Top cryptos

Extract from CoinMarketCap.com on September 22nd 2025

Meme of the week

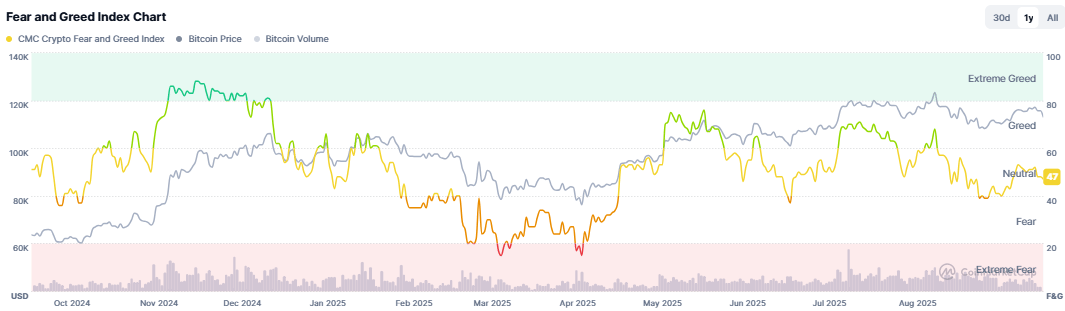

Market Sentiment:

F&GI from CoinMarketCap.com on September 22nd 2025

Market update: The market had gone up following Powell's rate cut announcement, but his more measured speech today brought everything back down, notably triggering a large wave of liquidations on long positions. As a result, we're now looking at BTC at $112K and retail interest at its lowest. It's only temporary and doesn't necessarily say anything about the coming weeks and months. We'll see.

Main points this week:

International update:

Thailand freezes millions of citizens' bank accounts: The Thai government has frozen millions of local bank accounts and imposed transfer restrictions. The central bank launched a massive campaign to combat the widespread scams in the country. The crackdown targets "mule" accounts—those used by scammers to launder money and access legitimate services. However, many regular citizens were caught in the crossfire and can no longer use their accounts. Additionally, all Thai citizens are reportedly facing new restrictions on large transfers, according to local reports.

Israel issues warning over $1.5 billion in USDT linked to Iran: Did Iran use Tether (USDT) to move funds to the Islamic Revolutionary Guard Corps? According to Israel, yes. The country issued a crypto seizure order as part of the ongoing digital currency conflict between the two nations. Israel’s NBCTF listed 187 USDT addresses it claims are Iranian and have cumulatively received $1.5 billion in USDT. Only about $1.5 million remains at present. Israel alleges the addresses are tied to the IRGC, already classified as a terrorist organization by several global powers. Tether has blacklisted 39 of the addresses. Blockchain analytics firm Elliptic confirmed the amounts but noted not all the addresses are definitively tied to the IRGC—some may belong to exchanges.

Bank of England wants to cap stablecoin holdings: The rapid rise of stablecoins is prompting global regulators to act. The Bank of England is proposing a cap on stablecoin holdings, despite opposition from domestic payment firms. According to the Financial Times, the BoE is concerned about the “financial stability risks stemming from large, rapid deposit outflows from the banking sector.” A similar fear exists in the US, where stablecoins are seen as financially disruptive. This stance contrasts with recent comments from Chancellor Rachel Reeves, who in July advocated for accelerating blockchain development, including tokenized assets and stablecoins.

UK and US to strengthen crypto cooperation: As the Trump administration redefines crypto regulation in the US, the UK has announced a plan for deeper cooperation with the US on crypto-related matters. This comes amid shifting global dynamics regarding digital assets.

Swiss banks test large-scale blockchain payment: UBS, PostFinance, and Sygnum Bank have conducted a legally binding interbank payment using the Ethereum blockchain. Coordinated by the Swiss Bankers Association, this proof-of-concept introduces “deposit tokens” representing Swiss francs on a public blockchain. Two test cases were explored: interbank settlement and automated exchanges of deposit tokens for tokenized assets. These tokens are digital representations of traditional bank deposits operating on a public chain, paving the way for further innovation in banking infrastructure.

