Top cryptos

Extract from CoinMarketCap.com on November 2nd 2025

Meme of the week

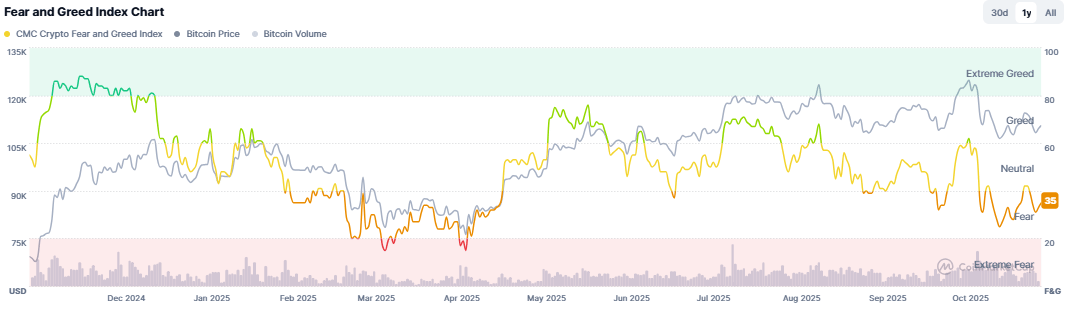

Market Sentiment:

F&GI from CoinMarketCap.com on November 2nd 2025

Market update: Macro conditions were rather favorable this week with a new Fed rate cut (25bps) and a relaxation/trade agreement between the USA and China. Despite this, the crypto market (and even the traditional one isn't reacting much more than that) has BTC around $110K today. The only sticking point on the macro level is the ongoing shutdown in the USA, which is preventing the mass launch of ETFs in the country. But overall, the macro foundations are good, sector announcements remain positive, a new Ethereum upgrade (Fusaka) is arriving on December 3rd; prices will follow.

Main points this week:

International/Macro Highlights:

Crypto ETFs Blocked: 155 Applications Remain Pending Due to US Shutdown – The US shutdown has now dragged on for three weeks. With the SEC operating at a reduced capacity with less than 10% of its staff, it has paused the 155 pending crypto ETF applications (tracked by Bloomberg), pushing decisions to November or December.

Hong Kong Approves First Spot Solana ETF, a Major Step for Digital Asset Integration into Regulated Financial Products – Following this, Osprey filed an S-1 with the SEC to launch a Solana ETF in the United States, marking increased international dissemination of SOL-based financial products.

France: A 15% Tax Targeting GAFAM Just Approved by Finance Committee – The National Assembly's Finance Committee is taking strong action against Tech giants like Google, Amazon, Apple, and Microsoft. They will be taxed at a rate of 15%, up from 3% previously, if the finance bill is approved.

CZ, Founder of Binance, Officially Pardoned by Donald Trump - BNB Soars – US President Donald Trump pardoned Changpeng Zhao, founder of Binance, this Thursday, October 23. This decision erases CZ's conviction for violating the Bank Secrecy Act and allows him to resume his business activities in the United States without restriction.

Trump Abruptly Halts Trade Negotiations with Canada Over an Advertisement – An advertisement aired by the province of Ontario strongly displeased Donald Trump, who announced yesterday that he was abruptly ceasing trade negotiations with Canada. The ad, created by the province of Ontario which continues to campaign against tariffs, was published last week and simply shows excerpts from a 1987 speech by former Republican President Ronald Reagan.

Liechtenstein Embarks on Blockchain with LTIN, Compliant with MiCA – On October 22, 2025, Liechtenstein officially launched LTIN, a sovereign blockchain infrastructure operated by Telecom Liechtenstein. This new network aims to provide blockchain services compliant with European regulations for businesses and institutions, with partners like Bank Frick and Bitcoin Suisse. The goal for Liechtenstein is to secure transactions and digital identities under national control. Additionally, the small country of 40,000 inhabitants is trying to stand out through its environmental commitment: LTIN runs on 100% renewable energy.

BNB Chain Sets Out to Conquer Kyrgyzstan – This weekend, Changpeng Zhao presented how Kyrgyzstan had adopted the BNB Chain across several pillars. Indeed, a national stablecoin (apparently the KGST) was launched on this blockchain, while a Central Bank Digital Currency (CBDC), which will be used for government payments among other things, is also ready to be deployed on the BNB Chain. Furthermore, CZ also revealed that a national cryptocurrency reserve will also be set up, including BNB, while Binance Academy will be deployed to "10 leading universities."

Yen Stablecoin: Japan Launches World's First Stablecoin Backed by Its Currency – The Japanese startup JPYC launched the first yen-backed stablecoin this Monday, October 27, 2025, fully guaranteed by bank deposits and Japanese government bonds. A new step forward for Asia in the stablecoin field, while China remains on the sidelines, maintaining its crypto ban. In a market dominated by dollar stablecoins, Japan enters the fray. Indeed, the JPYC, a yen-pegged stablecoin, arrived this Monday on the Ethereum, Avalanche, and Polygon networks. An important step for the Asian stablecoin market. The crypto maintains a 1:1 ratio with the Japanese yen, and each token is over-collateralized by domestic bank deposits and Japanese Government Bonds (JGB). The company has ambitions: it aims to issue over 10 trillion yen (approximately $66 billion) within three years. A goal that would allow JPYC to position itself against dollar-backed stablecoins, which currently represent over 99% of the global market according to the Bank for International Settlements. Already seven companies, like Densan System for e-commerce payments and HashPort for wallets, plan to integrate JPYC into their operations.

Nvidia Exceeds $5 Trillion Market Cap – On Wednesday, Nvidia became the first company in the world to reach a market capitalization of $5 trillion. This performance is even more remarkable considering that last July, Nvidia already achieved a world first by surpassing a $4 trillion market cap. Now, Apple and Microsoft have also joined this exclusive club.

Fed Cuts Interest Rates, But Market Doesn't React – On Wednesday, the Fed lowered its key interest rates by 25 basis points, but financial markets, including cryptocurrencies, reacted little. In his speech, Fed Chairman Jerome Powell addressed several key points, including risks regarding employment and inflation: "In the short term, inflation risks are tilted to the upside while risks to employment are tilted to the downside, which constitutes a complex situation. There is no risk-free path to conduct effective economic policy in the face of this tension between our employment and inflation objectives. Our reference framework invites us to adopt a balanced approach to achieve both goals of our dual mandate. As risks to employment have increased in recent months, the balance of risks has evolved. Consequently, we deemed it appropriate, at this meeting, to take a new step towards a more neutral policy."

The Bank of England has proposed stablecoin holding limits of £10,000–20,000 for individuals and £10 million for businesses, with exemptions for exchanges and payment firms requiring higher operational balances. The rules aim to prevent stablecoins from threatening financial stability or reducing bank deposits needed for lending. Governor Andrew Bailey emphasized careful management to avoid systemic risks while fostering innovation. This balanced approach positions the UK to compete in digital assets without compromising monetary control, reflecting its evolving regulatory stance.

Canaan is reportedly supplying bitcoin mining rigs to a major Japanese utility for a grid-stability research project, marking the country’s first publicly disclosed state-linked mining initiative. While Canaan did not identify the partner, the move follows earlier reports that a subsidiary of Japan’s largest utility, Tokyo Electric Power Company (TEPCO), had studied using surplus energy generated by solar and wind to mine bitcoin. Canaan said in its Thursday release that its hydro-cooled Avalon A1566HA servers will be used to “stabilize regional power-grid load through controlled overclocking and underclocking,” dynamically adjusting hashrate and voltage to balance energy use in real time.

Pakistan's Corner Stores Are Now Selling Stablecoins: A16z just led a $12.9 million funding round for ZAR, a fintech startup bringing stablecoins to Pakistan's 240 million people. The company isn't going the typical crypto exchange route. They're working with local corner stores and phone kiosks, the same networks people already use for mobile top-ups.

Customs Relaxation Between the United States and China — Asian Markets Soar: Since his arrival at the White House, President Donald Trump has destabilized global markets, particularly with his aggressive trade policy. However, an agreement seems to have been reached with China, opening the prospect of a potential easing that could be bullish for cryptocurrencies. This agreement, which is still considered fragile from China's side, between the two largest economic powers on the planet — accounting for 40% of the global GDP — opens up new, more favorable prospects for global markets as the year comes to a close. In Europe, analysts are already anticipating a positive start to the week.

Agreement Confirmed Between Donald Trump and Xi Jinping — A Temporary Calm or Sustainable Detente? The aggressive policy initiated by Donald Trump concerning tariffs directly influences the instability of financial markets. On his side, Donald Trump announces the imminent implementation of agreements on the majority of points of conflict between the two nations, accompanied by a reduction in average taxes on Chinese imports from 57% to 47%, and a 10% rate set for Fentanyl. Negotiations between the United States and China seem to be heading toward more peaceful exchanges, and even a possible agreement. President Trump is even considering the possibility — which is highly controversial in the United States — of selling Nvidia chips to China, but "not the latest Blackwell models."

Compliance/Regulation/Legal/Cyber:

Revolut Obtains Its European MiCA License - Heading Towards "Crypto 2.0" – The European MiCA regulatory framework for the crypto sector requires a license issued by EU authorities. A pass that the neobank Revolut has just obtained, determined to establish itself with a "Crypto 2.0" platform. According to Revolut's Head of Crypto Product, Leonid Bashlykov, this license represents "a green light to develop innovation responsibly across the entire EEA," with the goal of establishing "a new standard for fair, transparent, and accessible cryptocurrencies, for all."

France: SG Forge and Delubac & Cie Banks Obtain Their MiCA Approval – The two French banks Delubac & Cie and SG Forge have obtained their MiCA approval to offer their crypto services in Europe. For Joël-Alexis Bialkiewicz, Managing Partner of Banque Delubac & Cie, this new regulatory step is part of a broader bank project: "Crypto-assets are no longer just a trend: they have established themselves as a new asset class in their own right. Their adoption by both private and institutional investors is accelerating. Our ambition is to contribute to this adoption by offering a service that combines the innovation inherent to crypto-assets with the solidity of an independent bank. Delubac & Cie thus wishes to become a reference player to accompany its clients in this sustainable transformation of finance."

Michael Selig Appointed by President Trump to Head the CFTC, filling a leadership vacuum and marking a more crypto-friendly orientation. This decision comes in a context of regulatory harmonization between the SEC and CFTC regarding DeFi, DePin, and airdrops, and supports a pro-crypto dynamic in US markets.

Donald Trump Targeted by a Bill Banning US Elected Officials from Holding Crypto – Democrat Ro Khanna, a California Congressman, is preparing to introduce legislation prohibiting the President, Vice President, members of Congress, and their families from holding, trading, or launching cryptocurrencies. A project announced on October 27, 2025, during an interview on MSNBC, aimed at countering corruption risks.

Australia Has Decided to Classify Stablecoins and Wrapped Tokens as Financial Products – This decision places these assets under the supervision of the national financial framework, aligning with a global trend where stablecoin usage is becoming widespread.

dYdX Announced Its Intention to Expand to the United States by 2026 by Launching Spot Crypto Trading – This decision relies on a US regulatory environment deemed more favorable. The year 2025 also saw 21Shares launch an ETP on dYdX and the platform offer trading options accessible via Telegram.

Mt. Gox Delays Repayments Until October 2026 in Third Extension: The defunct Mt. Gox exchange has postponed its creditor repayment deadline by another year to October 31, 2026, marking its third extension. While the trustee has "largely completed" repayments to 19,500 creditors via Bitcoin and Bitcoin Cash distributions through Kraken and Bitstamp, many remain unpaid due to incomplete procedures. Mt. Gox still holds 34,689 BTC ($4B) from the original 142,000 BTC recovered after its 2014 collapse, with the latest delay approved by the court to address ongoing processing challenges.

