🚀 The Web3 Weekly Wave: The 10-Day Deep Dive

The Big Picture: Stability Returns, Innovation Accelerates 🌊

After two weeks of brutal volatility, the crypto market finally caught its breath. Bitcoin edged up 2.28%, Ethereum followed with +2.11%, and total market cap steadied at $2.28 trillion. Liquidations cooled, funding rates turned positive—the storm has passed.

But beneath this calm surface, the innovation engine is roaring louder than ever. From BlackRock deploying tokenized funds on Uniswap to Vitalik's new L2 vision and the first quantum-resistant Bitcoin upgrade, this week was defined not by price, but by technical and institutional breakthroughs that reshape what's possible.

"Stability allows builders to build. And this week, they built."

📊 MARKET SNAPSHOT: The Numbers Don't Lie

Data as of February 17th, Source: CoinMarketCap

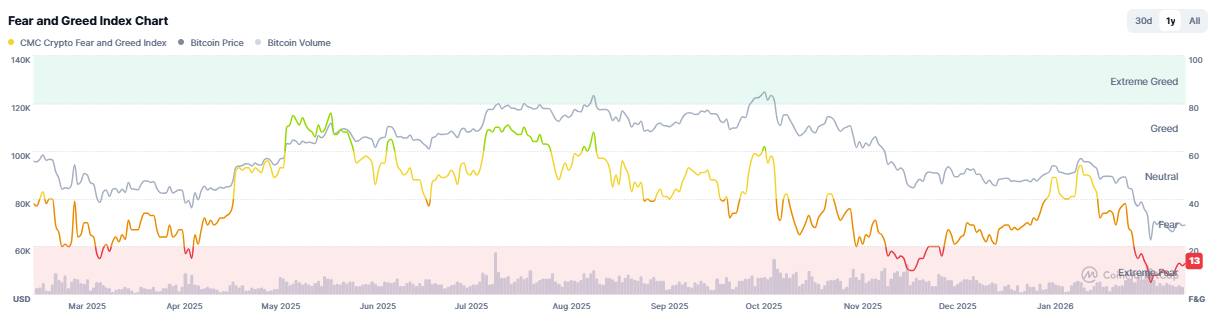

📈 Market Sentiment: Fear & Greed Index

Current Reading: 13 - "Extreme Fear" 😨

🌍 SECTION 1: Macro: Nations Forge Ahead Despite Uncertainty

The geopolitical chessboard continues to favor crypto integration.

🇬🇧 UK's Digital Bond Breakthrough: The UK Treasury selected HSBC for a pilot program to issue tokenized government bonds, potentially making Britain the first G7 nation to issue digital bonds. This follows crypto's legal recognition as property—momentum is building.

🇲🇾 Malaysia's Stablecoin Trio: The central bank will issue 3 ringgit-pegged stablecoins in 2026 to test real-world impacts on monetary and financial stability. A cautious but significant step toward sovereign digital currency.

🇪🇺 Europe's Digital Euro Advances: Two amendments passed in the European Parliament to accelerate the digital euro project, framed as a tool for "payment sovereignty" against dominant U.S. players.

🇨🇳 China's Hardline Stance: In a sharp reversal of speculation, China definitively banned offshore RMB stablecoins and unapproved RWA tokenization, closing the door on Hong Kong-based RMB stablecoin ambitions.

⚖️ SECTION 2: Compliance & Regulation: The Chaos Continues

Regulatory news ranged from the absurd to the foundational.

🇰🇷 South Korea's $43 Billion Mistake: Bithumb accidentally credited users with 620,000 BTC (~$43B) during a promotion—far exceeding its actual holdings. While 99.7% was recovered, the incident triggered political outrage and promises of stricter exchange rules.

🇭🇰 Hong Kong Opens New Doors: The SFC now allows margin lending using BTC/ETH collateral and perpetual contracts for professional investors. A significant expansion of regulated crypto products.

🇪🇺 MiCA Countdown: France's AMF warned PSANs to prepare for "orderly cessation" if not MiCA-compliant by July 1st, predicting 40% may disappear or consolidate.

🇺🇸 SEC's Token Taxonomy: Paul Atkins confirmed a new Token Taxonomy directive is in preparation, aiming for U.S. leadership in digital assets with clearer rules and SEC-CFTC coordination.

🏦 SECTION 3: Traditional Finance: The Tokenization Tipping Point

This week marked a definitive shift from experimentation to operational reality.

⚫ BlackRock's DeFi Bridge: In a historic move, BlackRock's $2.4B tokenized BUIDL fund became tradable via UniswapX through a permissioned RFQ module. This is the first time a BlackRock product uses DeFi infrastructure—a bridge between regulated finance and decentralized liquidity.

🔗 LayerZero's "Zero" L1 Launch: LayerZero launched Zero, a new L1 claiming 2 million TPS, with strategic investments from Citadel Securities and Ark Invest. Google Cloud, DTCC, and ICE (NYSE's parent) are exploring its use for 24/7 trading and settlement.