US Fed cuts interest rate by 0.25 points to 4–4.25% range: The rate cut follows uncertainty from Jerome Powell and political pressure, particularly from Donald Trump. Governor Miran advocated for a steeper 0.50-point cut. Median forecasts still suggest 50 basis points of further cuts in 2025, with rising downside risks to employment. In the crypto sector, this dovish stance could impact stablecoins like USDC and Tether, which is better positioned due to its reserve diversification.

China orders tech giants to halt purchases of Nvidia’s RTX Pro 6000D chip: Citing antitrust violations, China’s SAMR has banned firms such as Alibaba, Tencent, and Huawei from buying the RTX Pro 6000D chip. This “downgraded” version of the H20 was designed by Nvidia under US restrictions for the Chinese market. Nvidia denied the accusations. This move aligns with China's broader push for technological sovereignty, with local players like Huawei and Cambricon seen as nearing parity with Nvidia’s restricted offerings.

Michigan bill HB 4087 advances, allowing crypto investments for state funds: The bill, now in second reading, permits up to 10% of state funds to be invested in cryptocurrencies. Michigan has already experimented with Bitcoin and Ethereum ETFs through its pension fund. The move comes despite heightened federal scrutiny under the PATRIOT Act and increased oversight from the CFTC.

Laos turns to Bitcoin mining to monetize excess hydropower: With mounting debt and surplus electricity, Laos aims to profit from its hydroelectric dams by expanding into crypto mining. On August 20, the Ministry of Technology and Communications reviewed the pilot project’s progress. In 2024, electricity accounted for 26% of Laos’s total exports. After building numerous dams on the Mekong and its tributaries, the country now has more power than it can sell.

Compliance/Regulation/Justice/Cyber:

Spot ETF boom for altcoins? SEC approves rules that could fast-track listings: The SEC has approved a rule change that may accelerate the approval of future spot crypto ETFs. Eligible cryptos must be listed on Coinbase and have existing futures contracts for at least six months. Bloomberg ETF analyst Eric Balchunas notes that 12–15 cryptos qualify under these conditions, including SOL, XRP, SHIBA, ADA, and DOT. This doesn’t guarantee approval, but the process will be faster when it happens.

$220 million trading volume spike on Polymarket after Fed announcement: The Fed’s rate cut decision sparked a surge in predictive market activity. Polymarket saw $220 million in volume as users rushed to place bets on political and economic outcomes, particularly around Trump and the Fed’s actions.

First multi-crypto fund with BTC, ETH, XRP, SOL, and ADA approved by SEC: Grayscale's Digital Large Cap Fund (GDLC) was approved on September 17, 2025, to be publicly listed. It’s the first fund to offer exposure to all five major cryptocurrencies, potentially redirecting investor attention toward altcoins.

MiCA: French AMF adopts ESMA guidelines to fight market abuse: France’s financial regulator AMF will immediately begin applying ESMA's recommendations to detect crypto market abuse. Key new measures include mandatory social media monitoring (Twitter, Telegram, etc.) and closer scrutiny of crypto service provider employees with access to sensitive listing information. The AMF also introduced a standardized form, STOR (Suspicious Transaction and Order Reports), to report unusual orders and trades, including asset details and blockchain identifiers.

Strategy co-founder Michael Saylor, MARA CEO Fred Thiel, and more than a dozen other crypto execs joined Sen. Cynthia Lummis and Rep. Nick Begich in Washington, D.C. to push for U.S. strategic bitcoin reserve legislation. The BITCOIN Act proposes acquiring one million BTC over five years with "budget neutral strategies," building on President Trump's executive order establishing permanent federal bitcoin holdings. The bill sits before House and Senate committees, though hearings are not currently scheduled, with backers now working to expand support beyond its current Republican base.

The SEC has approved new generic listing standards for crypto ETFs, accelerating the approval process from up to 240 days to as little as 75. Exchanges like Nasdaq and NYSE Arca can now list crypto ETFs without filing individual 19b-4 forms if the underlying asset has a futures contract trading for at least six months. Analysts predict over 100 crypto ETFs could launch in the next year, covering assets like Bitcoin, Ethereum, and altcoins including Solana and XRP. This move mirrors a similar stock ETF expansion that previously tripled launch rates.

