Token Chronicle - June week 4

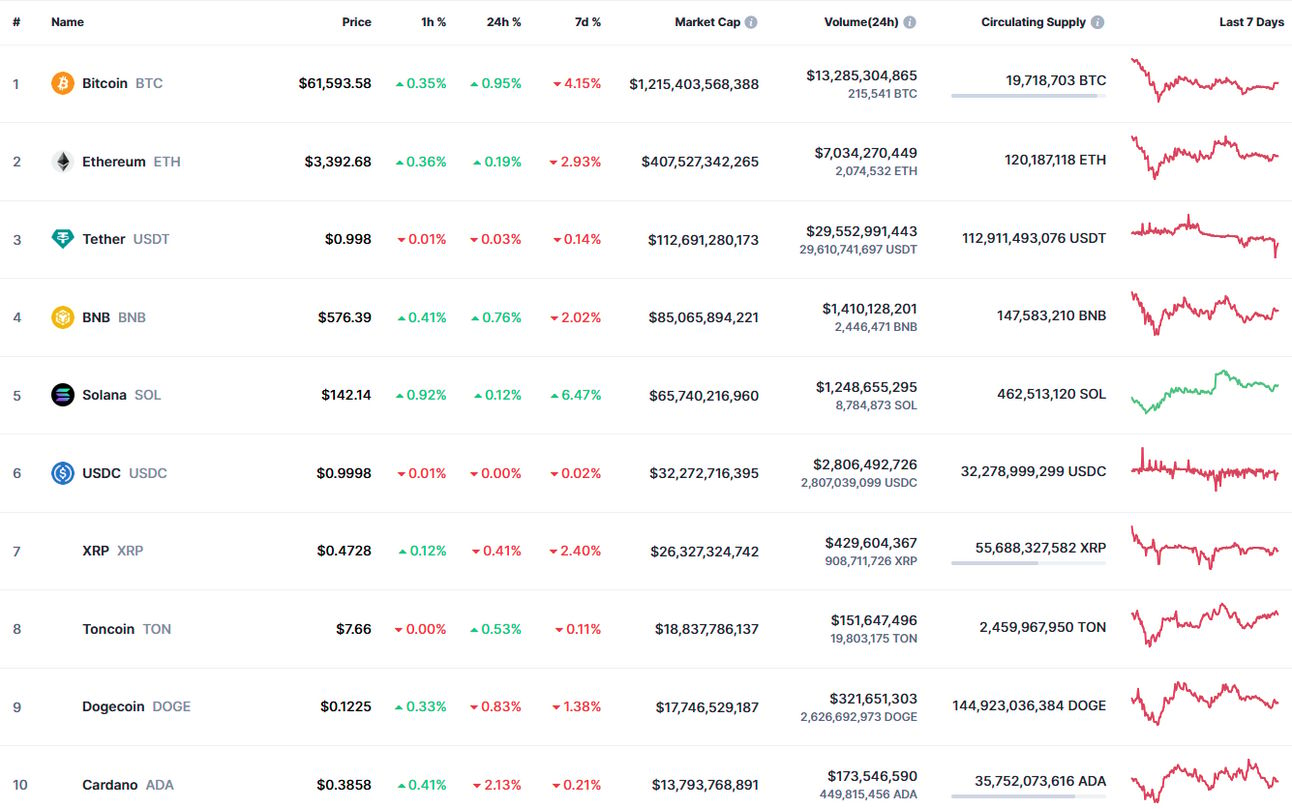

Top cryptos:

Extract from CoinMarketCap.com on June 30th 2024

Meme of the week:

Quick bites:

MtGox repayments begin in July in BTC and Bitcoin Cash; the company owes more than $9B to creditors.

Tether will cease issuing USDT on EOS and Algorand within 12 months to prioritize community blockchains.

Wikileaks founder Julian Assange has been released from prison in the UK and will not be extradited to the US.

Strike launches its BTC payment app via the Lightning Network in the UK.

Bybit surpasses Coinbase, becoming the world's 2nd largest crypto exchange by trading volume.

