Top cryptos

Extract from CoinMarketCap.com on August 21st 2025

Meme of the week

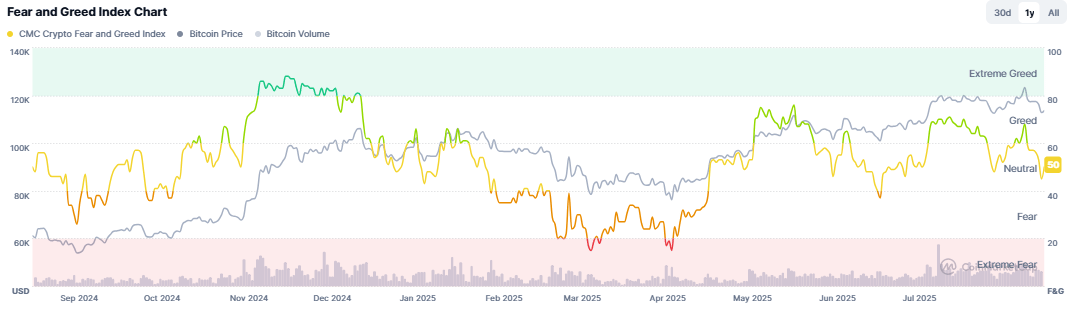

Market Sentiment:

F&GI from CoinMarketCap.com on August 21st 2025

Market update: A rather bearish week despite a rebound today. Indeed, all markets are down and awaiting several macro developments: the potential resolution of the war in Ukraine, but more importantly, Jerome Powell's speech at Jackson Hole tomorrow, which may or may not announce a new rate cut in September (long awaited). August is also generally conducive to calm or corrections.

Thus, BTC is at nearly $114K versus its ATH last week at $124K, and ETH is still holding its ground above $4K. Despite this, institutional investments and corporate treasury launches continue to multiply. September promises significant gains, I think—we'll see.

Main points this week:

International Update:

1) Asian and European stock markets on the rise: USA/China truce has an effect

A breath of relief. The economic truce between China and the United States has been extended, leading to an upswing in the stock markets last week. Asian markets closed higher overnight, following the extension of the truce between the U.S. and China. Japan’s flagship stock index, the Nikkei, ended its day up by 2.15%, also supported by significant gains in the Tech sector. On the Chinese side, the Shanghai Stock Exchange closed up by 0.50%, while the Hong Kong Stock Exchange posted a 0.25% increase. However, it’s worth noting that the Kospi, South Korea’s main stock index, closed down 0.53%. The truce between the U.S. and China was originally set to end on August 12 but has now been extended by 90 days. This is a good sign: negotiations are currently underway between the two economic powers, which have been engaged in an intense trade war in recent months.

2) Switzerland: More than 100 Spar stores now accept crypto

Retail chain Spar is rolling out cryptocurrency payments in its Swiss stores. Thanks to Binance Pay and fintech company DFX, customers can now pay for their groceries using Bitcoin, stablecoins, and around a hundred other cryptocurrencies. This national first illustrates the growing use of crypto in retail commerce.

3) The first yen-backed stablecoin coming soon to Japan

The stablecoin market is experiencing unprecedented adoption, to the point of reshaping the still uncertain field of central bank digital currencies (CBDCs). A first issuer of such a stablecoin will soon be authorized in Japan. According to media outlet Nikkei, the launch is expected as early as this fall. The goal appears to be to carve out a place for Japan’s national currency within a market “dominated by dollar-backed stablecoins, which exceed $250 billion (around 37 trillion yen).” At the same time, “Japan also aims to promote its use, notably as a means of international transfer.”

