Introduction

StarkNet is a layer 2 (L2) solution designed to bring scalability and privacy to the Ethereum blockchain.

This network uses zero-knowledge proofs, specifically a variant called STARK (Scalable Transparent Arguments of Knowledge), to achieve its goals.

Brief History:

StarkWare, the Israeli company behind StarkNet, was founded in 2018 by Eli Ben-Sasson and Uri Kolodny.

From the outset, StarkWare focused on developing STARK proofs and their application in blockchain scaling.

2019:

StarkWare raised $30 million in its first funding round, with notable investors such as Paradigm, Sequoia Capital, and Intel Capital.

2020:

StarkWare launched StarkEx, the first commercial solution based on STARK proofs. Various projects began using the protocol developed by StarkWare, the most well-known being dYdX, a decentralized exchange (DEX) platform where futures trading is possible.

2021:

Version 2 of StarkEx was released, introducing new features such as NFT transactions and payments. Several projects and platforms, including Immutable X (an NFT trading platform) and Sorare (a blockchain-based fantasy football game), integrated StarkEx to benefit from scalability and low transaction fees.

2022:

StarkWare launched StarkNet Alpha on the Ethereum mainnet. StarkNet gained attention from dApp developers due to its ability to process a large amount of information at a low cost.

2023:

The StarkNet Beta was launched, featuring improvements that increased its performance and functionality. StarkWare continued to forge partnerships to promote the adoption of StarkNet and StarkEx.

2024:

The STRK token was launched in February, with an airdrop to reward users and contributors to the ecosystem's development.

StarkWare solution:

StarkWare offers two main solutions:

StarkEx

StarkNet

Both solutions stem from the same observation: the Ethereum blockchain is not scalable, and its fees are too high. With only 15 transactions per second (TPS), Ethereum is neither known for being the fastest nor the most cost-effective chain.

To address this issue, the solutions provided by StarkWare operate as a layer 2 on top of the network founded by Vitalik Buterin. Indeed, by relying on the security and decentralization of the Ethereum network, the solutions developed on top of the main blockchain can focus their efforts on optimizing scalability.

StarkNet Solution:

StarkNet belongs to the broader family of rollups, which includes both optimistic rollups and ZK rollups.

Although their intrinsic operations differ, the underlying principle remains the same: move computations off-chain while keeping certain transaction data on-chain.

By offloading part of the computation and validation off-chain, the information retained on-chain is compressed to reduce its size and gas consumption.

How a Rollup Works:

Like other blockchains, particularly Ethereum, rollups operate using Merkle trees. Thus, all the data within a rollup must potentially be contained within a Merkle tree, which serves as the reference for the rollup's state.

Each rollup solution benefits from a smart contract that resides on the network's main chain, containing the rollup's root state, which effectively constitutes the contract's code. This state, considered valid, serves as the basis for evaluating future states.

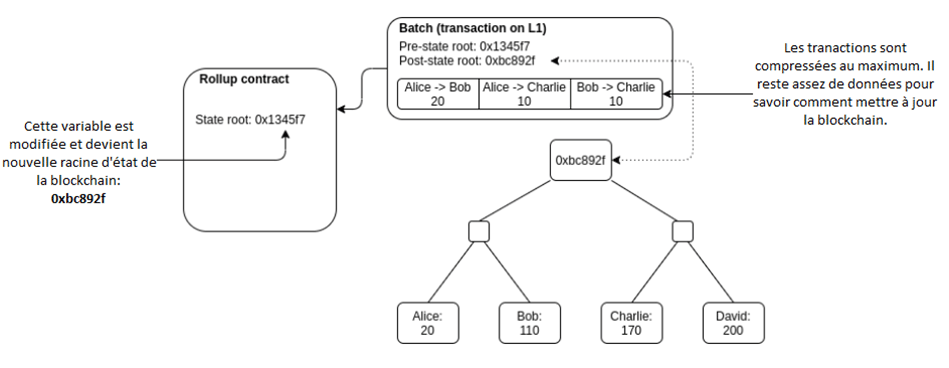

Figure 1: Publication of the state of a Rollup

Thus, only the root of the state is published on the main chain, and anyone can recalculate all the branches and leaves of this tree starting from this reference.

