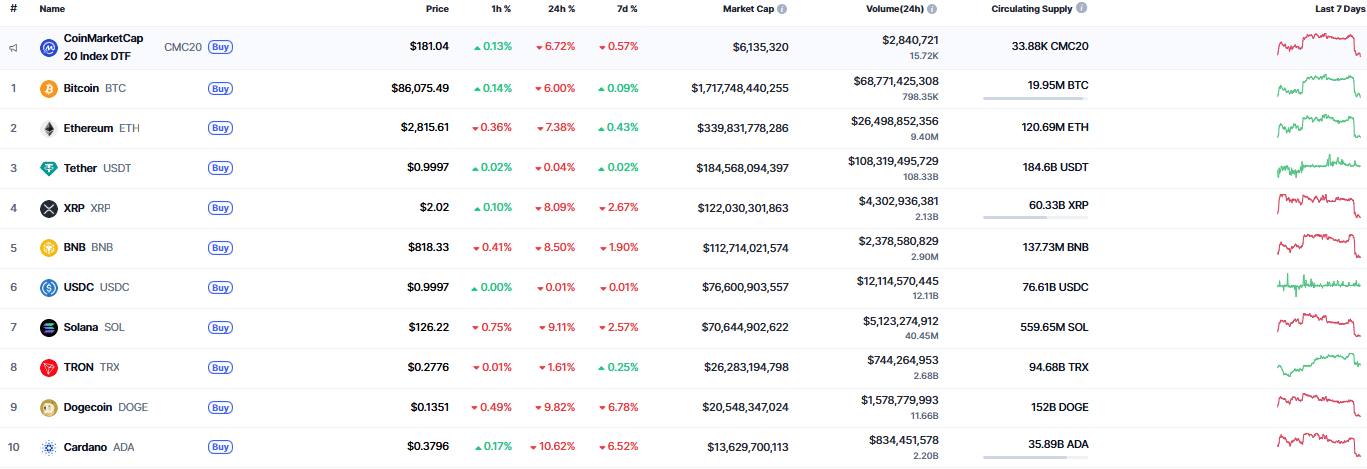

Top cryptos

Extract from CoinMarketCap.com on December 1st 2025

Meme of the week

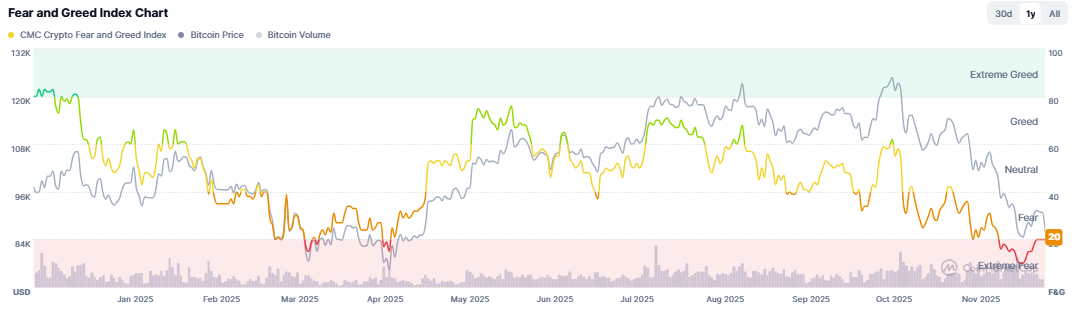

Market Sentiment:

F&GI from CoinMarketCap.com on December 1st 2025

Market update: Markets recovered slightly this week following the major drop from the previous week but are facing a new correction today. There's little to say other than that the climate of uncertainty continues, particularly regarding a potential rate cut in December and concerning AI and the valuation of technology stocks in general. Let's be patient and see how the market will evolve.

Main points this week:

International/Macro:

Elon Musk's DOGE department has just been dissolved 8 months before the end of its term: The establishment of the Department of Government Efficiency (DOGE) led by billionaire Elon Musk late last year promised to optimize US government spending. A year later, it has just been officially dissolved following an evident lack of activity and a mixed, at best, record.

Bitcoin mining quietly resumes in China despite the ban: Despite the ban imposed in 2021, Bitcoin mining is making a comeback in China, with its global market share reaching 14% by the end of October 2025. Indeed, whether individual miners or companies, many are exploiting cheap electricity in regions like Xinjiang.

