🚀 The Web3 Weekly Wave: The 10-Day Deep Dive

The Big Picture: Geopolitics Meets Price Action ⚔️

This week delivered a masterclass in how global power dynamics drive crypto markets. Bitcoin's surge past $94,000 was fueled not by a technical breakout, but by a geopolitical catalyst: the U.S. military intervention in Venezuela, interpreted by markets as a bullish move for oil control and dollar dominance. Yet, the momentum proved fragile, with BTC retreating to consolidate around $90K. The takeaway? Crypto remains hypersensitive to macro shocks, but beneath the volatile surface, the institutional machinery grinds forward—with JPMorgan, Morgan Stanley, and Visa making defining moves. The price is noisy; the infrastructure build-out is deafening.

"In times of geopolitical tension, digital assets don't just react—they often reveal their emerging role as a new financial frontier."

📊 MARKET SNAPSHOT: The Numbers Don't Lie

Data as of January 10th, Source: CoinMarketCap

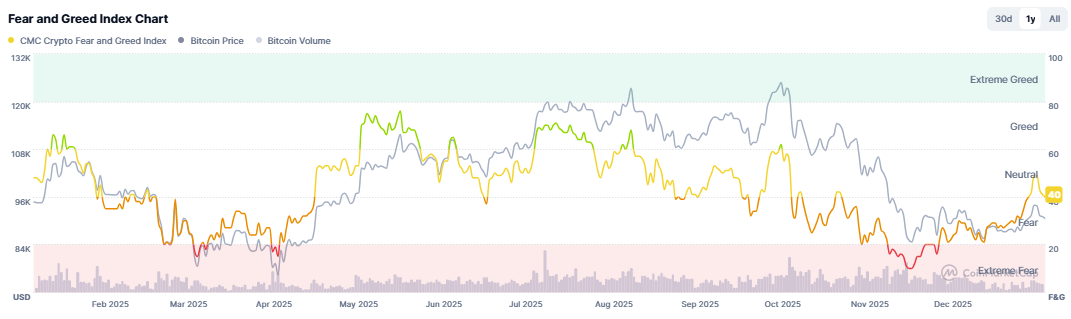

📈 Market Sentiment: Fear & Greed Index

Current Reading: 40 - Neutral😐

📈 On-Chain Intelligence: The Whale vs. Retail Divide

Data reveals a stunning divergence: Whales (1K-10K BTC holders) are buying aggressively at these levels, while small holders (<1 BTC) are selling. This classic accumulation pattern during "Fear" periods suggests smart money is positioning for the next leg up, while retail capitulates.

📈🌍 SECTION 1: Macro & Geopolitical Tremors

The board is being reset, and nations are moving their pieces.

🇺🇸 The U.S. Debt Spiral: Public debt hit a record $38.5 trillion. Annual interest payments now exceed $1 trillion—more than the defense budget. This unsustainable math makes future rate cuts and monetary dilution almost inevitable, a long-term bullish setup for hard assets.

🇻🇪 Venezuela Intervention: The U.S. move sent oil prices down and crypto up—a market bet on energy control and dollar strength. President Trump's demand for "total access" to Venezuelan resources signals a more aggressive resource nationalism that could destabilize traditional commodity markets.

🇷🇺 Russia's Crypto Legalization Plan: The central bank proposed allowing all citizens to buy crypto (with knowledge tests and annual caps) by 2026-2027. This is a monumental shift from restricting access to only the ultra-wealthy, potentially opening a massive new market.

🇨🇳 China's Digital Yuan Evolution: The PBOC will now allow interest payments on the digital yuan, transforming it from a "digital cash" to a "digital deposit" tool. This is a strategic move to boost adoption and compete directly with yield-bearing dollar stablecoins.

⚖️ SECTION 2: Compliance & Regulation Frontier

The rulebook is being written in real time, with a distinctly pro-innovation tilt.

🏛️ New U.S. Leadership, New Tone: Michael Selig, the new CFTC Chair, reaffirmed his pro-crypto stance, pledging to support innovation as the U.S. aims to become the "crypto capital of the world." The regulatory mood music has fundamentally changed.

🔐 Proof of Reserves Goes Mainstream: Binance announced all user funds are fully backed 1:1, verified via Merkle trees and zk-SNARKs. This transparency push, alongside its Abu Dhabi global license, marks the exchange's full pivot to compliance-as-a-competitive-advantage.

🌐 Global Licensing Blitz: Hong Kong proposed a dedicated licensing regime for crypto dealers/custodians (2026). Ghana passed a bill fully legalizing crypto trading. Taiwan is prioritizing VASP inspections. The map of regulated crypto hubs is expanding rapidly.

🇷🇺 Russia's Controlled Opening: A detailed framework aims to bring crypto into regulated channels by 2026-2027, with tiered access for retail vs. qualified investors. It's a pragmatic move to control, not ban, a thriving market.

