Top cryptos

Extract from CoinMarketCap.com on October 11th 2025

Meme of the week

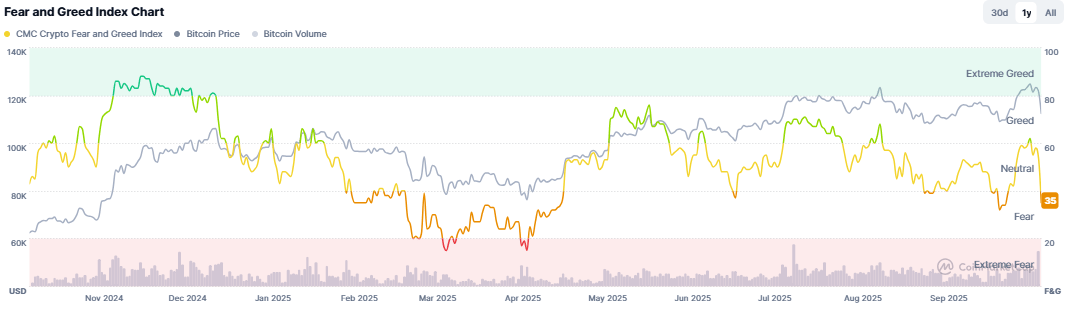

Market Sentiment:

F&G I from CoinMarketCap.com on October 11th 2025

Market update: October is going to be very volatile, and we are already getting a good preview. Indeed, we hit new highs this week with a new BTC ATH at $126K, but also a new drop overnight linked to trade tensions between the USA and China (over rare earths), causing BTC to fall back to $105K before recovering to $112K this morning. The rest of the market followed (over $550B liquidated).

Beijing announced a shock measure: any product containing more than 0.1% of rare earths of Chinese origin will now be subject to prior export authorization. Behind this decision lies a clear strategy. These strategic minerals are essential for manufacturing electronic chips, batteries, electric motors, lasers, and almost all modern technologies. By restricting their export, China is sending a direct message to Washington: it is ready to strike where it hurts the most.

Donald Trump, for his part, was quick to react. In a statement, he called China "very hostile" and announced two major measures effective November 1st: an increase in tariffs to 100% on Chinese goods, and the implementation of export controls on certain critical software.

This is pure macro, the impact of which will be absorbed by the market in the coming days, with the market remaining very bullish this month.

Main points this week:

International Highlights:

Shutdown in the United States: Will Pending ETF Approvals Be Delayed? – Crypto ETF launches in the United States are now on hold since the federal shutdown on October 1, 2025, triggered by a lack of a budget agreement between Republicans and Democrats in Congress. Indeed, the SEC is operating with a reduced staff, so the review of new products is suspended until funding is restored. The duration of the shutdown remains uncertain at this stage. The last US government shutdown was in 2018, during the first Trump administration, which lasted 34 days. But past shutdowns have shown that SEC staff can be flexible towards filers who delay their market launch due to the administration's halt.

European Systemic Risk Board Wants to Ban "Multi-Issuance" Stablecoins? – The European Union continues its regulatory offensive against stablecoins. The latest step: a ban issued by the European Systemic Risk Board (ESRB) on those issued jointly in the EU and in other jurisdictions. Implementing this restriction poses many problems, especially for stablecoin issuing companies already established and regulatory approved in the European Union, like Paxos and Circle (USDC). The consequences are still difficult to estimate, and no comment has been made by them on the matter.

Gold Surpasses $4,000: Inflation, Crisis, or a New Monetary Era? – The price of gold has just broken the historic threshold of $4,000 per ounce, driven by a global context marked by inflation, geopolitical tensions, and growing doubts about the dollar. In recent months, the global geopolitical and economic situation has been under strain. The war in Ukraine, tensions in the Middle East, economic sanctions, and Sino-American rivalries fuel growing uncertainty in the markets. Economically, persistent inflation, financial market volatility, and global debt at historic levels are undermining confidence in fiat currencies, including the dollar and the euro. Faced with this systemic instability, private investors and institutions are seeking solutions to preserve their purchasing power and financial sovereignty. In this context, gold is regaining its full relevance as a safe-haven asset.

