Introduction

Chainlink is an innovative platform that plays a crucial role in the smart contract ecosystem.

Launched in 2017 by Sergey Nazarov and Steve Ellis, Chainlink aims to solve a fundamental problem of smart contracts: their inability to access external data outside the blockchain.

By securely and decentralizedly connecting smart contracts to external data sources, Chainlink opens new perspectives for more robust and diverse blockchain applications.

Problem: Smart Contract Connectivity

A smart contract is defined as a digital agreement that has been rendered tamper-proof by being executed on a decentralized network of nodes, creating a more reliable form of digital agreement.

The problem with smart contract connectivity is their inability to interact with an external data flow or another resource outside the node network in which the smart contract itself is executed.

The decentralized nature of smart contracts also prevents them from accessing crucial data like web APIs, thus hindering their ability to use essential existing services such as banking payments.

This lack of external connectivity is inherent in all smart contract networks due to the method by which consensus is reached around blockchain transactions.

What are the Value Propositions of LINK?

Chainlink functions as a decentralized oracle network. Oracles are third-party entities that provide smart contracts with the external information needed for their execution.

For example, an insurance smart contract might need weather data to determine if a payout is due.

Unlike traditional centralized oracles, Chainlink uses a decentralized network of oracles to avoid single points of failure and ensure the integrity of provided data. Each oracle is incentivized to supply accurate and reliable data through a reward/penalty system.

Chainlink employs Oracle Service Contracts (OSCs), which are specific smart contracts that manage communication between oracles and smart contracts, determining oracle usage, data aggregation, and security.

Chainlink’s native token, LINK, is used to pay for oracle services. Oracle operators earn LINK tokens for providing reliable data, and smart contract users pay in LINK for access to this data.

LINK: A Secure Blockchain Middleware

Many inputs and outputs necessary for a smart contract already exist as data streams and APIs used by web/mobile applications. The challenge is enabling a smart contract to connect to these numerous external sources in a way that maintains the value of smart contracts as trustworthy and tamper-proof digital agreements.

Chainlink provides a secure, decentralized, and tamper-proof "blockchain middleware" that allows easy access to the multiple inputs and outputs needed for complex smart contracts. By simplifying how smart contracts securely access off-chain resources, Chainlink accelerates the development and increasing utility of smart contracts.

Architecture and Functionality

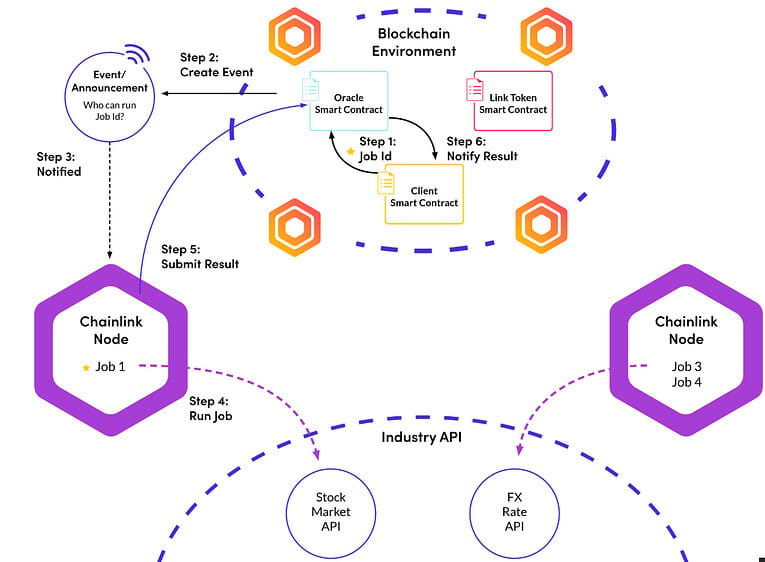

Chainlink is comprised of several key components that work together to provide external data to smart contracts:

Oracle Service Contracts (OSC)

As previously mentioned, OSCs are smart contracts deployed on the blockchain that manage interactions between data requesters (smart contract users) and data providers (oracles). They enable the selection of oracles, specify tasks, aggregate collected data, and ensure payment for services rendered in LINK.

Oracle Network

Oracles retrieve data from the outside world and transmit it to the blockchain. They are decentralized to avoid a single point of failure, enhancing security and reliability.

