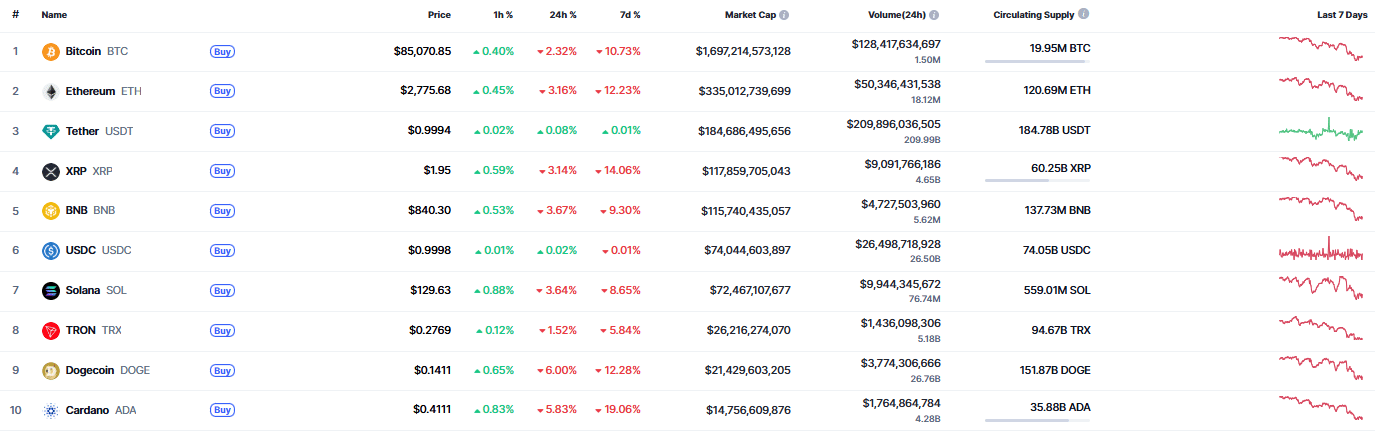

Top cryptos

Extract from CoinMarketCap.com on November 22nd 2025

Meme of the week

Market Sentiment:

Market update: Markets have plummeted amid a macro context of fears about an AI bubble and disappointing US economic data (thus no rate cut in December); BTC has lost $20k in 10 days. Bitcoin, like other cryptocurrencies, is facing a host of negative signals, explaining this gloomy sentiment. In the United States, the Federal Reserve is hesitant to continue its policy of lowering interest rates, which is hurting assets deemed risky.

Furthermore, the successive gains of the last two years are prompting investors to take profits. This could trigger a domino effect – the market sentiment from the Fear & Greed Index is currently pointing to "extreme fear." In the wake of the price drop, the assets under management for spot Bitcoin ETFs have now hit their lowest level since May.

Over the past two days, US stock markets have been particularly shaken. The S&P 500 lost $1.5 trillion in market capitalization in less than 2 hours. The index, which tracks major US companies, lost $15 billion per minute for about a hundred minutes. Investors seem to have been influenced by the release of a September jobs report, which strengthens the scenario of the Federal Reserve holding rates steady in December.

The withdrawal of investors from "risky" assets was also seen in cryptocurrencies, which failed to halt their declines overnight. The price of Bitcoin (BTC) is down 8.8% over the last 24 hours, while Ethereum's ETH is down 10.3%. The largest cryptocurrency is approaching the psychological threshold of $80,000, after having surpassed $90,000 just 3 days ago.

Main points this week:

International/Macro:

French growth is expected to reach 0.7% in 2025 and 0.9% in 2026, according to the Bank of France: France will avoid a recession, according to the governor of the Bank of France, François Villeroy de Galhau. But the country's budgetary situation continues to be a major concern. France continues to be crushed under the weight of debt, with endless parliamentary debates on the 2026 Budget. In response, several major rating agencies have downgraded France's rating in recent months.

Polymarket quietly relaunches in the United States: The predictive betting platform Polymarket has just set foot on American soil... very discreetly. It is preparing its grand comeback, amid exploding interest in its services. To be able to launch in the United States, the firm acquired QCX, a company that already holds the regulatory green light from the Commodity and Futures Trading Commission (CFTC).