Bitcoin: Will Sweden Apply a Tax Exemption for Small BTC Payments? – Bitcoin's monetary ambitions face certain obstacles, such as the significant volatility of BTC or the systematic taxation applied to the gains it generates. The latter reality was highlighted by a Swedish MP, who is requesting an exemption for small transactions to encourage its use.

Luxembourg's Intergenerational Sovereign Fund Invests 1% of Its Portfolio in Bitcoin – Luxembourg's Intergenerational Sovereign Fund (FSIL) has existed since 2014, aiming to build a reserve of high-quality assets and bonds for future generations. It represented a portfolio estimated at $764 million in its financial report last June, following a government injection of $62 million made each spring. According to estimates by the Luxembourg Times, the 1% announced by the Finance Minister could imply an investment of €7.6 million currently - about 62.5 BTC - and just over €8 million starting next year.

Bitcoin Tax Exemption in the US: Cynthia Lummis's Shocking Proposal in the Senate – Senator Cynthia Lummis has presented a bill aimed at easing taxation on Bitcoin payments. An initiative welcomed by the community, notably by Jack Dorsey, who the day before had called for an exemption for small transactions. Here's what the S.2207 bill could change: Transactions under $300 would be tax-exempt; These exemptions would be limited to $5,000 per year; Losses realized in cryptocurrencies could be deducted from other investments; Income from miners and stakers would only be taxed upon conversion to fiat currency; Cryptocurrencies could become eligible for tax deductions for charitable donations. This law would be valid until 2035, at which point the US Congress could reassess it to adapt to needs that have emerged during the decade. With this proposal, the US is moving closer to more flexible policies already in place in countries like Germany or Switzerland, where BTC held for more than one year is tax-exempt.

The European Commission has proposed its 19th sanctions package against Russia, introducing a direct ban on crypto services for Russian residents, including exchanges and wallet providers. This marks the EU’s first explicit move to target digital assets in its sanctions regime, aiming to close evasion channels used to bypass traditional financial restrictions. The measures require unanimous approval from all 27 Member States to take effect, aligning European policy with U.S. efforts to curb Russia’s use of crypto for cross-border value transfer amid ongoing conflict.

Kazakhstan just confiscated $16.7 million in crypto while shutting down 130 unlicensed platforms. The crackdown is massive compared to last year's 36 shutdowns. Authorities found 81 underground networks moving over $43 million in illicit funds.

Compliance/Regulation/Legal/Cyber:

MiCA 2.0? Europe Wants to Centralize Crypto Regulation Under ESMA's Authority – The European Union wants to end the fragmentation of market regulation – including cryptocurrencies – with a single supervisory body. But it faces discontent from some smaller countries. For crypto exchange platforms, this would imply some simplification: they would no longer need to acquire licenses per country. But the centralization of approvals and the homogenization of control could bring its share of new rules.

The SEC Plans to Finalize an "Innovation Exemption" by Year-End, allowing crypto companies to test products without complying with all regulatory constraints. This initiative fits into a landscape strengthened by 16 pending spot ETF applications and ongoing investigations into insider trading in the sector.

Plume Network Becomes an SEC-Validated Transfer Agent for Tokenized Securities – The principle of tokenizing financial securities is redrawing the boundaries of traditional finance. A dynamic within which the Plume Network project now registers, having been registered as a transfer agent with the SEC. Concretely, this transfer agent status will allow Plume Network to manage tokenized financial securities and the shareholder registry - transfers, certificates, dividends - directly on its blockchain. Simultaneously, it will ensure full interoperability with the US Depository Trust & Clearing Corporation (DTCC) settlement infrastructure. Plume Network will also be able to handle a wide range of associated services, such as on-chain IPOs or fundraising for small-cap projects or regulated funds. Procedures that will benefit from implementation reduced to a few weeks, compared to several months currently, thanks to automation implemented using smart contracts.