Aggregation Contract

This contract aggregates responses from various oracles to produce a single, reliable answer. It uses mechanisms like weighted averages, outlier elimination, and majority voting to ensure data accuracy and resistance to manipulation.

Chainlink Node

Each oracle in the network operates via a Chainlink node, software that connects the blockchain to external data sources. Chainlink nodes execute data requests and communicate results to smart contracts via OSCs.

Chainlink Core

Chainlink Core facilitates communication between Chainlink nodes and blockchains. It handles smart contract requests, assigns tasks to appropriate oracles, and processes received data before sending it to the aggregation contract.

External Adapters

These allow Chainlink nodes to connect to almost any data source (APIs, etc.). They translate external data into a format that nodes can understand and manipulate.

Operation Process

The operation process of Chainlink can be summarized in several steps:

Data Request: A smart contract sends a data request via an OSC, specifying the needed data and oracle conditions.

Oracle Selection: The OSC selects a set of oracles based on reputation, service cost, and other user-defined criteria.

Data Harvesting: Selected oracles retrieve the required data from various external sources (APIs, IoT sensors, databases, etc.).

Data Submission: Each oracle submits the harvested data to the aggregation contract on the blockchain.

Data Aggregation and Validation: The aggregation contract compiles data from different oracles and uses statistical methods to produce a final, reliable response.

Data Transmission: The aggregated data is sent to the originating smart contract, which uses it to execute its preprogrammed logic.

Oracle Reward: Oracles are paid in LINK for their services, as defined in the OSC.

Use Cases and Security

Chainlink Applications

Chainlink has numerous applications across various sectors due to its ability to connect smart contracts to external data. Here are some examples:

Decentralized Finance (DeFi)

DeFi platforms use Chainlink to obtain real-time market data, such as:

Asset prices

Interest rates

Financial indices

This mechanism enables automated and transparent financial transactions without intermediaries.

Insurance

Smart insurance contracts can use Chainlink to access weather, health, or other data to automatically trigger payments in case of claims, making the process faster, optimized, and less prone to fraud.

Online Gaming

Blockchain game developers can use Chainlink to integrate verifiable random data (VRF) for lotteries, loot boxes, and other mechanisms requiring a provably fair random system.

Supply Chain

Companies can track products throughout the supply chain using Chainlink to access IoT sensor data, ensuring product provenance and authenticity.

Chainlink's applications also extend to areas like cloud computing and finance for obtaining real-time currency exchange rates, among others.

Security and Decentralization

Security is at the core of Chainlink, as the decentralized network of oracles prevents data manipulation and Sybil attacks through several mechanisms:

Oracle Consensus: Data provided by multiple oracles is aggregated to reach a consensus, reducing the risk of incorrect data.

Staking and Penalties: Oracle operators must stake a certain amount of LINK as collateral. In case of malicious behavior, this collateral can be slashed.

Oracle Reputation: Each oracle has a reputation score based on past performance, helping to select the most reliable oracles.

Tokenomics

Let's now focus on the tokenomics of LINK and the various uses of its token:

Nodes: Retrieve off-chain information.

Data Transformation: Convert data formats to be understandable by the blockchain.

Off-chain Calculations: Perform necessary computations off-chain.

Smart Contract Integration: A smart contract on a network (e.g., Ethereum) will use a node to obtain information.

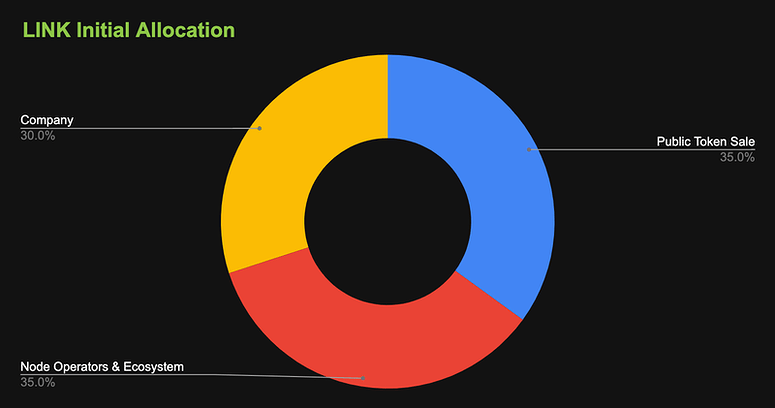

The initial total supply of LINK is 1,000,000,000 tokens, with a circulating supply of around 587,099,971 LINK, representing approximately 59% of the total supply.

