Top cryptos

Extract from CoinMarketCap.com on October 22nd 2025

Meme of the week

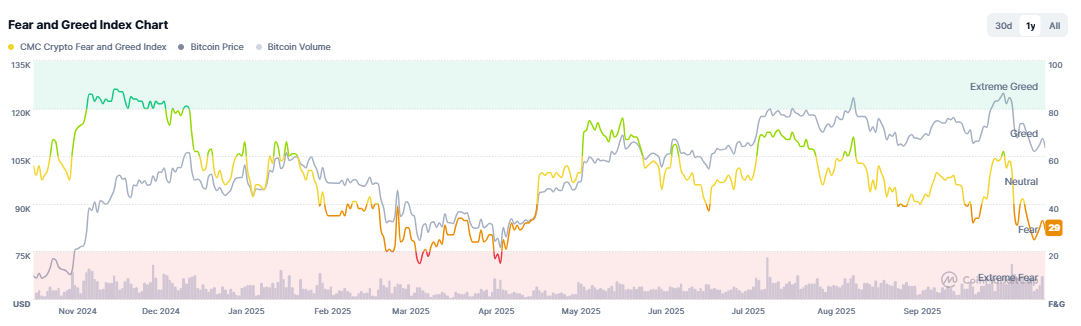

Market Sentiment:

F&GI from CoinMarketCap.com on October 22nd 2025

Market update: The market remains in a state of indecision this week, fluctuating between $106K-$114K against a backdrop of tensions with China and the US shutdown. We are seeing massive liquidations on both sides, while some players are investing heavily. Traders estimate that a potential new rate cut could arrive in October; regarding international tensions, everything will be decided at the summit on October 31st and the US/China meeting. Will we see the announced 100% tariffs against China?

Main points this week:

International Highlights:

Bhutan Launches First National Digital Identity System Based on Ethereum – This initiative, announced in the presence of Vitalik Buterin and Aya Miyaguchi, is part of a broader national strategy in favor of crypto-assets, which already includes green mining, crypto payments for tourism, and consideration of integrating BTC, ETH, and BNB into its reserves.

According to DBS Bank, with $550 Billion in Assets, Hong Kong and Singapore are Rushing to Adopt a Bitcoin-Friendly Policy – This statement follows the acceleration of tokenized product offerings by DBS and their growing involvement in blockchain infrastructure, notably via Hedera Hashgraph and the Partior payments project.

The Kenyan Parliament Has Approved a Legal Framework for Cryptocurrencies and Digital Assets – This text aims to attract investment to the sector and comes in a regulatory context strengthened since 2023, when the Worldcoin project was suspended as a precaution.

Binance is Returning Soon to South Korea, a Market with 16 Million Crypto Investors – By the end of the year, the cryptocurrency exchange Binance is expected to make its grand return to South Korea. Indeed, the world's largest crypto platform acquired a 67% stake in the Korean exchange GOPAX in February 2023. However, Binance encountered the regulatory setbacks we know of in the US later that year, which effectively stalled the review of the change of control by the Financial Intelligence Unit. Since then, Binance has been able to restore its image in the eyes of regulators and the review of GOPAX's change of control has resumed, raising hopes for a swift return of Binance to Korean soil.

Florida Has Proposed Allowing Investment in Bitcoin and ETFs in State and Pension Funds – This initiative is part of the dynamic of institutional Bitcoin adoption in October 2025, as US publicly traded companies now hold over one million BTC and BlackRock's spot Bitcoin ETF exceeds $93 billion in assets. In the same vein, the payments giant ACI, valued at $5 billion, has integrated Bitcoin payments into its global platform, confirming BTC's growing place in global financial services.

Donald Trump referred to the BRICS group as an "attack on the US dollar." The former president is now considering ending certain trade exchanges with China, particularly those related to cooking oil. This statement comes in the context of growing de-dollarization, as BRICS countries are developing an international payment system based on blockchain and BRICS+ projects to streamline global transactions.

President Trump declared that the United States is engaged in a trade war with China, asserting that without tariffs, there is no national security. These announcements come as markets rebound after a period of high volatility, with several initiatives linking these tensions to the crypto ecosystem, including the possibility of a presidential pardon for Changpeng Zhao and the creation of a TRUMP crypto fund estimated to reach up to one billion dollars.