Bank of England Backtracks on Its Stablecoin Holding Limit – Faced with the unprecedented rise of stablecoins, tempers are flaring among banks and other monetary management bodies. A situation that recently pushed the Bank of England to issue a cap on their holdings. At the same time, the Bank of England is also considering allowing companies to use stablecoins for settlement operations. An authorization expected to appear in its Digital Securities Sandbox (DSS), a framework for the issuance and exchange of assets on the blockchain still in the experimental phase.

Crypto Exchange Gemini Has Officially Launched Operations in Australia, continuing its international expansion. This move follows obtaining the MiCA license in Europe and the deployment of new products such as staking, derivatives, and tokenized stock trading.

The SEC has issued a no-action letter for DoubleZero’s 2Z token, signaling it won’t recommend enforcement and setting a precedent for utility token designs that avoid securities classification. The token coordinates decentralized physical infrastructure (DePin) for fiber-optic bandwidth, with rewards tied to user participation rather than profit from others’ efforts—satisfying the Howey Test’s fourth prong. This marks a shift from the SEC’s previous restrictive stance, offering a clearer path for functional, non-speculative tokens. However, the relief is fact-specific and doesn’t preclude future enforcement if designs deviate.

Australia has unveiled draft legislation to regulate digital assets, introducing two new categories under its Financial Services License regime: "Digital asset platforms" covering exchanges, custodians, and staking services, and "Tokenized custody platforms" for tokenized real-world assets. Both would face strict custody, disclosure, and operational rules, including a mandatory Platform Guide detailing risks and client rights. The Treasury aims to balance flexibility and consumer protection, with consultation open until October 24 as Australia moves to formalize its digital asset framework.

Singapore’s MAS is monitoring the impact of the U.S. GENIUS Act on global stablecoin adoption but believes it’s too early to gauge its full effect, Deputy PM Gan Kim Yong told parliament. The authority is preparing updates to its stablecoin framework via amendments to the Payment Services Act, creating an opt-in “MAS-regulated stablecoin” designation for compliant issuers. Other stablecoins will remain classified as digital payment tokens. MAS continues to support regulated innovation through pilots in programmable payments and cross-border settlement, balancing clarity with encouragement of digital infrastructure development.

The U.S. government shutdown has stalled crypto regulatory progress, halting Congress’s work on the CLARITY Act and other market structure bills. At agencies like the SEC and CFTC, only essential staff remain—delaying ETF applications, rulemakings, and guidance while pausing initiatives like “Project Crypto.” Treasury’s FinCEN and OFAC continue core national security functions, but stablecoin framework development is frozen. State regulators and SROs remain operational, but federal uncertainty leaves the crypto industry in a holding pattern until funding resumes and legislative activity restarts.

Dubai's crypto regulator VARA slapped 19 companies with fines and immediate cease-and-desist orders. TON DLT Foundation, GLEEC DMCC, and Triple A Technologies all made the list for running services without approval. The UAE has 25% crypto adoption, one of the highest globally, but regulators are making it clear that growth must happen within their rules.

India plans to double down on its central bank digital currency initiative, with Union Minister Piyush Goyal reaffirming government support for the RBI-backed digital rupee. Goyal said the CBDC aims to make transactions faster, more traceable, and less reliant on paper compared to traditional banking, according to local media reports. The minister also reiterated the government's discouragement of private cryptocurrencies, keeping them under heavy taxation without granting legal legitimacy. Despite regulatory resistance, India remains the world leader in grassroots crypto adoption, topping the global rankings for the second consecutive year, according to Chainalysis.

