Top cryptos

Extract from CoinMarketCap.com on November 12th 2025

Meme of the week

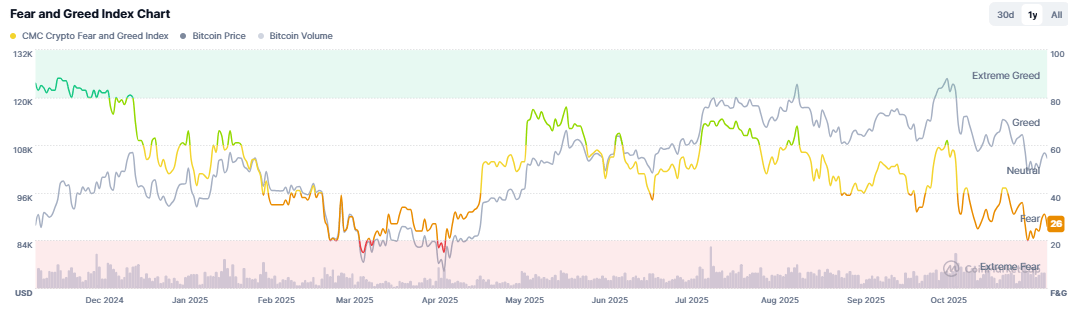

Market Sentiment:

F&GI from CoinMarketCap.com on November 12th 2025

Market update: BTC is stuck between $102k and $109k, doubt and fear dominate with talks of an AI bubble (fueled by Goldman Sachs and JPM); which "should" however explode in the next two years, an unoriginal narrative therefore. But on the other hand, macro is improving with the prospects of the end of the US shutdown and the improvement of Sino-US economic relations.

Main points this week:

International/Macro:

Exaion: A French offer could block the MARA acquisition: The acquisition of Exaion by Mara, an American Bitcoin miner, is raising concerns about France's digital sovereignty. While the deal is still pending validation, a French counter-offer has changed the game. It is led by industry players who wish to keep this strategic infrastructure under national control. The French consortium FlexGrid France, led by Sébastien Gouspillou, a recognized Bitcoin mining entrepreneur and co-founder of BigBlock Datacenter, and supported by the National Bitcoin Institute (INBi), has presented a €30 million counter-offer to EDF Pulse Holding to buy part of Exaion's capital. Unlike MARA's offer, which plans to exclude EDF from any intensive computing activity for 2 years, FlexGrid's proposal guarantees EDF complete freedom of action in its projects related to cloud, artificial intelligence, or mining.

Stock Market: Morgan Stanley and Goldman Sachs sound the alarm, is a contagion coming for cryptocurrencies? After the euphoria, the fall? Finance giants Morgan Stanley and Goldman Sachs are warning of a giant market correction in the coming months. “Markets go up, and then they pull back so people can reassess. […] It is likely that we will see a 10% to 20% decline in equity markets at some point over the next 12 to 24 months.” Cryptocurrencies, which are considered "risky" assets, generally follow the trends of the most volatile markets (Tech, AI…). If major institutions are therefore anticipating a correction, this could trigger liquidations or profit-taking in the crypto markets… Especially since a significant number of investors manage both stocks and cryptocurrencies.

Stablecoins: The Bank of England sets limits: Cryptocurrency sector regulation is accelerating around the world, albeit with significant disparities from one jurisdiction to another. This highly competitive reality is pushing the Bank of England to accelerate its pace to try to align with the United States, while imposing a holding cap on British citizens. The Bank of England is therefore maintaining its holding cap imposed on stablecoins, with the limit now increased to £20,000 for individuals and £10 million for companies. This situation is presented as temporary, although the duration of this transition period was not specified.

"We are making the U.S. the Bitcoin superpower": Donald Trump reaffirms his pro-crypto ambitions. On Wednesday in Miami, Donald Trump briefly touched on cryptocurrencies during a long speech, stating he would make the "United States the Bitcoin superpower."