Crypto executives from firms like Coinbase, Circle, and Uniswap met with 12 Democratic Senators to advocate for passage of a market structure bill, following recent industry backlash over a leaked Democratic policy draft. While the House has already passed the CLARITY Act, the Senate remains divided on DeFi regulation—with Republicans favoring developer protections and Democrats pushing for stricter oversight. Both sides may compromise by exempting sufficiently decentralized protocols from certain requirements. The engagement signals growing bipartisan momentum, with odds of a bill reaching the President’s desk before next summer’s recess now estimated at 60%.

President Trump has pardoned former Binance CEO Changpeng "CZ" Zhao, declaring an end to what the administration called Biden’s "war on crypto." Zhao served four months and paid a $50M fine after Binance’s $4.3B settlement for compliance failures. The pardon—which Zhao had formally requested—raises questions about his potential return to leadership, despite a lifetime ban from his 2023 plea deal. The move signals a dramatic shift in U.S. crypto policy, emphasizing regulatory reconciliation over punitive enforcement.

The Commodity Futures Trading Commission and Securities and Exchange Commission are pushing to complete their end-of-year crypto goals, particularly priorities set out in a report released by the White House over the summer. These priorities include SEC-enforced safe-harbors for crypto and the establishment of "fit-for-purpose" registration exemptions for securities distributions, while granting the CFTC the authority to "regulate spot markets in non-security digital assets." Additionally, CFTC Acting Chair Pham said the agency is prioritizing crypto trading and "tokenized collateral" by the end of 2025. The move comes as lawmakers in Washington D.C. work to draft and advance market structure legislation that would write rules for crypto at large, including designations for what parts of industry will fall under CFTC or SEC remit.

U.S. authorities have unsealed an indictment against Chen Zhi, leader of Cambodia’s Prince Group, charging him with wire fraud and money laundering tied to a massive forced-labor scam operation. The DOJ is seeking forfeiture of 127,271 BTC ($15B)—the largest in U.S. history—from proceeds generated through “pig butchering” crypto fraud. The network operated scam compounds with alleged corruption ties to Chinese officials, highlighting how transnational crime has evolved to exploit crypto, human trafficking, and state collusion. The case marks a landmark in global law enforcement’s use of blockchain analytics and international cooperation.

Japan’s Financial Services Agency is preparing reforms to allow banks to invest in and hold crypto assets, reversing a 2020 prohibition that cited volatility risks. The JFSA will also consider letting banks operate crypto exchanges and plans to criminalize crypto insider trading under securities laws. These steps align with a broader proposal to shift crypto oversight from the Payment Services Act to the Financial Instruments and Exchange Act, applying traditional market safeguards to address fraud, disclosure gaps, and market abuse. Detailed rules are expected by 2026.

Indonesia's central bank just announced plans for their own version of a stablecoin. Bank Indonesia is tokenizing government securities and tying them to their digital rupiah CBDC. It's basically a stablecoin built on the country's actual financial infrastructure.

Australia’s ASIC has finalized its INFO 225 guidance, confirming that most digital assets—including stablecoins and tokenized securities—are financial products requiring an AFSL, while clarifying Bitcoin is likely exempt. The regulator introduced a no-action position until June 2026, allowing firms time to assess compliance and seek licenses without enforcement risk. Targeted relief for stablecoin distributors is also proposed. The update provides clarity amid Treasury’s broader regulatory reforms, supporting innovation while aligning Australia’s framework with evolving digital asset use cases.

Hong Kong’s HKMA has confirmed it will fully adopt the Basel Committee’s strict crypto capital standards by January 2026, applying the highest requirements to Group 2 crypto assets (including most public blockchain tokens) with 1-2% exposure limits and full capital deduction. The move contrasts with Singapore’s recent deferral to 2027 and signals Hong Kong’s commitment to prudential discipline despite industry calls for recalibration. The draft policy is open for consultation until November 24, reinforcing the city’s alignment with global banking regulations.

The EU has adopted its 19th sanctions package against Russia, directly targeting a ruble-pegged stablecoin (A7A5) for the first time by sanctioning its issuer, developer, and trading platform. All A7A5 transactions are prohibited in the EU from November 25, alongside sanctions against an offshore crypto exchange in Paraguay used for evasion. The package also expands restrictions on Russian payment systems and adds eight banks from third countries. This marks a significant escalation in using crypto-focused measures to disrupt sanctions evasion and financial flows supporting Russia’s war economy.

Japan has launched its first fully regulated yen-backed stablecoin, JPYC, operating on Avalanche, Ethereum, and Polygon with 1:1 reserves in yen and Japanese government bonds. The stablecoin complies with the Payment Services Act, requiring user verification for issuance and redemption while enabling instant settlement and DeFi use. This marks Japan’s strategic move to integrate traditional finance with public blockchains, offering a transparent, sovereign digital currency that expands its role in global payments and tokenized markets.

Frax and IQ have launched KRWQ, the first Korean won-pegged stablecoin on Coinbase's Layer 2 network Base, debuting with a KRWQ-USDC pair on Aerodrome. Built on LayerZero's Omnichain Fungible Token standard, KRWQ also enables multichain transfers via the Stargate bridge, positioning it as the first won-pegged token with cross-chain functionality. However, KRWQ is currently unavailable to South Korean residents as local efforts to establish rules on stablecoins are still underway, with minting and redemption currently limited to eligible institutional counterparties. IQ said the project aims to become Korea's first fully compliant stablecoin, leveraging Frax's regulatory expertise as the government pushes to define the future framework for won-backed digital currencies.

Traditional Finance:

JPMorgan will allow institutional clients to use bitcoin and ether as loan collateral by the end of 2025, expanding beyond its earlier acceptance of crypto ETFs. The global program will rely on a third-party custodian to secure the pledged assets, enabling institutions to access liquidity without selling long-term holdings. This reflects both growing client demand and the bank’s strategic pivot under Jamie Dimon, aligning with peers like Morgan Stanley and Fidelity in expanding crypto-financial services amid a maturing regulatory landscape.

Moody's Maintains France's Rating... But Mentions Negative Outlook – The rating agency Moody's maintained France's sovereign rating while issuing a warning about the risk of deteriorating economic conditions. This is the third warning France has received in a month. Moody's notably points the finger at the suspension of the pension reform, deemed harmful to the long-term economy.

A BASE Token Capitalized at $34 Billion: JPMorgan Shows Optimism for Coinbase – While JPMorgan raised its price target for Coinbase stock, the bank also estimates that a BASE token could reach a market capitalization of $34 billion. "Given the total value locked (TVL) and revenues, we estimate a market capitalization of $12 to $34 billion is reasonable in the long term. We believe the majority of Base tokens would be distributed to developers, validators, and the Base community, but that Coinbase would retain a share. We estimate the Base token could generate $4 to $12 billion for Coinbase over time."

Western Union to Launch Its USDPT Stablecoin, Accompanied by a Digital Asset Network – More and more companies in the money transfer and payment sectors are turning to the opportunities offered by cryptocurrencies. A dynamic greatly accelerated by the current rise of stablecoins, which the giant Western Union will integrate into its network by 2026 with a native USDPT version. From a technical standpoint, Western Union's USDPT stablecoin will operate on the Solana (SOL) blockchain. The American company Anchorage Digital - also in charge of Tether's USAT stablecoin - will handle its issuance as it currently stands as the only one with the necessary federal banking charter.

T. Rowe Price, a $1.77T legacy asset manager, has filed for an actively managed crypto ETF targeting major cryptocurrencies like Bitcoin, Ethereum, Solana, and XRP. The fund aims to outperform the FTSE Crypto US Listed Index, signaling a significant shift as traditional finance firms build infrastructure to integrate digital assets. The move underscores the industry’s acknowledgment that ignoring crypto is no longer a viable strategy, reflecting growing institutional adoption amid evolving regulatory and market conditions.

Standard Chartered forecasts the onchain real-world asset market will surge from $35B to $2T by 2028—a 5,600% increase—driven by tokenization of money market funds, equities, and private assets. Analyst Geoffrey Kendrick credits stablecoins for building essential DeFi infrastructure through awareness, liquidity, and lending activity. He expects Ethereum to host most tokenized assets due to its reliability and network effects, while warning that U.S. regulatory delays beyond 2026 midterms pose a key risk to this growth trajectory.

Tech News:

Private Transactions Coming Soon to Base – Revolution or Mirage? A Return to Anonymity? – Brian Armstrong, CEO of Coinbase, confirms that the Layer 2 Base will soon offer private transactions. The CEO recalls that Coinbase acquired the company Iron Fish last March to begin working on this change. Iron Fish is a privacy-focused blockchain that uses Zero-Knowledge Proofs. The entry of a giant like Coinbase into this field therefore tends to show that the powers that be are more inclined to allow anonymization technologies to develop. To what extent? If the United States has become "crypto-friendly," they are also monitoring the sector more than ever.

AI: Claude and Gemini Will Soon Be Able to Access Your Crypto Wallets – The Coinbase platform just announced the launch of Payments MCP, a protocol that allows AI agents like Claude and Gemini to access crypto wallets. According to Coinbase, several major AI models like Claude (Anthropic) and Gemini (Google) will be compatible with this service, named. The protocol will allow them to access crypto wallets and execute transactions autonomously. This novelty is part of the x402 Foundation, an initiative led by Coinbase and Cloudflare, which aims to standardize AI payments. "The future of AI lies in the ability of agents to act and execute transactions, not just read and write. Payments MCP enables agents to act in the global economy, safely and autonomously: paying for computation, accessing paid data, tipping creators, or managing micro-economic activities."

Trezor Unveils Its New Quantum-Resistant Hardware Wallet – Trezor introduced the Safe 7, a new physical wallet featuring transparent components and a quantum-resistant architecture. This model marks a technical advance in a context where private key security and digital sovereignty are becoming major issues for cryptocurrency users. The so-called "quantum-ready" architecture. The wallet would be capable of receiving updates designed to resist future quantum computer attacks, thanks to a boot system planned to support post-quantum cryptographic algorithms.

Bitcoin Tips: This Social Network Presents a New Way to Support Content Creators – After launching its crypto wallet at the beginning of the month, Rumble now unveils Bitcoin (BTC) tips for content creators. In December 2024, the stablecoin giant Tether invested $775 million in Rumble, a video platform competing with YouTube. Although less known, Rumble reportedly has 51 million monthly active users. Consequently, this partnership leads the platform to develop blockchain initiatives, and at the beginning of the month, we also reported on the launch of a crypto wallet on Rumble, accompanied by the adoption of USAT, Tether's new GENIUS Act-compliant stablecoin.

Circle Launches Testnet of Its Arc Blockchain in Collaboration with BlackRock, HSBC, and Goldman Sachs – After presenting its Arc blockchain in August, Circle just opened the testnet to the public for this new Layer 1 dedicated to stablecoins. Arc presents itself as "a foundation for fiat stablecoin issuers, as well as for tokenized equities, debt securities, money market funds, etc." Consequently, the testnet is opening to various stablecoins pegged to currencies from other countries like Australia, Brazil, Canada, Mexico, and the Philippines. As for the various infrastructures and applications, we find the usual names already present on many other networks, such as Curve, Aerodrome, Euler Finance, Aave, Morpho, or Uniswap. Thus, it remains to be seen how the network will develop in the future, in an already highly competitive field where all offer the same services without truly differentiating elements.

Ethereum Developers Confirmed the Deployment of the Fusaka Upgrade for December 3, 2025 – It will integrate the PeerDAS system, double the data capacity of blobs, and increase the gas limit per block to 150 million units. This step should enhance scalability and accelerate the evolution of the mainnet.

