Token Chronicle - July week 1

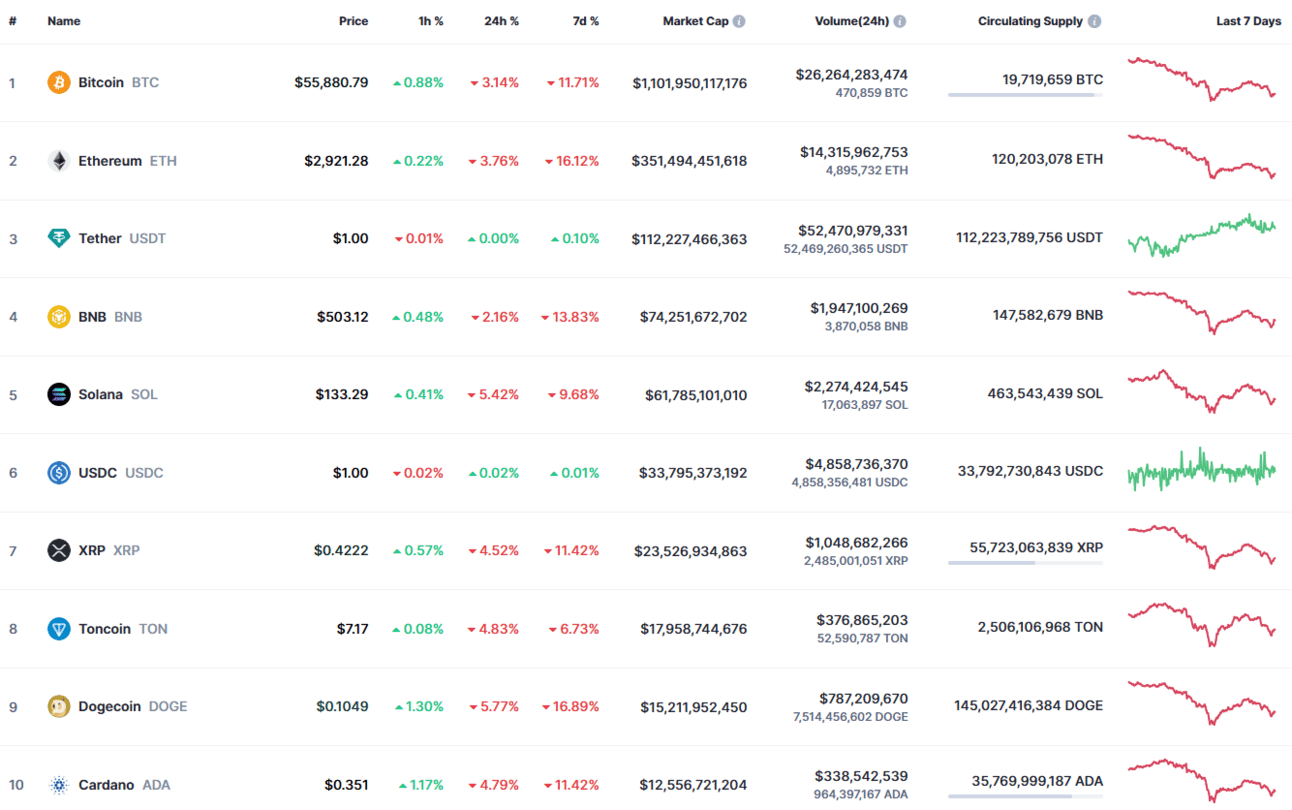

Top cryptos:

Extract from CoinMarketCap.com on July 8th 2024

Meme of the week:

Quick bites:

The German government reportedly sold 3,000 BTC worth $185 million in recent days.

According to Bloomberg, ETH ETFs could be listed as early as next week or the week of July 15.

July 4: more than $300 million was liquidated in 24 hours.

Mt. Gox has begun repaying its creditors in BTC and BTC Cash.

July Token unlocks:

Market update: Bloodbath this week in the market with BTC returning to the $53-55K range, causing the liquidation of many positions. This drop, linked to fears associated with massive sales by Mt. Gox, the German government, and the US, offers famous buying opportunities (especially in ALTs) before the bull run. We will see the situation when these massive sales (short-term uncertainty) are over and the upcoming inflows of money associated with the ETH ETF launches.

Main topics:

Japan: Sony plans to launch its cryptocurrency exchange: After acquiring Amber Japan through one of its subsidiaries last year, Sony aims to relaunch the cryptocurrency exchange operated by the company.

Circle becomes the first stablecoin issuer (USDC) to comply with MiCa.

The ECB revises its inflation targets (2%) for 2026 (from 2025).

France is said to have lost a quarter of growth following the dissolution of the assembly (uncertainties that would have led to the review of many investments).

Bittensor hack with $8M stolen and a 15% drop in the TAO price; TAO remains a solid AI-related project. Problem resolved and additional measures put in place.

Consensys acquires Wallet Guard (an open-source browser extension designed to secure cryptocurrency wallets) to improve the security of MetaMask.

Riot Platforms increases its hashrate by 50% and becomes the second-largest Bitcoin mining firm behind Marathon Digital.

Mt. Gox moves $2.7 billion worth of Bitcoin (BTC): Repayments finally begin.

A major turnaround. The Central Bank of Bolivia recently praised cryptocurrencies and expressed its intention to integrate them into the country's financial systems. Until now, the use of digital assets was prohibited in Bolivia.

South Korea continues to establish its regulatory framework surrounding cryptocurrencies. The country's financial regulatory agency has just launched a continuous monitoring system for cryptocurrency transactions. Its goal is to continuously analyze "abnormal" financial transactions on exchanges and cryptocurrency service providers. These providers have worked together with the regulator to develop a very comprehensive monitoring system: it would cover 99% of the country's transaction volume.

Join me on Twitter: @Token_Chronicle

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.