Top cryptos

Extract from CoinMarketCap.com on October 2nd 2025

Meme of the week

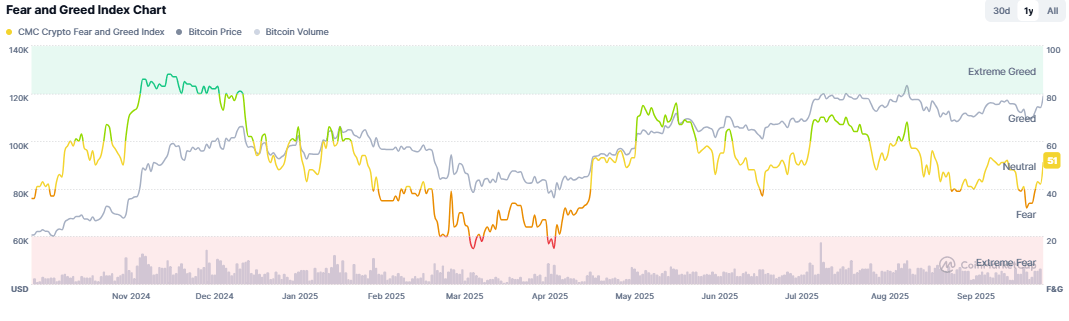

Market Sentiment:

F&G I from CoinMarketCap.com on October 2nd 2025

Market update: The crypto market gained $160 billion in market capitalization, with Bitcoin reaching $119,000. This momentum is driven by growing institutional adoption: BlackRock increased its exposure to BTC by 38.4% in its Global Allocation Fund, and Morgan Stanley plans to open crypto trading on E*Trade next year. Tether also strengthened its reserves by purchasing 8,888 BTC for $1 billion, bringing its total to over 86,000 BTC. The SEC approved Grayscale's first multi-crypto fund, providing access to assets like BTC, ETH, XRP, SOL, and ADA.

Strong rebound amid a US government shutdown (which currently benefits Gold and the crypto market) and a typically bullish October ("Uptober"); many ETFs are expected this month, along with solid consolidation by year-end.

Main points this week:

International Highlights:

Ethiopia Plans to Suspend Bitcoin Mining Activity by 2030 – Despite its high value in monetizing the power grid, Bitcoin mining continues to have a poor reputation. This situation could close its doors in Ethiopia by 2030, even though it has actively supported the development of its national energy infrastructure. This mining activity reportedly brought in nearly $300 million in one year, accounting for close to 40% of the revenue of Ethiopian Electric Power, the Ethiopian equivalent of EDF. A windfall for this country lacking foreign currency, following the war that ravaged the Tigray region between 2020 and 2022. The problem? The increase in national energy production is outpacing the construction of the necessary power lines to deliver it to the Ethiopian population. Indeed, only 25% of the territory is connected to the power grid, representing only 54% of the population.

Kazakhstan Announces Launch of National Stablecoin "Evo" with Solana and Mastercard – The accelerated development of the stablecoin sector is currently at the forefront of the crypto scene. The Central Bank of Kazakhstan has now joined this reality, announcing the launch of the Evo stablecoin pegged to its national currency. "Today, we are launching the first Kazakh stablecoin denominated in our national currency (tenge) within the Central Bank's regulatory sandbox. The modern world is experiencing an era of digital transformation, which presents challenges, but above all, a large number of opportunities. Crypto-assets and blockchain technology occupy a prominent place in this."

State of Ohio Now Accepts Cryptocurrency Payments – In the United States, the Secretary of Ohio announced that "state fees and services" can now be paid with cryptocurrencies. While it is not precisely specified which types of fees can be paid this way, we can assume this includes various administrative services chargeable to a citizen, or all registration fees related to businesses, for example.