Donald Trump stated that Chinese President Xi Jinping is open to a trade agreement and that he will meet with him on October 31 during the APEC summit in South Korea. This easing of US-China tensions led to a 2% increase in Bitcoin’s price.

Compliance/Regulation/Legal/Cyber:

Will Donald Trump Ultimately Pardon Changpeng Zhao? – Despite his forced removal from the Binance platform in 2023, Changpeng Zhao remains a central figure in the crypto ecosystem. If ongoing negotiations are to be believed, he could well benefit from a presidential pardon from Donald Trump. The information comes following a publication by Charles Gasparino, senior correspondent for Fox Business, on the X network. The reason is a possible dismissal of the charges against Changpeng Zhao in a case presented as "quite weak" that "certainly did not deserve a criminal conviction and prison sentence."

New York City Mayor Eric Adams Has Signed an Executive Order Creating the Office of Digital Assets and Blockchain Technology – This initiative aims to consolidate the city's crypto strategy and comes in a context of technological migrations between blockchains, such as Sorare's move to Solana or Morpho's arrival on Cronos, illustrating increased interoperability between networks.

ChatControl: Germany Opposes It and Saves Europeans' Privacy – Just as the European Union was about to impose widespread control of private communications via the ChatControl project, Germany stood as the ultimate bulwark. Its refusal prevented the adoption of a text that would have turned every European phone into a tool of permanent surveillance. ChatControl is a proposed European regulation, also called CSAR (Child Sexual Abuse Regulation), which aims to oblige messaging services like WhatsApp, Signal, or Telegram to automatically analyze users' private messages, images, videos, and links before sending them, and to block them if the algorithm detects prohibited content. The stated goal is to combat the dissemination of child pornography content. However, the planned mechanism would involve massive surveillance of private communications, including those protected by encryption. Concretely, platforms would have to deploy algorithms capable of scanning message content before sending. This would amount to installing an automated inspection system on all phones and applications in Europe, effectively removing the security of end-to-end encryption.

SEC Chairman Paul Atkins Stated that Crypto, Digital Assets, and Tokenization are the Agency's Top Priority – This direction aims to strengthen the regulatory framework and bring innovators back to the United States. The movement relies on a wave of tokenization of real-world assets and securities, with BlackRock, BNY Mellon, and Plume Network among the pioneers. Tokenized stocks on Solana and the proliferation of projects related to stablecoins, notably those from Sony, Samsung, and World Liberty Financial, confirm this dynamic.

The Swiss Gambling Authority Files a Complaint Against FIFA's NFT Platform – Wanting to integrate crypto offerings into a traditional company cannot be improvised, especially given the numerous regulatory requirements in the field. An experience FIFA just had with its NFT platform declared illegal in Switzerland.

Kraken acquired CFTC-regulated Small Exchange from IG Group for $100 million to help establish a fully U.S.-based crypto derivatives platform. The move gives Kraken a licensed Designated Contract Market, enabling it to offer spot, futures, and margin products under a unified regulated system. Co-CEO Arjun Sethi said the acquisition lets Kraken integrate clearing, risk, and matching functions inside one environment that meets global exchange standards. The deal follows Kraken's NinjaTrader purchase earlier this year and comes as annual U.S. crypto derivatives volumes surge 136% amid rising institutional demand.

The UK will appoint a Digital Markets Champion to coordinate private-sector tokenization of wholesale financial instruments and align technical development with regulatory goals. Economic Secretary Lucy Rigby announced the role alongside other initiatives: a Dematerialization Taskforce to phase out paper shares, the lifting of the retail ban on crypto ETNs, and a procurement process for tokenized government bonds. These steps aim to strengthen the UK’s digital asset sector and modernize its financial infrastructure through coordinated public-private effort.

Australia’s Treasury has released its Tranche 1a payments reform, formally bringing stablecoins under the AFSL regime supervised by ASIC. The draft classifies fiat-pegged, redeemable tokens as tokenized stored value facilities, integrating them into existing financial product rules. This follows ASIC’s recent issuance of the first stablecoin license to Macropod and builds on 2023 proposals to create a unified framework. The consultation runs until November 6, with full implementation planned for 2026, positioning Australia among the first to mainstream regulated tokenized payments.