Announced end of the US "shutdown"? Crypto market reacts positively: The US administration has been paralyzed for over a month, in what appears to be the longest "shutdown" in US history. A first step deemed positive has just been taken in this direction in the Senate, with an agreement reached to ensure government funding until January. This project must still pass through the House of Representatives before ending up on Donald Trump's desk for final validation. Despite these steps, bettors on the Polymarket platform are not discouraged, with an effective resolution seen as 85% likely by the end of this week at the latest.

Crypto investment products saw $360M in net outflows last week as Fed Chair Jerome Powell’s hawkish tone on future rate cuts created market uncertainty. Bitcoin ETPs experienced $946M in outflows, while Ethereum funds attracted $57.6M and Solana products saw $421M in inflows driven by new U.S. spot ETF demand. CoinShares noted the absence of key economic data and Powell’s caution about a December rate cut left investors in a “state of limbo,” favoring altcoins over bitcoin.

Kazakhstan plans to launch a $500M–$1B national crypto reserve fund by early 2026, funded through seized assets, state mining revenue, and investments in ETFs and crypto firms. Central bank Governor Timur Suleimenov emphasized caution toward direct crypto exposure. The fund will be managed by the Astana International Financial Centre, potentially with foreign partners, marking Kazakhstan’s strongest commitment to institutionalizing its digital asset strategy after years of state-led mining and regulatory development.

Pakistan just announced plans for a rupee-backed stablecoin. The same country that spent years pushing back against crypto. Banking officials claim there's a $20-25 billion opportunity sitting on the table. They're already building a central bank digital currency with the World Bank and IMF.

Compliance/Regulation/Justice/Cyber:

The European Commission is preparing a proposal to give ESMA a supervisory role equivalent to that of the US SEC, expected in December. This project is part of the continuation of MiCA 2.0 to centralize crypto regulation in Europe. Across the Atlantic, Donald Trump has appointed pro-crypto lawyer Michael Selig to head the CFTC, marking a favorable orientation for the ecosystem.

€600 million laundered in cryptocurrencies: 9 people arrested by several European police forces: This week, the European Union's Judicial Cooperation Unit (Eurojust) announced the arrest of 9 people suspected of having coordinated several cryptocurrency scams and laundered more than €600 million. The network members created dozens of fake cryptocurrency investment platforms, mimicking legitimate websites and promising high returns. They recruited their victims through various methods, such as social media advertising, cold calling, and disseminating false information and fake testimonials from celebrities or successful investors. When victims transferred cryptocurrencies to these platforms, they never got their money back.

The Balancer DeFi protocol was exploited for $128.6M across multiple chains due to a vulnerability in its V2 Composable Stable Pools, allowing attackers to drain assets like WETH and wstETH. Balancer paused affected pools while confirming V3 remained secure. Separately, Berachain validators halted their network to hard fork and recover $12M in user funds linked to the same exploit. Balancer’s native BAL token fell over 4% amid the breach and broader market decline, with a full post-mortem pending.

Hong Kong’s Securities and Futures Commission will permit licensed crypto exchanges to share global order books with overseas platforms, enhancing liquidity and price discovery by moving beyond its pre-funded local model. The regulator also exempted HKMA-licensed tokens and stablecoins from the 12-month trading history requirement for professional investors. SFC Chief Julia Leung stated the reforms aim to strengthen Hong Kong’s competitiveness as a global crypto hub while maintaining robust regulatory oversight.

Canada’s federal budget outlines plans to regulate stablecoins under the Bank of Canada, which will administer a new framework with CAD 10M in funding over two years. The central bank acknowledged stablecoins’ growing utility for payments, distinguishing them from other cryptocurrencies. Separately, Canada will create a dedicated Financial Crime Agency to investigate complex money laundering, organized crime, and online scams, enhancing the country’s ability to track and recover illicit proceeds amid evolving financial threats.

