as a legal advisor at the SEC.

International Points:

After blocking access to certain major Russian YouTube channels, Google has received the largest fine in history. The amount is astronomical, with 36 zeros before the decimal point. Such a penalty is more a strong political message than an actual expectation of payment, as even the world’s total money supply would not reach such a figure.

Metaplanet, a Japanese company listed on the Tokyo Stock Exchange, positions itself as a Bitcoin-friendly player, becoming the second-largest BTC holder in Asia through its “Bitcoin-first” strategy. This bold commitment attracts new investors and strengthens its innovative image. Currently, the company holds 1,018.17 BTC, worth a total of $63 million, with an average purchase price of $62,000 per Bitcoin.

Deutsche Telekom, the German telecommunications giant, takes another step towards blockchain, a field it has been involved in for several years. The company announced the launch of a pilot project in Bitcoin mining, exclusively using excess energy from green infrastructures. Although this is an exploratory phase for Deutsche Telekom, the telecommunications company is no stranger to blockchain technology. Since 2020, it has operated nodes for Celo, Polkadot, and Chainlink through its subsidiary MMS. In October 2022, it also launched an Ethereum staking service.

The CEO of crypto holding WonderFi was kidnapped in downtown Toronto. The executive was later found in a park in Etobicoke, about 20 kilometers from the abduction site. However, he had to pay a ransom of 1 million Canadian dollars, approximately 670,000 euros.

France: financial sector leaders issue €100 million in blockchain bonds. In partnership with major financial players like Crédit Agricole and BNP Paribas, the Caisse des Dépôts participated in issuing €100 million in blockchain bonds. Financial leaders are now actively exploring blockchain technology. The Caisse des Dépôts completed its first bond issuance on the blockchain, valued at €100 million. These are “digitally native” bonds based on HyperLedger Fabric technology, developed in partnership with IBM and the Banque de France as part of experiments around a future digital euro. BNP Paribas acted as the issuer and payer for these bonds, while IBCB Luxembourg Branch served as the investor, with Crédit Agricole Corporate and Investment Bank and Natixis Corporate & Investment Banking managing their placement.

The Fed and the BoE cut their rates from about 5% to 4.75% last Thursday, but their outlooks differ. The BoE signaled caution on further cuts, citing concerns over inflation from upcoming UK spending plans. The Fed, with a stable U.S. economy, avoided forward guidance, noting the uncertainties in next year’s political and economic landscape.

The Korean crypto industry saw strong growth in 1H24, with a 21% rise in crypto users to 7.78 million and a 67% increase in trading volume, reaching KRW 6 trillion (USD 4.3 billion). VASPs' operating profits surged by 106% to KRW 590 billion (USD 427 million). However, consolidation continues as coin-only exchanges decline, leading to a 7.7% drop in unique assets and a 5% fall in sector employment, primarily among coin-only exchanges. The Virtual Asset User Protection Act, Korea’s first comprehensive crypto law, is also pushing smaller players to exit due to compliance pressures.

At the inaugural Layer One Summit at the Singapore FinTech Festival, MAS Deputy MD Sing Chiong Leong announced plans to drive asset tokenization. Initiatives include forming commercial networks for liquidity, expanding its Global Layer 1 ecosystem, creating frameworks for tokenized assets, and testing a wholesale CBDC network. MAS MD Der Jiun Chia also highlighted a broader fintech vision focused on community, collaboration, and building capabilities in payments, tokenization, sustainability, and AI, including expanding GFTN Japan to strengthen international fintech ties.

Project mBridge, initiated in 2021 by HKMA, BOT, BIS, CBUAE, and China’s Digital Currency Institute, developed a PoC prototype for real-time, cross-border CBDC transactions. Now, after four years, BIS has exited the project, citing its maturity. Critics argue that mBridge offers a valuable alternative to Western payment systems and could help bypass sanctions. Regardless, mBridge’s success demonstrates the feasibility of cross-border CBDC transactions, marking a significant step for CBDC applications.