A Euro Stablecoin Soon? 9 European Banks Cooperate to Counter US Stablecoin Dominance – Nine major European banks, led by ING and UniCredit, announced on Thursday the creation of a consortium to launch the first MiCA-regulated euro stablecoin. The goal: to compete with American giants in a $295 billion market and to strengthen European financial autonomy. Since September 2025, nine major banks (ING (Netherlands), UniCredit and Banca Sella (Italy), KBC (Belgium), Danske Bank (Denmark), DekaBank (Germany), SEB (Sweden), CaixaBank (Spain) and Raiffeisen Bank International (Austria)) have embarked on creating an entity in the Netherlands tasked with launching a euro-pegged stablecoin. It will be governed by the MiCA regulation. According to a statement released today, the stablecoin aims for deployment in the second half of 2026.

MARA Close to Acquiring Majority of Exaion, EDF's Gem - Éric Ciotti Alerts – The American Bitcoin mining giant MARA Holdings is close to acquiring 64% of Exaion, an EDF subsidiary specializing in high-performance computing and blockchain services. This transaction, announced at $168 million, remains subject to Treasury approval and antitrust authorization; but it already rekindles the debate on French digital sovereignty. Recall, Exaion is a subsidiary of EDF created in 2020 via EDF Pulse Ventures, specializing in high-performance computing and blockchain services (validation, staking...), valorizing surplus electricity to power datacenters and cryptocurrency mining, while being registered as a digital asset service provider (DASP).

Kazakhstan Partners with Binance and Creates its Crypto Fund in BNB – After formalizing the project for a crypto reserve last June, Kazakhstan unveiled a sovereign fund in BNB. "We are proud that Binance Kazakhstan has become the strategic partner of the Alem crypto fund. The choice of BNB as the first digital asset testifies to the trust placed in the Binance ecosystem and opens a new chapter for the institutional recognition of cryptocurrencies in Kazakhstan. This is a significant step towards building a transparent and secure digital asset market, where government initiatives and global technologies work together for the benefit of the national economy."

United States Enters "Shutdown" – The risk was looming, it is now here: the US administration has entered a "shutdown." Republicans and Democrats failed to reach an agreement, leading to this forced pause. Public services are therefore partially halted, salaries suspended for civil servants, and economic activity is expected to slow sharply. The budgetary paralysis will last until the standoff between Republicans and Democrats in Congress is over. In a context of high political tension, it is possible that this could last for some time. Especially since Donald Trump seems to want to use this shutdown to continue firing thousands of federal employees, as he hinted again yesterday.

Buying Real Estate with Crypto in France? It Will Soon Be a Reality – On Tuesday, September 30, 2025, Banque Delubac presented its Delukey service, which allows settling a real estate transaction directly in cryptocurrencies, without prior conversion to euros, while maintaining the notarial framework of a classic sale. A first test operation is being finalized, with a mixed payment in crypto and euros. This possibility to pay for a property in cryptocurrencies will change many things. For a crypto-holding buyer, it will allow them to mobilize a crypto asset portfolio without selling it. Later, if the implementing decree allows it, it might even be possible to finance the operation via a Lombard loan. For the seller, this new solution gives them a choice on how to receive the funds: euros, crypto, or a mix of both. But it also requires accepting new mechanisms (escrow wallet, anti-volatility clauses).

Compliance/Regulation/Legal/Cyber:

SEC and CFTC Held a Joint Roundtable on September 29 to discuss their priorities regarding regulatory harmonization. This initiative is part of a bill seeking to coordinate their mandates to better oversee the DeFi, DePin sectors and airdrops. This bill also accompanies significant developments regarding spot crypto ETFs on altcoins.

FTX to Make a $1.6 Billion Repayment to Its Creditors on September 30. This operation is part of a reorganization plan validated in October 2024, following an initial payment of $1.2 billion in February and the announcement of a total repayment of $5 billion for May. These significant flows continue to raise questions about their potential effects on the cryptocurrency market.

SEC Chairman Wants to "Eradicate" Crypto Conflicts of Interest in the US - Really? Questioned during a conference about his management of conflicts of interest in the crypto sector, the SEC chairman said he was ready to eradicate them. A statement that inevitably provokes a reaction, given the numerous crypto activities of President Donald Trump. It seems important to recall that the American media The New Yorker published a comprehensive report just one month ago on Donald Trump's enrichment in the crypto sector. An opportunity to mention the fact that his status as president "is not subject to any of the regulations that prevent subordinate officials from conducting private business on the side."