End of the "shutdown" in the United States — Stock markets reach record levels: US administrations had been paralyzed for over 40 days by the longest "shutdown" in US history. This situation has just been resolved, triggering a surge in global stock markets in its wake.

Bitcoin: The Czech Central Bank adds BTC and other crypto-assets to its balance sheet: For some time now, Bitcoin has established itself as a cryptocurrency capable of integrating the treasuries of companies or the strategic reserves of countries like El Salvador or Bhutan. A major step that now concerns the Czech central bank with a purchase of BTC, as well as other crypto-assets. Following several months of internal discussions, this crypto-asset purchase operation was finally approved by the Bank's Council on October 30, 2025, for a total amount set at $1 million. This portfolio therefore includes BTC, an unidentified USD dollar stablecoin, and a "tokenized deposit on the blockchain." According to the official statement, the objective of this test is mainly to "gain concrete experience with blockchain-based technologies, which could profoundly alter the functioning of the financial system and the payment system in the future."

Taiwan to study the possibility of creating a strategic Bitcoin reserve: "The Prime Minister and the Central Bank of Taiwan have agreed to study Bitcoin as a strategic reserve, draft pro-Bitcoin regulations, and launch a pilot project for holding BTC in Treasury reserves, starting with seized funds." According to available information, this initiative is more specifically led by pro-Bitcoin MP Ju-chun Ko, with the active support of JAN3 CEO Samson Mow, who specializes in advising on this type of strategy dedicated to accelerating the "hyperbitcoinization" of the world.

Alibaba might choose JPMorgan's "stablecoin" for cross-border payments: To speed up cross-border payments for a future product, Chinese giant Alibaba might choose to use JPMorgan's JPMD. Alibaba is reportedly looking to launch an artificial intelligence capable of creating commercial contracts from discussions between a client and a supplier. In this B2B context, stablecoins would thus add value compared to traditional settlement methods by removing intermediaries to speed up cross-border transfers.

El Salvador increased its BTC reserve by nearly 17% with 1,090 new bitcoins. With the total now raised to 7,474.37 units, this new addition represents a 16.82% increase in the size of the country's reserve, bringing it to an estimated value of $668 million.

Cryptocurrencies: "the market should be able to recover more broadly". According to Wintermute analysts, the crypto market fall is the consequence of macroeconomic factors, and it could soon rebound. "This macroeconomic setup does not signal a prolonged bear market. With the market being primarily driven by macroeconomics, the next catalyst will likely come from monetary policy and interest rate expectations rather than cryptocurrency-specific investment flows. Once the main players have recovered, the market should be able to stage a broader recovery." Regardless, although nothing is yet confirmed, this optimism should be tempered with the lessons from the previous bear market. In the fall of 2021, an external factor unrelated to cryptocurrencies had already triggered the first falls, namely the famous black swan of the Chinese real estate developer Evergrande. In the following months, the beginning of Russia's invasion of Ukraine also sowed panic in financial markets, marking the start of a restrictive monetary policy, and it was only after these events that endogenous crypto incidents took over.

The Marshall Islands presented a universal income program via a digital wallet called Lomalo, based on the USDM1 stablecoin pegged to the US dollar. This project follows their pro-blockchain policy, after the legal recognition of DAOs in 2022.

NVIDIA signs another record quarter with $57 billion: Having passed the $5 trillion market capitalization mark last month, NVIDIA serves as a barometer for the US economy, to the point that the market closely watches every earnings release. On Wednesday, the computing giant released its latest quarterly figures, reporting record revenue of $57 billion for its third quarter, which ended on October 26 for the company.

The United Arab Emirates sovereign fund has tripled its stake in BlackRock's Bitcoin ETF, which now manages over $93 billion in assets. This move illustrates growing institutional interest in BTC, as BlackRock explores ETF tokenization and continues to strengthen its synergies with Circle, HSBC, and Goldman Sachs on the Arc project.