Pakistan unexpectedly proposed an amendment to its State Bank Act to legalize cryptocurrency, allowing the central bank to issue digital currency and regulate crypto services. The reasons for this shift remain unclear, but FATF's evolved stance on crypto risk mitigation may be influential, especially as Pakistan exited FATF’s gray list in 2022. Additionally, regional competition—particularly with India’s growing crypto adoption—might be prompting Pakistan to reconsider its anti-crypto position.

Melcoin, the crypto arm of Japan’s e-commerce giant Mercari, reported a ninefold rise in quarterly revenue, jumping from $200,000 to $1.8 million. Starting with Bitcoin in 2023, then adding Ethereum, Melcoin’s growth was fueled by integrating crypto with Mercari's shopping rewards program—an innovative approach in the crypto space. With 2.2 million users now trading, Melcoin’s success demonstrates the power of blending crypto access with a vast e-commerce user base.

Detroit is set to become the first major U.S. city to accept crypto for city services starting mid-2025. Through PayPal’s platform, Detroit's 630,000 residents will be able to pay for services like parking tickets and property taxes with crypto, marking a major step in modernizing access to government services.

Partnerships, Acquisitions, Fundraising:

Crypto.com announced the acquisition of Watchdog Capital, a broker-dealer registered with the SEC for stocks and options. This acquisition allows Crypto.com to offer stock and options trading to U.S. clients. CEO Kris Marszalek stated that the platform is “actively integrating traditional financial tools.”

Jack Dorsey's Block plans to boost investments in its bitcoin mining operations and self-custody wallet, Bitkey, while scaling back on music streaming app Tidal and winding down TBD, its Web5 project. Despite missing Q3 revenue estimates with $5.98 billion (vs. $6.24 billion expected) and issuing a weaker Q4 forecast, JPMorgan analysts remain optimistic about Block’s outlook. Block highlighted strong demand for its bitcoin products, progress in mining chip development, and its commitment to open-source initiatives.

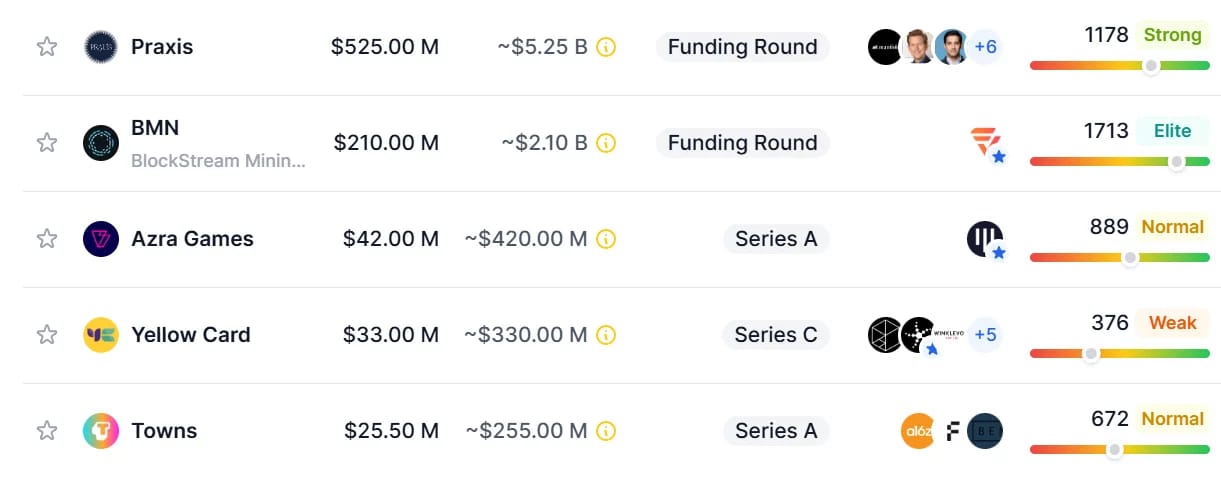

In October 2024, crypto projects raised over $1.2 billion, with more than $835 million raised by just five projects. According to DropsTab, here are the top 5 Web3 fundraisings in October 2024:

VC FUNDRAISES AND AIRDROPS |

Vlayer raises $10M for Ethereum data infrastructure development. Pond secures $7.5M for AI-driven crypto solutions. Cytonic raises $8.3M for blockchain compatibility solutions. Usual Money completes a $1.5M community raise. Phi closes a strategic round to fund its on-chain identity platform. Swell Network opens SWELL token claims, distributing 8.5% of the total supply. Arkham Exchange Points incentivizes volume for its new perpetual DEX. Sonic announces an NFT-based airdrop, tied to a December snapshot for Sonic Shards holders. |

Regulation/Justice:

The crypto industry reportedly lost $400 million due to Gary Gensler’s policies, the SEC Chair: According to the Blockchain Association, representing crypto and blockchain industry actors, the SEC actions have cost these companies hundreds of millions of dollars.