Patrick Witt, the executive director of the White House Council of Advisors on Digital Assets, said he expects a sweeping crypto market structure bill to pass before the end of 2025. The final bill may combine several proposals, including the House-passed Clarity Act and the Senate-drafted Responsible Financial Innovation Act, to create a full digital asset framework. Witt said the administration is working with both chambers to get the legislation onto President Trump's desk and set clear CFTC and SEC jurisdiction as soon as possible. Witt added that the U.S. is "open for business" and is moving full speed to bring crypto companies back onshore after years of regulatory flight.

SEC Chair Paul Atkins said in an interview with Fox Business that he aims to have an "innovation exemption" in place by year's end to fast-track bringing onchain products and services to market. Atkins has pushed the initiative since June as part of his broader "Project Crypto" effort to modernize securities rules for digital assets and is now accelerating the plans. He added that the SEC is coordinating closely with the CFTC. Both regulators are set to host a roundtable next week on novel crypto products amid unconfirmed rumors of a merger between the agencies. Atkins also voiced support for Congress' pending crypto market structure bill, which he expects to complement the SEC's regulatory push.

The FTX Recovery Trust sued Genesis Digital Assets, calling Sam Bankman-Fried's investment from sister firm Alameda in the bitcoin miner one of his most reckless uses of commingled funds. The lawsuit alleges Bankman-Fried pushed through the deal despite political unrest, energy caps, and new taxes that crippled bitcoin mining in Kazakhstan, where Genesis Digital is based. The trust said Genesis Digital provided no audited financials and its unaudited statements "bore no relation to reality." Ultimately, Bankman-Fried invested $1.15 billion in Genesis Digital, with $550 million to its co-founders Rashit Makhat and Marco Krohn, the trust added, asking the court to get that money back.

The Commodity Futures Trading Commission unveiled a new initiative to let derivatives traders post tokenized assets like stablecoins as collateral, Acting Chair Caroline Pham announced Tuesday. The move follows the agency's earlier pilot program with Circle, Coinbase, Crypto.com, Moonpay, and Ripple to test non-cash collateral in derivatives markets. Officials said tokenized collateral could boost efficiency and transparency while aligning with the GENIUS Act's new stablecoin framework, inviting public comments on the plan by Oct. 20.

Australia’s ASIC has introduced class action relief for distributors of stablecoins issued by AFS-licensed providers, exempting them from needing their own license if they supply the stablecoin’s product disclosure statement. The move follows Macropod becoming the first issuer to receive an AFS license for its AUD-pegged AUDM stablecoin. ASIC aims to support innovation while ensuring consumer protection, having clarified in 2024 that stablecoins are financial products requiring licensing. Updated INFO 225 guidance finalizing these rules is expected soon.

Major Korean financial institutions are advancing stablecoin projects, with Woori Bank and custodian BDACS completing a proof-of-concept for KRW1, a won-pegged stablecoin on Avalanche. Separately, Shinhan Bank, Nonghyup, and Kbank have finished technical verification for Project PAX, a Korea-Japan cross-border stablecoin remittance initiative. Market infrastructure provider KOSCOM has also filed five stablecoin trademarks, citing their emergence as a new payment method. These developments come as Korea’s FSC prepares to release draft stablecoin legislation next month, following two parliamentary proposals.

The Royal Canadian Mounted Police has executed Canada’s largest crypto seizure, dismantling the offshore exchange TradeOgre and confiscating over $56 million in digital assets. The platform operated without registration, KYC, or AML controls, attracting substantial illicit flows including Monero and Bitcoin. Investigation began with a Europol tip, with RCMP using blockchain intelligence to trace criminal proceeds across multiple wallets. The seizure signals that compliance is non-negotiable for exchanges and that even privacy-focused platforms leave forensic trails. The case highlights the growing effectiveness of international cooperation in combating crypto crime.

U.S. regulators are advancing measures to clarify crypto oversight while encouraging innovation, with SEC Chairman Paul Atkins targeting an "innovation exemption" by year-end to provide clearer rules for crypto firms. Simultaneously, CFTC Acting Chair Caroline Pham is exploring the use of stablecoins as collateral in derivatives markets, calling it a potential "killer app." These efforts, aligned with the GENIUS Act, reflect a shift toward balancing stricter oversight with support for crypto integration into financial systems. Public input periods this fall will be crucial in shaping the final frameworks.