The US Federal Reserve is not expected to lower its rates soon, contrary to market hopes. The reasons are multiple. Inflation, a key indicator watched by the Fed, is still at levels considered too high, exceeding 2%. The central bank fears that inflationary pressures will intensify again. It should also be noted that the recent US administration "shutdown" made it impossible to consult key data for the latest period. Lacking visibility, the Fed will likely prefer to wait for concrete data. Finally, the job market, while not booming, remains stable. This does not encourage the central bank to lower its rates to intervene quickly.

India is reportedly developing a "stablecoin" backed by its debt: The accelerated and unprecedented development of the stablecoin sector heavily favors the US dollar, to the point of worrying some world powers. A situation that India is trying to counter, with the announced launch of a token backed by its sovereign debt. Recent announcement of the creation of a "Asset Reserve Certificate (ARC)" type crypto-asset, currently being developed by Polygon and the Indian fintech Anq. Its specific feature? Proposing an innovative model backed by sovereign debt, "issued solely in exchange for Indian government securities (G-Secs) and Treasury bills."

Saudi real estate developer Dar Global plans to tokenize up to 70% of its $300 million Trump-branded Maldives resort, offering U.S. investors exposure from the development stage, Reuters reported. The firm said tokenization will serve as the project's primary financing mechanism, while it retains a 30% to 40% ownership stake. Dar Global and The Trump Organization are in discussions with the SEC about the planned token sale as they push blockchain-based real estate investment to a broader retail base. The resort, slated to open in 2028 near Malé, features roughly 80 luxury villas and is one of several joint projects between the firms.

SGX Derivatives rolls out bitcoin and ether perpetual futures on Nov. 24. The contracts let institutional investors trade crypto exposure without expiration dates. Fully regulated by Singapore's Monetary Authority. This is only the second perpetual futures offering in Singapore. The first launched in July.

Compliance/Regulation/Justice/Cyber:

A court in Dubai has ordered the global freezing of $456 million following the alleged misuse of TrueUSD reserves after a bailout conducted by Justin Sun. The case is part of Sun's initiatives around the Tron Treasury Company, supported by the Trump family, and reignites debates about treasury strategies within the ecosystem.

Aave Labs obtains a MiCAR license: Through its subsidiary Push Virtual Assets, Aave Labs has obtained authorization under the MiCA regulation. While one might wonder why a giant of decentralized finance (DeFi) needs a MiCAR license, Aave Labs has also answered this question. Thus, its Aave protocol remains decentralized, and this authorization only covers the offering of the regulated services mentioned previously. Although not specified, this news could lead to synergies with another recent development from Aave, namely the acquisition of Stable Finance last month, an application dedicated to stablecoins.

The SEC and CFTC have officially reopened after 43 days of paralysis thanks to a budget agreement passed by Congress and signed by President Trump. This resumption will allow the processing of files concerning crypto regulation and financial product approvals, including several ETFs, providing a renewed visibility to the sector after several weeks of uncertainty.

The EU wants to impose a single European supervisor: The European Union is attempting to optimize its regulatory framework by imposing the establishment of a single control body, modeled on the US SEC. A "new legal uncertainty" that does not really excite crypto players. A leading role that could fall to the current European Securities and Markets Authority (ESMA), at the risk of "disrupting years of work by national authorities and companies to regulate the sector." According to Robert Kopitsch, the current national-level processing of regulatory approvals for Digital Asset Service Providers (DASPs) allows for frequent and constructive exchanges with local authorities, in addition to ESMA's cross-border supervision. Especially with the effective implementation of the MiCA regulation being less than a full year old.

Mt. Gox moves $950 million in BTC — New selling pressure for Bitcoin? The collapse of the Mt. Gox cryptocurrency exchange platform appears as one of the first major scandals in the sector, occurring in 2014. A case still being settled, responsible for a recent transfer of $950 million in BTC to an unknown address. An operation still in progress, as the Mt. Gox address identified by the blockchain monitoring site Arkham Intelligence still shows a positive balance estimated at just over $3 billion (34,689 BTC). And, evidently, a new reimbursement campaign has just been triggered. Facts visible on the Arkham Intelligence site report 2 new transfers carried out in recent hours, for an amount estimated at just over $950 million at the time, or about 10,608 BTC total. 185.5 BTC were transferred to Kraken, the rest (10,422 BTC) to an unknown address.