Coinbase learned from Federal Deposit Insurance Corporation (FDIC) documents that the agency actively discouraged some American banks from entering the cryptocurrency market. “So far, we’ve discovered over 20 instances of the FDIC asking banks to ‘pause,’ ‘refrain from providing,’ or ‘discontinue’ crypto-banking services. The public deserves transparency, not an agency operating behind a bureaucratic curtain.”

Following initial discussions with the SEC, Immutable (IMX) received a Wells notice. After Crypto.com last month, Immutable becomes the latest entity in the ecosystem to be targeted by the SEC. Immutable stated that the SEC provided little detail on the investigation’s grounds, though it suspects it might relate to the 2021 private token sale of IMX.

Taiwan to implement a new securities and cryptocurrency law early next year, requiring industry companies to register in order to operate in the country. Taiwan’s Financial Supervisory Commission (FSC) will introduce these new rules in January 2025 to better regulate the crypto sector. Hsi-Ho Huang stated that “digital asset service providers must register in compliance with the new framework from January 2025.” This regulation will replace the anti-money laundering laws introduced in July 2021 to include cryptocurrencies and securities more broadly.

Justin Drake and Dankrad Feist, two Ethereum (ETH) researchers, announced their departure from the EigenLayer (EIGEN) restaking protocol, where they served as advisors. The researchers faced accusations of conflict of interest for potentially favoring EigenLayer in their work on Ethereum, despite being expected to remain neutral. Additionally, they were allegedly offered a large number of EIGEN tokens in exchange for their advisory roles.

The former Mt. Gox exchange transferred more than $2 billion in Bitcoin (BTC) to new wallets: In recent months, the bankrupt Mt. Gox exchange, which filed for bankruptcy over a decade ago, has been working to repay its creditors. In the last 24 hours, wallets associated with the exchange have moved billions of dollars in Bitcoin.

Traditional Finance:

After last year's experiments, UBS has renewed its interest in Ethereum (ETH) by launching a new tokenized fund on this blockchain. Last year, UBS conducted an experimental project with the Monetary Authority of Singapore (MAS), launching a trial fund on Ethereum. This week, the renowned bank announced a significant step forward by officially deploying a new fund on Ethereum, named the UBS USD Money Market Investment Fund Token (uMINT). As the name suggests, this is a money market fund, similar to BlackRock's tokenized BUILD fund. This new initiative reaffirms UBS’s interest in blockchain technology, notably through its UBS Tokenize branch. In June 2023, UBS Tokenize tokenized 200 million yuan in structured notes for a third-party issuer, and in November of the same year, it completed the world’s first cross-border redemption of a tokenized bond on a public blockchain.

Bitcoin in treasury holdings: an increasingly popular choice among companies. This week, Semler Scientific acquired an additional 47 BTC, bringing its total crypto holdings to over $72 million. More and more companies are incorporating Bitcoin to diversify their treasury. While publicly traded companies are required to disclose such holdings, it is likely that many privately held firms also own BTC.

After adding a Bitcoin ETF to its pension fund last summer, the State of Michigan is now turning to Ethereum (ETH). This time, Grayscale products have attracted attention. These investments follow those made last July, when the state added 110,000 shares of Ark Invest and 21Shares’ spot Bitcoin ETF, equivalent to about $7.4 million today.

With a market capitalization of $1.45 trillion, Bitcoin now surpasses Meta Platforms in the ranking of the most valued assets. This rise strengthens Bitcoin’s position as a global asset, competing with major players in financial markets.