Thailand’s SEC is developing guidelines for crypto ETFs that will extend beyond Bitcoin to include baskets of cryptocurrencies, with rollout expected early next year. The move aims to diversify investment options and follows recent regulatory reforms, including tax exemptions on crypto gains and relaxed custody rules. Thailand has progressively supported digital assets, previously allowing institutional Bitcoin ETF investments and launching a government-backed digital token. These steps underscore the country’s commitment to expanding its regulated crypto market.

Vietnam will limit its crypto exchange pilot to a maximum of five licensed platforms, requiring local incorporation, $380 million minimum capital, and majority domestic ownership. The five-year program, announced last month, restricts crypto trading to Ministry of Finance-approved venues and allows asset-backed token offerings solely to foreign investors, while prohibiting stablecoins and security tokens. The initiative builds on Vietnam’s rapid regulatory progress, including its Digital Technology Industry Law taking effect in 2026, as the country—ranked 5th globally in crypto adoption—advances its formal digital asset framework.

India will soon launch a CBDC to enable faster, traceable digital payments while reducing paper use, Commerce Minister Piyush Goyal announced. However, he expressed skepticism toward non-sovereign cryptocurrencies, emphasizing they lack asset backing and operate at users’ “own risk.” The government taxes crypto but neither encourages nor discourages it. Regulatory views remain divided: the central bank opposes legitimizing crypto, while the securities regulator supports shared oversight. India’s delayed crypto policy paper reflects ongoing hesitation, stalling comprehensive regulation despite the planned digital rupee rollout.

Dubai’s DFSA has proposed updates to its crypto token framework, shifting responsibility for token suitability assessments from regulators to licensed firms themselves, excluding stablecoins. The changes aim to create a more principles-based approach, allowing greater flexibility for innovation while maintaining international standards. The consultation also expands how funds can invest in crypto tokens, broadening regulated options within the DIFC. Feedback is open until October 31, 2025, as Dubai strengthens its position as a global digital asset hub balancing market growth with investor protection.

Traditional Finance:

Crypto Derivatives: CME Group to Launch 24/7 Trading in Early 2026 – CME Group announced on Thursday, October 2, 2025, that its cryptocurrency futures and options will be tradable 24 hours a day, 7 days a week on its CME Globex platform starting in early 2026. A decision subject to regulatory review, but one that responds to demand from institutional players who want to be able to manage risk at any time.

VanEck Has Officially Registered a Staked Ethereum ETF via Lido in Delaware. This initiative is part of a broader strategy to offer crypto ETFs focused on staking and to expand its offerings in the US and Europe, notably via HYPE ETFs and an ETP.

Morgan Stanley Recommends Crypto Allocation in Its Portfolios for the First Time – Finance giant Morgan Stanley is advising its clients to allocate up to 4% of their portfolios to cryptocurrencies, according to a report from its global investment committee. Bitcoin, Ether, and a few other cryptos are cited. To make these recommendations, analysts based their reasoning on two facts: Bitcoin has become a scarce asset, comparable to "digital gold," with historically high returns and decreasing volatility in recent years. But correlations between it and tech stocks are increasingly high, especially during periods of macro and market stress: this therefore justifies keeping exposure more measured in a multi-asset portfolio.

Grayscale Launches the First Spot Ethereum ETFs with Staking in the US – At the end of September, the US SEC promised a series of imminent regulatory decisions for pending spot ETFs. A dynamic on which giant Grayscale is capitalizing, by implementing a staking option for its Ethereum ETFs and its Solana Trust (GSOL).

S&P Global to Launch an Index Combining Cryptocurrencies and Crypto Company Stocks – There is no longer any doubt, the stock market has permanently crossed the border that previously separated it from cryptocurrencies. Proof is the latest index announced by S&P Global which combines exposure to cryptocurrencies and stocks of crypto companies. This index will be named the S&P Digital Markets 50, and it will expand the existing crypto offering from S&P Dow Jones Indices (S&P DJI). The company Dinari, specialized in issuing tokenized US stocks, will handle the creation of a "token intended to track this benchmark." In practice, this index will offer exposure to 35 companies involved in operations related to the crypto sector - infrastructure providers, financial services, blockchain applications, and support technologies - associated with 15 cryptocurrencies selected from the S&P Cryptocurrency Broad Digital Market index.