Ondo secures European approval for its tokenized securities platform: Ondo Global Markets has obtained regulatory approval to offer tokenized stocks and ETFs to investors in the European Union (EU) and the European Economic Area (EEA). Thanks to this major advancement, over 500 million investors in 30 European countries will soon be able to access regulated exposure to US markets directly via the blockchain. Launched last September, this platform allows investment in over 100 tokenized stocks and ETFs on Ethereum and on the BNB Chain, 24 hours a day, 7 days a week.

The OCC has clarified that national banks may hold crypto assets to pay blockchain network fees and support other permissible crypto activities, provided they implement strong risk controls. Interpretive Letter 1186 affirms that using tokens for “gas” fees aligns with safe and sound banking, signaling banks’ evolving role from custodians to active network participants. The guidance narrows regulatory fragmentation, offering certainty for integrating custody, settlement, and on-chain operations while emphasizing that blockchain mechanics require compliance parity with traditional finance.

Canada’s Parliament has approved a federal stablecoin framework in its 2025 budget, authorizing the Bank of Canada to oversee issuers and enforce rules on reserve quality, redemption rights, and operational resilience. The move follows years of consultation and aligns with the country’s Digitalization of Money initiative to balance innovation with consumer protection. Regulators will now develop detailed licensing and reserve standards through 2026, marking Canada’s shift from planning to implementation in digital asset regulation.

New Hampshire has approved the first U.S. municipal bond backed by Bitcoin, launching a $100M pilot that allows companies to use BTC as collateral for public financing. The state—already known for its pro-crypto policies—aims to integrate digital assets into traditional finance without taxpayer risk. If successful, the model could inspire other states to explore bitcoin-backed public instruments, marking a significant step toward blending crypto collateral with established funding frameworks.

AMINA Bank became the first international bank to win Hong Kong's Type 1 license for institutional crypto services. The approval lets AMINA offer trading and custody for 13 cryptocurrencies to institutional clients. Hong Kong's crypto trading volumes jumped 233% in the first half of 2025, and the region just approved its first Solana ETF in late October.

Japan's Financial Services Agency has finalized plans to reclassify 105 cryptocurrencies as financial products, pulling them under stricter disclosure and oversight rules, according to local media reports. Exchanges listing these assets will need to disclose key characteristics, such as whether the token has an issuer, the underlying blockchain technology used, and price volatility, while facing new insider-trading restrictions. However, the change could also see the tax rate on crypto income slashed from as high as 55% to 20%, bringing it in line with stock investment taxation, pending a 2026 review. The reforms signal Japan's push to reinvent itself as a Web3 hub after years of caution, with stablecoin initiatives and potential bank crypto trading services also advancing.

The Hong Kong Monetary Authority has launched the pilot phase of Project Ensemble to move tokenized deposits and other digital assets from controlled sandbox tests to live, real-value transactions. The de facto central bank's initiative will run through 2026, starting with tokenized money-market fund trades and real-time liquidity and treasury management. The HKMA plans to support interbank settlement through its RTGS system before upgrading to 24/7 settlement in tokenized central bank money over time. The pilot underscores Hong Kong's push to lead Asia's tokenization race as Singapore accelerates its own trials for tokenized bills and cross-chain deposit transfers.

The Bank of England has proposed a regulatory regime for “systemic” GBP stablecoins, requiring reserves in UK government debt and central bank deposits and imposing temporary holding caps of £20,000 for individuals and £10M for businesses. The BoE aims to prevent deposit flight and ensure stablecoins function like cash, with caps lifted once risks are managed. The framework signals the UK’s acceptance of stablecoins in payments under tight oversight, intersecting with broader CBDC and tokenized deposit discussions while aligning with its regulated digital money vision.

At the Singapore FinTech Festival, the Monetary Authority of Singapore (MAS) launched a live trial of tokenized government bills, settling transactions instantly with wholesale CBDC. This marks the first time a central bank has tokenized its own short-term debt, enabling primary dealers to subscribe and trade with reduced settlement lag and counterparty risk. The pilot advances Project Guardian’s vision of interoperable, programmable finance, signaling MAS’s shift from experimentation to implementation in building next-generation digital market infrastructure.

Brazil’s central bank has launched its first comprehensive crypto licensing framework, requiring virtual asset service providers (VASPs) to obtain authorization and meet capital requirements of $2M to $7M based on operational scale. Foreign firms must establish a local presence, with a nine-month compliance window. The rules also impose enhanced reporting for large transactions (over ~$100,000) and integrate crypto into foreign exchange oversight, emphasizing stability, transparency, and alignment with global standards amid industry concerns over high capital barriers.

Traditional Finance:

Nasdaq has published the official listing notice for the spot XRP ETF, marking a key step in the introduction of XRP to US stock markets. This launch comes in a context of growing institutional interest, with up to $5 billion in flows expected in the first month and the SEC's approval of the first Grayscale multi-crypto fund including XRP (GDLC).

JPMorgan launches its JPM Coin on Coinbase's layer 2: The JPM Coin, JPMorgan's token, is now available on Coinbase's layer 2 solution, Base. This evolution is notable because it creates another bridge between a "traditional" finance actor and a public blockchain. It is also based on a cryptocurrency established for several years, a rare thing in traditional finance. The JPM Coin was indeed created in 2019.

JPMorgan Chase invested no less than $102 million in BitMine Immersion Technologies, a key player in the Ethereum ecosystem that holds nearly 3% of the total ETH supply. An indirect stake in the Ethereum blockchain, revealed in an SEC filing. BitMine is a company listed on the NYSE American (under the ticker BMNR) and formerly specialized in Bitcoin mining. In 2025, it shifted its strategy towards the massive accumulation of Ethereum. It became the world's largest corporate holder of ETH with over 3.5 million tokens, representing about 2.9% of the total circulating ETH supply.

Fidelity Investments introduced a SOL ETF on the NYSE under the ticker FSOL. This launch follows the gradual integration of crypto products onto traditional financial markets, under SEC supervision.

The CBOE announces the launch of "continuous futures" on Bitcoin and Ethereum: The Chicago Board Options Exchange (CBOE) clearly wants to join the current hype surrounding decentralized perpetual contract platforms, like Hyperliquid. On the agenda: the announced introduction of "continuous futures" on Bitcoin and Ethereum. "Cboe's Bitcoin and Ether continuous futures will offer investors US-regulated, perpetual-like exposure. Clearing will occur centrally via Cboe Clear U.S., a CFTC-regulated derivatives clearing organization, and will be available for trading 23 hours a day, 5 days a week."

Société Générale issues tokenized bonds for the first time in the United States: After having issued tokenized bonds in the past, Société Générale is repeating the experience with a first in the United States. Specifically, these securities are short-term bonds backed by the variable rate of the "Secured Overnight Financing Rate Data" (SOFR). These bonds are issued by the subsidiary SG Forge using technology from Broadridge Financial Solutions and were acquired by DRW. This time, the Canton Network blockchain was selected, while the famous US bank BNY acted as an intermediary as "paying agent."

Analysts estimated that the end of the US government shutdown could allow a wave of crypto ETF approvals as early as 2026. Matt Hougan, CIO of Bitwise, predicts over 100 new products following the recent launch of several spot ETFs on Solana, Litecoin, and Hedera. However, 155 applications remain pending, slowed down by the SEC and the federal shutdown.

The iShares Staked Ethereum Trust ETF was registered in Delaware, paving the way for institutional access to Ethereum staking. This advancement is part of a dynamic of financial products linked to ETH, while the Ethereum Foundation is working on the Interop Layer and Vitalik Buterin is advocating for network stabilization.

Tech News:

Aerodrome and Velodrome announced their merger under the name "Aero," which will be launched on Ethereum and Circle's Arc blockchain. Holders of Aerodrome will receive 94.5% of the new token, and those of Velodrome 5.5%. This operation comes as Ethereum reaches a record for transactions per second ahead of its Fusaka upgrade scheduled for December.

Telcoin obtains a US banking charter to launch its Digital Asset Bank: The current evolution of the regulatory landscape in the United States now allows crypto projects to request a banking charter to operate as a "Digital Asset Bank." "This charter allows Telcoin to become the first true blockchain bank, directly connecting US bank accounts to regulated 'Digital Cash' stablecoins. Its flagship product, eUSD, will be the first US dollar stablecoin issued by a bank and natively on-chain, offering consumers and businesses a secure and compliant way to use Digital Cash for payments, transfers, and savings."

Avalanche (AVAX): Will the Granite upgrade restart its DeFi ecosystem? The permanent and highly competitive evolution of the blockchain sector highlights some projects, to the clear detriment of other less popular ones. A decline in interest affecting the Avalanche ecosystem, seeking a new breath of life with its imminent Granite upgrade. In practice, this Granite upgrade will bring 3 essential modifications (ACP) to the Avalanche blockchain, which are: More stable cross-chain messaging; Biometric authentication; Dynamic block times. The first evolution of this upgrade involves more efficient cross-chain messaging, capable of reducing computation costs, but also guaranteeing better transaction finality (fewer failures) and more reliable multi-chain dApps. At the same time, more dynamic management will allow validators to adjust block times based on network conditions, going below one second. A modification that should enable instant operations for swaps or DeFi transactions.

An end to changes? Vitalik Buterin calls to "ossify" Ethereum to stabilize it: Vitalik Buterin believes that Ethereum (ETH) must stop continuously transforming itself. He calls for an "ossification" of the network to bring stability. According to Vitalik Buterin, the role of innovation and exploration must now be left to layer 2 solutions.

The Ethereum Foundation unveils "Interop Layer" — A unified layer 2 ecosystem as a single blockchain: The Ethereum blockchain stands as a historical and essential player in the cryptocurrency ecosystem, constantly evolving. The latest major step: reunifying its layer 2s with "Interop Layer" to give the impression of being on a single blockchain. The solution proposed by "Interop Layer" consists of developing "a wallet-centric multi-chain experience [that] becomes your universal window into the Ethereum ecosystem, and the network feels like a seamless experience rather than an archipelago of islands." In practice, this will mainly allow users to sign once for a cross-chain transaction, while preserving the essential guarantees of the Ethereum blockchain: such as self-custody, censorship resistance, disintermediation, and verifiable on-chain execution.

This new crypto wallet unlocks by scanning... Your blood vessels: The "G-Knot" unlocks by scanning biological information of its owner. The company G-Knot offers this wallet, in partnership with a Korean biometric security firm. Put on sale today, it analyzes the rhythm of your blood flow and the vascular architecture of your finger to unlock. In other words, it requires both the person's living index finger and a two-factor authentication code to open this wallet. The revolution is that no seed phrase is necessary. Furthermore, the company is currently working on a "multi-signature" system. This would allow the wallet to be locked until several people simultaneously validate its opening.

RippleX Head of Engineering J. Ayo Akinyele and outgoing Ripple CTO David Schwartz outlined how native staking could work on the XRP Ledger, while stressing that such ideas remain exploratory and complex. Akinyele said staking would require rethinking XRPL's fee-burning model to create a sustainable rewards pool, while balancing fairness, governance, and the network's long-standing design principles. "For holders, these models can offer a more direct way to participate in network governance, though they can also introduce new complexities around fairness and distribution," he said.

Adoption (Sentiment, Retail and Corporate Reserves):

Cash App, founded by Jack Dorsey, has expanded its features to allow Bitcoin payments via the Lightning Network as well as stablecoins. This evolution is part of the rise of the Lightning Network, already adopted by SoFi and Revolut, and complemented by Square, which now makes Bitcoin accessible in over 4 million US merchants.

This Monday, Strategy formalized the acquisition of 8,178 bitcoins, which constitutes its largest investment since last July. Being the largest acquisition since the 21,021 units on July 29, this brings Strategy's holdings to 649,870 bitcoins. This reserve thus weighs $61.9 billion, or 3.2% of BTC's market capitalization. To finance these new acquisitions, Strategy issued new interest-bearing preferred shares STRF, STRC, STRK, and STRE.

Funding and Partnerships:

Kalshi has partnered with Coinbase for the custody of the USDC stablecoin on its prediction market platform. Users can now deposit and transfer USDC, while these markets see their visibility increase thanks to their integration on Google Finance.

Grayscale, the world's largest asset manager specializing in cryptocurrencies, is preparing to go public soon. Several famous names are currently working on the file, such as Morgan Stanley, Bank of America, and Wells Fargo. When the project is finalized, Grayscale is expected to be listed on the New York Stock Exchange under the symbol GRAY. With over 40 products, Grayscale reported $35 billion in assets under management as of September 30 last year.

Ethena would be working on HyENA, a decentralized perpetual contract trading platform (perp DEX) built on Hyperliquid's HIP-3 model, with USDe as the sole collateral. This alliance would unite Ethena's stability with the power of the Hyperliquid engine, paving the way for a new generation of on-chain derivative products. A strategic collaboration that could mark a major turning point for DeFi in 2025. If this collaboration would be a turning point for Ethena, it also constitutes a major strategic step for Hyperliquid. Until now, the protocol had distinguished itself mainly through its technical performance and liquidity, but it still lacked an external reference partner to validate its HIP-3 model. With HyENA Trade, this is now done. HyENA becomes the first large-scale implementation of the HIP-3 standard, a format that allows third-party teams to build their own derivative platforms by relying on Hyperliquid's engine. It is a validation "in the real world," much more powerful than any announcement or testnet.

Mastercard chooses Polygon to extend its verified aliases to self-custodied wallets: The adoption of cryptocurrencies requires certain necessary evolutions to make their access simpler and mainstream. A dynamic driven by traditional players like Mastercard, which is behind an extension of its verified alias service to self-custodied wallets. "By streamlining wallet addresses and adding meaningful verification, Mastercard Crypto Credential enhances trust in digital token transfers. The specialized expertise of Mercuryo and Polygon with our infrastructure makes crypto assets more accessible and reinforces Mastercard's commitment to delivering secure, intuitive, and scalable blockchain experiences for millions of users worldwide." From a technical point of view, the Polygon Labs structure will be in charge of providing the necessary infrastructure with its blockchain. For its part, the company Mercuryo, specialized in crypto payment APIs, will onboard users on behalf of Mastercard Crypto Credential to issue the famous aliases, after having performed a full Know Your Customer (KYC) verification.

According to Fortune, Kraken raised $200 million from Citadel, Ken Griffin's fund, bringing its valuation to $20 billion. This fundraising follows a strong third quarter with $648 million in revenue and over $10 billion in volumes on xStocks in 135 days.

Revolut chooses Polygon as its main infrastructure for its crypto operations: For some time, the banking sector has been looking for effective and secure ways to offer crypto services to its clients. A dynamic also initiated by neobanks like Revolut, which has just chosen Polygon to host its payment, trading, and staking services. With this integration, Polygon aims to bring its crypto infrastructure to over 65 million Revolut users, spread across 38 countries. An ambition supported by its November results, which report over $690 million in volume processed via its blockchain ecosystem within the Revolut app, "demonstrating real adoption by an active user base."

France: Deblock raises €30 million to "build the first on-chain bank": Deblock, a French reference in the convergence between banking services and cryptocurrency, has raised €30 million. This is therefore the largest funding round in the history of crypto-banking. "This fundraising validates our vision: the bank of tomorrow will be on-chain, or it will not exist! Since our launch, we have proven that it is possible to combine the security of a regulated account with the power and transparency of decentralized finance. Users no longer want to choose between their bank and their crypto; they want both, in the same place, simply. We are going to massively democratize access to the best decentralized financial services, making them as simple to use as an instant transfer."

AI-native social engineering defense platform, Doppel, raises $70M in a Series C funding round led by Bessemer Venture Partners, with participation from a16z, South Park Commons, Sozo Ventures, and more. Crypto card and wallet project, Deblock, raises €30M in a Series A funding round led by Speedinvest, alongside Commerz Ventures and Latitude, among others. RWA-stablecoin incubator, Obex, raises $37M in a funding round led by Framework Ventures, LayerZero and Sky. MegaETH global leverage trading platform, HelloTrade, raises $4.6M in a seed round led by Dragonfly Capital, with support from Mirana Ventures and angel investors.

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.