A leaked draft of the Senate Democrats’ digital asset framework proposes classifying DeFi front ends and liquidity providers as “brokers,” subjecting them to broker-dealer registration and reporting rules. Critics warn this could force developers and liquidity offshore by imposing unworkable compliance on decentralized systems. The approach blurs lines between code and control, risking innovation while aiming to address illicit finance. TRM and others advocate for balanced risk mitigation through real-time intelligence sharing, rather than one-size-fits-all KYC mandates that may undermine DeFi’s open-source nature.

Singapore’s MAS will defer implementation of the Basel Committee’s crypto capital standards until January 2027, responding to industry concerns over punitive treatment and regulatory arbitrage. The rules would place most public blockchain assets in Group 2, subjecting them to strict capital deductions and exposure limits. MAS cited technological advances and a lack of global alignment, noting early adoption could disadvantage local banks. The delay reflects a broader international slowdown as jurisdictions reassess the framework’s proportionality amid evolving digital asset markets.

Brazil’s Federal Police has dismantled a $540M crypto laundering network in "Operation Lusocoin," making 11 arrests and freezing BRL 3 billion in assets. The scheme used shell companies and exchanges to conceal drug trafficking and tax evasion proceeds. With TRM Labs’ analytics, authorities traced and froze 4.33M USDT, marking Brazil’s sixth case using the T3 Financial Crime Unit (TRON/Tether/TRM). The operation highlights Brazil’s growing expertise in crypto crime investigations and commitment to cross-border collaboration against illicit finance.

The European Banking Authority has detailed how AML/CFT supervision will be implemented under MiCA, urging coordinated cross-border oversight to prevent forum shopping and ensure consistent enforcement. The report highlights persistent risks like opaque ownership, weak governance, and misuse of outsourcing—calling for stricter checks on beneficial ownership and management fitness. It also warns against reverse-solicitation loopholes used to serve EU clients without registration. The EBA emphasizes that as crypto integrates with traditional finance, robust compliance, governance, and cross-border cooperation must underpin the EU’s regulatory maturity.

Japan’s Financial Services Agency could potentially allow banks to buy and sell crypto and register as crypto exchanges, enabling retail traders greater access to digital asset markets, according to local media site Yomiuri Shimbun. The watchdog is set to discuss the reform at an upcoming meeting of the Financial Services Council, an advisory body to the Prime Minister. Current FSA supervisory guidelines that ban domestic banks from holding digital assets in part due to price volatility. At the same time, the FSA is mulling reforms that would explicitly prohibit trading crypto assets based on non-public information, with violators facing financial penalties proportional to their illicit gains.

Traditional Finance:

Citibank, a Major Player with $1.7 Trillion in Assets, Has Announced the Launch of a Cryptocurrency Custody Service for 2026 – This shift is part of a dynamic of increasing institutional integration: CME Group plans to make crypto derivatives tradable 24/7 starting in 2026, Deutsche Bank is also preparing a similar offering. These announcements reflect a strengthened commitment from major banks towards digital assets.

According to the BlackRock CEO: "We Are Only at the Beginning of the Tokenization of All Assets" – The BlackRock CEO reaffirms his belief in tokenization. It's impossible to ignore the financial revolution promised by the tokenization of real-world assets (RWA). A digitization on the blockchain that opens many perspectives, both for market liquidity and their openness to [...]. A global market currently estimated at $34 billion, of which BlackRock already captures over 8% market share with an activity estimated at $2.8 billion. An amount largely invested in the sector of tokenized Treasury bills, where the BUIDL fund alone represents 34% of the market share.

The French Finance Giant ODDO BHF Launches a Euro-Based Stablecoin – A future heavyweight of stablecoins? The French investment bank ODDO BHF is venturing into this type of cryptocurrency. Its EUROD will track the euro and will be listed on a European platform. ODDO BHF is a Franco-German financial group active in investment banking, asset management, and private banking. 175 years old, it holds a major place in Europe, notably as a bridge between French and German markets.

OKX and Standard Chartered Bank Roll Out a New Feature in Europe for Institutional Traders – Indeed, European institutional clients of OKX can now choose to hold their digital assets with Standard Chartered, which acts as an "independent and regulated custodian." Initiated in April 2025 in the United Arab Emirates, this collaboration now extends to Europe to give clients greater flexibility in the custody of their cryptocurrencies. Simultaneously, these clients can still execute their trading operations in real time from OKX.

The 5th Largest US Bank, US Bank, Has Announced the Creation of a Division Dedicated to Digital Assets and Payments – This initiative extends its cryptocurrency custody services launched in 2021. It fits into a broader context of institutional adoption, alongside BNY Mellon, Swift, and the State of Ohio, which are promoting cryptocurrency payments.