Using its private blockchain and native token, J.P. Morgan will soon allow institutional clients to make instant currency conversions between the euro and the dollar. Through Kinexys, the new name of its private blockchain previously called Onyx, institutional clients can bypass the typical 1-2 day settlement for foreign exchange transactions. This service is facilitated by JPM Coin, a token dedicated to institutional and private sector cross-border payments. Currently, more than $2 billion in transactions are processed using Kinexys's native token. JPM Coin now enables dollar and euro payments for J.P. Morgan's institutional clients via Kinexys. This initiative represents one of the few large-scale distributed ledger deployments by a major bank, even though it manages only a small fraction of the $10 trillion that flows daily through J.P. Morgan.

BlackRock’s Bitcoin ETF surpasses its gold ETF launched in 2005. Thanks to significant capital inflows this week, the assets under management of BlackRock’s Bitcoin ETF now exceed those of its gold ETF.

Tech News:

After obtaining approval for the Global Dollar (USDG) stablecoin from the Monetary Authority of Singapore in July, several crypto industry players officially launched this dollar-pegged cryptocurrency. Among the companies involved in the project are Anchorage Digital, Bullish, Galaxy Digital, Robinhood, Nuvei, Paxos, and Kraken. Kraken officially made the stablecoin available on its platform for trading this Monday evening. The cryptocurrency is available in the United States, but not yet in Europe.

A course change to navigate turbulent waters: OpenSea announces a brand-new platform coming next month. Historically dominant in the non-fungible token (NFT) space, OpenSea has faced challenges recently. The company had to lay off half of its staff almost a year ago due to a significant drop in revenue. Since then, additional challenges have arisen, including a warning letter from the Securities and Exchange Commission (SEC).

After partnering with Binance to offer cryptocurrency payments to French merchants, Ingenico has partnered with Crypto.com to globalize this payment method. On Tuesday, Ingenico and Crypto.com announced a partnership to provide a cryptocurrency payment solution and merchant services to millions of merchants worldwide. This "plug-and-play" solution will be based on Ingenico’s new merchant wallet, connected to smart Android Axium payment terminals. Unlike a simple crypto payment system integrated into Android Axium terminals, Crypto.com Pay will allow customers to earn rewards for their transactions, while merchants will have access to additional services related to the terminal that they can also use via their connected devices. Currently, Ingenico and Crypto.com are in advanced discussions with partner merchants to launch a pilot of their solution in Q1 2025.

After rumors surfaced last month, Arkham officially announced its new crypto trading platform on Wednesday. For now, Arkham has not released detailed information about the platform’s specifics, as the shared registration link currently leads to its on-chain analysis tool. Last month, it was reported that this exchange would cater more to retail investors, which seems confirmed by the registration process. Additionally, a points system based on trading and referrals has been introduced, enabling eligibility for ARKM rewards.

Eclipse launched its mainnet blockchain, a unique layer-2 network combining Ethereum’s and Solana’s technology. Built on the Solana Virtual Machine (SVM), Eclipse offers fast, low-fee transactions on Ethereum, bundling them for periodic settlement on Ethereum's main chain. This architecture enables Solana-native developers to build or port dApps that are faster and cheaper than those native to Ethereum, enhancing flexibility and performance for developers and users.

Focus: Are memecoins really decentralized?

The popularity of memecoins often sparks debates within the crypto community. Some memecoins, like SPX6900, promote decentralization, appealing to individual investors, while others adopt a structure more akin to traditional crypto projects with fundraising rounds. Are memecoins losing their essence by becoming more professional?

The crypto community is turning away from altcoins considered utility/technological due to their high centralization, particularly because of the involvement of venture capital (VC) firms in fundraising rounds for crypto projects.

As a result, the retail investor might have no chance of being profitable against the VCs, even serving as "exit liquidity" for them.

In light of this, which is often criticized by the crypto community, retail investors might choose not to bet on "VC coins" but instead on tokens with a more equitable launch and distribution, where the rules of the game are not skewed.

One type of token that fits this narrative perfectly is the memecoin.