Taiwan’s central bank has endorsed stablecoin regulation under the proposed Virtual Asset Service Act, warning that payment use could impact traditional systems and enable money laundering. It recommends aligning with U.S. and EU frameworks, requiring issuers to hold reserves partly with the central bank and in high-quality liquid assets once scale is reached. The draft Act, led by the FSC, mandates full reserves, par redemption, and audits for stablecoins while licensing exchanges, custodians, and brokers to ensure comprehensive oversight.

Brazil's central bank extended core financial-sector rules to crypto firms, requiring VASPs to obtain authorization and meet governance, security, and AML standards. The framework brings centralized intermediaries, custodians, and brokers under tighter supervision, including foreign-exchange rules for stablecoin trades and cross-border transfers. Transactions involving "unauthorized counterparties" will face a $100,000 cap, as regulators target fraud, scams, and money-laundering risks. The rules take effect in February 2026 with a nine-month transition window, reinforcing Brazil's position as Latin America's most regulated crypto market.

Traditional finance:

Paris-based Sequans has sold 970 BTC ($94.5M)—nearly a third of its holdings—to repay convertible debt, reducing its treasury to 2,264 BTC and dropping its rank among public bitcoin holders. The firm called the divestment a “strategic asset reallocation” to strengthen its balance sheet amid a 56% stock decline since adopting its BTC strategy. The move frees capital for potential share buybacks or preferred stock issuance, marking the first major bitcoin sale by a corporate treasury for debt repayment.

JPMorgan analysts warn that IREN’s $9.7B Microsoft AI deal, while cementing its infrastructure shift, will strain finances as the firm spends over $9B on GPUs and data centers in the coming year. They raised their 2026 price target to $28, citing strong cloud momentum but flagging dilution risk from equity issuance. IREN expects the contract to yield $1.94B in annual revenue with 85% margins, targeting 140,000 GPUs by 2026. Despite a recent pullback, shares trade near $60—more than double JPMorgan’s target—reflecting bullish AI pivot optimism.

Bybit and Backed Finance have teamed up to bring tokenized shares of companies like Nvidia, Apple, Microsoft, and Strategy onto the Mantle Layer 2 network. The collaboration lets users move assets between Bybit and Mantle for faster onboarding and deeper liquidity while enabling non-U.S. investors to access the tokenized equities permissionlessly. Backed's xStocks, integrated with Kraken and major Solana DeFi protocols since June, have already surpassed $1.6 billion in onchain volume, the company said. Real-world assets, including tokenized equities, are expected by some to grow into a multi-trillion-dollar market.

JPMorgan analysts project bitcoin could reach $170,000 within 6–12 months, citing its volatility-adjusted valuation against gold and a completed deleveraging phase in perpetual futures. They note bitcoin’s open interest has reset to historical norms, signaling a healthier derivatives market, with Ethereum showing similar but less pronounced trends. This follows their earlier assessment that bitcoin remained undervalued relative to gold, reinforcing a bullish outlook for the cryptocurrency amid improved market structure.

Google Finance will integrate Polymarket and Kalshi prediction data into search results, allowing users to track real-time market odds on future events. This follows major funding rounds—Polymarket’s $2B ICE-backed valuation and Kalshi’s $300M raise—as competition intensifies. Kalshi led monthly volume with $4.4B vs. Polymarket’s $3B in October. Polymarket plans a POLY token airdrop and U.S. re-entry, while Kalshi targets broad crypto app integration. Bernstein notes prediction markets are expanding into multi-sector information hubs.

The Depository Trust and Clearing Corporation (DTCC) has listed five spot XRP ETFs from major issuers in its active and pre-launch category, signaling growing expectation for imminent debuts. The listings for the Bitwise, Franklin Templeton, 21Shares, Canary Capital, and CoinShares funds are generally viewed as a positive step but do not guarantee a launch, with several issuers still waiting for their amended S-1 filings to go effective. However, expectations are rising for spot XRP ETFs to launch this month as the SEC's new generic listing standards now let issuers fast-track launches without procedural delays. Indeed, Canary Capital CEO Steven McClurg reportedly said the firm is ready to launch its XRP ETF this week, echoing growing industry expectations for a mid-to-late November introduction.