Figure 2: Publication of new transactions via a Rollup

When new transactions are recorded on the network's second layer, users can publish a block, which is a set of transactions in the form of a Merkle tree, as well as the root of the old and new states.

The Rollup smart contract on the chain will then verify the validity of the proposed root state and its previous state, and if they match, the new root state will become the current state of the Rollup.

ZK Proofs:

Zero-Knowledge Proofs (ZK-Proofs) are a cryptographic method that allows one party (the prover) to prove to another party (the verifier) that a statement is true without revealing any information beyond the truth of the statement itself.

These proofs are used to maintain confidentiality while ensuring the integrity and verifiability of the information.

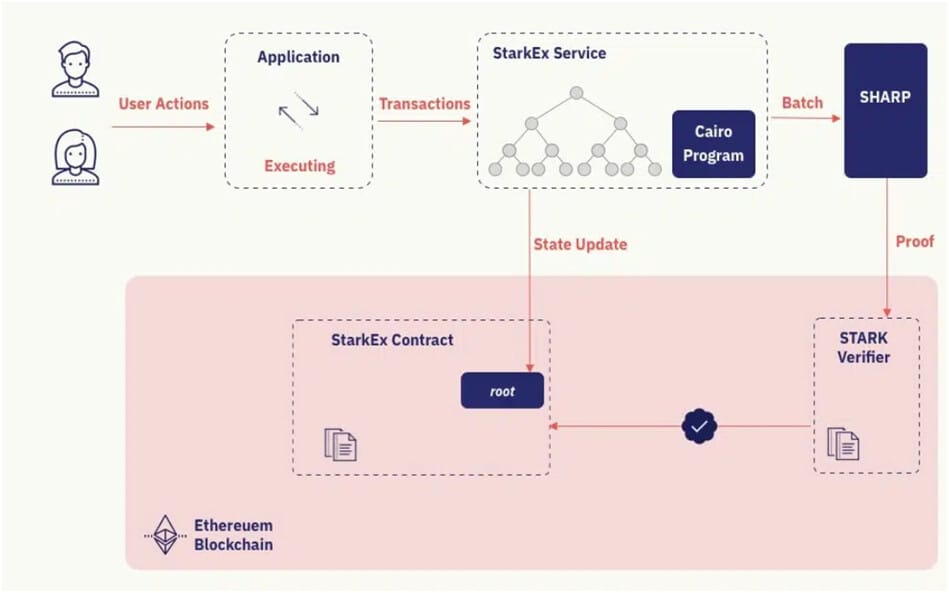

Illustration representing the path taken by a transaction on StarkNet

To illustrate a situation where such technology would be relevant:

Lisa wants to take out a loan to buy a car. The seller asks her to prove that she has at least $100,000 (it's a nice car, and Lisa isn’t new to a bull run!) in her bank account.

With ZK Proof technology, she can prove that she indeed holds the required amount without revealing the exact balance of her account.

Although the term ZK proof is fairly common in our ecosystem, it is important to note that this term is not always used correctly. In reality, a Zero-Knowledge Proof does not reveal any information about the calculation included in a transaction.

Currently, even though this is the goal, the technology is not fully developed. The term is thus somewhat of a misnomer.

What StarkNet offers is a validity proof (which guarantees the integrity of the calculation) called STARK.

STARKs:

STARKs (Scalable Transparent ARguments of Knowledge) are a subset of Zero-Knowledge Proofs designed to be particularly scalable and transparent.

Developed by Eli Ben-Sasson and his team, STARKs aim to address some of the challenges associated with other types of ZK-Proofs, such as SNARKs (Succinct Non-interactive Arguments of Knowledge).

Here are some of the advantages of STARKs:

Scalability:

STARKs are designed to be highly scalable, allowing for the efficient proof of large amounts of data. They can handle a high number of transactions, which is crucial for large-scale applications like blockchains.

Transparency:

Unlike SNARKs, STARKs do not require an initial setup with secret parameters that must be destroyed to prevent compromise. This lack of an initial setup makes STARKs more transparent and secure.

Quantum Resistance:

STARKs use cryptographic primitives that are considered resistant to attacks by quantum computers, making them more robust against future advances in cryptography.

Efficiency:

Although STARKs generate larger proofs compared to SNARKs, they are very efficient in terms of verification, making them suitable for applications requiring rapid validations.