4) The state of Wyoming officially launches its stablecoin on several major blockchains

After announcing the project last spring, the state of Wyoming has unveiled its stablecoin, FRNT, deployed on several public blockchains. Named Frontier Stable Token, it is a stablecoin backed by Treasury bonds, with a slight over-collateralization of 2%. What’s notable is that FRNT is deployed on the mainnets of public blockchains, specifically: Ethereum (ETH), Solana (SOL), Arbitrum (ARB), Avalanche (AVAX), Base, Optimism (OP), and Polygon (POL). This decision is significant, as past government or financial giant blockchain experiments typically occurred on private networks. We may be witnessing a genuine paradigm shift.

5) China accelerates creation of yuan-backed stablecoins

The stablecoin sector is currently booming, driven by accelerated adoption from traditional finance and leading banking actors. While the U.S. dollar clearly dominates the field, China seems determined to speed up its entry into the market. This marks a major strategic shift from China’s historical aversion to cryptocurrencies—but necessity seems to prevail. According to Reuters, details of China’s plan on the matter should be released in the coming weeks, following consultations currently underway by regulatory bodies.

6) BtcTurk, Turkey's largest cryptocurrency exchange, suspended all crypto deposits and withdrawals. Cybersecurity firm Cyvers detected millions worth of digital assets moving suspiciously across multiple networks. BtcTurk claims the suspension was due to "unusual activity" detected during routine hot wallet inspections.

7) The U.S. Federal Reserve has ended its “Novel Activities Supervision Program,” a crypto-focused oversight effort launched in August 2023 to monitor banks experimenting with digital assets and fintech. In a statement Friday, the Fed said it had gained sufficient understanding of these activities and will fold oversight back into its standard supervisory framework. The move reflects a broader regulatory shift under the Trump administration. U.S. agencies including the FDIC and SEC have eased prior restrictions, with the FDIC now allowing banks to engage in crypto without pre-notification, and the SEC working on “Project Crypto” to modernize digital asset rules.

Compliance / Regulation / Justice / Cybersecurity:

1) Memecoin launcher Odin.fun hit by $7 million hack

Memecoin launcher Odin.fun has just lost several million dollars in BTC due to a hack. A member of the Odin community reported that 58.2 BTC were drained from the platform, amounting to $7 million at the time of the incident. According to the analyst, hackers added liquidity to the protocol to artificially inflate the price of several tokens (notably SATOSHI). They then removed their share from the pool and sold tokens to realize profits in BTC. The operation was carried out within a few hours.

2) Google Play bans crypto wallets, then reverses course: self-custody still under threat

Google Play Store briefly attempted to enforce strict regulatory requirements on crypto wallets, including non-custodial ones. The measure, announced on August 13, 2025, risked excluding many apps before the company reversed the decision under community pressure and criticism. The policy initially required crypto wallet developers to obtain a regulatory license to publish their apps. It affected 15 jurisdictions, including the U.S. and the EU, without distinguishing between custodial and non-custodial wallets. Under pressure, Google eventually backtracked and clarified that the policy would not apply to non-custodial wallets, ending the immediate threat of their exclusion.

3) BIS wants to blacklist all cryptos passing through wallets without KYC

The Bank for International Settlements (BIS) is positioning itself as an active opponent of cryptocurrency development. Its latest proposal: to blacklist all cryptos passing through wallets without KYC (Know Your Customer). According to BIS economists, a main issue with crypto is the inability to control flows and identify users. BIS is advocating for widespread KYC adoption, calling for "a culture of due diligence among crypto market participants." The main targets are non-custodial wallets that do not require KYC. In practice, BIS proposes assigning "an Anti-Money Laundering (AML) compliance score based on the likelihood that a crypto unit or balance is linked to illicit activity." If the result is insufficient, the funds will be placed on a “rejection list.”

4) SEC chairman wants to protect crypto market from “regulatory overreach”

Since Paul Atkins took over as head of the U.S. SEC, a new era has begun for the crypto sector—especially as he promises to protect the market from “regulatory overreach.” This opening has been described by analysts at wealth management firm Bernstein as “the boldest and most transformative crypto vision ever presented by an SEC chairman,” with the potential to “rewrite Wall Street’s rules.” After Gary Gensler’s strict anti-crypto policy, Atkins' shift is a complete 180.