Vietnam has approved a pilot program for regulated crypto asset issuance, trading, and services, allowing licensed platforms to operate under strict rules. Only foreign investors can participate in asset-backed crypto offerings (excluding stablecoins and security tokens), while trading is restricted to platforms approved by the Ministry of Finance. License requirements include local incorporation, $380M minimum capital, and majority local ownership. The move builds on Vietnam’s rapid regulatory advances, including June’s Digital Technology Industry Law, which formalizes crypto’s legal status from 2026, aligning with its top-five global adoption ranking.

South Korea’s Ministry of SMEs has lifted a six-year ban preventing crypto firms from obtaining venture certification, granting them access to government financing and support programs. The move aligns with President Lee Jae-myung’s push to foster digital asset innovation, including upcoming stablecoin legislation and crypto ETF plans. Simultaneously, regulators are tightening user protections: new guidelines restrict crypto lending to top-20 assets, ban leverage, and impose user-based limits. These steps reflect Korea’s balanced approach—promoting growth while ensuring accountability through industry self-regulation via DAXA before formal laws are enacted.

France’s AMF, Austria’s FMA, and Italy’s CONSOB are pushing for a tougher EU crypto oversight framework, citing uneven MiCA implementation and gaps in cross-border investor protection. They propose direct ESMA supervision of major CASPs, stricter cybersecurity audits, and centralized white paper reviews to prevent regulatory arbitrage. The regulators also want to restrict EU intermediaries from accessing non-MiCA-compliant platforms, ensuring a level playing field. These reforms aim to harmonize enforcement while balancing competitiveness with robust safeguards, aligning with global standards from the FSB and IOSCO.

The UK’s Financial Conduct Authority has released CP25/25, a consultation paper outlining how existing FCA Handbook rules will apply to crypto firms, including Senior Manager accountability, Consumer Duty, and operational resilience standards. The proposals aim to align crypto regulation with traditional finance rigor, closing gaps in disclosure, governance, and consumer protection. Firms must obtain authorization before conducting regulated crypto activities in the UK. Feedback is invited through mid-November, with the rules seeking to balance innovation with market integrity and consistent supervision.

The New York Department of Financial Services (DFS) has issued new guidance mandating blockchain analytics for banks and financial institutions dealing with digital assets. The framework requires tools like TRM Labs for screening customer wallets, monitoring VASP transactions, assessing third-party risk, and detecting sanctions evasion or money laundering. Controls must be tailored to each institution’s risk profile, with ongoing adaptation to emerging threats. DFS emphasizes that crypto compliance is no longer optional—financial firms must actively safeguard system integrity as adoption grows.

Tech news:

PayPal Links makes sending crypto as easy as texting: PayPal is working to simplify crypto transfers with its new “Links” service, aiming to make sending crypto as simple as sending a message. This feature will soon support assets like Bitcoin, Ethereum, and more, across PayPal, Venmo, and compatible global digital wallets. Notably, P2P transfers using PayPal Links will be exempt from 1099-K tax reporting in the US.

Google launches AI payment protocol supporting stablecoins: Google has introduced an open-source protocol enabling AI applications to process payments, including both card and stablecoin transactions. Built in collaboration with Coinbase and the Ethereum Foundation, the protocol is part of a vision where AI agents autonomously buy and sell services or resources. Example use cases include AI financial advisors negotiating loans or AI shoppers interacting with e-commerce platforms.

MetaMask officially launches its mUSD stablecoin: MetaMask has launched mUSD, a Treasury-backed stablecoin issued by Bridge (a Stripe subsidiary) and deployed on the M0 platform. It is now available on Ethereum and Linea, with respective supplies of $4.96 million and $19.37 million.

Ethereum update ‘Fusaka’ to launch December 3: Ethereum’s next major upgrade, Fusaka, is scheduled for December 3, 2025. Key features include PeerDAS, doubling blob data capacity, and raising the gas limit per block from 30 million to 150 million units. The goal is to improve scalability while maintaining decentralization and security, particularly for rollup-based solutions.

Base, the Coinbase-incubated Ethereum Layer 2, is exploring a native token to accelerate decentralization and expand ecosystem opportunities, marking a shift from its previous ETH-only gas model. CEO Brian Armstrong confirmed the evaluation but emphasized no definitive plans are in place. The move follows Kraken’s Layer 2, Ink, which also recently announced its own token. Base highlighted recent upgrades like sub-second transactions and Stage 1 decentralization, alongside a new cross-chain bridge enabling SOL and Solana-based assets to flow into its apps, strengthening interoperability within the Optimism Superchain ecosystem.