The next US Federal Reserve Chairman could be crypto-friendly: While tensions between Donald Trump and the current Federal Reserve Chairman, Jerome Powell, are legendary, this may not be the case with the next one. The new Fed Chair could indeed be a Trump ally, open to cryptocurrencies. According to sources interviewed by Bloomberg, the search for a new Federal Reserve Chairman has settled on a top candidate: Kevin Hassett. Close to Donald Trump, he is already a White House economic advisor. However, Jerome Powell could leave his post in May 2026, as his term ends then. It is up to the country's president to nominate a successor, who must then be approved by the Senate.

Texas buys $5 million worth of BlackRock's Bitcoin ETF: While Texas plans to launch its strategic Bitcoin reserve, the state has invested $5 million in BlackRock's IBIT. According to a law passed earlier this year, this famous strategic reserve should amount to $10 million. If that is the case, it will then be a matter of seeing whether the recently acquired IBIT shares will be held or converted.

Trump launches "Mission Genesis": an AI research project to dominate China: US President Donald Trump signed an executive order on Monday, November 24, 2025, to launch Mission Genesis, a federal program aimed at accelerating scientific research through AI. A project compared to the Manhattan Project of World War II, with massive investments... and risks of unprecedented technological centralization. In detail, Mission Genesis relies on the creation of a unified platform that will leverage federal scientific data to train next-generation AI models. The Department of Energy is taking the lead on this program and will gather resources from national laboratories, American universities, and technology companies.

Tokenized money market funds pose a risk to global finance, according to BIS experts: The tokenization of real-world assets (RWA) is redrawing the boundaries of traditional finance, to the point of worrying members of the Bank for International Settlements (BIS). The reason: the development of tokenized money market funds capable of amplifying risks related to traditional finance.

$9 billion and stablecoins: Bolivia makes its crypto revolution to emerge from financial crisis: Bolivia has just announced multilateral loans worth several billion dollars to initiate an exit from its financial crisis. It also plans to rely on cryptocurrencies. The goal is to stabilize the economy and curb runaway inflation. This will also allow the country to fill its fiscal deficit and acquire foreign currency. Bolivia authorized the use of cryptocurrencies last year – they were previously prohibited. Since then, cryptocurrency transactions have exploded, in a context where dollars are hard to find. Bolivians are also turning to alternative assets to protect themselves from the high inflation affecting the country.

Fed: A risk of a "hawkish rate cut" for Bitcoin: The Federal Reserve meets on December 9 and 10 in a context where rate cut expectations play a central role in the recent volatility of cryptocurrencies and other markets. A gap between market expectations and the Fed's new projections could reignite selling pressure.

Compliance/Regulation/Justice/Cyber:

Upbit suffers a $30 million hack – Withdrawals suspended: The largest South Korean exchange platform Upbit has just suffered an attack leading to a loss of $30 million. Withdrawals are currently suspended. A hot wallet of the platform was targeted. A critical internal wallet flaw after a $30M hack this week, revealing that weak signatures allowed attackers to potentially derive private keys from onchain data. The exchange halted deposits/withdrawals, froze $1.5M in stolen assets, and moved remaining funds to cold storage while overhauling its wallet system. Upbit will cover all customer losses from reserves. South Korean authorities are investigating possible involvement by North Korea’s Lazarus Group in the breach.

S&P rating agency criticizes Tether over its management of USDT reserves: While the stablecoin sector leader Tether continues to break records, the S&P Global rating agency has just downgraded the rating of its flagship token, USDT. The reason: decreasing over-collateralization and reserves with management deemed opaque. "S&P Global Ratings has reassessed Tether's (USDT) ability to maintain its peg to the US dollar to 5 (weak), from 4 (constrained) previously. This downgrade reflects an increase, since our last analysis, in the proportion of riskier assets supporting USDT reserves."

Balancer will redistribute $8 million recovered from the $128 million stolen: Following a recent exploit in early November, the Balancer protocol attempted to recover part of the $128 million stolen. The time has now come to redistribute the meager loot of $8 million actually saved.

KuCoin obtains its MiCA license and can return to France: Having left France last summer, KuCoin will finally be able to return soon thanks to obtaining its MiCA license. A look back at this new regulatory step for the famous cryptocurrency exchange.

Ripple has received approval from the Monetary Authority of Singapore to operate under the "Major Payment Institution" status, allowing it to offer fully licensed payment services in the country.

Strike CEO Jack Mallers accused JPMorgan Chase of debanking after it closed his personal accounts citing unspecified “concerning activity” and refused to provide details. Mallers published the closure letter, alleging it reflects ongoing “Operation Chokepoint 2.0” efforts to restrict crypto access—despite Trump’s executive order penalizing such practices. JPMorgan previously closed Strike’s business account and has rejected user deposits, claiming the company engages in “fraudulent activities,” highlighting tensions between banks and crypto firms despite political assurances.