Polymarket CMO Matthew Modabber confirmed during a Degenz Live podcast appearance on Thursday that the company will launch a native POLY token and airdrop following months of speculation. Modabber said the team aims to eventually release a token with real utility and longevity, prioritizing thoroughness of design over speed of release. However, the company is first focusing on relaunching its U.S. app, which recently received regulatory approval to go live again after a 2022 halt. "Why rush a token if we need to prioritize the U.S. app?" Modabber said. "After the U.S. launch, there will be a focus on the token and getting that live and making sure that it's well done."

MetaMask has launched multichain accounts, enabling users to manage EVM, Solana, and soon Bitcoin addresses within a single account. The update simplifies wallet management by merging EVM and non-EVM addresses, reducing account switching and making cross-network activity seamless. The feature is live by default in MetaMask Mobile 7.57 and Extension 13.5, using the BIP-44 standard to organize multiple accounts from one recovery phrase.

Adoption (Sentiment, Retail & Corporate Reserves):

Crypto Adoption Breaks Records in 2025: 716 Million Investors and $46 Billion in Stablecoin Volumes – In 2025, crypto broke new records in terms of adoption. In its latest report, a16z reviews the evolution of different sectors of the ecosystem. For example, in the real-world assets (RWA) pillar, the value of tokenized assets has now surpassed $30 billion, compared to $9 billion in 2024. Regarding decentralized finance (DeFi), Solana (SOL) and Hyperliquid (HYPE) seem to stand out as the big winners, capturing 53% of revenue-generating economic activity. Finally, more generally, the various blockchains now total about 3,400 transactions per second, which now exceeds the number of trades executed on the Nasdaq during market hours.

The Trump Sons' Bitcoin Treasury Adds $160 Million in BTC to Its Reserve – The Trump family is now establishing itself as a key player in the crypto ecosystem. A multi-faceted strategy, which just involved a purchase of $160 million in BTC for its mining and treasury company American Bitcoin.

S&P Global Downgrades Strategy's Debt Rating to "B-" – Too Much Bitcoin and Not Enough Dollars? – On Monday, S&P Global analysts rated Strategy's debt at "B-" following concerns about its dollar liquidity. Indeed, S&P Global analysts indicate that their decision is motivated by Strategy's significant US dollar liquidity needs, while a large part of its treasury is denominated in BTC. Factors that could lead to a further downgrade over the next 12 months include the possibility of Strategy struggling to access financial markets, particularly due to a drop in BTC, but analysts are also concerned about the risk regarding debt maturity payments.

Metaplanet Ready to Risk Its Bitcoins to Buy More – Metaplanet is no longer content with just buying Bitcoin: it is now using it as collateral to borrow. The board of directors approved a share buyback of up to 150 million shares (approximately 13% of the capital) for a maximum amount of 75 billion yen, or nearly $500 million. If BTC continues to rise, Metaplanet could benefit from a snowball effect, releasing ever more value without selling its BTC. But if the price of Bitcoin were to fall or grow slower than the loan interest rate, Metaplanet could be forced to liquidate part of its reserves... potentially impacting the market and triggering cascading liquidations.

Faced with Evident Success, Visa Announces Support for 4 Stablecoins – Each day brings new announcements regarding the integration of cryptocurrencies into the offerings of major global payment players. A dynamic already successfully initiated by the giant Visa, to the point of motivating it to add 4 stablecoins to its network. The CEO of Visa also highlighted the fact that his company already facilitates over $140 billion in crypto and stablecoin flows, notably for purchases made with Visa cards ($100 billion).

Pavel Durov Unveils Cocoon: A Decentralized AI Network Implemented on the TON Blockchain and Telegram – The development of AI often comes at the expense of data collected en masse by centralized operators. The goal of this Cocoon project lies mainly in offering a decentralized AI service, using "private and confidential computation." In this case, this intention relies on a DePin-type infrastructure, already widely used by the sector's flagship project Bittensor (TAO).