Tech News:

The Ethereum ecosystem sets a new record for transactions per second (TPS): With the proliferation of its layer 2s, Ethereum should no longer be understood as a simple blockchain, but as a full-fledged ecosystem. This nebula serving a common interest has just seen its number of transactions per second (TPS) reach a new record.

Bitcoin miners are massively turning to AI: Companies dedicated to Bitcoin mining are currently undergoing a large-scale internal transformation, largely associated with the emergence of artificial intelligence (AI). This change in dynamics appears to be accelerating among the sector's leaders. Miner TeraWulf appears as a very active player in this shift, following the signing of two 10-year hosting contracts with Fluidstack, a company specialized in high-performance cloud computing, for a total of 200 MW. Initiatives also undertaken by Core Scientific, Cipher Mining, CleanSpark... and even Marathon Digital, which is behind an operation to buy the majority stake in EDF's HPC and blockchain subsidiary, Exaion.

Adoption (Sentiment, Retail and Corporate Reserves):

More than half of hedge funds have invested in crypto: According to a recent report, cryptocurrencies are increasingly attracting traditional investment structures like hedge funds. More than half of them are already actively exposed to cryptocurrencies, and this is just the beginning. This is from the 7th annual global report on crypto hedge funds recently published by the Alternative Investment Management Association (AIMA), presented as the world's largest association of alternative investment managers. 45% of ETF investors plan to get exposure to cryptocurrencies over the next year. Since the approval of spot Bitcoin and Ethereum ETFs on the US market in early 2024, exchange-traded funds applied to cryptocurrencies have been booming. This adoption could accelerate significantly next year.

Strategy arrives in Europe and raises 620 million euros to buy more Bitcoin: A new security, the STRE, to attract European investors and finance the purchase of BTC. Strategy continues to increase its exposure to Bitcoin, and this time it's targeting Europe. The company led by Michael Saylor has just raised €620 million through an issue of perpetual preferred shares called Stream (STRE). This operation marks a new stage: it is the first time the company has structured a euro-denominated offer, aimed at qualified European investors and professional clients, to support its Bitcoin accumulation plan.

Over 4 million merchants in the US can now accept Bitcoin with a few clicks: Square has just activated a major feature: over 4 million merchants in the US can now accept Bitcoin with a simple click. This integration marks a concrete step towards the daily use of BTC as a payment method that is accessible, flexible, and fee-free for merchants. The option is currently reserved for in-person payments; online and invoice payments should also be supported soon. Another advantage that should appeal to merchants: no conversion fees will be applied until 2027. After that, a 1% rate will take effect, well below bank card payment fees, which typically range from 2% to 4%.

Coinbase is rolling out savings accounts in the UK, offering 3.75% AER interest and marking the first regulated savings product from a crypto-native exchange. The Clearbank-powered accounts offer instant access with no minimum balance or lockup, positioning Coinbase closer to traditional fintech competitors. Coinbase's savings accounts also offer protection via the Financial Services Compensation Scheme, ensuring that customers' GBP deposits are covered up to £85,000 ($112,000) if the provider fails — the same safeguard they receive with a traditional UK bank. Coinbase plans to expand access to all UK users in the coming weeks as it integrates savings, payments, and crypto trading into a single financial platform.

Funding and Partnerships:

Coinbase will not acquire this stablecoin startup: a $2 billion deal falls through: Recently, discussions were in full swing between Coinbase and stablecoin startup BVNK regarding an acquisition. However, we have learned that this deal will ultimately not take place.

Ripple announced the acquisition of Palisade, a company specialized in digital asset custody, in order to expand its services for institutions. This operation follows the purchase of Hidden Road in April for $1.25 billion, confirming Ripple's strategy to strengthen its global presence in DeFi and financial services. The climate remains favorable for Ripple after the end of its regulatory conflict with the SEC.