More than 300 victims of Hamas’ 2023 attack on Israel have sued Binance in North Dakota, alleging the exchange “knowingly facilitated” illicit transactions for the militant group through weak compliance and opaque entities. The suit claims these flows supported the October 7 attacks, though Binance maintains it adheres to sanctions and U.S. officials have minimized crypto’s role in Hamas financing. The case adds to Binance’s legal challenges following its $4.3B settlement and former CEO CZ’s conviction and pardon.

Terraform Labs founder Do Kwon asked a U.S. court to cap his prison sentence at five years ahead of his Dec. 11 sentencing for fraud tied to the $40 billion collapse of the Terra-Luna ecosystem. His attorneys argued the government's 12-year recommendation overlooks mitigating factors, including Kwon's cooperation and the role of third-party actors in exploiting Terra's vulnerabilities. The filing cites Kwon's undisclosed deal with Jump Trading and frames his actions as driven by hubris and desperation rather than personal enrichment. Kwon's lawyers also pointed to his nearly two years of detention in Montenegro and noted he still faces a separate 40-year sentence request from South Korean prosecutors.

The Basel Committee will fast-track a review of its global crypto capital standards after the U.S., U.K., and Singapore delayed or rejected implementation. The original framework—set for 2026—imposed strict requirements on most crypto assets, but BCBS Chair Erik Thedéen acknowledged “dramatic” market shifts and stablecoin growth necessitate changes. With major jurisdictions diverging, the revised rules could significantly impact how banks engage with digital assets, balancing prudential safety with evolving institutional participation.

Hong Kong’s SFC has warned that licensed virtual asset platforms are being used for money laundering layering, citing rapid deposits/withdrawals with minimal trading as key red flags. The regulator outlined nine behavioral indicators—including activity mismatching client profiles, sequential small transfers, and immediate fiat-to-crypto conversions—and urged firms to strengthen AML/CFT controls. This includes enhanced monitoring, wallet screening, and address whitelisting, emphasizing that effective compliance requires contextual vigilance beyond checklist-based assumptions.

Thai authorities recovered 432,000 USDT (over THB 14M) stolen via malware that compromised authenticator backups and seed phrases. The Cyber Crime Investigation Bureau collaborated with Binance, Bitkub, Tether, and TRM Labs to trace the hacker’s cross-chain movements, freeze suspect wallets, and secure the funds. This case—one of Thailand’s largest crypto recoveries—showcases how public-private coordination, blockchain analytics, and rapid response can effectively disrupt cybercrime and return stolen assets.

Traditional Finance:

Grayscale's DOGE and XRP ETFs debut on Wall Street today: will make their stock market debut on NYSE Arca. A look back at this novelty, which marks a new step in the integration of altcoins into traditional markets.

Venture capital firms invested $4.6 billion in Q3 — A record since 2022: The appeal of a sector can be measured in different ways, one of them being to measure the amount of funds invested by venture capital firms. And with its $4.6 billion, the third quarter of this year shows an unmatched record since the unprecedented successes of 2021/2022. During this third quarter, 7 deals alone captured half of the funds deployed by venture capital firms in crypto and blockchain-focused companies, including: Revolut ($1 billion), Kraken ($500 million), Erebor ($250 million), Trésor ($146 million), Fnality ($135 million), Mesh Connect ($130 million), and ZeroHash ($104 million).

JPMorgan offers to bet on Bitcoin's rise with this new investment product: To allow its clients to bet on the rise of Bitcoin (BTC) while partially protecting themselves from a decline, JPMorgan will launch a structured product built around BlackRock's spot Bitcoin ETF, IBIT.

Amundi's €5.57 billion fund lands on the Ethereum blockchain: On Thursday, Amundi unveiled a collaboration with CACEIS to tokenize one of its euro funds on the Ethereum blockchain. A look back at this first for the €2.3 trillion asset management giant. Named AMUNDI FUNDS CASH EUR - J28 EUR DLT (C), note that the fund has existed since June 24, 2011, but it now adopts a hybrid subscription mode, leaving the choice between a traditional investment or a tokenized one on the Ethereum (ETH) blockchain. Specifically, the first on-chain transaction took place last November 4th. "Asset tokenization is a transformation that should accelerate in the coming years worldwide. This first initiative on a money market fund demonstrates our expertise and the robustness of our methodology to cover concrete use cases. Amundi will pursue and expand its tokenization initiatives to benefit its clients in France and internationally."

Tokenized stocks: Nasdaq wants to move 'as fast as possible': Following the many tokenized stock solutions emerging, Nasdaq is advancing its own work. For a few months now, the subject of tokenized stocks has gained momentum, to the point that many cryptocurrency platforms have launched their solution. For its part, Nasdaq announced last March, through its President Tal Cohen, that it was working on a tokenized stock project that would open the door to 24/5 trading within the famous American exchange.

Franklin Templeton just launched XRPZ, their XRP exchange-traded fund, on NYSE Arca. The $1.5 trillion asset manager is the fourth major player to jump into XRP ETFs this month. Grayscale is waiving all management fees for three months or until they hit $1 billion. Franklin's waiving fees on the first $5 billion until May 2026.

Robinhood is launching a futures and derivatives exchange via a joint venture with Susquehanna, acquiring CFTC-licensed MIAXdx to power the platform. Susquehanna will provide initial liquidity, with MIAX retaining a 10% stake. The exchange—set for 2026—will expand Robinhood’s prediction markets, which have already seen 9B+ contracts traded by 1M+ users through its Kalshi partnership. Bernstein analysts note the move positions Robinhood to capture more of the growing prediction-markets revenue under regulated infrastructure.

Tech News:

Adoption of the ISO 20022 payment standard promises greater interoperability with DeFi: The interbank messaging system SWIFT announces the official implementation of the ISO 20022 standard as the new standard language for international payments. An option that will enable the transfer of tokenized value and unprecedented interoperability with decentralized finance (DeFi). "The rich, structured data of ISO 20022 is fundamental to the future of payments — and a cornerstone of Swift's strategy to enable an instant, frictionless, interoperable, and inclusive future. This migration will both strengthen risk management and control capabilities to better meet compliance requirements, and lay the foundation for the next generation of payments."

ATOM: Cosmos launches (yet another) complete tokenomics overhaul: Cosmos Labs announced on Wednesday, November 26, the launch of a complete overhaul of ATOM's tokenomics. They wish to abandon the current inflationary model for a system based on real revenue generated by the network. This overhaul is not the first for Cosmos. The ecosystem has multiplied economic adjustments since 2022, without ever truly finding its balance. In September 2022, the team published the White Paper 2.0 (ATOM 2.0) with a complete overhaul of tokenomics. In January 2023, V2 was launched. Then, less than a year later, in November 2023, a community vote halved the maximum inflation, bringing it down from 20% to 10%, which dropped the staking APR from 19% to 13.4%.

Adoption (Sentiment, Retail and Corporate Reserves):

French football fantasy startup Sorare refocuses its activity in Paris and reduces its workforce: Sorare announces a recentralization of its activities at its Paris headquarters, as well as a reduction in its workforce, despite beginnings presented as promising for its "Sorare 26" program initiated last September. Its New York office — still involving about ten members — will be permanently closed and its total workforce reduced by almost 30%, with the announced departure of about thirty of its current employees.

Coinbase Ventures has outlined its 2026 investment strategy, prioritizing perpetual futures for real-world assets, specialized trading platforms, and innovations in DeFi, AI, and robotics. The firm sees synthetic perps for macro themes like inflation and volatility as key opportunities, alongside composable derivatives, onchain credit, and prediction market terminals. It also forecasts a breakout year for AI-driven smart contracts and automated onchain businesses, highlighting crypto’s convergence with autonomous technology.

Swedish buy now, pay later provider Klarna is launching a KlarnaUSD stablecoin on the Paradigm and Stripe-backed Tempo blockchain to cut cross-border payment fees — marking a major reversal from CEO Sebastian Siemiatkowski's earlier crypto skepticism. The USD-backed token is live on Tempo's testnet and slated for a 2026 mainnet debut, using Stripe subsidiary Bridge's Open Issuance infrastructure. Klarna's move taps into booming global stablecoin usage, with annual volumes nearing $27 trillion and USD-pegged supply climbing toward $300 billion. "Crypto is finally at a stage where it is fast, low-cost, secure, and built for scale," Siemiatkowski said, noting that Klarna serves 114 million customers and processes $112 billion in gross merchandise volume annually.