5) Terraform Labs co-founder Do Kwon pleaded guilty to wire fraud and conspiracy charges tied to TerraUSD's 2022 crash, which erased $40B+ in investor funds. The 33-year-old waived trial rights and faces up to 25 years in prison. Kwon was arrested in Montenegro (2023) for using fake documents and extradited to the U.S. after warrants from both U.S. and South Korean authorities. Earlier civil rulings found him liable for fraud in SEC cases. His guilty plea marks a pivotal moment in one of crypto’s most catastrophic failures.

6) A sophisticated scam using AI-generated YouTube tutorials has drained over $1 million from victims lured by fake MEV trading bots. Attackers used aged YouTube accounts with manipulated comments to promote malicious smart contracts disguised as arbitrage tools. Victims deploying these contracts unknowingly routed ETH to hidden attacker wallets via obfuscated code (XOR scrambling, hex conversions). The scheme highlights growing risks of AI-assisted crypto fraud, combining social engineering with technical deception. SentinelLABS warns users to verify smart contracts and avoid unvetted "investment" tutorials.

7) Donald Trump’s crypto adviser, Bo Hines, has stepped down after just a few months, with his deputy, Patrick Witt, taking over as the industry’s key liaison in Washington. Both Hines and Witt are former Yale football stars who pursued law degrees and ran unsuccessful congressional campaigns before aligning with Trump. Witt, who briefly played as an NFL free-agent quarterback for the Saints, will now lead crypto policy efforts, including pushing for federal regulations and a national crypto stockpile. His social media now lists the role previously held by Hines, signaling continuity in Trump’s pro-crypto agenda.

8) The New York State Department of Financial Services (NYDFS) fined Paxos Trust Company $26.5 million for AML deficiencies, citing failures in customer due diligence, transaction monitoring, and investigations. NYDFS found Paxos improperly relied on Binance’s unverified compliance claims and failed to detect high-risk activity like cross-chain transactions. The enforcement action mandates $22 million in compliance upgrades through 2027, requiring enhanced onboarding checks, real-time monitoring, and blockchain analytics tools. This case establishes NYDFS’s expectation that crypto firms must independently verify partners, implement dynamic risk detection, and maintain rigorous investigation protocols. The penalty signals regulators’ growing intolerance for weak AML controls in digital assets.

9) The U.S. Securities and Exchange Commission has pushed back decisions on several crypto ETF proposals, including five spot XRP ETFs (Grayscale, 21Shares, Bitwise, CoinShares, and Canary), CoinShares’ proposed spot Litecoin ETF, and Grayscale’s spot Dogecoin ETF. It also delayed a proposal from 21Shares that would allow staking within its spot Ethereum ETF. Meanwhile, the SEC postponed its decision on the Truth Social Bitcoin and Ethereum ETF to Oct. 8. The application, tied to Donald Trump’s media company, has drawn criticism due to the president’s growing personal and business ties to crypto. All delays are procedural — the SEC frequently takes the full review period. But with the agency recently approving in-kind creations and redemptions for crypto ETFs under the Trump administration, this wave of delays pushes key altcoin ETF decisions into Q4 just as industry momentum is building.

10) South Korea’s Financial Services Commission reportedly plans to submit a stablecoin regulation bill to lawmakers in October. The proposed bill is expected to outline rules for issuance, collateral management, and internal risk controls, forming part of the country’s broader digital asset legal framework. President Lee Jae Myung has backed efforts to build a robust local stablecoin market to bolster monetary sovereignty. South Korea’s four largest banks — KB Kookmin, Woori, Shinhan, and Hana — may reportedly meet with USDC stablecoin issuer Circle’s President Heath Tarbert next week during his visit. Meanwhile, Japan could reportedly approve its first yen-denominated stablecoin as early as this fall.