The Board of Newsmax, a Company Listed on the NYSE, Has Approved the Allocation of Up to $5 Million for the Purchase of Bitcoin and Trump Coin Over the Next 12 Months – This move is part of the trend observed in the third quarter of 2025 where US publicly traded companies already held over one million BTC.

Crypto Companies Will Be Able to Open an Account at the Fed – Promoting blockchain technologies, a Fed governor unveiled a project for a payment account for crypto companies. Indeed, to offer banking services, a crypto company today must partner with an institution that already holds an account with the Fed. With this new model, it would remove intermediaries, albeit at the cost of some concessions compared to a classic master account. "To manage the size of the accounts and their impact on the Fed's balance sheet, reserve banks would not pay interest on payment account balances, and balance caps could be imposed. These accounts would not benefit from intraday overdraft privileges; if the balance reaches zero, payments would be rejected. They would not be eligible for discount window loans and would not have access to all Federal Reserve payment services for which reserve banks cannot control intraday overdraft risk."

Tech News:

American Tech Billionaires Launch Erebor Bank Focused on the "Innovation Economy" – The development of the crypto sector in the US has often encountered a very mixed reception from the banking sector. A situation that could be about to change with the creation of Erebor Bank, backed by a group of tech billionaires. According to statements from a source close to the matter interviewed by the Financial Times, this bank wishes to propose an operational model presented as "stable, low-risk, reliable, doing normal banking things without ruining everyone with unnecessary risks." Its target? Companies involved in the "innovation economy," such as cryptocurrencies, artificial intelligence, defense, and manufacturing.

Kraken Enters the Market for Exchange-Traded Derivatives in the United States – The approval of spot Bitcoin ETFs in the US was the first symbolic step in the interconnection between the crypto sector and traditional finance. A rapprochement just confirmed by the Kraken platform, following the acquisition of the company Small Exchange.

Bitcoin: A New Ultra-Scalable Layer 2 Has Just Been Launched – The Ark protocol makes its mainnet debut with Arkade. This new Layer 2 allows for the creation of complex financial applications on Bitcoin, while remaining true to its principles. No bridge, no wrapped tokens, no risk of altering the base protocol. Bitcoin becomes programmable. The goal is simple: to bring tokenized activity back to Bitcoin, and particularly assets like USDT, by offering them the infrastructure they have always lacked on the main layer.

Adoption (Sentiment, Retail & Corporate Reserves):

Tom Lee, Chairman of Bitmine, Indicated that a Rise in Ethereum to $12,000 Would Not Be a Blow-Off Top but a Price Discovery Phase – He added that 95% of investors currently have no exposure to Bitcoin, suggesting considerable growth potential. These remarks come in a climate of growing institutional interest in digital assets.

Ripple Labs Wants to Raise $1 Billion to Launch an XRP Treasury – Despite a notable slowdown, the race for corporate crypto treasuries continues. The latest project: a fundraising estimated at $1 billion led by Ripple Labs for its XRP cryptocurrency. According to available information, this operation is currently being led by Ripple Labs using a Special Purpose Acquisition Company (SPAC) structure. A specific acquisition company listed on the stock exchange with the aim of acquiring an existing company. In practice, this operation would consist of accumulating XRP in a listed Digital Asset Treasury (DAT), using external financing, but also XRP held by Ripple, in a proportion that remains unknown for now.

Bo Hines, CEO of the US Branch of Tether, Recommended Never Selling Bitcoin – This statement follows Tether's acquisition of 8,888 BTC for approximately one billion dollars, bringing its holdings to over 86,000 BTC. In a volatile context, with BTC having fallen to around $106,000, the company continues to bet on Bitcoin's long-term value.

Ripple is leading a $1 billion raise to create a new XRP digital asset treasury, Bloomberg reported, citing sources familiar with the matter. The fundraising is expected to occur via a special purpose acquisition company (SPAC), with Ripple contributing part of its own (substantial) XRP holdings. The details of the raise and the transaction structure are still being discussed and remain subject to change, but if completed, the new entity could become the largest XRP-focused DAT to date. The move comes amid cooling sentiment around DAT firms like Strategy, Metaplanet, and BitMine, as some begin to trade at market caps below their net crypto asset values. In June, Singapore-based Trident Digital announced plans to raise $500 million to build an XRP treasury.

Funding & Partnerships:

MetaMask Partners with Polymarket to Integrate Prediction Markets into Its Wallet – Soon, MetaMask will integrate the prediction market giant Polymarket into its Web3 wallet.

The Conservative Newsmax Channel Will Buy Millions of Dollars Worth of TRUMP and Bitcoin – Another link between American politics and cryptocurrencies. The Newsmax channel, historically aligned with the conservative movement, announces a reserve in Bitcoin and the TRUMP memecoin.

BitMine Has Acquired Approximately $2.2 Billion Worth of Ether, or Nearly 1.7 Million ETH – This operation is part of a dynamic where Citizens Bank forecasts ETH at $7,000 by 2026 and $20,000 by 2030. The Ethereum ecosystem remains very active: the Ethereum Foundation deposited $16 million on Morpho, and MegaETH is preparing its ICO with the support of Vitalik Buterin. However, the number of staking validators is at its lowest since June 2024.

Coinbase Acquires Echo, the Leading Fundraising Platform on the Blockchain – The Coinbase platform is multiplying strategic acquisitions to solidify its position in the current development of the crypto sector. The stated goal is to make fundraising more community-oriented, with operations that allow project developers to connect directly with individual investors without necessarily needing to go through traditional venture capital firms, using private sales or self-hosted public token sales operated with its flagship product, Sonar.

House of Doge, the corporate arm of the Dogecoin Foundation, is set to go public via a reverse merger with Nasdaq-listed esports firm Brag House Holdings under the ticker TBH. The combined entity will integrate Dogecoin-denominated payments, merchant services, licensing, and treasury operations to generate recurring revenue, according to a press release. House of Doge will control the majority of the merged company, with its CEO, Marco Margiotta, heading up the outfit, while Brag House CEO Lavell Juan Malloy II will continue to serve on the board and lead the Brag House vertical. The merger follows a string of House of Doge-linked deals, including a 21Shares ETP launch, a CleanCore treasury partnership, and a custody tie-up with Robinhood.

China Renaissance wants to raise $600 million for buying and holding BNB through a publicly traded U.S. company. If this closes, it would be one of the largest institutional bets on BNB ever made by a public entity. His family office recently hosted a dinner in Singapore titled "BNB Visionary Circle: Igniting the Next Trillion."

BlackRock, Nvidia, Microsoft, and xAI are acquiring Aligned Data Centers for $40B, valuing power capacity at $8M per megawatt—160% above typical bitcoin miner valuations. The deal covers 5 GW of operational and planned capacity across 50 sites. Analysts suggest similar financing could drive 150-500% equity upside for miners like IREN and Riot as institutional capital floods power infrastructure. Bitcoin miners are increasingly pivoting to AI compute operations, leveraging their secured power capacity to capitalize on the AI boom’s demand for high-density energy.

Coinbase is investing in Indian exchange CoinDCX to expand its presence across India and the Middle East. While the financial terms of the deal were not disclosed, CoinDCX CEO Sumit Gupta said the deal valued the exchange at $2.45 billion post-money, pending regulatory approval. Coinbase previously invested in CoinDCX via Coinbase Ventures, participating in multiple funding rounds since 2020. Founded in 2018, CoinDCX has over 20.4 million users and $165 billion annualized transaction volumes across its products. In July, CoinDCX suffered a $44 million exploit where hackers disguised as recruiters lured one of its software engineers to install malware on his company laptop.

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, said it will invest up to $2 billion in Polymarket, reflecting a pre-investment valuation of about $8 billion. ICE will also become a global distributor of Polymarket’s event-driven data, and the two companies plan to collaborate on future tokenization initiatives.

Tempo, a stablecoin- and payments-focused blockchain developed by Stripe and Paradigm, reportedly raised $500 million in a Series A round at a $5 billion valuation. The round was co-led by Greenoaks and Thrive Capital, with Sequoia, Ribbit Capital, and SV Angel participating. Stripe and Paradigm did not contribute capital to the round.

Kalshi raised $300 million in a Series D round at a $5 billion valuation — just over three months after closing a $185 million Series C at $2 billion. The new round was co-led by Andreessen Horowitz (a16z) and Sequoia Capital, with Paradigm as a major participant. Additional backers include Coinbase Ventures, General Catalyst, Spark Capital, and CapitalG.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.