Funding & Partnerships:

IBM Partners with French Startup Dfns to Launch a New Crypto Platform – IBM announced its partnership with the Paris-based company Dfns for the launch of Digital Asset Haven this Monday, October 27, 2025. It is a platform allowing banks and companies to manage their cryptocurrencies. This solution covers over 40 public and private blockchains and integrates compliance tools like identity verification and anti-money laundering controls. In short: a turnkey offering for cautious institutions. The French startup brings its expertise in crypto wallet management via its Multi-Party Computation (MPC) technology and Hardware Security Modules (HSM). Dfns, which has created 15 million wallets for 250 clients and secures over one billion dollars in monthly transactions, counts among its clients institutions like ABN AMRO, Fidelity, Zodia Custody, and Stripe.

OpenAI IPO - An Estimated Valuation of $1 Trillion – The current rise of artificial intelligence is carrying the company OpenAI - and its flagship product ChatGPT - to the heights. A momentum that could be accompanied by an imminent IPO, already envisioned as one of the largest of all time. OpenAI just underwent a complex restructuring to reduce its dependence on the giant Microsoft, the world's second most valuable company ($4 trillion) behind the now undisputed leader Nvidia and its $5 trillion. This IPO would indeed allow OpenAI to raise capital more effectively and make larger acquisitions using stock issuance procedures, to satisfy the expansion appetites - estimated in trillions of dollars for AI infrastructure - of its CEO-founder Sam Altman.

Maple Finance Collaborates with Aave to Develop Loans Collateralized by Tokenized Assets – After several successful integrations on Pendle, Morpho, Euler, and Kamino, SyrupUSDC, Maple Finance's stablecoin, is preparing to take a new decisive step: its integration on AAVE V3. The announcement marks a strategic turning point for the RWA ecosystem. Beyond a simple technical partnership, this collaboration between Maple and AAVE symbolizes a convergence between two major DeFi players. SyrupUSDC is an innovative yield-bearing stablecoin, backed by loans to leading companies and institutional funds. Each token is guaranteed by carefully verified receivables, ensuring robust security and generating stable yield directly on the blockchain. This asset is fundamental for Maple Finance, as it combines stability, transparency, and profitability, thereby strengthening the platform's position as a leader in institutional decentralized finance. By facilitating access to predictable yields while minimizing risks, SyrupUSDC meets the strict requirements of institutional investors, making it a strategic pillar for the Maple ecosystem.

Ethereum Giant Consensys Preparing for Its Stock Market Entry – Since its creation in 2014, the company Consensys has been a historical and essential player in the Ethereum ecosystem. A position that could well be accompanied by an upcoming stock market entry, with the support of JPMorgan and Goldman Sachs banks.

Mastercard Could Acquire This Crypto Startup for $2 Billion – As the boundaries between traditional finance and blockchain blur a little more each day, Mastercard is reportedly in discussions to acquire Zerohash, a startup providing crypto infrastructure, particularly on stablecoins. Indeed, according to 5 anonymous sources close to the matter, negotiations are for a deal with an amount between $1.5 and $2 billion.

U.S. institutional crypto prime broker FalconX is acquiring 21Shares, a major crypto ETP manager with over $11B in assets across bitcoin, ether, and basket products. The merger combines FalconX’s trading and derivatives infrastructure with 21Shares’ ETP distribution expertise, focusing on expanded institutional offerings. The move follows FalconX’s recent launch of a 24/7 OTC options platform, signaling consolidation as crypto capital markets mature and demand for structured products grows globally.

Trump Media’s Truth Social is launching “Truth Predict” in partnership with Crypto.com, becoming the first publicly traded social platform to offer prediction markets. Users can trade event contracts using Crypto.com’s compliant infrastructure and convert “Truth gems” to CRO tokens for transactions. CEO Devin Nunes framed the move as “democratizing information” amid a surge in prediction market popularity, with rivals like Kalshi and Polymarket reaching multibillion-dollar valuations. The feature expands Truth Social’s ecosystem while tapping into growing demand for speculative event trading.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.