Traditional Finance:

1) PayPal stablecoin issuer applies to become a bank

Now Paxos: the stablecoin company has applied to become a banking institution. Several companies have made similar moves, including Ripple (which recently launched its own stablecoin) and Circle (issuer of USDC). Paxos is clearly aiming for a strong position in the heated stablecoin battle.

2) Solana (SOL) ETF – SEC delays decision to October

The SEC previously stated it needed more time to review the flood of crypto ETF applications it receives. It has once again delayed the decision date for several spot Solana ETFs.

3) U.S. banks demand changes to Trump’s GENIUS Act on stablecoins

The largest banking coalition in the U.S. is pressuring the Senate to revise the GENIUS Act, signed by Donald Trump in July 2025. Why? They argue that some loopholes in the law could undermine credit and financial stability. Key concern: the ban on stablecoin issuers paying interest, which they believe is too easily circumvented.

4) Bitcoin: U.S. bank SoFi becomes first to adopt the Lightning Network

Cryptocurrencies are deeply reshaping the boundaries of the traditional financial sector. American bank SoFi now offers clients access to Bitcoin’s Lightning Network. It partners with Lightspark, a company specializing in enterprise Bitcoin infrastructure. The system will use the open-source Universal Money Address (UMA), which works similarly to an email address for money transfers.

5) Crypto asset manager Grayscale registered Cardano Trust ETF and Hedera Trust ETF entities in Delaware on Tuesday. The SEC has already acknowledged NYSE Arca's 19b-4 filing for Grayscale's spot Cardano ETF and Nasdaq's similar filing for Grayscale's Hedera ETF, with past Delaware registrations often preceding official S-1 filings with the agency. Also on Tuesday, Grayscale launched two investment trusts offering exposure to the native tokens of DeepBook and Walrus, both of which provide trading and data infrastructure within the Sui blockchain ecosystem.

6) Standard Chartered raised its Ethereum year-end price target from $4,000 to $7,500 and its 2028 target from $7,500 to $25,000. The bank's analysts said the backdrop for the world's second-largest cryptocurrency had "improved dramatically" thanks to aggressive buying by corporate treasuries, strong ETF inflows, new U.S. stablecoin rules, and renewed technical roadmap momentum. Ethereum treasury firms and spot ETFs have bought roughly 3.8% of the circulating ether supply since early June, nearly double the comparable pace from a Bitcoin perspective. Policy support from the GENIUS Act and stablecoin growth on Ethereum bolster fee revenue and DeFi activity, strengthening ETH's investment case alongside the network's Layer 1 and Layer 2 expansion plans, the analysts said.

7) Canary Capital just registered a Trump Coin ETF in Delaware, targeting the Official Trump token sitting at a $1.9 billion market cap. This isn't some random crypto project anymore - we're talking about the fifth-largest memecoin potentially getting its own regulated investment product. The memecoin sector is worth over $82 billion right now. These tokens are becoming impossible for Wall Street to ignore.

8) Canary Capital's CEO Steven McClurg thinks Bitcoin could reach $150,000 before 2025 ends, but he's warning that a bear market might follow in 2026. Bitcoin just hit a new all-time high of $124,128, and institutional money keeps pouring in through ETFs. Despite ETH being the biggest gainer among major cryptos lately, he thinks it won't even reach new all-time highs and expects the current surge to "wane."

9) Bernstein analysts reiterated that the current crypto bull market could stretch into 2027 — beyond the traditional four-year cycle — driven by U.S. policy momentum, institutional support, and broader participation beyond bitcoin. In a new note, the firm raised or maintained its price targets on Coinbase ($510), Robinhood ($160), and Circle ($230), citing surging trading volumes, product expansion, and infrastructure positioning. “We expect a long crypto bull market, continuing the surge into 2026 and potentially peaking in 2027,” the analysts wrote. They forecast that bitcoin could reach $150K–$200K within the next year but emphasized the coming cycle will broaden to include Ethereum, Solana, and DeFi tokens — fueling inflows into trading platforms and stablecoin issuers.