The SEC and FINRA are investigating unusual stock trading activity before digital asset treasury firms announced plans to purchase cryptocurrencies, the WSJ reported, citing sources familiar with the matter. Regulators flagged sharp price jumps and high trading volumes ahead of the announcements as potential red flags. SEC officials reportedly cautioned some companies about possible Regulation Fair Disclosure violations tied to selective information sharing. The probes come as crypto treasury strategies surge, with more than 200 DATs running the Michael Saylor-inspired playbook and raising over $20 billion so far this year.

Poland's parliament approved one of the strictest crypto regulations in the EU, and the industry is furious. Every crypto business operating in Poland - exchanges, custody providers, all of them - will need a license from the financial regulator. Companies have six months to comply or shut down. The penalties? Up to $2.8 million in fines and two years in prison.

Traditional Finance:

Société Générale to Launch Its USDCV Stablecoin on the Bullish Platform – Société Générale bank has chosen the Bullish Europe exchange platform to offer its stablecoin, USDCV. The link between Bullish and Société Générale was already established last August. The American company indeed went public and received the proceeds of its IPO in stablecoins. Among these were USDCV and EURCV, the two stablecoins from SG Forge. This Tuesday, however, the two companies announced a partnership. Bullish Europe will indeed be the first platform where USD CoinVertible (USDCV) will be listed. Recall, this stablecoin was created relatively recently: it arrived on Ethereum and Solana last June.

Ripple: BlackRock and VanEck's Tokenized Funds Become Compatible with RLUSD Stablecoin – Ripple and Securitize have formalized a partnership, enabling connections between the RLUSD stablecoin and BlackRock and VanEck's tokenized funds. "The partnership with Ripple to integrate RLUSD into our tokenization infrastructure constitutes a major advance in automating liquidity for tokenized assets. Together, we offer real-time settlement and programmable liquidity for a new category of compliant, on-chain investment products, thus harnessing the full potential of blockchain for institutional finance."

Wall Street on the Verge of Being Flooded with Crypto ETFs – Despite ongoing regulatory advances in the US, the highly anticipated approval of spot crypto ETFs by the SEC is currently at a standstill. A situation that could change quickly, with the announced release of about a hundred funds in the coming months. Until now, the SEC's approval procedure for crypto ETFs involved a 240-day regulatory obstacle course. A deadline that has just been shortened to 75 days total, for any exchange-traded fund that meets certain very specific basic criteria, such as having a futures contract on a regulated US exchange.

Morgan Stanley to Allow Crypto Trading of BTC, ETH, and SOL via Its E*Trade Platform – Ongoing regulatory advances in the US seem to be unleashing the potential of cryptocurrencies in traditional finance. The latest example: banking giant Morgan Stanley plans to open crypto trading on its E*Trade platform early next year. In practice, this trading service will open in the first half of next year via the E*Trade platform, an American online brokerage firm founded in 1982 that Morgan Stanley integrated into its subsidiaries following an acquisition in 2020. An option developed in partnership with crypto infrastructure provider Zerohash, now valued at $1 billion following a recent $140 million funding round in which Morgan Stanley participated. Its Managing Director, Edward Woodford, sees this as a necessary step. Alongside this development, Morgan Stanley also plans to offer a new asset allocation strategy that incorporates consideration of cryptocurrencies, with percentages to be set according to client objectives. The goal is to offer them a comprehensive portfolio solution.

BlackRock Files for Creation of a Bitcoin Premium Income ETF in the State of Delaware. This new product aims to generate income through selling Bitcoin options while maintaining exposure to the asset.

Vanguard is considering allowing its brokerage clients to access third-party crypto ETFs, potentially reversing its longstanding ban on digital asset products due to their perceived volatility. The $10 trillion asset manager faces growing client demand and shifting regulatory attitudes under the Trump administration and new SEC leadership. While Vanguard still has no plans to launch its own crypto ETF, the move would open its 50 million U.S. investors to popular bitcoin and ether funds. Analyst Eric Balchunas called the potential shift a smart response to market trends and investor interest.