🏦 SECTION 3: Spotlight - The Institutional Onslaught (JPMorgan & Morgan Stanley)

This week belonged to the banking titans.

🎯 JPMorgan's Multi-Front Assault:

Institutional Trading: Exploring spot and derivatives crypto trading for its clients, managing nearly $4 trillion in assets.

Corporate Payments: Partnering with Ripple's GTreasury to revolutionize inter-company settlements for multinationals.

Stablecoin Launch: JPM Coin (JPMD) is set to launch on the Canton Network, moving from an internal settlement tool to a potential industry-standard "stablecoin."

🚀 Morgan Stanley's Surprise Offensive: The banking giant filed for 3 crypto ETFs (BTC, ETH, SOL) in 24 hours and announced a crypto wallet for 2026. This from a firm that once symbolized institutional skepticism. They are not dipping a toe; they are diving in.

📈 The Ripple Effect: Bank of America now allows its 15,000 wealth advisors to proactively recommend Bitcoin ETFs. PwC is going "hyper-engaged" with crypto clients, citing regulatory clarity. The herd is no longer approaching—it has arrived.

⚡ SECTION 4: Tech Deep Dive - Ethereum's Scalability Leap

Vitalik Buterin declared Ethereum has "solved the blockchain trilemma." Here's what that means.

🧩 The Trilemma Solved? Buterin credits ZK-EVMs (for scaling/security) and PeerDAS (for data availability) with reconciling decentralization, security, and scalability. This isn't just an upgrade; it's a philosophical shift in Ethereum's capabilities.

🔧 Glamsterdam on the Horizon: Following the successful Fusaka upgrade, the next major hard fork, Glamsterdam, is slated for 2026. Its centerpiece is EIP-7732 (Enshrined Proposer-Builder Separation), which aims to democratize block building and mitigate MEV abuse.

💸 Private Transactions Go Live: Zama Protocol launched on mainnet, enabling the first confidential stablecoin transfer (cUSDT) on Ethereum using Fully Homomorphic Encryption (FHE). Real financial privacy is now on-chain.

🏆 A Historic First: Grayscale's Ethereum ETF (ETHE) became the first U.S. ETF to distribute staking rewards, creating a new model for yield-generating investment products.

🤑 SECTION 5: Major Funding & Corporate Moves

Capital flows to infrastructure and accumulation.

🐳 Tether's Treasury Strategy: The stablecoin giant purchased $780M worth of Bitcoin, bringing its holdings to 96,370 BTC (~$8.6B). It's now the second-largest corporate BTC holder, turning its reserves into a strategic treasury.

🚫 Ripple Stays Private: Despite a $40B valuation, Ripple's President confirmed no IPO plans, relying on its strong balance sheet and nearly $4B in acquisitions to build a full-service digital asset platform.

🛒 Walmart Enters the Fray: The retail giant now accepts Bitcoin and Ethereum payments via its OnePay app. This isn't a niche test; it's a mainstream distribution channel with millions of users.

📊 MicroStrategy & BitMine Keep Stacking: MicroStrategy added 1,286 BTC, holding 673,783 BTC total (~$63B). BitMine added 32,977 ETH. The corporate accumulation thesis is stronger than ever.

😂 WEB3 MEME OF THE FORTNIGHT

🎲🎁 BONUS SECTION: Where Smart Money is Building

Beyond the headlines, venture capital is funding the next wave's foundational layer.

🧱 Infrastructure Over Hype: Major rounds are going to the unsexy plumbing: $30M for on-chain fixed income (Haven), $35M for tokenized traditional asset trading (Architect), and $13M for decentralized broadband (Dawn). The focus has shifted from consumer apps to the robust infrastructure needed for mass adoption.

🏆 The Uncontested Settlement Layer: One data point says it all: the tokenized real-world asset (RWA) market grew 237% this year to $18.9B, and Ethereum hosts over $12B of it. When BlackRock, Robinhood, and major banks choose a chain to build on, the network effect becomes insurmountable. The institutional settlement layer race is over.

The Takeaway: The capital flow reveals the next cycle's theme: Institutional-grade infrastructure on Ethereum. The money is betting on utility, not speculation.

📊 The Final Word: The Accumulation Window

The Noise: Price volatility tied to geopolitics. Retail fear. Consolidation chatter.

The Signal: JPMorgan and Morgan Stanley launching products. Walmart accepting crypto. Russia legalizing for all citizens. Ethereum solving its trilemma. Whales buying while retail sells.

Your Compass: We are in a phase where institutional adoption and technological breakthroughs are outpacing price appreciation. This creates a rare window. The entities with the longest time horizons—nation-states, mega-banks, and corporate treasuries—are actively building and accumulating. Their actions, not daily candles, define the trend.

Stay steady. The building continues.

Catch you in the next edition! 👊

—

Enjoying The Wave? Share it with a friend to help them navigate!

Token Chronicle

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.