RLUSD Stablecoin Payments: Ripple partners with Mastercard, Gemini, and a US bank: On Monday, Ripple (XRP) announced a collaboration with Mastercard, Gemini, and WebBank, a US national bank, aiming to develop use cases for the RLUSD stablecoin. Indeed, the stablecoin is to be used on its native blockchain, XRP Ledger (XRPL), for transactions on Gemini payment cards. According to the press release, this integration into the "existing settlement processes of Mastercard and WebBank" should occur "in the coming months, [...] subject to obtaining the required regulatory approvals."

Ripple's valuation reaches $40 billion: Since the official dismissal of the proceedings initiated against it by the US SEC, Ripple is once again asserting itself at the forefront of the cryptocurrency sector. This position has just allowed it to raise $500 million, bringing its current valuation to $40 billion.

Hercle, a stablecoin infrastructure firm that enables institutions to manage cross-border payments, raised $60 million in new capital. The round includes a $10 million equity investment led by F-Prime, with participation from Fulgur Ventures and Exponential Science, alongside a $50 million credit line from undisclosed investors.

MegaETH, an Ethereum Layer 2 project aiming for "real-time" transaction speeds, concluded the public sale of its MEGA token with a raise cap of $49.95 million. The sale was 27.8x oversubscribed, attracting nearly $1.4 billion in commitments at the maximum price. It was conducted as an auction at a fully diluted valuation (FDV) ranging from $1 million (at starting price) to $999 million (at ceiling price), with the "hypothetical" FDV based on total commits reaching about $28 billion. Allocations and refunds for unfilled commitments will be finalized on or after Nov. 5.

Pave Bank, a “programmable” commercial bank supporting fiat and digital assets, raised $39 million in a Series A funding round led by Accel, with participation from Tether Investments, Quona Capital, Wintermute, Helios Digital Ventures, Financial Technology Partners, Yolo Investments, Kazea Fund, and GC&H Investments.

Solana, Fireblocks, Monad, and Polygon just formed an alliance called the Blockchain Payments Consortium. They're bringing together some of the industry's biggest players to tackle cross-chain payments.

Perpetual DEX aggregator, Liquid, raises $7.6M in a seed round led by Paradigm, with support from General Catalyst, Alpen, and several angels, including Lighter founder, Vlad Novakovski. Social crypto trading app, Fomo, raises $17M, in a Series A round led by Benchmark, alongside new angel investors, including notable CT figures such as Luca Netz, Jez, and 0xLawliette. Cross-chain solver infrastructure, Sprinter, raises $5.2M in a seed round led by Robot Ventures, with support from Topology Ventures, Atka Capital, A Capital, Bond Street Ventures and more. Crypto payments infrastructure, Arx Research, raises $6.1M in a seed round led by Castle Island Ventures, with participation from Inflection, Placeholder, Seed Club Ventures and 1kx.

Lighter has raised $68 million in a funding round led by Founders Fund and Ribbit Capital, with participation from Haun Ventures and Robinhood, Fortune reported. The funding values the firm at around $1.5 billion, a source with direct knowledge of the matter told The Block, as top VCs double down on perp DEX infrastructure. Lighter operates both its own Ethereum Layer 2 and a decentralized exchange, targeting CEX-level performance for perpetual futures contracts with onchain verification and instant settlement. Perpetuals now dominate crypto trading on CEXs and DEXs by trading volume, with onchain activity reaching a record $1.2 trillion in October. Lighter also plans to expand into spot trading, while token warrants in the round signal an eventual token launch, with details yet to be announced.

Pascal Gauthier, CEO of Paris-based Ledger, told the Financial Times the firm is eyeing a New York IPO or a private funding round next year, and is actively expanding its presence in the city. "Me spending more time in New York is with the understanding that money is in New York today for crypto, it's nowhere else in the world, it's certainly not in Europe," he said. Gauthier added that the company is having its strongest year yet, with revenues already in the triple-digit millions ahead of the peak holiday period, amid a surge of demand for its crypto hardware wallets. Ledger claims to secure roughly $100 billion in bitcoin for customers and continues to ship new products, including the new Ledger Nano Gen5 device.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.