It is also worth mentioning that since the supply of LINK tokens is limited, it can be considered deflationary, as an increase in demand would logically lead to an increase in price.

Here is a graph representing the distribution of the LINK token:

Partnerships, fundraising

Chainlink successfully conducted an Initial Coin Offering (ICO) in 2017, raising nearly $32 million:

$29.00 million was raised during the private sale on September 19, 2017, with an average price of $0.09

$3.00 million was raised during the public sale on September 19, 2017, with an average price of $0.11

The project attracted well-known investors and partners from the WEB3 ecosystem, but also gained interest from GAFAM companies, notably Google, since its inception.

The Team and Latest Developments

Team

Chainlink was co-founded by Sergey Nazarov and Steve Ellis in 2017. Before Chainlink, Nazarov co-founded several tech companies, including SmartContract, a platform aimed at connecting smart contracts to external data and banking payments.

Steve Ellis graduated in computer science from New York University and worked as a software engineer before co-founding Secure Asset Exchange, a company designed to facilitate web access to a decentralized asset exchange.

The idea for Chainlink emerged from their shared vision to enable smart contracts to universally connect to blockchains and external data sources.

Since its inception, Chainlink has grown and established partnerships with various data providers.

Latest Developments

Chainlink has recently signed a significant partnership with Spanish telecommunications giant Telefónica.

In terms of product enhancements, Chainlink is working intensively on its technologies, regularly updating them to remain a leader in their field.

They publish quarterly updates on improvements made to their project. Recently, Chainlink has made updates to several features, including:

CCIP: Chainlink's Cross-Chain Interoperability Protocol (CCIP) is the global standard for interoperability between public and/or private blockchains.

Data Feeds: Chainlink's data feeds are the industry-standard oracle solution providing smart contracts with reliable information sources (cryptocurrency prices, RWA valuations, sports results, weather events, etc.).

Data Streams: Chainlink Data Streams is an oracle solution based on a pull model and low latency, providing latency-sensitive protocols, such as perpetual futures contracts, with rapid access to high-frequency off-chain market data, which can be retrieved and verified on the blockchain at any time.

Proof of Reserve: Chainlink Proof of Reserve provides autonomous, reliable, and timely reports on cross-chain and off-chain reserves supporting tokenized assets, for example.

And many more!

Currently, Chainlink's main challenge is RWA (Real World Assets)! The focus is on ensuring that tokenized assets transfer seamlessly between blockchains without interference with their intrinsic value.

Promising Partnerships for RWA

The Smart NAV project, a strategic collaboration between DTCC, Chainlink, and leading banks such as JPMorgan and BNY Mellon, focuses on the seamless integration of Net Asset Value (NAV) data into blockchain environments.

Renowned institutions, including American Century Investments, Edward Jones, Franklin Templeton, Invesco, MFS Investment Management, Mid Atlantic Trust, State Street, and U.S. Bank, have shown significant interest in tokenizing conventional assets. Chainlink's CCIP has played a major role in enabling the transmission of standardized data across different blockchains.

This pilot project is part of a broader trend where the tokenization of real-world assets (RWA) is gaining increasing attention.

Financial giants like BlackRock, Citi, and HSBC are exploring this technology for its benefits in operational efficiency, settlement speed, and transparency.

Another notable success is the collaboration with SWIFT. A historic partnership was initiated in September 2022 to test Chainlink’s technology via the cross-chain interoperability protocol.

One year later, the tests were successful and allowed institutions to envision overcoming a previously insurmountable technological barrier. This CCIP will serve as a unique gateway for exchanging tokenized assets across different blockchains.

Market on the Brink of a Financial Boom

A promising future can be anticipated for the tokenization market. Citi estimates its potential value between $4 trillion and $5 trillion by the end of the decade. Boston Consulting Group is even more optimistic, projecting a forecast of $16 trillion by 2030.

Conclusion

In conclusion, Chainlink is emerging as a crucial infrastructure for the future of smart contracts and decentralized applications.

By providing secure and reliable access to external data, Chainlink enables smart contracts to reach their full potential across various domains.

As blockchain technology continues to evolve, the importance of solutions like Chainlink will only grow, paving the way for larger and bolder innovations.

For a visual summary of this project, see the image below: