Introduction

Intro: Discover the ecosystem around Mantra, or rather the OMniverse. Founded in 2020 by John Patrick Mullin, the project revolves around four main pillars that we will discuss below. The Mantra ecosystem is multi-chain, initially launched on the Ethereum network, it has integrated Binance Smart Chain (BSC), Polkadot, and the Mantra Chain strives to develop products for Cosmos.

What Mantra Offers: Mantra is a vertically integrated blockchain ecosystem. The OMniverse Mantra includes:

The Mantra DAO (Decentralized Authorized Organization)

Mantra Chain

Mantra Finance

Mantra Nodes

Architecture:

Mantra Chain: Mantra Chain is built on the Cosmos SDK (Software Development Kit) because Cosmos aims to be the "Internet of Blockchains" by creating a network of independent blockchains. These independent blockchains are called "zones" and are powered by Byzantine Fault Tolerant (BFT) consensus protocols like Tendermint, the blockchain engine of Cosmos.

The Principle of Byzantine Faults

Let's dive into a bit of theory to explore or revisit one of the main problems a blockchain can encounter!

The Byzantine Generals' Dilemma presents the problem of coordination among multiple generals positioned at different locations around a city they wish to besiege.

Each general must decide whether to attack or retreat, and this decision must be mutual and executed in sync. Communication difficulties arise because messages between generals are sent via messengers, who can be delayed, destroyed, lost, or even falsified by malicious generals.

In the context of blockchains, each general represents a network node, and the nodes must reach a consensus on the state of the system. To avoid failure, at least ⅔ of the nodes must be reliable and honest. If the majority of nodes act maliciously, the system is vulnerable to failures and attacks, such as the 51% attack.

Byzantine Fault Tolerance (BFT)

In brief, Byzantine Fault Tolerance (BFT) characterizes a system capable of withstanding the range of failures derived from the Byzantine Generals Problem. This means that a BFT system can continue to function even if some of its nodes fail or act maliciously.

Let's close our parenthesis on the Byzantine Generals and dive back into the OMniverse!

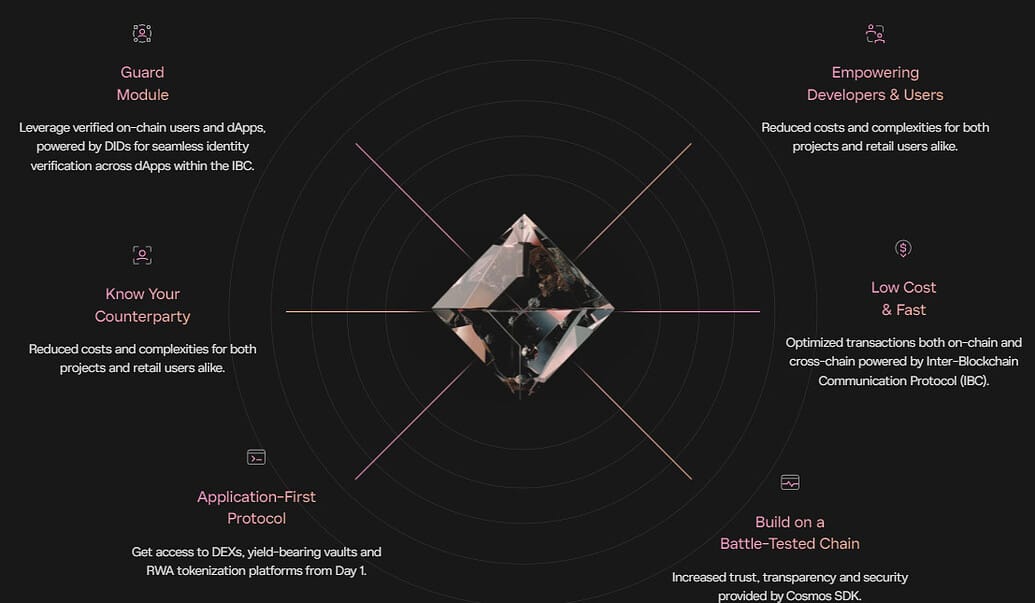

Mantra starts with a theory: future regulations will primarily focus on the application layer rather than the protocol layer. Therefore, it makes sense to create a protocol that supports a variety of regulated activities.

Mantra Chain is interoperable with other blockchains in the Cosmos ecosystem through the IBC (Inter-Blockchain Communication) module.

It offers development tools and the ability to create anything from games to Web3 applications, including secure and decentralized exchanges (DEX). Recently, it has been focusing its efforts on a promising market: Real-World Assets (RWA).

Indeed, the Real World Asset (RWA) sector seems to be on the rise. Mantra Chain is positioning itself by enabling builders to rely on its technology and expertise in legal compliance.

The network is also EVM (Ethereum Virtual Machine) compatible.

Mantra Chain also uses a powerful decentralized identification (DID) module for all KYC (Know Your Customer) and AML (Anti-Money Laundering) needs. The module facilitates the development of products that utilize enhanced features and ecosystems.

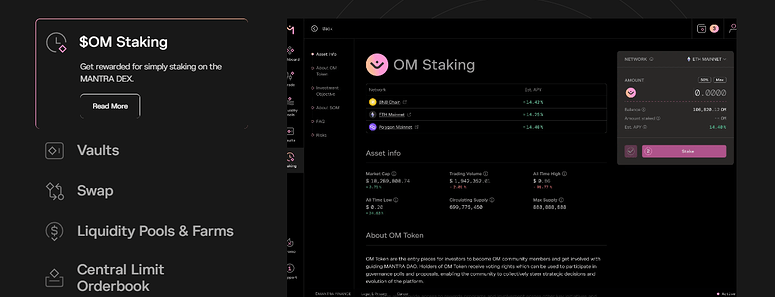

Mantra Finance: Mantra Finance aims to be a platform that brings the speed and transparency of DeFi (decentralized finance) to the established but opaque world of TradFi (traditional finance).

The platform will allow users worldwide to trade, issue, and earn digital assets in a non-custodial and permissionless manner.

According to the roadmap (discussed at the end of this post), the full range of products that Mantra Finance aims to offer should be available by the end of the year. As of the time of writing (July 2024), staking and vaults are already accessible.

While these products are being rolled out throughout the year, Mantra Finance is also seeking to obtain licenses in the United Arab Emirates, Latin America, and other regions of the world.

Additionally, Mantra aims to leverage the licenses already obtained by SOMA.finance in the United States, another DeFi platform founded by John Patrick Mullin.

Mantra DAO: Since its inception, Mantra has always focused on engaging its community at every stage, and its transparent governance mechanism is the core that brings people together.

To reach a broader community beyond the OMniverse and Sherpas (users who have set up a wallet on the Mantra Chain, excluding validators and developers), the Mantra DAO strives to bring these principles and structures to other projects and their many protocols.

The Mantra DAO governs the various protocols of the OMniverse, granting governance power to token holders. With OM tokens, it is possible to propose or vote on future implementations.

MANTRA Nodes: The Mantra Nodes are the cornerstone of the vertically integrated stack that forms the foundation of the OMniverse.

The primary function of node operations is to generate revenue for the company and grow the Sherpa community's assets by offering more yield opportunities across multiple blockchains.

Additionally, these validation nodes support Mantra in establishing a presence on new and emerging blockchain networks and expanding into a larger institutional space as an ecosystem. This also opens up opportunities to extend Mantra's multi-chain DeFi ecosystem.

Mantra Nodes also offers Infrastructure as a Service (IaaS), meaning it can set up validation node operations for institutions and individuals.

The range of services offered by Mantra Nodes includes node management, staking for individuals (on-chain and off-chain), institutional nodes, and the development and deployment of cloud/white-label nodes.

The Team:

Founder and CEO of Mantra

John Patrick Mullin is an entrepreneur specializing in DeFi and digital assets. He is the CEO and co-founder of MANTRA and SOMA.finance. Mullin has been investing and building in the cryptocurrency space for over 10 years.

He holds a degree in International Business from SLU-Madrid and discovered Bitcoin in 2013. He also has a dual master's degree in Management from the European Business School in Wiesbaden and in Economics from Tongji University in Shanghai.

After his studies, Mullin worked as a senior research analyst at a major Chinese state bank, where he focused on emerging technologies such as blockchain and FinTech. He also founded a FinTech community in Shanghai. This experience led him to leave banking to co-found a cryptocurrency exchange project in Hong Kong.

Since then, Mullin has founded MANTRA, a blockchain for the tokenization of Real World Assets (RWA), and SOMA.finance, a regulated DeFi application in the United States. As an educator and speaker, he has lectured at prestigious universities such as Harvard, London Business School, the National University of Singapore, and Peking University.

Core Team of Mantra

Jayant Ramanand is the co-founder of Mantra. He has previously worked in the technology sector in India, where he held high-responsibility roles. With over 10 years of experience in the tech industry, Jayant has also produced content about DeFi on YouTube.

Charu Pareek is the Product Lead of Mantra Chain. She has previously worked for major banks, including HSBC as a senior consultant, and later at Mox Bank, where she held a position close to senior management.

Matthew Crooks serves as the Chief Technology Officer (CTO) at Mantra Chain. With over 25 years in the technology sector, he specializes in insurance and financial services. He has created, launched, developed, and sold several companies. His expertise spans both technical and strategic domains.

Fundraising:

Mantra DAO has raised funds several times. In 2020, at its initial launch, the company raised about $5.9 million through a token sale. More recently, in March 2024, Mantra Chain, a branch of Mantra DAO focused on real-world asset tokenization, raised $11 million to develop a network centered on real assets within the Cosmos ecosystem. This fundraising effort was particularly aimed at securing regulatory approvals in the Middle East.

Partners:

Among Mantra Chain's partners, it’s no surprise to see Keplr, the most popular decentralized wallet in the Cosmos ecosystem.

We also have, among others, SwissBorg, a Swiss crypto exchange platform.

Chainlink, a leading oracle network is another key partner.

Additionally, we can see the presence of Ondo Finance, a protocol enabling the tokenization of U.S. bonds that collaborates with BlackRock, often considered the world's largest investment management firm.

Recently, Ondo announced its intentions to integrate its products into the Cosmos ecosystem.

Tokenomics:

On the beautiful, colorful chart above, you can admire the initial distribution of the 888,888,886 tokens as follows:

8.5% of the total supply, or 75,555,555 OM, was allocated to the public sale (all of which have been released to date).

9% of the total supply, or 80,000,000 OM, was allocated to the private sale (all of which have been released to date).

17.5% of the total supply, or 155,555,555 OM, was allocated to the team and advisors (all of which have been released to date).

30% of the total supply, or 266,666,666 OM, is reserved for staking rewards (most of these tokens have been unlocked, with full unlocking expected in about 400 days).

12.5% of the total supply, or 111,111,111 OM, is allocated for marketing purposes (most of these tokens have been unlocked, with full unlocking expected in about 400 days).

10% of the total supply, or 88,888,888 OM, serves as a reserve for Mantra DAO (most of these tokens have been unlocked, with full unlocking expected in about 400 days).

12.5% of the total supply, or 111,111,111 OM, is designated for Mantra DAO grants (these are only unlocked if there is a governance vote from the community in favor).

Roadmap:

The project appears to be delivering on its promises and meeting its deadlines. Indeed, the OM token can be found on major exchanges, including Binance, Uniswap, and OKX.

It will be interesting to monitor Mantra’s future licensing acquisitions and their impacts. Similarly, keeping an eye on the development of Mantra Finance will be important to see if the planned implementations will significantly affect the Total Value Locked (TVL).

Conclusion:

In conclusion, Mantra is establishing itself as a key player in the blockchain landscape with its integrated and diverse ecosystem. From Mantra Chain to the DeFi platform, including the DAO and Mantra Nodes, each component plays a crucial role in delivering innovative and transparent solutions.

The vision and commitment of the team, led by John Patrick Mullin, ensure ongoing growth and adaptation in an ever-evolving sector.