Introduction

A stablecoin is a digital asset whose value is linked to a stable underlying asset, such as a fiat currency, a commodity, or even a set of assets.

The primary goal is to reduce price fluctuation and ensure stability in a crypto market that is often characterized by strong variations.

As a result, the connection between cryptocurrencies and DeFi has become essential through stablecoins. Unlike "classic" cryptocurrencies such as Bitcoin or Ethereum, which can experience high volatility, stablecoins are designed to maintain a constant value.

There are mainly three types of stablecoins, each using a different method to ensure price stability:

Stablecoins backed by fiat currencies

Stablecoins backed by cryptocurrencies

Algorithmic stablecoins

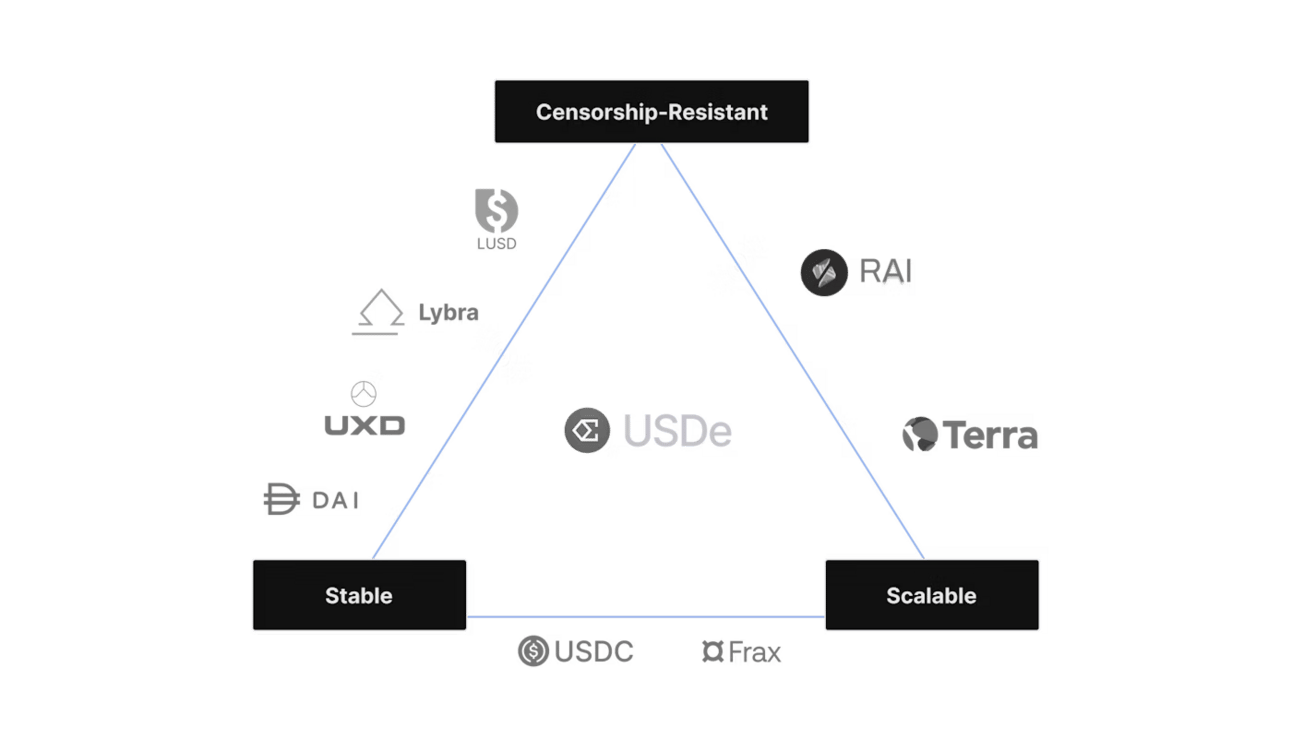

Stablecoin Trilemma

What is the Ethena project?

The Ethena project is an innovative platform in the DeFi space operating on Ethereum, centered around the creation of a synthetic stablecoin called USDe.