Swift to Use a Consensys Blockchain for Its Global Payments Network – This Monday, Swift revealed it is working with Consensys to integrate blockchain into its global cross-border payments network. Available 24/7, this network is intended to facilitate "the reliable and scalable flow of tokenized value" interoperably between different networks using smart contracts. "We provide powerful and efficient rails today and are evolving rapidly with our community to build the infrastructure of the future. Through this initial distributed ledger concept, we are paving the way for financial institutions to propel the payment experience to the next level, thanks to Swift's proven and reliable platform, at the heart of the sector's digital transformation."

BlackRock Increases Its Bitcoin Exposure by 38% in One of Its Main Funds – Asset management giant BlackRock announces it has increased its exposure to Bitcoin by 38.4% within the Global Allocation Fund, its fund managing $17.1 billion in assets. The fund therefore currently holds a line of $66.4 million in its Bitcoin ETF, slowly bringing BlackRock closer to its official recommendation to allocate 1 to 2% of portfolios to Bitcoin.

Cloudflare CEO Matthew Prince announced plans for the internet infrastructure firm to launch its own NET Dollar stablecoin, fully collateralized by the U.S. dollar. No exact date of launch was given, but the company said the stablecoin will be available soon. Cloudflare positioned NET Dollar as a tool for automated, machine-to-machine payments across networks and ecosystems globally amid the rise of AI agents. The move comes as stablecoin competition intensifies, with Bank of America, JPMorgan, Société Générale, and MetaMask also developing their own tokens in addition to Tether, Circle, and PayPal's existing offerings, among others. Citi analysts' base case forecast for stablecoin issuance by 2030 is now $1.9 trillion, or $4 trillion in a bull case scenario, up from around $282 billion today.

Tech News:

Plasma Blockchain to Launch a Neobank Dedicated to Stablecoins – The stablecoin sector is currently undergoing a significant transformation, linked to new US regulatory advances. A redistribution of the landscape that is prompting the Plasma blockchain to announce the upcoming launch of a neobank specialized in the field. In practice, this neobank will officially come into existence following the launch of the Plasma blockchain's mainnet beta, deployment of which is scheduled for next September 25. The goal? To offer a physical or virtual payment card rechargeable with USDT stablecoins, and gradually others.

Layer 1 blockchain Kaia and LINE NEXT, the web3 arm of messaging giant LINE, plan to launch Project Unify later this year, a stablecoin superapp to integrate payments, remittances, and on/off-ramps in one interface. The app will support stablecoins tied to major currencies, including the U.S. dollar, Japanese yen, Thai baht, Korean won, Indonesian rupiah, Philippine peso, and Singapore dollar, with features like deposits, rewards, and message-based transfers. Unify will ship with an SDK for issuers and developers, aiming to consolidate Asia's fragmented payments infrastructure and drive cross-border stablecoin adoption.

World Liberty Financial will soon launch a debit card with Apple Pay integration for its USD1 stablecoin, alongside a new app combining Venmo-like payments and Robinhood-style trading. Co-founder Zak Folkman emphasized the project will remain chain-agnostic and never develop its own blockchain. Despite WLFI’s token falling 37% since its September debut, Folkman framed the venture as a long-term endeavor focused on product development and stablecoin adoption rather than short-term price moves, stating the team is building for “decades” of staying power.

Adoption (Sentiment, Retail & Corporate Reserves):

Tech Giants Sony and Samsung Enter the Stablecoin Sector – Sony and Samsung - but also a16z and Hashed - have apparently just taken part in a funding round organized by Coinbase Ventures. The goal? To support the development of the startup Bastion, specialized in developing regulated infrastructure for stablecoins. This funding round reportedly raised the sum of $14.6 million, allowing Bastion to surpass the $40 million mark obtained during its funding cycles. The last similar operation involved venture capital firm Andreessen Horowitz (a16z) in September 2023, with a total of $25 million. But Bastion also offers a service named Stablecoin-as-a-Service, allowing organizations of all sizes to "seamlessly integrate Web3 infrastructure into existing technologies through a white-label platform and API that include custody wallets, smart transaction routing, and data analytics."

The Stablecoin Wave Continues: Visa Joins the Battle – Visa's turn. The payments giant is starting a pilot project to use stablecoins for international payments. The payments service announces today the launch of a pilot platform to test international settlements in stablecoins. This relies on "Visa Direct," a service that allows sending money in real time directly to a bank card, account, or digital wallet, rather than via a classic bank transfer.

Stripe Aims to Enable Any Company to Launch Its Own Stablecoin – The number of new stablecoin projects continues to increase day by day, towards the end of the year. A trend that could, however, experience an even greater acceleration, with the launch of the Open Issuance platform by Stripe. According to Stripe's Head of Technology, Will Gaybrick, his company's goal is to "move cutting-edge technologies from the experimental stage to mass adoption." In this case, this more specifically concerns setting up a service capable of "allowing any company to launch and manage its own stablecoin with just a few lines of code." In practice, the Open Issuance platform aims to simplify the creation of stablecoins, to allow any company to launch its own native version. Particularly because relying on tokens issued by external providers would not allow them to "fully leverage all potential benefits."

This Nasdaq-Listed Company Wants to Create a $2 Billion SOL Solana Treasury Company – VisionSys, a Nasdaq-listed company, announced on Wednesday its intention to launch a Solana Treasuries Company with $2 billion worth of SOL. Initially specialized in AI technologies related to brain-computer interaction, VisionSys intends to set up a $2 billion reserve. Firstly, the company announces that it plans to acquire 500 million SOL over the next six months.

Japanese bitcoin treasury firm Metaplanet said Monday it had acquired another 5,419 BTC for $632.5 million at an average price of $116,724 — marking its largest purchase yet. The acquisition lifted Metaplanet's total holdings to 25,555 BTC, worth $2.9 billion, reclaiming its place as the fifth-largest public company bitcoin holder. Earlier this month, the firm announced a $1.4 billion share issuance earmarked for more BTC purchases and set up a U.S. subsidiary to expand its bitcoin income generation business. Meanwhile, Strategy bought another 850 BTC for $100 million, taking its total holdings to 639,835 BTC, and BitMine topped 2% of Ethereum's supply with over 2.4 million ETH on its balance sheet.

SharpLink Gaming just announced they're putting their Nasdaq-listed stock directly on the Ethereum blockchain. The company holds over 838,000 ETH worth $3.3 billion and partnered with Superstate to make this happen. SBET shareholders will soon hold their shares natively on Ethereum while staying fully compliant with regulations. The company claims to be the first publicly traded firm tokenizing shares on Ethereum.

Visa is piloting stablecoin funding for Visa Direct, letting businesses, including banks and remittance providers, send cross-border payments more efficiently. The pilot aims to slash settlement times from days to minutes, boosting liquidity and speeding up payouts. Circle's USDC and EURC are the first stablecoins being tested, with more assets potentially added as demand grows. Visa treats those stablecoins as "money in the bank" or available balances for payouts, enabling businesses to send money abroad without locking up large sums of cash days in advance. The firm said recipients can still be paid in local currency, even if businesses pre-fund in stablecoins.

Funding & Partnerships:

$10 Billion: The Ambitious Projects of Changpeng Zhao's Investment Fund – Changpeng Zhao plans to continue investing massively in the crypto sector, via his YZi Labs fund. While his name is little known to the general public at this stage, Yzi Labs is one of the world's largest investors in the crypto sector. To the point of considering opening up to external investors. The director of Yzi Labs, Ella Zhang, indeed stated this week that she is considering transforming the fund into an open fund. That said, Ella Zhang believes the company currently lacks sufficient expertise in biotech and AI. She also wants to ensure regulatory solidity – the arrival of US investors indeed generally leads to increased scrutiny.

Giant Tether Seeks to Raise a Record $20 Billion – Stablecoin market leader Tether is reportedly in talks to raise a record $20 billion. The goal? To maximize its existing strategies while accelerating the development of its new projects. "Tether is considering a fundraise from a selected group of leading investors, to maximize the scale of the company's strategy across all its existing and new business lines (stablecoins, ubiquitous distribution, AI, commodity trading, energy, communications, media) on a scale multiplied by several orders of magnitude."

This Bitcoin (BTC) Miner Backed by Google Plans to Raise $3 Billion – TeraWulf, a Bitcoin (BTC) miner backed by web giant Google, is preparing to raise $3 billion. On Thursday, Patrick Fleury, CFO of TeraWulf, revealed to Bloomberg that the company is now preparing to raise about $3 billion, still with the aim of building data centers with Google's support. This time, Google is providing an additional $1.4 billion in financial support, raising its stake in TeraWulf to 14%. Here, the organization of this fundraising has been entrusted to Morgan Stanley, and it could take the form of "high-yield bonds or leveraged loans."

Kraken Reportedly Raising $500 Million for IPO – As Kraken could go public, the cryptocurrency exchange reportedly conducted a discreet $500 million funding round. The subject of a Kraken Initial Public Offering (IPO) is not new; in June 2024, Bloomberg reported a project for a $100 million fundraise ahead of a stock market entry, while last March it was revealed that this IPO was planned for 2026. Now, Fortune reveals that according to a source close to the matter, Kraken ultimately closed a $500 million funding round this month, ahead of a listing valued at $15 billion.

Bit Digital, Whose Treasury is in Ethereum, Plans to Raise $100 Million via a Convertible Bond Issue, continuing a trend where crypto players use this mechanism for their financing. Similar examples include The Blockchain Group (€63.3 million in BTC) or projects at Riot Platforms and Coinbase, in an environment influenced by the evolution of the DeFi ecosystem around Ethereum.

Tether Signs Partnership with Conservative Platform Rumble to Promote Its New Stablecoin – Tether wishes to conquer the United States with its new USAT stablecoin. The company is betting on a partnership with the video platform Rumble, a historic base for American conservatives, including President Donald Trump. Created in 2013, it is an unmoderated platform hosting many accounts linked to the American far-right, as well as some Russian media banned particularly in Europe. American conservatives, including Donald Trump, have made it an alternative to YouTube, which moderates political content and fake news more strictly.

Avalanche Treasury Co. Announced a $675 Million Merger with Mountain Lake Acquisition Corp to form a treasury containing over one billion dollars in AVAX, including $460 million in cash. This initiative is part of an ambitious fundraising and financial structuring strategy, while ETF applications for AVAX have been filed with the SEC.

Strive, the DAT co-founded by Vivek Ramaswamy, has agreed to acquire Semler Scientific in an all-stock deal that will create a combined bitcoin treasury of more than 10,900 BTC — worth $1.2 billion. The merger values Semler at a 210% implied premium based on Friday's closing price, with each share converting into 21.05 Strive Class A shares. Strive also disclosed on Monday that it had bought another 5,816 BTC for $675 million at an average price of $116,047 per bitcoin, bringing its total holdings to 5,886 BTC ahead of the tie-up. Semler currently holds 5,021 BTC, according to Bitcoin Treasuries data. Post-close, Strive's management and board will remain, while Semler's executive chairman, Eric Semler, is expected to join the new combined board.

Bitcoin miner-turned-AI hosting provider Cipher has signed a 10-year, $3 billion AI hosting deal with Fluidstack, providing 168 MW of IT load capacity from its Barber Lake facility in Texas. Google will backstop $1.4 billion of Fluidstack's lease obligations as part of the deal in exchange for warrants equal to a 5.4% equity stake in Cipher. The agreement includes two further optional five-year renewals that could lift the total value to about $7 billion. Cipher also proposed an $800 million private offering of zero-coupon convertible senior notes on Thursday to help fund its data center expansion plans.

South Korean internet giant Naver plans a share swap through its financial arm to make Dunamu, the parent company of Upbit, a 100% subsidiary, according to local reports. The move would integrate the country's largest crypto exchange into Naver Financial's broader financial services ecosystem. Unlike a traditional merger, both entities will remain legally intact after the transaction. The move comes as South Korea pushes to formalize a won-pegged stablecoin framework and broader digital asset regulation by year-end.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.