BNY Mellon Bank Explores Tokenizing Deposits to Facilitate Transfers and Payments – As cryptocurrencies now establish themselves far beyond their ecosystem, the banking sector is preparing to welcome the accompanying changes. This is the case for American giant BNY Mellon, which is exploring deposit tokenization and payments with blockchain.

BlackRock's Spot Bitcoin ETF Has Become the Most Profitable Fund in the Company's History – In less than 2 years, BlackRock's spot Bitcoin ETF has become a giant in the sector. The iShares Bitcoin Trust (IBIT) exceeds $93 billion in assets and generates more revenue than the group's flagship ETFs, demonstrating the growing appeal of Bitcoin within institutional finance.

SWIFT is partnering with ConsenSys and Linea to integrate a blockchain-based shared ledger, aiming to modernize cross-border payments with real-time settlement and automated smart contract rules. This builds on previous pilots with Chainlink and UBS, using ISO 20022 standards to bridge traditional finance with on-chain execution. The shared ledger seeks to eliminate reconciliation delays and FX risks by creating a neutral coordination layer, though instant settlement remains aspirational without prepositioned liquidity. The initiative reflects SWIFT’s iterative approach to adopting blockchain while navigating governance, regulation, and global bank integration.

JPMorgan analysts projected bitcoin could hit $165,000 by year-end, citing its undervaluation relative to gold on a volatility-adjusted basis. The bitcoin-to-gold volatility ratio has dropped below 2.0, with bitcoin now consuming 1.85 times more risk capital than gold, implying a 42% upside from its $2.3 trillion market cap, they said. The analysts noted that bitcoin flipped from being $36,000 overvalued at the end of 2024 to about $46,000 undervalued relative to gold today. They described retail-driven inflows into bitcoin and gold ETFs since late 2024 as part of a broader "debasement trade" tied to deficits, inflation, and weakening fiat currencies.

Robinhood CEO Vlad Tenev predicted most major markets will roll out asset tokenization frameworks within five years, calling it "a freight train" that will eventually consume the entire financial system. However, he acknowledged broad global tokenization adoption could take a decade or more, with the U.S. likely lagging due to entrenched infrastructure that already works "decently well." Tenev framed stablecoins as the simplest tokenized assets, arguing that dollar-pegged coins strengthen U.S. dollar dominance and preview broader tokenized asset adoption. He also forecast that crypto and traditional finance will fully merge, erasing distinctions as tokenized assets become the default channel for global exposure to U.S. equities.

U.S. spot bitcoin ETFs pulled in $1.21 billion on Monday — their largest daily inflows since the Trump election surge in November — as BTC hit new all-time highs. BlackRock's IBIT dominated with $970 million worth of inflows alone, lifting its assets under management to nearly $100 billion and cementing its place as BlackRock's top revenue-generating ETF. Combined spot bitcoin ETF assets have surged to around $170 billion since their January 2024 debut, with IBIT on pace to become the fastest ETF ever to reach the $100 billion AUM milestone. Meanwhile, the U.S. Ethereum ETFs saw net inflows of $181.8 million on Monday, again led by BlackRock's ETHA product with $92.6 million, adding to a six-day positive streak totalling nearly $1.5 billion.

Standard Chartered projects that up to $1 trillion could exit emerging market bank deposits for U.S. dollar stablecoins by 2028, as users seek safer, more liquid alternatives to local banks. Standard Chartered analysts expect the global stablecoin market value to reach $2 trillion by late 2028 from around $300 billion today, with emerging markets driving most of the growth via savings use cases. Egypt, Pakistan, Colombia, Bangladesh, and Sri Lanka rank among the most exposed to deposit flight, while countries like Turkey, India, Brazil, and South Africa also face high adoption risk, the analysts said. The trend could pressure EM banking revenues but also create opportunities if banks integrate or custody stablecoins, as adoption broadens despite new U.S. regulations, they added.