This particular stablecoin stands out for its ability to offer stability against cryptocurrency fluctuations while generating yields through complex strategies, notably through delta-neutral positions (we’ll revisit this concept later).

Ethena has quickly established itself as a key player in this ecosystem, drawing considerable attention with a TVL of over $2.5 billion at the time of writing.

Ethena is now among the Top 10 most-used DeFi protocols (across all sectors, including restaking, DEXs, etc.):

This project was designed to meet the growing demand for high-performing stablecoins in a highly volatile environment.

The stablecoin market is quite lucrative, which is why many initiatives are being launched in this area. You've likely already heard about the record profits of the company Tether. It's easy to understand why being positioned in this business is so enticing.

Moreover, DeFi has brought a fresh approach to managing money with increasingly intricate and complex strategies. DeFi intersects with the boundaries of traditional finance, where companies leverage it to structure products resembling real-world assets, such as U.S. Treasury bonds.

All these economic combinations attract companies and investors because they know that attractive returns can be associated with these risky strategies.

Structure and Functioning of Ethena

Main Mechanisms

The core of the Ethena project is based on three main mechanisms that enable the USDe to maintain its stability while generating yields for its users.

Overcollateralization

To keep the USDe stable, it is overcollateralized. This means that each dollar in circulation is backed by a higher value in cryptocurrencies deposited in liquidity pools.

This overcollateralization acts as a safeguard, absorbing market fluctuations and theoretically preventing the USDe from losing its peg to the U.S. dollar.

Algorithmic Adjustments

The price of the USDe is constantly monitored by market algorithms. These algorithms intervene automatically when the USDe price begins to fluctuate from its dollar peg, aiming to bring it back to the target value of $1. There are two possible scenarios:

When the price of USDe drops, the algorithms sell cryptocurrencies from the liquidity pools to buy circulating USDe. This reduces the available supply of USDe, and following supply and demand principles, its price will rise.

If the USDe price exceeds $1, the algorithms create new USDe and sell it on the market, increasing the USDe supply and thus lowering its price.

Market Incentives

Users can acquire USDe by exchanging other stablecoins or by providing collateral (such as stETH). This process generates a temporary price discrepancy, quickly corrected by market participants who rebalance the liquidity.

Users can then stake their USDe to receive sUSDe, a mirrored token representing the deposit, which accumulates yields. These yields come from Ethereum staking income and payments from derivative markets where Ethena places short positions on ETH.

This structure allows Ethena to generate risk-adjusted yields, which is particularly appealing in a low-yield environment.

Creation of USDe

Stablecoins are essential in our crypto ecosystem, and Ethena positions its own as the ultimate stablecoin, offering resistance to censorship while being stable and scalable.

Stablecoin Trilemma - Ethena version

Sometimes, charts and tables are much better than lengthy explanations, so here is a summary table comparing the advantages of USDe against other stablecoins.