Tech News:

1) Stripe secretly building Tempo, a blockchain focused on payments and stablecoins

Stripe is preparing to launch Tempo, a Layer 1 blockchain designed for fast stablecoin payments. The confidential project was uncovered in a job posting. This fintech giant appears to want to control the full payment technology stack. Tempo’s infrastructure is being built in partnership with crypto fund Paradigm, whose co-founder Matt Huang sits on Stripe’s board. The project remains under wraps, with only five people currently working on it.

2) Circle to launch a dedicated blockchain for USDC

During its quarterly results presentation, Circle announced it is building a Layer 1 blockchain called Arc, dedicated to its USDC stablecoin. Arc will be EVM-compatible and designed to provide a professional-grade base for stablecoin payments, forex operations, and financial market apps. It uses USDC as native gas and includes an integrated stablecoin exchange engine, sub-second settlement finality, and on-demand privacy controls.

3) Coinbase supports DeFi with new USDC fund

On Tuesday, Coinbase launched a new USDC fund aimed at boosting liquidity across the DeFi ecosystem. “Our goal is to ensure greater stablecoin liquidity throughout the onchain ecosystem, giving users access to reliable rates on both mature and emerging protocols.” First deployments will target Aave, Morpho, Kamino, and Jupiter to strengthen their stablecoin liquidity.

4) Jack Dorsey’s Block unveils scalable, modular Bitcoin mining rigs

Block, the company founded by Jack Dorsey, now offers sustainable mining rigs thanks to their modular and upgradable components. The new “Proto Rig” model is designed to last 10 years (vs. 3–5 years for current machines). Interchangeable parts, such as hashboards, allow upgrades and repairs without replacing the entire unit. This could save miners 15–20% on infrastructure upgrades. However, Block enters a saturated market dominated by Bitmain and MicroBT, who collectively supply most of Bitcoin’s network. Miners already embedded in that hardware ecosystem may be reluctant to switch.

5) MetaMask to integrate Tron (TRX) blockchain

Continuing to expand beyond the Ethereum ecosystem, MetaMask will soon support the Tron (TRX) network. Solana (SOL) was recently integrated, and Bitcoin (BTC) support is expected in Q3.

6) Babylon’s $5 billion Bitcoin staking protocol advanced its DeFi capabilities by introducing trustless vaults, enabling BTC holders to deposit tokens without relying on centralized entities. These vaults, secured by smart contracts, allow Bitcoin to serve as collateral for DeFi applications like lending, stablecoin issuance, and staking. Users can stake BTC to support proof-of-stake networks and earn rewards in Babylon’s native token, BABY. This innovation is part of a larger effort to unlock Bitcoin’s value for decentralized finance across multiple blockchains, enhancing its utility beyond just a store of value.

7) Sentient, a New York AI firm, launched The GRID, an open-source network for developing and monetizing AGI systems, offering a decentralized alternative to closed platforms like OpenAI. Developers can integrate AI agents, models, or tools to earn token rewards, with optional monetization via usage fees or subscriptions. The network already features 40+ AI agents, 50+ data sources, and 10+ models, including Web2 tools like Napkin (generative graphics) and Exa (search), as well as Web3 agents on chains like Base, Polygon, and Arbitrum. Users interact via Sentient Chat, an interface for discovering and combining AI agents to automate tasks like scheduling, coding, and data analysis. This initiative aims to foster collaborative, decentralized AI development.

8) Deribit, now owned by Coinbase, will launch USDC-settled linear bitcoin and ether options on Aug. 19 — a move aimed at expanding stablecoin-settled derivatives to the two largest crypto assets. The rollout also includes BTC and ETH dated futures settled in USDC. The new contracts follow growing institutional and retail demand for fiat-equivalent settlement and come 18 months after Deribit introduced similar altcoin options. Unlike inverse options, linear contracts pay out proportionally in USDC and are designed to improve capital efficiency. Deribit, the largest crypto options exchange, posted its best-ever trading volume in July and was acquired by Coinbase in a $2.9 billion deal finalized this week.