BNY Mellon, the world’s largest custodian bank, is piloting blockchain-based deposits to modernize its $2.5 trillion daily payments infrastructure using tokenized deposits for faster, cheaper settlement. The move aligns with peers like JPMorgan and signals that tokenization is evolving from experimentation to potential core infrastructure. As a systemically critical institution with $53 trillion in custody assets, BNY’s adoption could drive broader market efficiency, embedding blockchain beneath traditional finance rather than replacing it—a historic shift for the 240-year-old bank.

BlackRock’s spot bitcoin ETF IBIT now holds 802,198 BTC ($98B), surpassing 3.8% of Bitcoin’s total supply and overtaking MicroStrategy’s corporate treasury. The fund is nearing a $100B AUM milestone—the fastest in ETF history—after a $4B+ daily inflow streak. Overall U.S. spot bitcoin ETFs attracted $440.7M in a single day, extending an eight-day run above $5.7B total. Analysts describe the demand as unprecedented, signaling robust institutional appetite as IBIT continues to dominate the crypto ETF landscape.

Morgan Stanley will open crypto fund access to all client accounts, including retirement plans, on Oct. 15, removing wealth and risk-profile barriers that had previously limited participation, CNBC reported. The change follows President Trump's August executive order directing regulators to ease restrictions on crypto assets in 401(k) plans, though full regulatory changes are still pending. Advisors will now be able to recommend bitcoin and ether funds from issuers like BlackRock and Fidelity to a much broader investor base. Morgan Stanley's Global Investment Committee also recently endorsed crypto allocations of up to 4% in model portfolios, framing the asset class as speculative but increasingly mainstream.

Tech News:

Prediction Markets: Polymarket Now Offers Bitcoin (BTC) Deposits – Bitcoin's turn. The prediction market platform Polymarket now offers deposits in BTC, among a growing list of supported assets. Polymarket already offers deposits via Ethereum, Polygon, Arbitrum, and Solana, which also includes stablecoins like USDT and DAI. Winning bets are paid out in USDC. According to data shared by Token Terminal, the total volume processed by Polymarket since its launch is approaching $19 billion. This corresponds to an 81% market share in a booming prediction market ecosystem.

Ocean Protocol Leaves the Artificial Superintelligence Alliance — A Failure of Crypto and AI Projects? – This Thursday morning, Ocean Protocol announced its departure from the Artificial Superintelligence Alliance with immediate effect. In the spring of 2024, Fetch.ai (FET), Ocean Protocol (OCEAN), and SingularityNET (AGIX) came together under a single banner: the Artificial Superintelligence Alliance. With the Alliance, only the FET token was supposed to remain, and the promises were great to mark the artificial intelligence sector. In their statement, the Ocean Protocol teams did not indicate the precise reasons for this split but provided some information regarding the OCEAN token. Thus, users who still wish to migrate it to FET can continue to do so, while platforms that may have delisted OCEAN in the past can list it again if they wish.

Walmart-backed fintech platform OnePay plans to add bitcoin and ether trading and custody to its mobile banking app later this year, according to CNBC. The rollout, powered by ZeroHash, will reportedly let users convert crypto to cash in-app to spend at Walmart stores or pay down card balances. The move follows Walmart's prior exploration of a dollar-backed stablecoin and aligns with the more crypto-friendly U.S. policy environment under the Trump administration. If finalized, OnePay's integration would put crypto rails in front of one of America's largest retail user bases during a historically bullish period for the market.

Galaxy Digital has launched GalaxyOne, a consumer platform and app that combines a 4% cash account, crypto custody, and trading, and zero-commission trading on U.S. equities and ETFs. Users can buy, hold, and transfer Bitcoin, Ethereum, Solana, and Paxos Gold at launch, with support for more tokens planned. Accredited investors can also access Galaxy Premium Yield, an 8% APY investment note powered by Galaxy's institutional lending business, but not FDIC-insured. The rollout marks Galaxy's expansion from institutional services into retail, building on its 2024 acquisition of the finance "super-app" Fierce.

Bitcoin miners are becoming key players in the AI boom, leveraging their 14+ gigawatts of secured power and pre-built infrastructure to offer hyperscalers a faster alternative to greenfield data centers. Bernstein analysts note miners can reduce AI deployment timelines by up to 75%, avoiding lengthy grid queues. Their top pick, IREN, holds 3 GW of power capacity and 23,300 GPUs, projecting $500M in AI cloud revenue by 2026. This synergy positions miners as strategic partners in meeting surging AI compute demand.

Adoption (Sentiment, Retail & Corporate Reserves):

Stablecoins Surpass $300 Billion in Market Cap for the First Time – The total market capitalization of stablecoins, these cryptos pegged to a fixed currency like the dollar, has just exceeded $300 billion for the first time in their history, this Friday, October 3, 2025, according to DefiLlama data. This 46.8% progression since the start of the year testifies to the advances in the field and above all to their massive adoption in recent months.

Stablecoins Could Capture $1 Trillion from the Banking Sector – Stablecoins are now establishing themselves as the new popular use case linked to the crypto sector, capable of disrupting the global monetary balance. An evolution that could capture $1 trillion coming directly from the banking sector in the coming years. A situation that is pushing Standard Chartered bank to warn about what it presents as the largest capital flight the banking sector has ever experienced. Indeed, the stablecoin market could capture the equivalent of $1 trillion "leaving banks in emerging markets (...) within about three years."

Bitcoin life insurance company Meanwhile has raised $82 million in new funding co-led by Haun Ventures and Bain Capital Crypto, with participation from Pantera and Apollo, among others. The round, structured as a performance-based convertible rather than traditional equity, will fund bitcoin purchases for Meanwhile's balance sheet and its global expansion plans, building on a $40 million Series A closed in April. Meanwhile's bitcoin-denominated life insurance business has grown its assets under management by more than 200% year-over-year, exceeding 660 BTC ($80 million) across hundreds of policyholders. The firm plans to expand into markets like Hong Kong, Dubai, and Singapore by 2026 and partner with insurers to integrate bitcoin into annuities and savings products.

Funding & Partnerships:

Morpho Partners with Crypto.com to Land on Cronos Blockchain – Crypto.com and Morpho have formed a partnership to deploy the famous DeFi protocol on the Cronos blockchain. A partnership involving the deployment of the lending and borrowing protocol on the Cronos blockchain. While Morpho has already distinguished itself in recent days, notably through its collaborations with Coinbase and SG-Forge, this new association is in anticipation of the launch of Morpho Vaults directly in the Crypto.com application.

Samsung Partners with Coinbase to Bring Crypto to Over 75 Million Users – Major announcements are succeeding one another in this year-end, decidedly marked by the growing adoption of cryptocurrencies. It is now mobile phone giant Samsung announcing a partnership with Coinbase to facilitate access for its users. This partnership, intended to simplify access to cryptocurrencies, requires having a Coinbase One account, the all-in-one subscription plan from the Coinbase platform, paid via a monthly subscription at 3 levels. Starting today, US Galaxy smartphone users can access this service, offered directly in the Samsung Wallet application.