Summary Table of Differences Between Stablecoins - Ethena’s Perspective

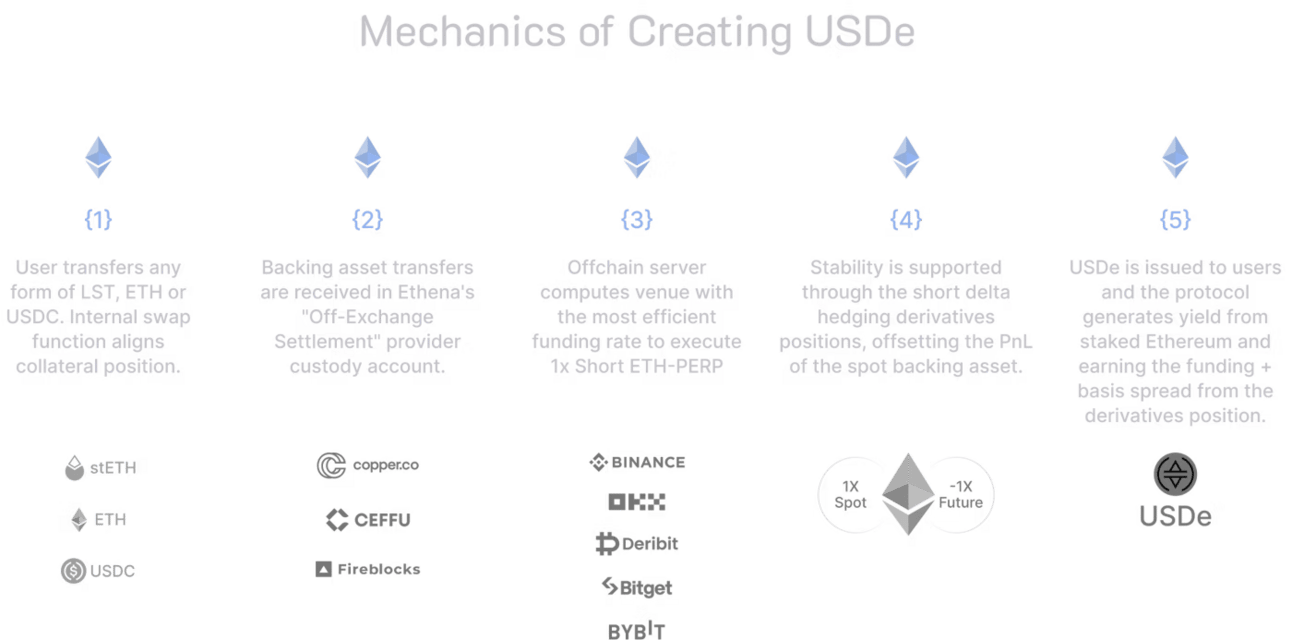

The process of creating USDe involves several steps, which are presented below:

Diagram of Ethena's Process for Creating USDe

The user begins by depositing collateral in the form of LST in ether, native ETH tokens, or stablecoins (e.g., USDC). By using perpetual futures on DEX and/or CEX, Ethena uses this collateral to short ETH.

Ethena directly deploys the collateral into an "off-exchange partner" account (settlement provider) to avoid risks associated with traditional centralized exchanges. These actors allow Ethena to delegate or offload assets for derivative positions under all market conditions, without waiting as a regular user would. These operations generally take a few seconds and cost the Ethena protocol nothing.

Ethena then opens a short position on ETH/USD on its associated partner markets.

The delta-neutral position between the spot ETH and the short ETH on the derivative markets ensures a 1:1 peg with USD, providing Ethena the ability to hedge against ETH price fluctuations and maintain the parity between USDe and the dollar.

Subsequently, an equivalent amount of USDe tokens is minted and transferred to the user's account, who can then stake them to receive new sUSDe tokens, known as Ethena Staked USDe.

What does the term "Internet Bond" mean?

When a user provides liquidity to a company or entity, it constitutes a bond in the traditional world. In return, the liquidity provider will receive regular payments in addition to the loan's interest, allowing them to make some profits.

With Ethena, it is possible to borrow USDe from the protocol or contribute in other ways by depositing liquidity into the protocol by staking their USDe. These USDe stakers thus benefit from a share of the platform’s revenue. This is therefore a form of commitment that the project has designated as the "Internet Bond."

"The Internet Bond will merge the yield derived from staked Ethereum with the funding and the basis spread of perpetual and futures markets, to create the first crypto-native on-chain ‘bond’ serving as a savings instrument denominated in dollars for users in authorized jurisdictions." (Ethena Whitepaper)