Adoption (Sentiment, Retail, Corporate Reserves):

1) Ethereum enters top 25 global market caps, surpassing Netflix and Mastercard

Ethereum (ETH) has just hit a new milestone: it now ranks 22nd among the world’s largest market capitalizations, ahead of Netflix and Mastercard. This further cements Ethereum’s global presence and draws the attention of major investors.

2) Nearly 8% of Ethereum is now held by ETFs and corporate treasuries

Institutional holdings of Ethereum are growing fast. Nearly 8% of ETH’s total supply is now held by ETF managers and corporate treasuries—a sharp rise from April. Key holders include Bitmine Immersion Tech (1.2M ETH), The Ether Machine (600K ETH), and SharpLink Gaming (345.4K ETH). Among ETFs, BlackRock leads with $13.1B in assets under management via its iShares Ethereum Trust, followed by Fidelity’s Ethereum Fund at $3B—for a combined total of $31.9B.

3) Ethereum (ETH), Solana (SOL), Ripple (XRP)… Altcoin season to start in September, says Coinbase

So far, Bitcoin (BTC) has been the only crypto to surpass its all-time high, but altcoins may be next, according to a recent Coinbase Institutional report. BTC dominance has dropped from 65% in May to 59% in August—signaling capital is shifting to altcoins. CoinMarketCap’s “Altcoin Season” index has also climbed. Macro-wise, the report highlights the potential impact of the Federal Reserve’s expected rate cut in September, which historically drives investors back to riskier assets like crypto.

4) This Ethereum Treasury Company to pay ETH dividends to shareholders

Ethereum Treasury Company BTCS is launching a new model by paying dividends in ETH to its shareholders. Eligibility depends on how shares are held—traditional brokers disqualify holders from receiving the $0.35 per share “loyalty payment,” according to the FAQ.

5) BNB Treasury Company delisted from Nasdaq for rule violation

Windtree Therapeutics, a pharmaceutical company that recently pivoted to becoming a BNB Treasury Company, has been delisted from Nasdaq. One key rule requires a minimum share price of $1. Despite a brief rebound last month, WINT stock fell below that threshold on May 1 and now trades at just $0.11, with a market cap of only $13.83 million.

6) MicroStrategy has purchased 155 BTC for $18M, bringing its total holdings to 628,946 BTC—nearly 3% of Bitcoin’s supply—further solidifying its lead among 151 public companies with BTC treasuries. The latest buy was funded through preferred stock sales (STRF & STRC), continuing its aggressive accumulation strategy. With $46.1B spent and $30B in unrealized gains, Executive Chair Michael Saylor teased more purchases, tweeting: "If you don’t stop buying Bitcoin, you won’t stop making money." However, the pace has slowed as the firm shifts from common stock to preferred stock financing, adhering to its mNAV ratio limit of 2.5x (currently 1.5x).

7) BitMine has surpassed 1.15 million ETH, positioning it as the largest corporate Ethereum treasury firm globally, with its holdings accounting for almost 1% of the ether supply, worth nearly $4.9 billion. The company added 317,000 ETH, worth approximately $1.3 billion, in just one week, continuing its aggressive accumulation strategy this summer and becoming the first to exceed the 1 million ETH mark. BitMine has positioned itself as an Ethereum-denominated treasury and staking company at a time when institutional adoption is maturing amid regulatory developments. BitMine chairman Tom Lee, also co-founder of Fundstrat, suggested recently that Ethereum could be entering a "2017 Bitcoin moment," and could reach $30,000 or more if those trends compound.