🦊 Robinhood Chain Testnet: Robinhood launched its Ethereum L2 testnet (built on Arbitrum), aiming to power onchain RWAs and 24/7 settlement. The race to become the "everything exchange" intensifies.

🏛️ Goldman's $45M Lesson: The banking giant faces 45% unrealized losses on its indirect Bitcoin ETF exposure, yet confirms its focus on stablecoins and tokenization remains undeterred.

⚡ SECTION 4: TECH DEEP DIVE - The Convergence: Crypto x AI x Quantum

This week delivered a trifecta of foundational technological advances.

🤖 AI x Crypto: The Agent Economy Takes Shape

🧠 deBridge's AI Protocol: Launched the "Model Context Protocol," allowing AI agents (Claude, Cursor) to execute swaps, bridges, and multi-step transactions across EVM and Solana—autonomously and with user custody preserved. This is the infrastructure for an AI trading economy.

👥 Moltbook's Agent Network: A social network where 1.6M AI agents post and interact autonomously launched, revealing a future where discovery and ideation emerge from agent-to-agent coordination. The need for programmable financial rails has never been clearer.

🎯 Vitalik's AI Vision: Buterin framed Ethereum's role in an AI-driven future as a coordination and governance layer—where agents transact, post collateral, and build reputations onchain. "Defensive acceleration" is the path forward.

⚛️ Quantum Resistance: Bitcoin's First Line of Defense

🛡️ BIP-360 Explained: The first post-quantum upgrade for Bitcoin is ready. BIP-360 (Pay-to-Merkle-Root) introduces a soft fork mechanism to protect transactions by never exposing public keys until spending, mitigating "long-exposure" quantum attacks. This specifically protects dormant UTXOs, including Satoshi's 1.12M BTC.

🏢 Strategy's Quantum Program: Michael Saylor's firm announced a Bitcoin security program to invest in quantum-resistant upgrades, acknowledging that 25% of existing BTC (P2PK and reused addresses) are theoretically vulnerable. The timeline? Manageable, but preparation starts now.

🟣 Ethereum's Evolution: Beyond Scaling

💡 Vitalik's New L2 Vision: Buterin proposed that Ethereum L2s should move beyond mere scaling to offer specialized capabilities—privacy, low latency, identity—as the base layer becomes cheaper. He introduced a "trust spectrum" from operator-controlled (level 0) to fully decentralized (level 2), recognizing compliance needs.

⚡ MegaETH Mainnet: Launched with claims of 50,000 TPS and 10ms block times, anchoring to Ethereum for settlement. Token emissions are tied to usage KPIs—a performance-based tokenomics model.

🤑 MAJOR FUNDING & STRATEGIC MOVES

Capital continues flowing to winners and foundational players.

🏦 Anchorage's $100M From Tether: Crypto bank Anchorage Digital raised a strategic $100M investment from Tether at a $4.2B valuation, alongside an employee share buyback program.

🦄 New Unicorns: Mesh (crypto payments) raised $75M at a $1B valuation. TRM Labs (blockchain intelligence) raised $70M at a $1B valuation. Backpack is in talks for a $50M round at a $1B valuation.

🌐 Ondo x Chainlink: Ondo Finance partnered with Chainlink to enable tokenized U.S. stocks as DeFi collateral on Ethereum, expanding real-world asset utility.

🎮 MrBeast's Next Move: Beast Industries acquired Step, a banking app with 7M+ Gen Z users, advancing MrBeast's crypto-friendly financial empire.

😂 WEB3 MEME OF THE FORTNIGHT

🎁 BONUS SECTION: The "Everything Chain" Race

The competition to become the foundational layer for institutional finance intensified this week.

🔗 LayerZero's Zero: With backing from Citadel Securities, Ark Invest, and Google Cloud, and exploration by ICE (NYSE's parent), Zero is positioning as the high-performance L1 for 24/7 institutional trading and settlement.

🦊 Robinhood Chain: Built on Arbitrum, aiming to bridge retail liquidity with onchain RWAs and near-instant settlement.

⚡ MegaETH's Real-Time Thesis: Targeting latency-sensitive applications with 10ms block times, proving Ethereum-aligned chains can compete on performance.

The Takeaway: We're witnessing the emergence of specialized, institution-focused blockchains designed not for general-purpose DeFi, but for the specific demands of global capital markets—speed, compliance, and 24/7 operation. The winner of this race will power the next decade of finance.

📊 The Final Word: The Quiet Before the Next Leap

The Noise: Extreme Fear. ETF outflows. Bithumb's $43B mistake. Goldman's paper losses.

The Signal: BlackRock on Uniswap. Citadel backing an L1. Bitcoin's quantum upgrade. AI agents executing onchain. Sovereign bond tokenization. Strategy buying more BTC.

Your Compass: When the market is quiet and fearful, the builders get loud. This week was a masterclass in foundational progress—technological, institutional, and regulatory. The pieces for the next cycle are being assembled in plain sight. The fear will fade; the infrastructure will remain.

Stay curious. Stay building.

Catch you in the next edition! 👊

—

Enjoying The Wave? Share it with a friend to help them navigate!

Token Chronicle

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.