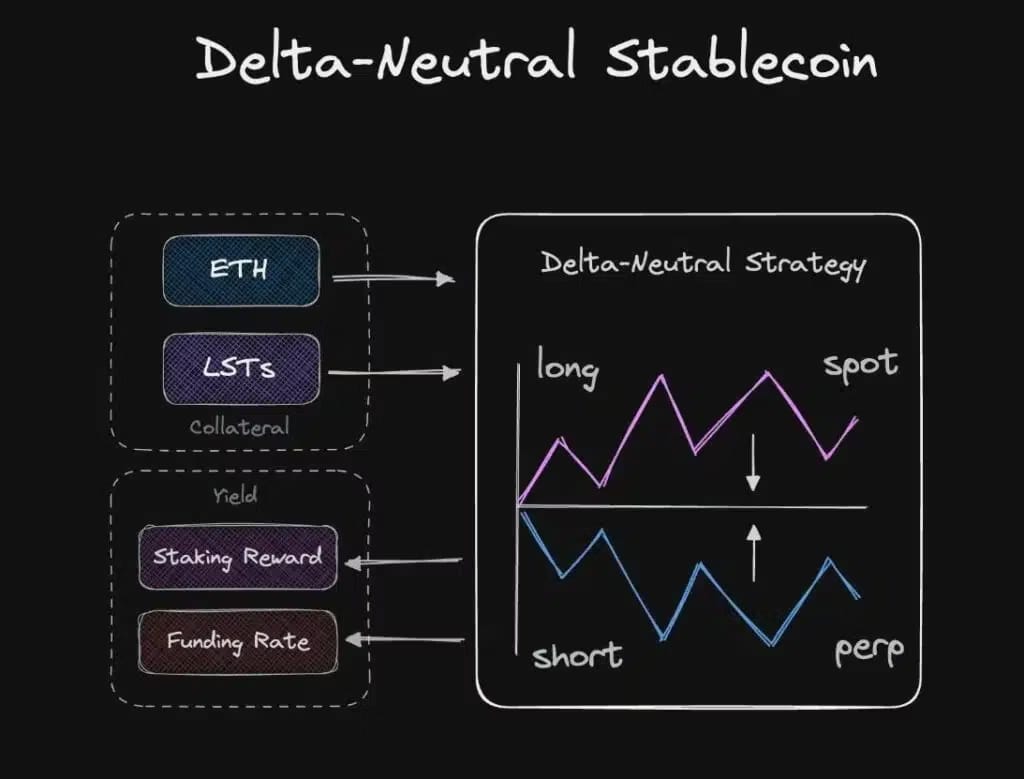

The "Delta-Neutral" Strategy

Characteristics of the Delta-Neutral Model

The term "delta" refers to the sensitivity of the derivative contract to fluctuations in the underlying asset’s price. The "Delta-Neutral" model used by Ethena for its USDe aims to minimize risks related to the price volatility of Ethereum. Here are its key characteristics:

Hedging Against Price Fluctuations: When a user deposits ETH as collateral to generate USDe, Ethena automatically opens a short position on ETH through external partners, outside of exchanges. This short position aims to offset potential losses if the price of ETH falls. This mechanism acts as a "Hedge," similar to the f(X) protocol mechanism presented on CR.

Neutral Ratio: The user’s ETH deposit, held in "spot" by the protocol, combined with the short position, creates a ratio that targets neutrality. This mechanism gives the "Delta Neutral" model its name, contributing to the stability of the USDe.

Risk Management: Ethena uses delta hedging to achieve delta neutrality, maintaining portfolio value stability despite ETH price fluctuations. This strategy involves taking short positions on ETH or derivative products tied to ETH to offset potential value losses.

Returns for Users: Ethena shares the benefits from Ethereum staking and hedging with users, rewarding them with USDe proportional to the amount of Ethereum they provide. This yield is variable and depends on market conditions.

Partial Decentralization: While the USDe aims to be a decentralized stablecoin, it relies on external partners for managing short positions and "custodians" like Copper and Ceffu for asset security (see the USDe section diagram). Ethena employs an "Off Exchange Settlement" (OES) mechanism to minimize reliance on exchanges.

Limited Transparency: The use of external partners and off-chain asset management raises transparency concerns. Ethena addresses this by providing legal attestations confirming asset holdings by custodians and exploring zk-SNARK technology to prove system solvency without revealing sensitive information.

Market Conditions Dependency: The "Delta Neutral" model is effective in bullish markets with positive funding rates. However, during market downturns and negative funding rates, the profitability and stability of the system may be tested.

Insurance Fund: Ethena has an insurance fund, financed by a portion of system yields, to compensate for negative funding periods and act as a last-resort buyer in case of a USDe price drop. However, part of this fund is exposed to USDe in liquidity pools, making it vulnerable if USDe loses its peg.

In summary, Ethena’s "Delta-Neutral" model is a complex system designed to stabilize USDe by using short positions on ETH. While it offers advantages in terms of stability and potential yield, it carries risks tied to market conditions, limited transparency, and the system's complexity.

What is meant by the concept of Delta-Neutral Stability?

A portfolio can be considered "Delta-Neutral" when its delta is 0. This means that the portfolio is not exposed to price fluctuations of the underlying asset.

For example, if Ethena naturally has a positive delta of 1 ETH from a user who stakes 1 ETH, and Ethena takes a short position on a perpetual contract with a position size equal to 1 ETH, the delta of Ethena's portfolio would be 0. This neutrality in delta ensures that the portfolio is not affected by price changes of the underlying asset, in this case, ETH.

When a portfolio is Delta-Neutral, its value in USD remains constant regardless of market conditions (i.e., no matter how much the price of ETH changes).

The price of ETH might triple and then drop by 90% in the next moment, but this would not impact the portfolio's USD value (except for temporary fluctuations between the spot and derivative markets).

Indeed, the tripling of the price of 1 ETH perfectly offsets the losses from the short perpetual position of equal size.

Key Revenue Sources for Ethena

Ethena generates revenue from two distinct sources: Liquid Staking and Funding on Short Positions. Here’s an overview of these principles:

Liquid Staking of ETH: Ethena stakes the ETH deposited by users on liquid staking platforms like LidoDAO. These platforms offer returns in exchange for locking ETH to validate transactions on the Ethereum network. A portion of these earnings is shared with USDe stakers.

Positive Funding on Short Positions: Ethena uses the deposited ETH to open short positions in the derivatives market, betting on ETH price declines. When these short positions generate "positive funding" (i.e., traders betting on a price increase pay fees to those betting on a decrease), these earnings are distributed to USDe stakers.

These two revenue streams are considered sustainable and exogenous, meaning they don’t rely on inflation of the native protocol token. They allow Ethena to offer attractive returns to USDe holders while contributing to the stability of the stablecoin.

Differences Between Ethena and Terra Luna

Given the past issues with algorithmic stablecoins, we must compare Ethena with Terra Luna.

Ethena presents several arguments to differentiate its protocol from Terra Luna, particularly in terms of collateral nature, stability mechanisms, and risk management. Here’s a breakdown for critical analysis:

Collateral Nature:

Ethena: USDe is backed by a basket of crypto assets, primarily Ethereum. Ethena uses short positions on ETH to hedge against price volatility.

Terra Luna: The UST stablecoin was algorithmically pegged to the LUNA token. The system relied on arbitrage between UST and LUNA to maintain stability.

Stability Mechanisms:

Ethena: Uses the Delta-Neutral model to minimize ETH price volatility impact.

Terra Luna: Relied on an algorithm adjusting the supply of LUNA and UST to maintain UST's stability. This system was vulnerable to attacks and loss of confidence, as seen with the collapse of the Terra ecosystem.

Risk Management:

Ethena: Highlights several risk management measures, including the use of regulated "custodians" for asset storage, an insurance fund to cover potential losses, and exploring zk-SNARKs for enhanced transparency.

Terra Luna: Lacked robust security mechanisms for extreme market events. The system's heavy reliance on arbitrage between UST and LUNA, combined with insufficient reserves, made it susceptible to collapse.

Decentralization:

Ethena: While using external partners for short position management and asset custody, Ethena promotes its decentralized nature, with users able to acquire USDe on the secondary market without permission.

Terra Luna: While marketed as decentralized, the system was heavily controlled by the Luna Foundation, raising concerns about its true decentralization.