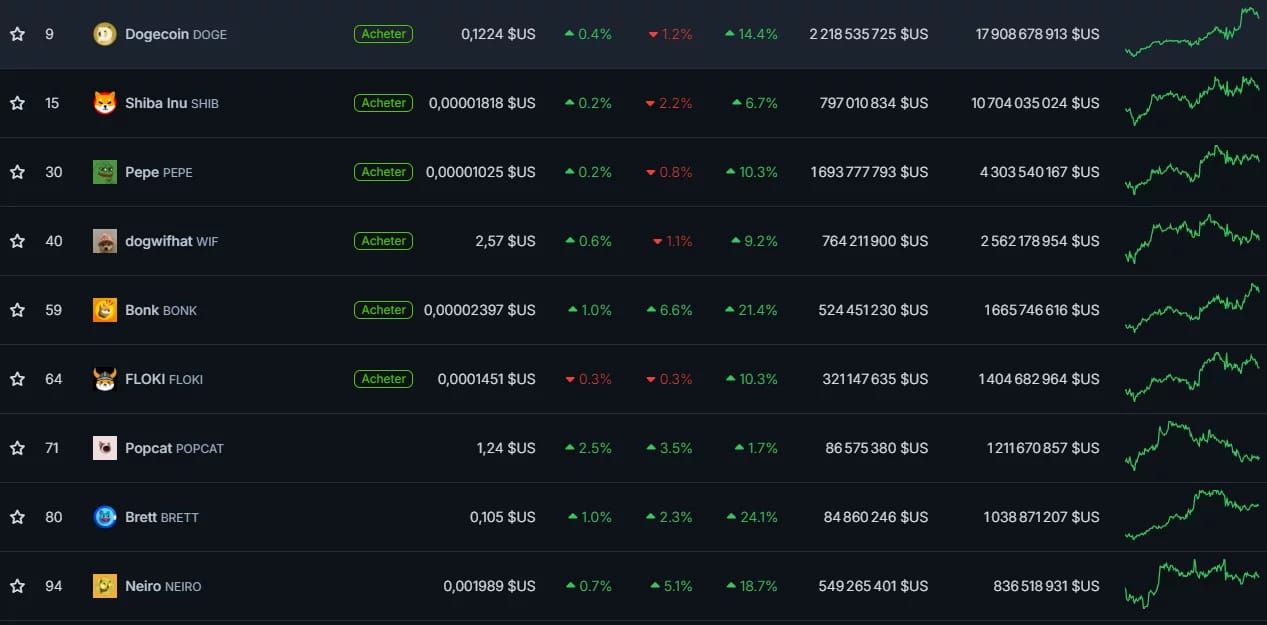

Day by day, memecoins are taking an increasingly significant role in the crypto market. As a result, we are seeing more highly capitalized memecoins that are shaking up many of the so-called "more serious" crypto projects.

In fact, no fewer than 9 memecoins are currently ranked among the top 100 most capitalized cryptos across all categories:

But are memecoins truly decentralized?

Memecoins, often celebrated for their decentralized and community-driven ethos, are increasingly becoming intertwined with venture capital (VC) structures, calling into question whether they are truly decentralized. Originally, the appeal of memecoins lay in their seemingly organic launches, limited institutional control, and appeal to retail investors. However, recent trends reveal that many memecoins now exhibit characteristics traditionally associated with VC-backed tokens.

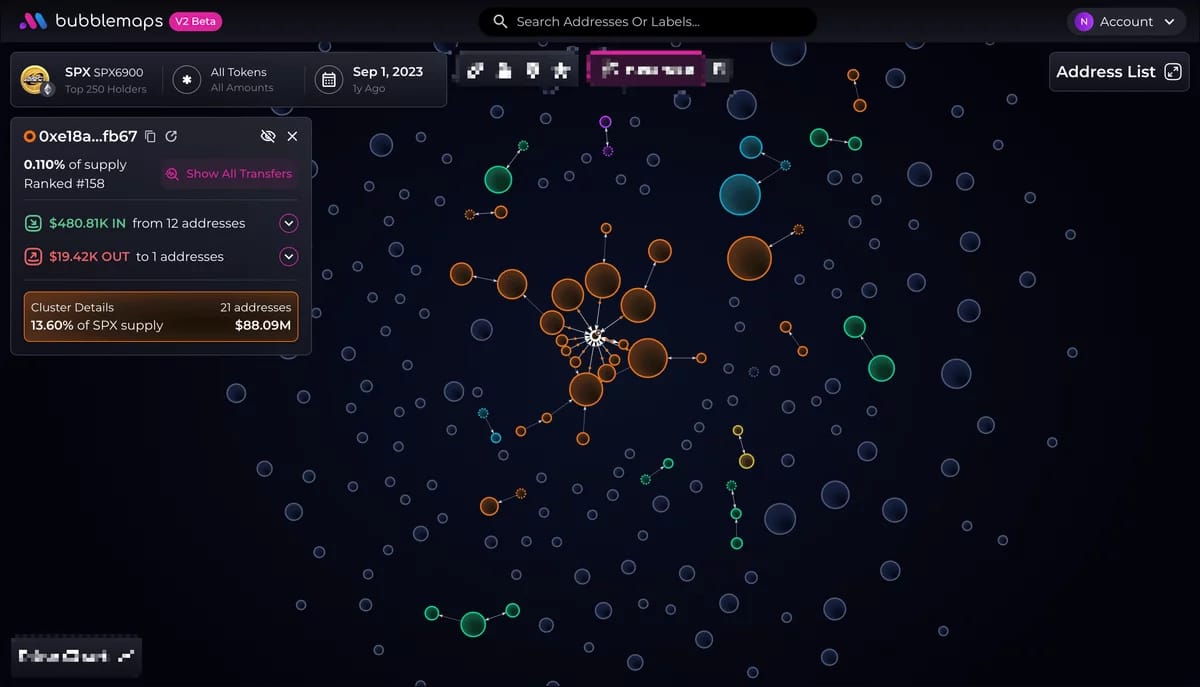

The Case of SPX6900: A Closer Look with Bubblemaps

Bubblemaps is an on-chain data visualization tool that allows for the representation of token distribution and connections between wallets in the form of bubbles. It helps identify suspicious behaviors, such as token concentration or coordinated transactions.

SPX6900, a memecoin inspired by the S&P 500, provides a strong example of what is expected in a fair, decentralized token launch. Using its on-chain visualization tool, Bubblemaps confirmed that SPX6900’s launch showed no “red flags.” Bubblemaps found no “coordinated sniping” or suspicious token clusters, which would suggest concentration of ownership or manipulation. The largest holder cluster held only 13.6% of the supply as of September 2023, primarily linked to community reimbursements. Over time, token ownership also became more decentralized, indicating a healthy distribution.

Bubblemaps outlined essential elements of a fair memecoin launch:

Organic growth without manipulation.

No insiders or privileged early buyers.

A progressive decrease in cluster size over time to avoid control concentration.

While this example shows a successful decentralized model, other memecoins have not adhered to these principles, and more are taking on VC-like characteristics.

The Rise of VC-Backed Memecoins

Many memecoins, initially celebrated for their organic, community-driven launches, are now attracting institutional investments and evolving into full-fledged asset classes. The project “Memecoin” with its MEME token is a prominent example. Marketed with the tagline “No utility. No roadmap. No promises,” it might seem like a straightforward memecoin on the surface. However, MEME's tokenomics reveal significant institutional involvement: 9GAG, the company behind Memecoin, raised $16 million through private sales across funding rounds. The project also includes allocations for “contributors” (the team) and “advisors”—a surprising choice for a project that claims to lack a roadmap or utility.

The “advisor” allocation raises questions about the true nature of MEME and other similar projects. While claiming to follow a decentralized approach, the structure resembles a VC-backed project, casting doubt on its independence from institutional influence. As institutional funds like DWF Labs and Three Arrows Capital shift from traditional utility cryptos to memecoins, they further challenge the community-driven origins of memecoins by promoting their memecoin holdings as promising assets.

In summary, while tools like Bubblemaps help to verify fair launches and track decentralized ownership, the growing trend of VC-backed memecoins suggests that these tokens may be gradually moving away from the values that once made them appealing to the crypto community. This shift could mean that the line between traditional crypto projects and memecoins is blurring, potentially reshaping the decentralized ethos of the memecoin market.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.