Gary Gensler remains silent on the ETH ETF launch date but says the process is "smooth." Eric Balchunas now estimates the launch will be after July 8.

Coinbase sues the SEC and FDIC over unsatisfactory responses to FOIA requests about crypto regulation.

VanEck files for a Solana ETF with the SEC, followed by 21Shares a few days later.

Blackrock claims BTC is a hedge against geopolitical uncertainty (a borderless asset) and monetary devaluation risks.

Bolivia lifts the ban on BTC and crypto payments; meanwhile, the UAE is considering a ban on crypto payments within the country.

July Token unlocks:

Market update: The market is currently quiet, awaiting rate decisions and ETH ETF launches. Patience is key, but the outlook is very bullish for the coming months: Ethereum ETF, halving effect, Solana ETF, various projects/news, and US elections with pro-crypto candidates. There's a general trend of falling interest rates, although in the US, rate cuts might only come in the fall despite good inflation and employment figures. Bearish points include upcoming customer’s fund releases from MtGox and FTX bankruptcies, which could lead to selling pressure and potential price drops (or buying opportunities).

Main topics:

Billionaire Michael Dell (founder of Dell) may soon turn to Bitcoin, following Michael Saylor's example.

Ethereum ETFs might not launch until next week (around July 8) due to holiday delays in the USA and SEC's slow process. Funds are starting to share their fees. The war for the better fees is starting with VanEck offering zero fees until at least 2025.

Mt. Gox will repay $9 billion in Bitcoin and Bitcoin Cash starting in July, after years of delays. This could impact the crypto market as investors might sell their recovered Bitcoins, causing selling pressure and price drops. Mt. Gox lost 740,000 Bitcoins in a 2014 hack, worth about $592 million at the time. This news could explain recent price declines, but as the bull run approaches, clients might wait to maximize gains.

Gaming giant Konami, in partnership with Ava Labs, launches Resella, an NFT solution on Avalanche. Resella aims to revolutionize gaming and Web3 by enabling easy NFT creation, issuance, and exchange within traditional and decentralized apps. It eliminates the need for a Web3 wallet and simplifies transactions, including those in Japanese yen. Powered by Avalanche, Resella offers fast processing and near-zero fees.

Nubank, the largest neobank in Latin America, integrates the Lightning Network, a Bitcoin layer 2 solution for near-instant transfers with low fees.

Bybit surpasses Coinbase in trading volume due to competitive fees, but Coinbase remains more significant due to its US ETF partnerships and popular Base blockchain.

Solana launches two new products, "Blinks" and "Actions," to enhance integration between social networks (Web2) and blockchain (Web3).

Major moves in the mining industry: Marathon Digital starts mining Kaspa (KAS) to diversify, and CleanSpark acquires competitor GRIID for $155 million.

MegaETF blockchain raises $20 million with support from Vitalik Buterin. The project, built on EVM, aims for greater speed and lower fees, with a testnet planned for autumn 2024.

Coinbase sues the SEC and FDIC; the SEC targets Consensys (Metamask).

Analysts estimate $15 billion inflow in the first 18 months for ETH ETFs, and Solana could reach $1300 post-ETF launch.

Major partnership between Coinbase and Stripe: USDC is now available on Stripe, allowing merchants in 150 countries to accept this stablecoin. Base, Ethereum's layer 2, will serve as a crypto/fiat ramp with USDC in the US. Coinbase integrates Stripe's fiat-to-crypto solution in its non-custodial wallet, offering options like Apple Pay to enter the crypto ecosystem.

MiCA regulations on stablecoins take effect in the EU, particularly Article 23, which bans companies from issuing stablecoins with a daily volume exceeding one million transactions or $200 million. This theoretically disqualifies popular stablecoins like USDT and USDC within the EU. Currently, this applies only to issuers; exchanges have an additional six months to comply.

Join me on Twitter: @Token_Chronicle

Disclaimer: The information disclosed here does not constitute an investment advice ; it is for informational purposes only and does not constitute investment advice. You should do your own research while investing in crypto and only invest money you are ready to lose.