Response to Criticism:

Ethena: Ethena Labs acknowledges concerns about similarities with Terra Luna and aims to address them by emphasizing key differences in collateral nature and risk management mechanisms.

Terra Luna: Prior to its collapse, the Luna Foundation downplayed criticisms about system risks and dismissed comparisons to other failed algorithmic stablecoins.

Ethena Labs distinguishes itself from Terra Luna by offering a more diversified collateral, more robust stability mechanisms, better risk management, and greater decentralization.

However, it’s important to note that, like any algorithmic stablecoin, USDe carries inherent risks. The complexity of the system and its dependence on market conditions require thorough analysis before making any investment.

Tokenomics and Governance

ENA Token

In April 2024, the project launched its governance token, ENA, which enables users to participate in key decisions regarding the protocol.

The ENA token plays a central role in the future expansion of the protocol, with incentives and decentralized governance.

However, there is no innovative utility to the token, as it is quite standard.

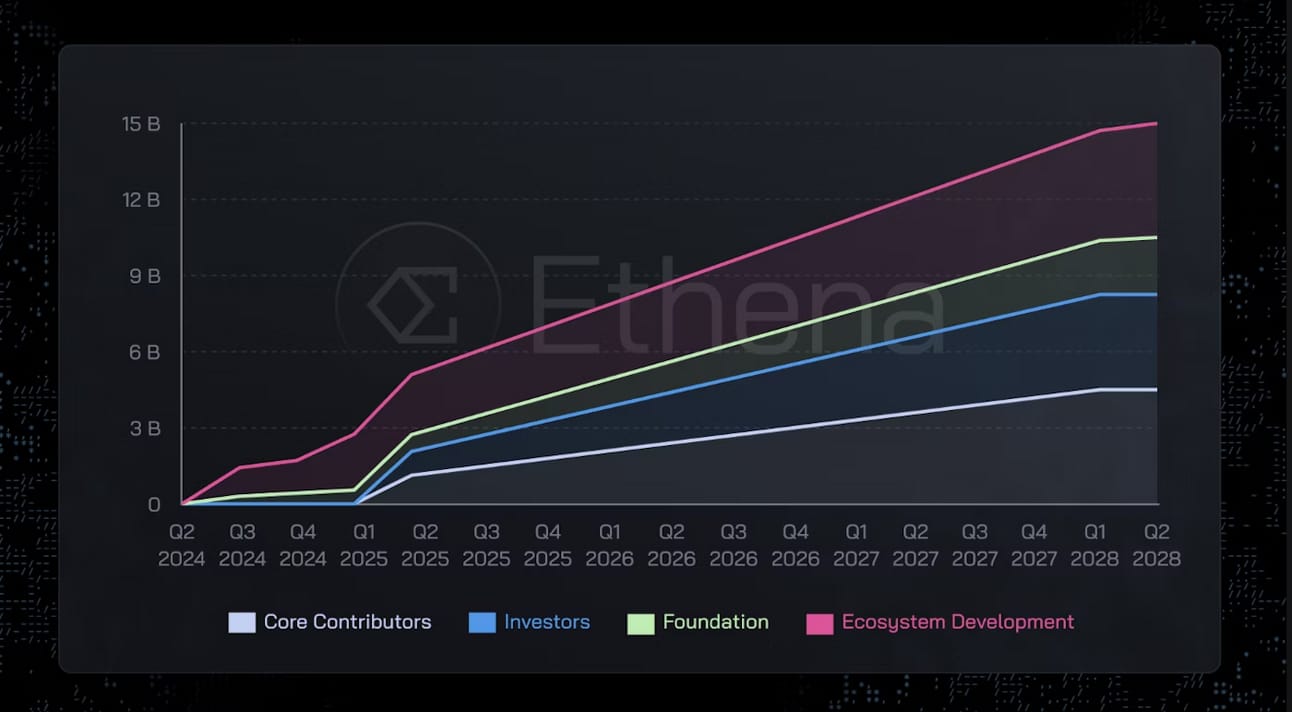

Tokenomics

The initial circulating supply was 1.425 billion tokens, with 750 million tokens (5% of the total supply) allocated to the first airdrop in 2024.