8) Ethereum’s daily transactions are approaching their January 2024 peak of 1.9 million, fueled by higher network capacity, lower fees, and bullish market sentiment. Seven-day averages have already surpassed previous records, with stablecoin transfers and DeFi activity leading the surge. A 50% gas limit increase since March has boosted throughput, cutting costs for DeFi and P2P transactions below $1. Fidelity Digital Assets notes DeFi now dominates ETH burns, highlighting its key role in sustaining this growth. The uptrend reflects Ethereum’s scaling progress amid rising institutional and retail interest.

9) Retail traders went "ultra bearish" when Bitcoin dipped below $113,000. According to Santiment, this marks the most negative social media sentiment since June. Retail traders "did a complete 180" after Bitcoin failed to bounce back and dropped to a 17-day low of $112,600. The total crypto market cap fell below $4 trillion for the first time in two weeks.

Funding and Partnerships:

1) Bitcoin mining at EDF? MARA to invest in Exaion

By the end of the year, Bitcoin mining giant MARA Holding is expected to acquire 64% of EDF subsidiary Exaion. Exaion is registered as a digital asset service provider (PSAN) and offers cloud services—especially known for running validator nodes on PoS blockchains like Tezos (XTZ) and Chiliz (CHZ). “Our partnership with Exaion will bring together two global leaders in data center and digital energy development. As data protection and energy efficiency become top priorities, the combined expertise of MARA and Exaion would allow us to offer secure and scalable cloud solutions designed for the AI-driven future.”

2) Crypto exchange Bullish aims for $1 billion+ IPO

Institutional crypto exchange Bullish is targeting a larger-than-expected IPO, launching with $1.1B in backing from major industry players. Investors include billionaire Peter Thiel and firms like BlackRock and ARK Invest—who together contributed $200M. Founded in 2021 by Block.One (creator of EOS), Bullish is tailored for professional investors and aims to become the “Goldman Sachs of crypto.”

3) AI startup Perplexity plans $34 billion offer to buy Chrome

Perplexity, currently valued at $18B, has submitted a letter of intent to Google with a $34B bid to acquire Chrome, according to the Wall Street Journal. The startup, which offers a search engine and LLM-style assistant, hopes to boost its position in the saturated AI market with this move. Major investment funds are reportedly backing the deal.

4) Crypto exchange Gemini details upcoming IPO

Late last week, Gemini publicly filed with the SEC for its upcoming IPO. The company plans to list on Nasdaq under the symbol “GEMI.” Notable underwriters include Goldman Sachs, Citigroup, Morgan Stanley, and Cantor Fitzgerald. The offering price has not yet been disclosed. The filing also reveals a credit agreement with Ripple to borrow up to $75M in RLUSD stablecoin, potentially expandable to $150M in $5M increments.

5) Google to acquire 8% of Bitcoin miner after $1.8 billion deal

Last week, Bitcoin miner TeraWulf announced a major agreement in which Google will acquire approximately 8% of the company. TeraWulf signed “two 10-year high-performance computing (HPC) colocation agreements” with AI cloud platform Fluidstack.

6) RD Technologies, a Hong Kong-based fintech firm specializing in stablecoin infrastructure, raised $40 million in a Series A2 round. The round was jointly led by a consortium of existing and new investors, including ZA Global, China Harbour, Bright Venture, and Hivemind Capital. Bit2Me, a Spanish crypto exchange, raised $32.7 million (€30 million) in a round led by Tether, which also acquired a minority equity stake. The funding will support Bit2Me’s EU expansion. Stable, a new Layer 1 blockchain being built for stablecoins, raised $28 million in a seed round co-led by Bitfinex and Hack VC. Other investors included Franklin Templeton, eGirl Capital, Mirana, Castle Island Ventures, Nascent, and Blue Pool Capital.

7) VivoPower's stock jumped 32% after announcing a $100 million plan to buy private Ripple Labs shares. They claim this gets them XRP exposure at $0.47 per token - an 86% discount to current market prices. They've lined up BitGo for custody and Nasdaq Private Market for transactions, pending Ripple's approval.