After the Dollar and Euro, Tether Bets Big on Tokenized Gold – Giant Tether (USDT) does not hide its ambitions: it intends to promote its gold-backed token, XAUt. To do this, it will soon launch a treasury company, in partnership with Antalpha. Antalpha is close to Bitmain, one of the most powerful BTC mining companies in the world: it supplies 82% of the world's mining machines. The maneuver would therefore have 2 advantages for Tether: promoting its XAUT, while continuing to invest in the mining sector. The targeted fundraising would be set at $200 million, to accumulate XAUT. At this stage, the stablecoin's market cap exceeds $1.5 billion. It is the most capitalized gold stablecoin at the moment.

Historic! Polymarket Raises $2 Billion, Absolute Record in Crypto – Polymarket, the prediction market platform, has just closed the largest fundraising ever done for a crypto company: $2 billion in a single round. This money comes from Intercontinental Exchange, the parent company of the New York Stock Exchange NYSE. With these $2 billion invested by Intercontinental Exchange, the company is now valued at $8 billion. Not bad for a startup founded in 2020, during Covid-19, by a young American who was 22 at the time.

Crypto exchange Kraken reportedly closed a $500 million fundraise at a $15 billion valuation last month. Contributors included undisclosed investment managers, venture capital firms, Kraken co-CEO Arjun Sethi's Tribe Capital, as well as Sethi in a personal capacity. Kraken is now said to be in advanced talks for a new round that could value the exchange at about $20 billion, with a $200–$300 million commitment from a strategic investor expected as it ramps up fundraising ahead of a potential public listing.

Flying Tulip, a new crypto project founded by DeFi veteran Andre Cronje, raised $200 million in a private seed token round to build an onchain exchange spanning “all of DeFi.” The round valued Flying Tulip’s token at a $1 billion fully diluted valuation (FDV) and had no single lead investor. Participants included Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, and Lemniscap, among others.

Fnality International, a U.K.-based blockchain wholesale payments firm, raised $136 million in a Series C round led by WisdomTree, Bank of America, Citi, KBC Group, Temasek, and Tradeweb. They were joined by existing backers Banco Santander, Barclays, BNP Paribas, DTCC, Euroclear, Goldman Sachs, ING, Nasdaq Ventures, State Street, and UBS.

PayPay, a SoftBank Corp. group company, has acquired a 40% equity stake in Binance Japan to link crypto assets with everyday digital payments. The partnership aims to combine PayPay's 70 million-user network with Binance's blockchain infrastructure to expand web3 access across Japan. Binance Japan users will soon be able to buy and sell crypto directly using PayPay Money within the Binance app, marking one of the first initiatives between the two firms. Executives said the alliance will deliver seamless and secure integration between fiat payments and crypto transactions nationwide.

Kraken is expanding access to CME futures beyond crypto to include equity indices, commodities, FX, and metals as part of its all-in-one trading push. The exchange will route traders directly to CME markets through its regulated futures commission merchant, Kraken Derivatives US. The move follows Kraken's $1.5 billion acquisition of NinjaTrader and comes as it explores a potential $20 billion IPO. Kraken aims to challenge brokerages like Robinhood as well as other crypto and web3 trading platforms that are beginning to expand into traditional asset classes.

Prediction platform Kalshi has raised $300M at a $5B valuation, backed by Sequoia, a16z, and Paradigm, to fund a global expansion into 140+ countries. The firm, which now holds 60% market share against rival Polymarket, aims to integrate its event contracts into major crypto apps within a year. The raise coincides with Polymarket’s $2B investment from ICE, valuing it at $9B, as both platforms pursue growth—Kalshi via international reach and Polymarket via U.S. re-entry under CFTC approval.

Coinbase and Mastercard are competing to acquire London-based stablecoin firm BVNK in a deal valued between $1.5B and $2.5B, with Coinbase currently leading the bidding. BVNK processes $20B+ annually for clients like Worldpay and recently received investment from Citi Ventures. The potential acquisition—which would surpass Stripe’s $1.1B purchase of Bridge—highlights intensifying demand for stablecoin infrastructure following Circle’s IPO and the U.S. GENIUS Act, which created regulatory clarity for dollar-pegged tokens.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.