Today, 2.75 billion ENA tokens are in circulation. The distribution of the allocations is as follows:

Main Contributors: 30% of the $ENA tokens, with a one-year cap and a 3-year lock-up period with monthly unlocks.

Investors: Hold 25% of the $ENA tokens, with a one-year cap and monthly unlocks.

Foundation: 15% allocated to the foundation.

Ecosystem Development: 30% dedicated to ecosystem growth, including funding various initiatives.

Token Release Schedule

I'm not a big fan of the tokenomics, where a large portion is held by 55% of the project's supporters, including core contributors and investors. This leaves little room for diversification among the actors in the Ethena ecosystem.

On the other hand, I want to raise your awareness regarding the release schedule, as the token inflation is expected to increase with the massive release of tokens in the coming years, all the way until 2028.

If you hold ENA tokens for the long term, this is an important factor to consider, especially if you're expecting significant performance. The selling pressure will be very high, at least in the short/medium term.

Fundraising and Partnerships

Fundraising

Ethena has successfully raised funds several times since its creation in 2021. The project raised $6.5 million from DragonFly Capital and OKX Ventures in July 2023.

Ethena also raised funds from Binance on February 15, 2024, though the amount has not been disclosed.

Arthur Hayes, one of the co-founders of BitMEX, also supports the project and is among the early investors in Ethena, alongside ByBit, Deribit, Synthetix, Aave, Curve, and Frax.

Partnerships

2024 has been a productive year for the Ethena project, as it recently announced a partnership with BlackRock and introduced a new stablecoin, UStb, backed by BlackRock’s tokenized BUIDL fund, which primarily invests in U.S. Treasury bonds.

Ethena emphasizes that the addition of UStb, backed by a less volatile asset than ETH, can provide additional protection against unfavorable market conditions. Moreover, its backing by BlackRock’s tokenized liquidity fund offers increased stability and a different risk profile compared to USDe. This diversification aims to ensure the project’s sustainability, even in the event of unfavorable market conditions for USDe.

History and Team of the Project

Founded in 2021 by a team with significant experience in the web3 and blockchain space, Ethena quickly gained the attention of investors during its ICO.

The team behind Ethena consists of individuals with extensive backgrounds in both blockchain and traditional finance. They bring valuable expertise to the project through their experience at well-established companies.

Guy Young is the founder and CEO of Ethena Labs. His background at Cerberus Capital Management provides him with a sharp understanding of markets and economic mechanics from the traditional finance sector.

Alex Fowler is the Chief Operating Officer at Ethena Labs. He plays a key role in the daily operations and strategic growth of the Ethena platform, connecting users, miners, and investors.

Conor Ryder is the Head of Research at Ethena Labs. He has analyzed the cryptocurrency market for several years, holds a background in traditional finance, and is a CFA charterholder.

It is important to note that while the team’s quality is promising, it does not guarantee Ethena’s success. The project's success will also depend on the robustness of its underlying technology, the effectiveness of its marketing strategy, and the team’s ability to adapt to the rapidly changing cryptocurrency market.

Conclusion:

Algorithmic stablecoins are still a relatively new technology that has not been tested over the long term. There are risks associated with using any algorithmic stablecoin, including:

Risk of losing parity: The price of an algorithmic stablecoin may diverge from its nominal value if the algorithmic adjustment mechanism does not function correctly.

Risk of hacking: Algorithmic stablecoins can be hacked, potentially leading to the loss of user funds.

Regulatory risk: Governments in different countries may regulate or even ban algorithmic stablecoins in the future.

It is important to fully understand these risks before acquiring USDe or any other algorithmic stablecoin.

As you may know from the experience with UST Luna and its disastrous outcome, this type of project remains risky, even though Ethena has implemented measures to prevent any issues similar to Luna's.

Despite concerns from the community, Ethena's USDe has managed to carve out a place in the stablecoin landscape since the summer of 2024.