8) Rumble announced its intent to acquire Northern Data in a deal worth €1 billion ($1.17 billion), excluding the high-performance computing specialist's bitcoin mining division. The all-stock transaction would grant Northern Data shareholders about 33.3% ownership of Rumble, receiving 2.319 Class A shares for each Northern Data share. Tether, a majority shareholder of Northern Data, supports the acquisition and would become Rumble's largest Class A stockholder, building on its $775 million strategic investment in the popular YouTube alternative in December. The potential deal aims to position Rumble as a leader in AI cloud services, with its stock up over 10% on Monday following the news.

9) 180 Life Sciences, which is rebranding to ETHZilla, saw its share price surge over 90% on Tuesday after Peter Thiel-controlled entities announced they had acquired a 7.5% stake in the company. The firm also disclosed holding 82,186 ETH, bought at an average price of $3,806.71, and valued at approximately $349 million. ETHZilla closed a $425 million private placement earlier this month, with over 60 participants, including prominent crypto investors and founders, and holds $238 million in USD cash equivalents. The company aims to build a differentiated Ethereum treasury vehicle, with plans to generate cash flow through onchain yield strategies.

10) Coinbase completed its $2.9 billion cash-and-stock acquisition of Deribit, expanding its product offering across futures, perpetuals, and options. The deal positions Coinbase as the global leader in crypto derivatives, integrating $59 billion in open interest and over $1 trillion in annual trading volume. The transaction included $700 million in cash and 11 million shares of Coinbase Class A common stock. Notably, Deribit's founders, John Jansen and Marius Jansen, are exiting the company following the acquisition.

11) Galaxy Digital has secured $1.4 billion in debt financing to retrofit its Helios bitcoin mining facility into a high-performance AI datacenter for cloud computing company CoreWeave. The two firms have signed a 15-year lease under which Galaxy will provide up to 800 MW of computing power. The deal marks a major expansion of Galaxy’s business model beyond crypto and into AI infrastructure. CoreWeave, which began as a crypto miner, is now one of the largest providers of GPU cloud services. Galaxy expects to generate over $1 billion in average annual revenue from the agreement.

12) Web3 learning platform, Hack Quest, raises $4.1M in a pre-A funding round led by Open Campus and Animoca Brands, with support from Stepn, Gate Ventures, Hashkey, Outlier Ventures, and more. Payment infrastructure firm, Transak, raises $16M in a strategic round led by Tether and IDG Capital, with participation from Primal Capital, 1kx, Umami Capital and more. Cross-border payment infrastructure, Honeycoin, raises $4.9M in a funding round led by Flourish Ventures, with support from Visa, LAVA, Antler and more. Web3 gaming project, Shrapnel, raises $19.5M in two funding rounds, with the most recent round led by Gala Games, with other investors including Griffin Gaming Partners and Polychain Capital. Lens introduces Lens Token Distributor, distributing GHO to eligible users directly to their Lens accounts based on their activity and contribution. HyperEVM liquidity layer, Mizu Labs, kicks off Mizu Points, allowing users to check their accrued points so far.

12) Valantis, a modular DEX protocol, has acquired StakedHYPE, the second-largest liquid staking platform on Hyperliquid’s HyperEVM chain, as it doubles down on LST-focused infrastructure. The deal gives Valantis control of StakedHYPE’s development and scaling, with Thunderhead’s (the entity behind StakedHYPE) founder, Addison Spiegel, joining as an advisor. StakedHYPE currently holds over $200 million in TVL, and Valantis plans to integrate it deeply across its stack. Valantis says this vertical integration will deepen liquidity and efficiency in LST trading. While Valantis is VC-backed, Thunderhead has been profitable and bootstrapped since launch. The full deal has closed, but financial terms remain undisclosed.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.