The Ethereum Foundation is launching a full-time AI team with one goal: make Ethereum the backbone of the entire AI economy. Led by core developer Davide Crapis, the "dAI" team is already working with major Silicon Valley companies on secret partnerships. They're building ERC-8004, a standard that lets AI agents seamlessly transact across Ethereum.

Hyperliquid's validator community awarded the reserved USDH stablecoin ticker to Native Markets, beating out bids from Paxos, BitGo, Ethena, and Frax in the exchange's first major governance vote. Native Markets plans to roll out USDH in stages, starting with capped testing of mints and redemptions "within days" before opening a USDH/USDC pair and lifting limits. The stablecoin will be issued on HyperEVM, fully backed by cash and U.S. Treasuries with reserves managed by BlackRock offchain and Superstate via Stripe-owned Bridge onchain. USDH's reserve yield will fund HYPE buybacks and programs to expand distribution, posing a potential challenge to Circle's $6 billion USDC dominance on Hyperliquid.

Adoption (sentiment, retail, and corporate reserves):

Changpeng Zhao warns of corporate treasury risks in crypto: The crypto industry’s intersection with traditional finance is accelerating, but Binance founder CZ warns of underprepared firms managing complex treasury strategies. He believes many lack the expertise required and that some failures are inevitable, especially when dealing with low-cap crypto assets.

Is public interest in Bitcoin fading? Google searches hit annual low: Google Trends data shows searches for “bitcoin” have dropped to a 12-month low, suggesting waning public interest. However, BTC’s price has risen over 70% since last year, highlighting a disconnect between search volume and market performance. A correlation remains in terms of timing, but not in magnitude.

Traditional finance:

Bitwise CIO Matt Hougan predicted that the Securities and Exchange Commission's proposed generic listing standards could unleash a wave of new crypto ETPs and spark a year-end rally. Current rules force each crypto ETP through a one-off SEC filing that can drag on for 240 days with no guarantee of approval. Generic standards would allow predictable approvals in as little as 75 days, provided the ETPs meet predefined criteria — most likely tied to whether the asset already has a regulated futures market in the U.S. at exchanges like the CME or Cboe, Hougan said.

PayPal is introducing a new peer-to-peer payments feature called PayPal Links, with plans to expand support to BTC, ETH, and PYUSD stablecoin transactions soon. It lets users send one-time payment requests and avoids 1099-K tax reporting for gifts, reimbursements, and shared expenses between friends and family on PayPal and Venmo. PayPal will first roll out the feature in the U.S. before expanding to the UK and other markets later this month, aiming to connect billions of wallets worldwide, the company said. The move builds on PayPal's growing crypto push, with PYUSD now a $1.3 billion market cap stablecoin powering its "Pay with Crypto" feature for merchants.

Tether has launched USAT, a new U.S.-regulated stablecoin issued by Anchorage Digital Bank with Cantor Fitzgerald as custodian, diverging from its flagship $170B USDT to comply with the GENIUS Act. Unlike USDT’s mixed reserves (80% Treasuries, 20% risk assets), USAT will hold strictly short-term Treasuries, cash, and repos, aligning with U.S. law. Led by former White House official Bo Hines, the move aims to penetrate the domestic market while preserving Tether’s profitable offshore model. The success of USAT will test demand for compliant, non-yielding stablecoins against growing competition like yield-bearing alternatives.

DBS Bank just teamed up with Franklin Templeton and Ripple to launch tokenized trading and lending services for institutional investors. The partnership combines Franklin Templeton's tokenized money market fund with Ripple's RLUSD stablecoin on DBS Digital Exchange. Investors can trade between the two 24/7 and even use the tokenized fund as loan collateral.

Funding & Partnerships:

Helius Medical Technologies ditched medical devices to become a Solana treasury company. They raised over $500 million from Pantera Capital, with their stock jumping 250% in pre-market trading. This comes right after Galaxy Digital and others committed $1.65 billion to another Solana treasury firm.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.