Metaplanet drew another $130 million from its bitcoin-backed credit facility, bringing total borrowing to $230 million as it looks to ramp up BTC purchases, income strategies, and potential share buybacks. The firm said its 30,823 BTC reserve — valued near $2.7 billion — provides ample collateral headroom for loans taken under the $500 million credit line, even amid bitcoin's sharp price decline. Despite being the fourth-largest publicly traded bitcoin treasury company, Metaplanet's shares have plunged 81% since June, and its BTC stack now carries roughly $600 million in unrealized losses.

BitMine added 14,618 ETH to its treasury on Thursday, worth roughly $44 million, according to data from Arkham, though the firm has not formally confirmed the transaction. The move follows BitMine's recent $200 million buy and pushes its Ethereum holdings toward its goal of owning 5% of the total supply. As of its last official announcement, BitMine holds 3,629,701 ETH worth about $10.9 billion. In a recent interview, Chair Tom Lee reiterated his long-term bullish stance, predicting ETH could climb to between $7,000 and $9,000 by January after bottoming near $2,500. Lee also forecast a dovish Fed pivot that could lift broader crypto markets, adding that bitcoin could break above $100,000 again this year.

Funding and Partnerships:

Bitcoin miner CleanSpark announces record revenue linked to its AI strategy: Bitcoin miner CleanSpark reports very positive results for 2025, despite the current drop in BTC. A "transformative" year largely supported by its expansion into the artificial intelligence (AI) sector.

Monad launched its high-throughput, EVM-compatible blockchain on mainnet after completing a public token sale that raised about $269 million from more than 85,000 participants on Coinbase's new ICO platform. The project locked 50.7% of the total MON supply upon launch — including allocations for the team, investors, and treasury — with vesting set to ramp up quarterly from 2026 through 2029. Initial circulating supply includes roughly 38.5 billion MON tokens for ecosystem development, alongside a separate 3.3 billion MON community airdrop allocation, and 7.5 billion MON from the token sale.

Dunamu-operated Upbit is preparing to pursue a Nasdaq IPO after its planned merger with tech giant Naver, marking a potential landmark U.S. listing for South Korea's largest crypto exchange. The merger, executed through a stock-swap, would fold Upbit under Naver's corporate umbrella and streamline Dunamu's ownership structure. The IPO chatter lands as rival exchange Bithumb also explores a U.S. listing, highlighting rising public-market ambitions among South Korea's major trading platforms. Dunamu's recent strong financials — including 85% year-over-year profit growth — add momentum to Upbit's potential U.S. market debut.

Visa partnered with crypto infrastructure company Aquanow to expand stablecoin settlements across Central and Eastern Europe, the Middle East, and Africa. They're using USDC to cut costs and settlement times for banks and payment companies. Deutsche Börse announced plans to integrate a euro-pegged stablecoin this week too.

TON restaking protocol, Nexton, raises $4M in a strategic funding round led by Danal Pay, with other investors including TON Foundation, Amber Group, MetaLab Ventures, and more.

RWA protocol, Pruv Finance, raises $3M in a pre-A funding round, with investors including UOB Venture Management, Saison Capital, Taisu Ventures, Spiral Ventures, and Royal Group.

SpaceComputer raises $10M in a seed round led by Maven11 and Lattice, with support from Superscrypt, Amber Group, Arbitrum, HashKey, and more.

Leveraged yield exchange, RateX, raises $7M in a strategic round, with investors including GSR, Gate, Animoca Ventures, Crypto.com Capital and more. AI infrastructure blockchain, Talus, opens registration for their upcoming airdrop for early supporters. The airdrop claim date is yet to be announced.

Hyperliquid liquid staking protocol, Kinetiq, launches their governance token, KNTQ, airdropping tokens to eligible users via HyperCore.

Prediction markets platform Kalshi reportedly raised $1 billion at an $11 billion valuation, less than two months after announcing a $300 million round at $5 billion. The new raise is said to be led by returning investors Sequoia and CapitalG, with existing backers including Andreessen Horowitz, Paradigm, Anthos Capital, and Neo.

Crypto exchange Kraken announced raising $800 million across two rounds to accelerate its strategy of bringing traditional financial products onchain. The first $600 million tranche included institutional investors such as Jane Street, DRW Venture Capital, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital, alongside a major commitment from Arjun Sethi’s family office (Sethi is Kraken’s co-CEO). Kraken also secured a $200 million strategic investment from Citadel Securities at a $20 billion valuation.

Monad, an EVM-compatible Layer 1 blockchain developer, raised $187.5 million from its public token sale on Coinbase. After a strong first day, interest cooled but the sale ultimately finished oversubscribed, drawing $276.1 million in total commitments.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.