Cairo :

The contracts and operating system on StarkNet are written in Cairo, which enables the deployment and scaling of any use case. Cairo is a new programming language described as "Turing-complete," referring to the expression "CPU Algebraic Intermediate Representation."

Cairo is optimized for ZK rollups. It allows you to do everything you can do on an EVM and much more, as the computations are significantly less costly.

This language opens the door to entirely new possibilities that were not previously feasible on blockchains, such as in the gaming sector with genuine blockchain games.

To avoid requiring developers to learn a new language, smart contracts developed for Ethereum can be converted into Cairo using a "transpiler," such as Warp from Nethermind, although they will not be fully optimized for StarkNet.

StarkEx: Private Version of StarkNet

StarkEx is a scaling solution tailored and built for specific DApps, including DEXs like dYdX or DeversiFi and NFT protocols like Immutable X.

StarkEx is essentially a permissioned version of StarkNet, customized for specific protocols, unlike StarkNet, which allows anyone to deploy smart contracts without permission.

StarkEx can currently be used in three modes:

zkRollup Mode: Data is aggregated in a rollup and published on-chain.

Validium Mode: Data is kept off-chain.

Volition Mode: Hybrid mode.

dYdX relies on zkRollup mode to provide fast and cost-effective crypto transactions for its traders, while DeversiFi, Immutable X, and Sorare use Validium mode. This is made possible by Cairo, the programming language used by Starkware products. Additionally, the SHARP (Shared Prover) technology ensures that gas costs between transactions in a batch can be shared, resulting in very low gas fees.

Tokenomics:

The StarkNet token, STRK, has several uses:

It can be used to pay transaction fees.

It can be staked to secure the network and earn rewards.

It is used for project governance, including voting on various updates.

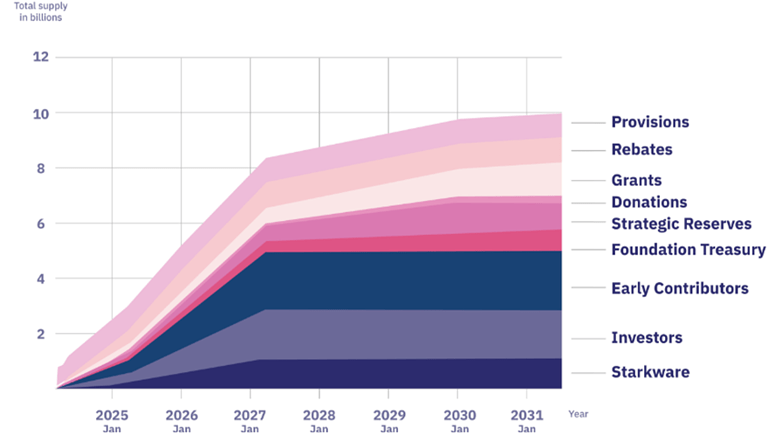

Out of the total supply of 10 billion, only 1,300,311,845 tokens are in circulation.

These figures might signal a high inflation risk for the token, as only 13% of the supply has been released. Therefore, substantial selling pressure can be expected during upcoming token releases.

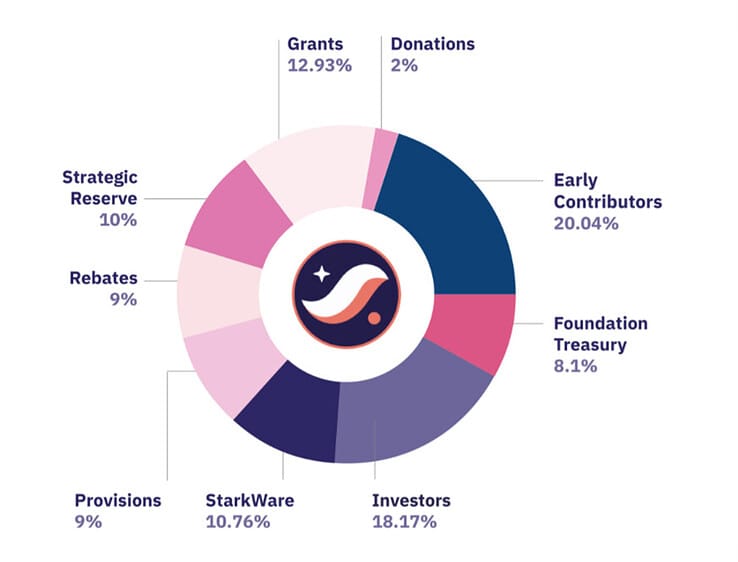

Token Distribution for STRK:

20.04%: Early Contributors

Tokens allocated to StarkWare team members and early contributors. These tokens are subject to a vesting schedule, as detailed below.18.17%: Investors

Tokens allocated to StarkWare investors. These tokens are subject to a vesting schedule, as detailed below.10.76%: StarkWare

Tokens allocated to StarkWare for operational services such as paying fees, providing other services on StarkNet, and engaging other service providers.12.93%: Grants, including Development Partners (PD)

Tokens allocated for grants to support research or work done to develop, test, deploy, and maintain the StarkNet protocol.9.00%: Community Provisions

Tokens distributed to those who have contributed to StarkNet and supported or developed its underlying technology.9.00%: Community Discounts

Tokens allocated for StarkNet discounts to partially cover the costs of integrating with StarkNet from Ethereum.10.00%: Strategic Reserves of the Foundation

Tokens allocated to the StarkNet Foundation to fund ecosystem activities aligned with the Foundation's mission.8.10%: Foundation Treasury

Tokens allocated to the StarkNet Foundation's treasury available for operations and future initiatives.2.00%: Donations

Tokens reserved for donations to institutions and organizations such as universities, NGOs, etc., as decided by the StarkNet Foundation.

Up to 0.64% (64 million tokens) will be unlocked on the 15th of each month, starting from April 15, 2024, until March 15, 2025, totaling 7.68% (768 million tokens) unlocked by March 15, 2025.

Up to 1.27% (127 million tokens) will be unlocked on the 15th of each month, starting from April 15, 2025, until March 15, 2027, totaling 30.48% (3.048 billion tokens) unlocked by March 15, 2027.

STRK Token Unlock Schedule:

The Team:

Among the leadership members, we have Eli Ben-Sasson, the co-founder and current CEO of StarkWare. He has been researching cryptographic proofs and zero-knowledge proofs of computational integrity since earning his Ph.D. in theoretical computer science from the Hebrew University in 2001.

Eli is the co-inventor of the STARK, FRI, and Zerocash protocols and the founding scientist of Zcash. Over the years, he has held research positions at the Institute for Advanced Study in Princeton, Harvard, and MIT, and more recently, he was a professor of computer science at the Technion before leaving to co-found StarkWare.

In the scientific advisory team, we find highly qualified individuals who have graduated from prestigious institutions and work at universities such as Harvard or MIT. Many of them have been awarded prizes for their respective work.

Among them is Alessandro Chiesa, also a co-founder of StarkWare. Alessandro is a faculty member in computer science at the University of California, Berkeley.

His research spans complexity theory, cryptography, and security, focusing on the theoretical foundations and practical implementations of short and easily verifiable zero-knowledge proofs.

He is the co-inventor of the Zerocash protocol and the author of libsnark, the leading open-source library for succinct zero-knowledge proofs. Alessandro is also one of the founding scientists of Zcash. He holds a bachelor's degree in computer science and mathematics and a Ph.D. in computer science from MIT.

Partnerships and Fundraising:

In its various fundraising rounds, StarkNet has raised over $282 million, which is substantial.

Leading players who participated in these rounds include Pantera, Polychain Capital, Consensys, Coinbase Ventures, Paradigm, Sequoia, 3AC, and Alameda Research, to name a few.

Among the early investors are the Ethereum Foundation and Vitalik Buterin.

Conclusion:

In conclusion, StarkWare offers two alternatives: StarkEx and StarkNet. The former is a permissioned version of StarkNet, while the latter allows anyone to deploy smart contracts without permission.

Both solutions address the same challenge: scaling Ethereum. To tackle the blockchain trilemma, StarkWare provides a Layer 2 solution based on ZK proofs, specifically through its STARK technology.

With a talented team and significant resources, StarkWare is well-positioned to revolutionize the field of cryptography. Many players in the crypto ecosystem, including major investment funds and figures like Vitalik Buterin, the founder of Ethereum, place high hopes in this technology.